TIDMBLU

RNS Number : 1112E

Blue Star Capital plc

28 June 2023

28 June 2023

Blue Star Capital plc

("Blue Star" or "the Company")

Half-Yearly Results

Half-yearly Results for the six months ended 31 March 2023

Executive Chairman's Statement

I am pleased to report Blue Star's half-yearly results for the

period ended 31 March 2022.

Highlights

-- The Company's two principal investments, representing

approximately 94% o f the portfolio's value, continue to make

steady progress. No new investments were made during the

period.

-- The Company incurred a pre-tax loss for the period of

GBP1,165,942, (H1 2022: loss GBP996,806).

-- The cash position of the Company at 31 March 2023 was

GBP155,563, compared with GBP113,416 as at 31 March 2022. The value

of the portfolio of quoted investments held by the Company at 31

March was approximately GBP147,000.

-- The NAV per share as at 31 March 2023 was 0.2p.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation.

The Directors of the Company are responsible for the release of

this announcement.

For further information, please contact:

Blue Star Capital plc +44 (0) 777 178 2434

Tony Fabrizi

Cairn Financial Advisers LLP +44 (0) 20 7213 0880

(Nominated Adviser & Broker)

Jo Turner / Liam Murray

About Blue Star

Blue Star is an investing company with a focus on new

technologies. Blue Star's investments include SatoshiPay Limited, a

payments business using blockchain technology; 4 early-stage to

mid-level esports companies, including Dynasty Gaming & Media

Pte. Ltd., whose B2B white label platform is a full-stack gaming

ecosystem; and Sthaler Limited, an identity and payments technology

business which enables a consumer to identify themselves and pay

using just their finger.

Forward looking statement disclaimer

Certain statements made in this announcement are forward-looking

statements. These forward-looking statements are not historical

facts but rather are based on the Company's current expectations,

estimates, and projections about its industry; its beliefs; and

assumptions. Words such as 'anticipates,' 'expects,' 'intends,'

'plans,' 'believes,' 'seeks,' 'estimates,' and similar expressions

are intended to identify forward-looking statements. These

statements are not guarantees of future performance and are subject

to known and unknown risks, uncertainties, and other factors, some

of which are beyond the Company's control, are difficult to

predict, and could cause actual results to differ materially from

those expressed or forecasted in the forward-looking statements.

The Company cautions shareholders and prospective shareholder

holders not to place undue reliance on these forward-looking

statements, which reflect the view of the Company only as of the

date of this announcement. The forward-looking statements made in

this announcement relate only to events as of the date on which the

statements are made. The Company will not undertake any obligation

to release publicly any revisions or updates to these

forward-looking statements to reflect events, circumstances, or

unanticipated events occurring after the date of this announcement

except as required by law or by any appropriate regulatory

authority.

Chairman's Statement

The first half of the year has been one of steady progress for

the Company's two main investments. As previously stated, it is the

Board intention to establish up to date valuations for these two

investments during 2023. A formal sales process has been initiated

by the Board for its stake in SatoshiPay which is expected to

complete by the end of 2023. There is no guarantee this will lead

to an acceptable offer or that the Board will accept an offer.

Below we provide the following portfolio company highlights,

inclusive of updates, for the six-month period ended 31 March 2023

and any subsequent developments.

Dynasty Gaming and Media ("Dynasty")

The Company first invested in Dynasty in October 2019. Over the

intervening period, Dynasty has built a leading esports and gaming

platform . Having successfully built the platform, Dynasty's

business model has, over the last 18 months, evolved from being a

pure SaaS provider to that of an operator where it can fully

benefit from the technology platforms it has developed. Recent

deals have seen it take up ownership rights in the businesses with

which its partnering, as described below.

In October 2022, Dynasty announced that it had signed a

distribution agreement with Indosat Ooredoo Hutchison ("IOH"),

Southeast Asia's second largest telecommunications company, with

almost 100 million subscribers in Indonesia. This agreement sees

Dynasty deliver Web3 Play to Earn ("P2E") games, developed by

Pioneer Media Holdings Inc, to IOH which will actively promote to

their extensive subscriber base. The first P2E title, which has

been localised for the Indonesian gaming market will be launched

imminently . Additional titles are planned to be released during

the second half of 2023.

Dynasty also announced that it has entered into a 50/50 joint

venture in Australia with Lets Play Live ("LPL") in May 2023. The

board understands that LPL is the region's leading esports

tournament organiser and content creator with over 400,000 existing

customers and long-term partnerships with the world's leading games

publishers. The JV launched in Australia in May 2023 and is

understood to be the most significant gaming platform and community

in Australia.

