TIDMBAR

RNS Number : 2159A

Brand Architekts Group PLC

28 September 2020

Brand Architekts Group plc

("Brand Architekts" or the "Group")

Final Results

Brand Architekts Group plc announces its final results for the

52 weeks ended 27 June 2020.

Overview of Results:

Group Continuing Operations

2020 2019 2020 2019

---------- ---------- ------------ ----------

Revenue GBP23.7m GBP77.3m GBP16.3m GBP19.7m

---------- ---------- ------------ ----------

Underlying operating (loss) GBP(0.8)m GBP4.4m GBP0.1m GBP2.4m

/ profit (1)

---------- ---------- ------------ ----------

(Loss) / Profit before taxation GBP2.2m GBP4.1m GBP(4.3)m GBP1.8m

---------- ---------- ------------ ----------

EPS 12.9p 20.7p

---------- ---------- ------------ ----------

Net cash / (debt) GBP18.0m GBP(7.2)m

---------- ---------- ------------ ----------

(1) Underlying operating profit is calculated before exceptional

items, share based payments, and amortisation of

acquisition-related intangibles

Financial headlines:

-- Revenues for the 52 weeks of GBP16.3m (excluding sales from

discontinued operations), a decline of 17% on the prior year.

-- UK sales declined by 16%, driven by low consumer confidence

and pressure within the retail environment, and the impact of store

closures as a result of the outbreak of COVID-19.

-- International sales declined by 24% following the heavy

impact of currency devaluation in Turkey, the effect of increased

tariffs on cosmetic goods shipped from China to USA and the impact

of COVID-19 across several of our markets.

-- Underlying Gross Profit Margin, excluding exceptional

inventory provisions and write offs made at the year end of

GBP2.5m, was 35.2%. Gross profit margin including these items

declined to 19.6% (2019: 35.6%).

-- Continuing operations made an underlying operating profit of

GBP0.1m, while the Group made an underlying operating loss of

GBP0.8m (2019: underlying operating profit GBP4.4m).

-- Group Profit before tax decreased to GBP2.2m (2019: profit before tax GBP4.1m).

-- Net cash position at the year ended June 2020 was GBP18.0m (2019: net debt GBP7.2m).

Operational highlights:

-- Creation of a solely Owned Brands business following the

disposal of the Contract Manufacturing Business for GBP35

million.

-- Operational transition now complete.

-- Appointment of new Executive team to build scale and deliver further profitable growth.

-- Detailed review of operations undertaken including full review of brand portfolio.

Quentin Higham, Chief Executive, commented:

"Since joining in May, I have been impressed with the depth of

our product portfolio and the professionalism of the team, who have

endured the most difficult of trading conditions with great

resilience and determination. Following a detailed review of all

operations, I believe we now have the right strategy to deliver

sustainable, profitable growth over the coming years."

Roger McDowell, incoming Non-Executive Chairman, commented:

"Having already been involved with the business for a number of

years as a Senior Independent Director, I am very excited to be

working with the new management team. I have no doubt that we have

the model and depth of resources to position us for success over

the next few years.

I would like to thank Brendan Hynes for his stewardship, as he

has overseen the transformation of the Group to a fully focused

branded business with a very strong balance sheet.

I look forward to working with the rest of the Board as we seek

to deliver growth organically, through transformational investment

and focus on DTC (direct to consumer) and through targeted

acquisitions."

For further information please contact:

Brand Architekts plc

--------------------------------- ---------------

Roger McDowell Incoming Non-Executive Chairman via Alma

Quentin Higham Chief Executive

Tom Carter Chief Finance Officer

--------------------------------- ---------------

Shaun Dobson / Jen

Boorer N+1 Singer (Nomad) 0207 496 3000

--------------------------------- ---------------

Josh Royston / Sam

Modlin Alma PR 07780 901979

--------------------------------- ---------------

CHAIRMAN'S STATEMENT

This financial year has been one of transformation for the

Group, while presenting both opportunities and challenges in equal

measure.

In August 2019 we concluded the disposal of our manufacturing

business, leaving a company solely focused on owned-brands, and

with a strong balance sheet. While this deal was transformational,

it also required the business to go through a period of significant

operational transition. We needed to recruit a fresh management

team with the necessary experience and ambition to reflect this

change of focus, and who could put in place their own strategic

vision for delivering shareholder value.

