TIDMBRK

RNS Number : 4321W

Peel Hunt LLP

27 April 2016

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN, IS NOT

FOR RELEASE, PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN, INTO OR FROM THE UNITED STATES, CANADA, JAPAN, THE

REPUBLIC OF SOUTH AFRICA OR AUSTRALIA OR TO US PERSONS. THIS

ANNOUNCEMENT IS NOT AN OFFER OF SECURITIES FOR SALE IN THE UNITED

STATES. THE SECURITIES DISCUSSED HEREIN HAVE NOT BEEN AND WILL NOT

BE REGISTERED UNDER THE US SECURITIES ACT OF 1933, AS AMENDED (THE

"US SECURITIES ACT") AND MAY NOT BE OFFERED OR SOLD IN THE UNITED

STATES ABSENT REGISTRATION OR AN EXEMPTION FROM REGISTRATION UNDER

THE US SECURITIES ACT. NO PUBLIC OFFERING OF THE SECURITIES

DISCUSSED HEREIN IS BEING MADE IN THE UNITED STATES AND THE

INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE AN OFFERING OF

SECURITIES FOR SALE IN THE UNITED STATES, CANADA, JAPAN, THE

REPUBLIC OF SOUTH AFRICA OR AUSTRALIA.

27 April 2016

Brooks Macdonald Group plc

("Brooks Macdonald")

Intended sale of ordinary shares by Directors

(the "Placing")

Peel Hunt LLP ("Peel Hunt") announces that Richard Spencer, a

Director of Brooks Macdonald, intends to sell up to 550,000

ordinary shares in Brooks Macdonald ("Ordinary Shares"). In

addition Simon Wombwell, also a Director of Brooks Macdonald,

intends to sell 35,000 Ordinary Shares. The combined total of up to

585,000 shares (the "Placing Shares") represents approximately 4.3

per cent. of the Company's issued share capital.

Assuming that the Placing is completed in full, Richard Spencer

and Simon Wombwell (together the "Vendors") will retain beneficial

interests in 1.7 per cent. and 0.4 per cent. respectively of the

issued ordinary share capital of the Company.

Richard Spencer has agreed to a lock-in arrangement in relation

to the balance of his Ordinary Shares which will last until the

first anniversary of the completion of the Placing.

The Placing will be conducted by means of an accelerated book

build secondary placing to institutional investors. Peel Hunt has

been appointed as sole bookrunner in respect of the Placing. The

books of the Placing will open with immediate effect. The final

price at which the Placing Shares are to be sold will be agreed by

Peel Hunt and the Vendors at the close of the book build process.

The results of the Placing will be announced as soon as practicable

thereafter. The Placing Shares are expected to be sold on a T+2

basis.

The timing of the closing of the books will be at the absolute

discretion of Peel Hunt and the Vendors.

In relation to the Placing, Richard Spencer makes the following

statement:

"I have held a substantial interest in Brooks Macdonald since

co-founding the company in 1991. It is now appropriate to diversify

my personal financial risk profile whilst retaining a significant

shareholding in Brooks Macdonald. I remain committed to the Group

in my role as Chief Investment Officer and continue to have every

confidence in the Group's prospects."

Contacts

Peel Hunt LLP

ECM

Al Rae 020 7418 8914

Edward Fox 020 7418 8972

Corporate

Adrian Haxby

Guy Wiehahn 020 7418 8900

MHP Communications

Reg Hoare / Giles Robinson

/ Charlie Barker 020 3128 8100

IMPORTANT ANNOUNCEMENT

MEMBERS OF THE PUBLIC ARE NOT ELIGIBLE TO TAKE PART IN THE

PLACING. THIS ANNOUNCEMENT AND ANY OFFER OF SECURITIES TO WHICH IT

RELATES ARE ONLY DIRECTED AT PERSONS WHO (1) IN ANY MEMBER STATE OF

THE EUROPEAN ECONOMIC AREA ARE QUALIFIED INVESTORS WITHIN THE

MEANING OF DIRECTIVE 2003/71/EC AND ANY RELEVANT IMPLEMENTING

MEASURES (THE "PROSPECTUS DIRECTIVE"); (2) IN THE UK ARE QUALIFIED

INVESTORS (WITHIN SUCH MEANING) WHO ARE ALSO (A) "INVESTMENT

PROFESSIONALS" FALLING WITHIN ARTICLE 19(5) OF THE FINANCIAL

SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005 (AS

AMENDED) (THE "ORDER"); OR (B) PERSONS FALLING WITHIN ARTICLE

49(2)(A) TO (D) OF THE ORDER (ALL SUCH PERSONS REFERRED TO IN (1)