Dynasty is also building close relationships with two of the

Company's other portfolio businesses, Googly Media Holdings

("Googly") and Paidia Gaming ("Paidia"). Googly had a soft beta

launch in May 2023 which proved highly successful. India is a

particularly exciting market, being arguably the fastest growing

gaming market and already the largest mobile gaming market with

500m gamers forecast to grow to 800m gamers within the next 5 years

. Dynasty's partnerships with Googly and Paidia sees it sharing 50%

of all revenue generated . Paidia is a female focused business and

brand based in North America and is performing strongly.

To date, the Company has invested approximately GBP968,000 in

Dynasty. Based on Dynasty's valuation of US$50 million in the last

equity fundraising round, the Company's holding in Dynasty is

valued at approximately US$6.5 million (approximately

GBP5.4million).

Googly and Paidia

The Company owns 0.6% of Googly which on the basis of the most

recent external valuation was worth approximately GBP59,000. The

Company also invested in 2022 and this is currently valued at cost

of approximately GBP59,800.

SatoshiPay

The Company first invested in SatoshiPay in January 2017.

SatoshiPay's mission is to connect the world through instant

payments. To achieve this ambition, SatoshiPay has focused on

building the Pendulum Network Project ("Pendulum") which was

established in June 2021.

Pendulum, a smart-blockchain infrastructure technology company,

aims to decentralize forex and traditional finance, by providing

the missing link between fiat currency and De-Fi ecosystems through

a sophisticated smart contract network.

In the period under review, Pendulum has achieved a number of

key operational milestones. In December 2022 Pendulum completed its

crowdloan as a precursor to it becoming a Polkadot Parachain.

Pendulum's crowd loan was the fastest parachain crowdloan in the

history of the Polkadot ecosystem, demonstrating the strong support

and enthusiasm for Pendulum's integration into the Polkadot

ecosystem.

Pendulum parachain went live on Polkadot mainnet in February

2023 and the corresponding utility token called PEN was listed on

MEXC in March 2023 under the name PULUM (

https://www.mexc.com/de-DE/exchange/PULUM_USDT ).

Finally, earlier this month Pendulum released "Spacewalk", its

blockchain bridge connecting the Stellar and Polkadot networks.

Pendulum described Spacewalk as a trust-minimized bridge that

supports the smooth and seamless transfer of stable assets between

the two ecosystems, allows closer collaboration in the De-Fi sector

and drives synergies between traditional fintech services and the

De-Fi sector.

Pendulum is committed to advancing foreign exchange ("Forex")

trading into the blockchain space to integrate a tranche of the

$6.6 trillion traded daily in Forex markets. It is hoped that the

Spacewalk bridge will serve as critical infrastructure to bring

initial stablecoin liquidity required for Forex trading to Pendulum

and, in turn, to all of Polkadot and Stellar. The nabla.fi team

(formerly known as 0xAmber.com) are about to launch their

novel-design decentralized exchange with oracle-guided pricing and

single-sided liquidity provision for maximum capital efficiency and

attractive FX rates on chain.

As of 31 March 2023, Blue Star has invested approximately

GBP1.9m in SatoshiPay which represents a shareholding of 27.9% of

SatoshiPay's issued share capital, worth GBP4.3m, based on the last

external fund raise in 2019. It is the Board's view that the

valuation of SatoshiPay may have increased significantly since the

last fund raise and it has therefore appointed a specialist firm to

carry out a sales process to ascertain the market value of the

business. There is no guarantee that this will lead to an

acceptable offer and no obligation on the Board or SatoshiPay to

accept any offer but the Board believes this is the only viable way

to independently value its stake in SatoshiPay.

Sthaler

The Company invested in Sthaler in June 2015. Sthaler is an

Identity authentication business FinGo delivers a reliable, fast,

and secure method of identifying an individual at a point of sale

or service to not only personalize and enrich the experience, but

to tackle fraud and financial exclusion. Individuals are anonymous

by default; the ethos of the business is to protect the fundamental

human right to privacy. FinGo uses near infra-red (NIR) light to

illuminate and reveal the hidden pattern of veins within a person's

finger. FinGo encrypts the pattern and then stores it on a server,

cloud or blockchain as an instantly usable anonymous "key" linked

to a digital wallet (an app). The wallet enables a user to add

debit and credit cards or virtually any online account and is

approved to authenticate multiple payment types including payment

cards and real-time payments (bank account-to-account).

During the period under review, Sthaler has built on its

existing partnerships in Australia, Poland, UK and Egypt and

secured further partners and customer opportunities in the

Netherlands, Israel, Ethiopia, Guatemala. Although Sthaler's

technology applies to almost all sectors, the current focus is in

the following sectors: general retail, banking, healthcare and

gambling.