While the search was underway, we were fortunate to be able to

call on the experience of Chris How to act as Interim Chief

Executive, and I would like to thank him for providing executive

management continuity during this challenging period. Even so, the

distractions of managing the sale and realigning our management

structure inevitably impacted business performance during the

reporting period.

With these issues now behind us, I am pleased to say that in

Quentin Higham as CEO and Tom Carter as CFO, I am confident that we

have the right team in place to develop and execute an exciting new

strategic plan to deliver shareholder value for the business. They

have identified and will build the right platform of systems and

processes to drive the business forward.

This new executive team joined the business as we were starting

to see the effects of the COVID-19 pandemic. This had an immediate

effect on the buying habits of both consumers and retailers alike,

presenting both risks and opportunities for the Group.

Performance review

The final quarter of the financial year was heavily impacted by

COVID-19, with non-essential retailers closed during this period

and International business effectively on hold.

As a result net sales for FY20 were GBP16.3m, (excluding sales

from discontinued operations), a decline of 17% on the prior year.

Sales in the first half were GBP10.6m, a decline of 15% when

compared to H1 2019 (GBP12.5m). Sales in the second half of FY20

declined by 21%, to GBP5.7m (H2 2019: GBP7.2m).

Following the heavy impact of currency devaluation in Turkey and

the effect of increased tariffs on cosmetic goods shipped from

China to USA, international sales declined by 24%. Looking forward,

should the tariffs be reversed, the Board believes that the Group

is well placed to recover a large proportion of the affected USA

business.

UK sales declined by 16%, despite encouraging volume growth

across our three 'drive' brands, two of which were re-launched

within the period. The decline was largely due to one significant

customer, however, overall low consumer confidence and pressure

within the retail environment has resulted in a reduction of both

category space and the effectiveness of promotional activity.

Gross profit margin declined to 19.6% (2019: 35.6%). Underlying

Gross Profit Margin, which excludes Gross Profit of GBP2.5m from

exceptional inventory provisions and write offs made at the year

end, was 35.2%. As part of the business transformation to focus on

Owned Brands with a new management team, a number of decisions were

taken to reshape the brand portfolio, triggering adjustments to

these brands and related inventory. This includes brands being

exited, de-listed, re-launches and clearance of older products

which may have historically been sold through discount channels.

These costs are one off as part of the business transformation,

therefore margins are expected to normalise in FY20/21.

Profit before tax decreased to GBP2.2m (2019: profit before tax

GBP4.1m). This included exceptional items of GBP3.5m comprising the

profit made on the disposal of the manufacturing business of

GBP8.9m offset with exceptional costs of GBP5.4m.

Impact of COVID-19

Clearly, the outbreak of COVID-19 in March presented us with a

challenge that no business had experienced before. We took

immediate steps to ensure the health and well-being of our

employees, clients and suppliers and this still remains the top

priority for the Group. I would like to thank all our employees for

their tireless work and dedication throughout these challenging

times.

Encouragingly, overall sales performance during H2 was stronger

than the Board had anticipated. Even so, we weren't immune to the

fluctuating demands of customers and end-consumers, and during the

last quarter of FY20 the impact of the pandemic had a significant

effect on the sales mix.

Our brands' performance within UK grocers showed single digit

growth, while our online sales channels, whether through large

e-tailers such as Amazon or our own branded websites, have

delivered high double digit growth. As a result of the shift to

online we stepped up promotional activity to capitalise on this

route to market.

These gains did not offset the significant decline in other high

street outlets, whose store traffic was impacted during lockdown.

Additionally, several key international markets did not place

orders during Q4 FY20 due to the closure of most general

merchandise and department stores.

Unsurprisingly, sales of handcare products increased

significantly and we were able to secure extra supply to support

retailer demand. But it was also no surprise that sales of male

haircare and shaving products saw a major decline.

Response to COVID-19

In order to mitigate the impact of COVID-19 on the business, the

Group took a number of decisions to reduce operating costs and

associated cash requirements. These included:

-- a number of short-term reductions on our discretionary expenditure

-- a short-term suspension of rent payments for our offices in Teddington

-- steps to manage staff costs, including a hiring freeze across a number of vacant positions

-- all Board directors agreeing to a 20% reduction in their

respective salaries or fees (April-June).