AND (2) TOGETHER BEING REFERRED TO AS "RELEVANT PERSONS"). THE

INFORMATION REGARDING THE PLACING SET OUT IN THIS ANNOUNCEMENT MUST

NOT BE ACTED ON OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT

PERSONS. ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS

ANNOUNCEMENT RELATES IS AVAILABLE ONLY TO RELEVANT PERSONS AND WILL

BE ENGAGED IN ONLY WITH RELEVANT PERSONS.

The information contained in this Announcement is restricted and

is not for release, publication or distribution, directly or

indirectly, in whole or in part, in, into or from the United States

(including its territories and possessions), any state of the

United States and the District of Columbia, collectively the

"United States") Australia, Canada, Japan or the Republic of South

Africa or any jurisdiction in which the same would be unlawful.

The Placing Shares have not been, and will not be, registered

under the US Securities Act or under the securities laws of any

State or other jurisdiction of the United States, and, absent

registration, may not be offered or sold in the United States

except pursuant to an exemption from, or in a transaction not

subject to, the registration requirements of the Securities Act and

the securities laws of any State or other jurisdiction of the

United States. There will be no public offering of securities in

the United States or elsewhere.

The distribution of this announcement and the offering or sale

of the Placing Shares in certain jurisdictions may be restricted by

law. No action has been taken by the Vendors, Peel Hunt, or any of

Peel Hunts's affiliates that would, or which is intended to, permit

a public offer of the Placing Shares in any jurisdiction or

possession or distribution of this announcement or any other

offering or publicity material relating to the Placing Shares in

any jurisdiction where action for that purpose is required. Persons

into whose possession this announcement comes are required by Peel

Hunt to inform themselves about and to observe any such

restrictions.

The information in this Announcement may not be forwarded or

distributed to any other person and may not be reproduced in any

manner whatsoever. Any forwarding, distribution, reproduction, or

disclosure of this information in whole or in part is unauthorised.

Failure to comply with this directive may result in a violation of

the Securities Act or the applicable laws of other jurisdictions.

This Announcement has been issued by, and is the sole

responsibility of Brooks Macdonald. No representation or warranty

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by Peel

Hunt or by any of its respective affiliates or agents as to or in

relation to, the accuracy or completeness of this Announcement or

any other written or oral information made available to or publicly

available to any interested party or its advisers, and any

liability therefore is expressly disclaimed.

Peel Hunt is acting for the Vendors only in connection with the

Placing, and no one else, and will not be responsible to anyone

other than to the Vendors for providing the protections offered to

clients of Peel Hunt nor for providing advice in relation to the

Placing. Peel Hunt is authorised by the Financial Conduct Authority

and regulated by the Financial Conduct Authority and the Prudential

Regulation Authority. This statement does not seek to limit or

exclude responsibilities or liabilities which may arise under the

FSMA or the regulatory regime established thereunder.

Neither the content of Brooks Macdonald's website nor any

website accessible by hyperlinks on the Brooks Macdonald's website

is incorporated in, or forms part of, this Announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DSHEAPLKAFAKEFF

(END) Dow Jones Newswires

April 27, 2016 02:01 ET (06:01 GMT)

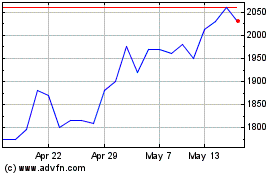

Brooks Macdonald (LSE:BRK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Brooks Macdonald (LSE:BRK)

Historical Stock Chart

From Jul 2023 to Jul 2024