Blue Star invested GBP50,000 in Sthaler and as of 31 March 2023

the Company's holding in Sthaler is valued at approximately

GBP398,000, based on Sthaler's last completed fundraise.

Quoted investments

The Company currently holds 11,951,500 shares in Guild Esports

plc and 62,500 shares in East Side Games Group Inc. These

investments currently have a combined value of approximately

GBP93,762.

Outlook

The Board remains focussed on supporting its current portfolio

businesses with the objective of establishing up to date market

values in the second half of 2023. The Company's two principal

investments continue to achieve significant operational milestones

and the Board remains confident that the portfolio retains

significant potential.

Tony Fabrizi

Executive Chairman

Statement of Comprehensive Income

for the six months ended 31 March 2023

Unaudited Audited

Year ended

Six months ended 31 March 30 September

2023 2022 2022

GBP GBP GBP

Revenue - - -

Loss on disposal of investments (81,491) - (338,836)

Fair value movements in financial instruments designated at fair

value through profit or loss: (730,155) (900,037) (445,223)

(811,646) (900,037) (784,059)

Share based payment (243,248) - -

Administrative expenses (111,626) (100,642) (517,003)

------------- ------------ -------------

Operating loss (1,166,520) (1,000,679) (1,301,062)

Finance income 578 3,873 54

Loss before and after taxation and total comprehensive income for

the period (1,165,942) (996,806) (1,301,008)

------------- ------------ -------------

Loss per ordinary share:

Basic and diluted loss per share (0.02p) (0.02p) (0.03p)

The loss for the period was derived from continuing operations

and is attributable to equity shareholders.

Statement of Financial Position

as at 31 March 2023

Unaudited Audited

Year ended

Six months ended 31 March 30 September

--------------------------- -------------

2023 2022 2022

GBP GBP GBP

Non-current assets

Financial assets at fair value through profit or loss 10,389,061 11,463,552 11,390,278

Convertible loan note - 158,323 -

10,389,061 11,621,875 11,390,278

------------- ------------ -------------

Current assets

Trade and other receivables 16,700 28,243 8,072

Cash and cash equivalents 155,563 113,416 86,575

172,263 141,659 94,647

------------- ------------ -------------

Total assets 10,561,324 11,763,534 11,484,925

------------- ------------ -------------

Current liabilities

Trade and other payables 69,511 44,825 70,418

Total liabilities 69,511 44,825 70,418

------------- ------------ -------------

Net assets 10,491,813 11,718,709 11,414,507

------------- ------------ -------------

Shareholders' equity

Share capital 4,892,774 4,892,774 4,892,774

Share premium account 9,575,072 9,575,072 9,575,072

Other reserves 243,248 - -

Retained earnings (4,219,281) (2,749,137) (3,053,339)

10,491,813 11,718,709 11,414,507

------------- ------------ -------------

Statement of changes in equity

as at 31 March 2023

Share capital Share premium Other reserves Retained earnings Total

-------------- ---------------- ------------------ ------------------ -----------

GBP GBP GBP GBP GBP

Six months ended

31 March 2023

At 1 October 2022 4,892,774 9,575,072 - (3,053,339) 11,414,507

Loss for the period and

total comprehensive

income - - - (1,165,942) (1,165,942)

Share based payment - - 243,248 - 243,248

At 31 March 2023 4,892,774 9,575,072 243,248 (4,219,281) 10,491,813

-------------- ---------------- ------------------ ------------------ -----------

Six months ended

31 March 2022

At 1 October 2021 4,892,774 9,575,072 - (1,752,331) 12,715,515

Loss for the period and

total comprehensive

income - - - (998,806) (998,806)

At 31 March 2022 4,892,774 9,575,072 - (2,749,137) 11,718,709

-------------- ---------------- ------------------ ------------------ -----------

Year ended

30 September 2022

At 1 October 2021 4,892,774 9,575,072 - (1,752,331) 12,715,515

Loss for the year and

total comprehensive

income - - - (1,301,008) (1,301,008)

At 30 September 2022 4,892,774 9,575,072 - (3,053,339) 11,414,507

-------------- ---------------- ------------------ ------------------ -----------

Statement of cash flows

for the six months ended 31 March 2023

Unaudited Audited

Six months ended Year ended

31 March 30 September

2023 2022 2022

GBP GBP GBP

Operating activities

Loss for the period (1,165,942) (996,806) (1,301,008)

Adjustments for:

Finance income (578) (3,873) (54)