However, the business took the decision not to participate in

the furlough scheme, so that the team could focus on its response

to consumer behaviour post COVID-19, and to plan for FY21.

Board changes

Over the period, and following the sale of our manufacturing

business, we made a number of changes to the executive team and

Board. We now believe that we have the team in place to build scale

and deliver further profitable growth.

Quentin Higham became CEO, effective from 4 May 2020. Despite

the difficulties of joining the business in the midst of lockdown,

his deep industry experience and passion for brands has been

evident from the outset. Quentin joined Brand Architekts from

Yardley of London Ltd. where he had been Managing Director for 10

years. Previously he had been Marketing Director at Coty and was

Head of UK Marketing at global cosmetics company Revlon.

On 22 June 2020 Tom Carter joined the Group as Chief Financial

Officer. Tom brings strong financial and operational skills to the

business and the Board believes he is the right person to steer

Brand Architekts to the next stage in its development. Tom joined

from Technetix Group Limited, a market-leading technology company,

where he was Group Finance and Operations Director. Previously, he

was Regional Business Controller at Alliance Boots, Financial

Controller at Sky Media and Finance Manager at Procter &

Gamble. Tom trained as a Chartered Accountant with PwC.

As announced on 14 July 2020, Chris How was appointed as a

non-executive director with immediate effect. Chris was formerly

the CEO of Swallowfield PLC (the previous name of the Group) and

recently served as interim CEO of Brand Architekts. Chris brings

continuity, detailed knowledge of the business and extensive,

relevant sector experience. I have no doubt that he will provide

sound counsel to Quentin and Tom.

After seven years in the role, as announced on 14 July 2020, I

informed the Group of my intention to step down from the Board

following the presentation of these financial results. With the

Group now transformed into a strong, fully brands-focused,

cash-positive business, and with a new executive team in place, I

feel that now is the right time to step aside. I am proud of the

work that we have done to transform the business and believe that

it has never been better placed to build scale and drive

growth.

Roger McDowell, the incumbent Senior Independent Director and

Chair of the Remuneration Committee, will succeed me and take on

the role of Non-Executive Chairman. Roger is an experienced

Chairman and non-executive director, and his extensive knowledge of

the business provides for a smooth and seamless transition.

Dividends

Following the sale of the manufacturing business and subsequent

reorganisation, the Group has not delivered an operating profit

this year. Accordingly, the Board will not be proposing a final

dividend. The payment of the interim dividend was cancelled as a

result of uncertainty following the coronavirus outbreak. The

Group's dividend policy will be kept under review and further

updates made as appropriate.

Outlook

As we enter the new financial year the difficult trading

conditions remain and the impact on the high street in particular

is uncertain. This is evidenced by the caution being shown by

retailers for their forthcoming Christmas orders, where agreed

volumes are down on last year both domestically and I

internationally.

The impact of COVID-19 on our business has been significant, but

we have responded well to these challenges. We now have in place a

new management team, an experienced and committed workforce and a

strong balance sheet with significant positive cash.

We are responding to structural changes in the market, by

accelerating our strategy to develop and invest in online sales,

further innovative NPD and a stronger focus on distribution in both

the UK and internationally. There is still considerable work to be

done on relaunching a number of underperforming brands;

rationalising ranges & improving productivity. All of these

plans are in place but given retailer range review dates, will not

come to fruition until H2 this year.

Given the strength of our balance sheet, we also remain alert to

further acquisition opportunities which offer the potential to

build scale and deliver incremental shareholder value.

Given these uncertain conditions it would be inappropriate to

provide guidance on the likely outcome for the year at this time.

This will be kept under review and guidance will be provided when

there is greater clarity.

Brendan Hynes

Non-Executive Chairman

CEO'S STATEMENT

It is a great pleasure to give you my first impressions of Brand

Architekts, having taken up the reins as Chief Executive in

May.

I can safely say it has been an induction like no other I've

experienced: when I arrived the business had hunkered down due to

COVID-19, against a sad backdrop of ghost-town high streets and

rapidly changing retail habits. The lockdown also meant that

getting together with my new colleagues was necessarily confined to

Microsoft Teams.

However, it was instantly clear to me that I was inheriting a

team that had become adept at making light work of challenges and

changes. With unswerving dedication and passion, they had already

embraced significant structural and management changes during this

reporting year. They proceeded to address the pandemic, and its

considerable business and logistical implications, with the same

calm professionalism.