Fair value losses 730,155 900,037 445,278

Impairment of convertible loan note - - 150,846

Loss on disposal of investments 81,491 - 338,836

Share based payment 243,248 - -

Working capital adjustments

(Increase)/Decrease in trade and other receivables (8,628) 107,258 127,429

Decrease in trade and other payables (907) (189,317) (163,725)

----------- ---------- -------------

Net cash used in operating activities (121,161) (182,701) (402,398)

----------- ---------- -------------

Investing activities

Proceeds from sale of investments 189,571 - 192,867

Interest received 578 11 -

----------- ---------- -------------

Net cash generated from investing activities 190,149 11 192,867

----------- ---------- -------------

Net cash generated by financing

activities - - -

----------- ---------- -------------

Net increase/(decrease) in

cash and cash equivalents 68,988 (182,690) (209,531)

Cash and cash equivalents at

beginning of the period 86,575 296,106 296,106

----------- ---------- -------------

Cash and cash equivalents at

end of the period 155,563 113,416 86,575

----------- ---------- -------------

Notes to the Interim Financial Statements for the six months

ended 31 March 2023

1. Basis of preparation

The principal accounting policies used for preparing the Interim

Accounts are those the Company expects to apply in its nancial

statements for the year ending 30 September 2023 and are unchanged

from those disclosed in the Company's Report and Financial

Statements for the year ending 30 September 2022.

The nancial information for the six months ended 31 March 2023

and for the six months ended 31 March 2022 have neither been

audited nor reviewed by the Company's auditors.

2. Critical accounting estimates and judgements

The Company makes certain estimates and assumptions regarding

the future. Estimates and judgements are continually evaluated

based on historical experience and other factors, including

expectations of future events that are believed to be reasonable

under the circumstances. In the future, actual experience may di er

from these estimates and assumptions. The estimates and assumptions

that have a signi cant risk of causing a material adjustment to the

carrying amounts of assets and liabilities within the next

financial year are discussed below:

Fair value of financial instruments:

The Company holds investments that have been designated at fair

value through pro t or loss on initial recognition. The Company

determines the fair value of these nancial instruments that are not

quoted, using valuation techniques, contained in the IPEVC

guidelines. These techniques are signi cantly a ected by certain

key assumptions. Other valuation methodologies such as discounted

cash ow analysis assess estimates of future cash ows and it is

important to recognise that in that regard, the derived fair value

estimates cannot always be substantiated by comparison with

independent markets and, in many cases, may not be capable of being

realised immediately.

In certain circumstances, where fair value cannot be readily

established, the Company is required to make judgements over

carrying value impairment, and evaluate the size of any impairment

required.

3. Share based payment

All services received in exchange for the grant of any

share-based remuneration are measured at their fair values. These

are indirectly determined by reference to the fair value of the

share options/warrants awarded. Their value is appraised at the

grant date and excludes the impact of any non-market vesting

conditions (for example, profitability and sales growth

targets).

Share based payments are ultimately recognised as an expense in

the Statement of Comprehensive Income with a corresponding credit

to other reserves in equity, net of deferred tax where applicable.

If vesting periods or other vesting conditions apply, the expense

is allocated over the vesting period, based on the best available

estimate of the number of share options/warrants expected to vest.

Non-market vesting conditions are included in assumptions about the

number of options/warrants that are expected to become exercisable.

Estimates are subsequently revised, if there is any indication that

the number of share options/warrants expected to vest differs from

previous estimates. No adjustment is made to the expense or share

issue cost recognised in prior periods if fewer share options

ultimately are exercised than originally estimated.

Upon exercise of share options, the proceeds received net of any

directly attributable transaction costs up to the nominal value of

the shares issued are allocated to share capital with any excess

being recorded as share premium.

Where share options are cancelled, this is treated as an

acceleration of the vesting period of the options. The amount that

otherwise would have been recognised for services received over the

remainder of the vesting period is recognised immediately within

the Statement of Comprehensive Income.

4. Loss per ordinary share

The calculation of a basic loss per share is based on the loss

for the period attributable to equity holders of the Company and on

the weighted average number of shares in issue during the

period.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SESFWWEDSEFM

(END) Dow Jones Newswires

June 28, 2023 02:00 ET (06:00 GMT)

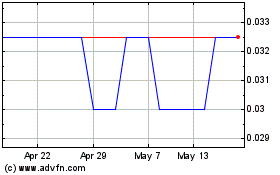

Blue Star Capital (LSE:BLU)

Historical Stock Chart

From Oct 2024 to Nov 2024

Blue Star Capital (LSE:BLU)

Historical Stock Chart

From Nov 2023 to Nov 2024