I'm also excited to be working with two fellow new recruits to

the management team: Tom Carter (Chief Financial Officer) and

Joanna Hutton (Commercial Director). We have already launched

ambitious new growth plans, and across our business I'm entirely

confident we have the talent, drive and portfolio to deliver

them.

Initial findings

Brand Architekts is not in fact entirely new to me. I have

worked in the beauty sector for nearly 30 years and was involved

with BA brands such as Fish! and Real Shaving Company in previous

roles.

One of my first tasks was to review how we are organised. Brand

Architekts was only established in its current guise in August 2019

and there were transitional service agreements in place until the

end of that calendar year. Much of my initial focus was therefore

on making sure that we have the right structures and processes in

place to give us the insight we need across all functions of the

business.

Of course, one of the businesses key strengths is its portfolio

of brands. Understanding the needs of retailers and delivering

products to meet those needs has been the foundation of Brand

Architekts' success and reflects the strength of relationships we

enjoy. This is also a time when the breadth of our portfolio comes

into its own: we cover both female beauty and male grooming

products, and at different price points ranging from "masstige" to

everyday accessible value. This should give us resilience as the

true economic impact of the pandemic becomes increasingly felt. We

are increasingly focused on productivity and rationalising

underperforming SKUs and brands.

As we move into FY21 and beyond, I see immediate priorities in

three specific areas:

-- Getting closer to our end-consumers' needs and wants. Just as

we have forged strong relationships with customers, we need to do

the same with consumers. Consumer habits change at pace and it is

only by being hard-wired into those evolving needs that a brand can

achieve its full potential. By complementing our team's knowledge

of the marketplace with more deep-dive data analysis, we can

improve and create more powerful, sustainable brands.

Pleasingly, our portfolio contains brands with considerable

untapped potential. Once we have gained consumer insight, we will

invest in these specific brands to accelerate market awareness,

drive demand and achieve higher ROI. Even where certain brands do

not merit extra investment, they can still be profitable and cash

generative.

-- Strengthening our DTC channels. As I write, high street

outlets are cautiously emerging from lockdown. While this is

heartening to see, footfall is, and is expected to remain,

depressed for the foreseeable future. COVID-19 has highlighted that

we have a pressing need to build a robust direct-to-consumer (DTC)

channel. We will invest the resources required and actively get

closer to our consumer base.

-- Realise our full potential internationally. Although we

already have a presence in 28 countries, there is much more we can

do. The love of high quality, efficacious, yet affordable beauty

products transcends borders and I will be drawing on my

international experience to oversee this personally.

I am pleased to say that the sale of our manufacturing business

in 2019 means we have the resources to make these investments

happen. We also intend to supplement these organic initiatives with

acquisitions which will strengthen our core competences, and/or

address areas of weakness. It is always hard to predict a timeline

for M&A activity, but we will approach opportunities

selectively. The Board will be focused on the right deals - those

that complement our strategy and generate good ROI - rather than

quick deals.

With this combination of organic and acquisitive initiatives,

I'm confident that within five years we will have created a company

delivering GBP50m of annualised revenues. To this end we have

launched "Project 50" internally, and we are united in believing

that while this goal is ambitious, it is also eminently achievable.

Project 50 will enable us to achieve scale and increase earnings,

resulting in improved shareholder value.

This Project 50 plan allows for the challenging retail

conditions we are witnessing now and the uncertainty around when

they might improve. In FY21, the year ahead will be one of

consolidation for Brand Architekts as we finalise the platform, the

products and the routes to market that will drive this business

forward.

Quentin Higham

Chief Executive Officer

FINANCIAL REVIEW

Key Performance Indicators

To measure and monitor our progress against our growth strategy,

we track our performance against a set of ambitious targets and

milestones. The goals we set are closely assessed to ensure we

focus our efforts to deliver both in the short term and long term.

A summary of the financial measures used are:

2020 2019

----------------------------------- ----------- ----------

Reported Results from continuing

operations

----------- ----------

Revenue (note 5) GBP16.3m GBP19.7m

----------- ----------

Underlying operating profit GBP0.1m GBP2.4m

(1)

----------- ----------

(Loss) / Profit before taxation GBP(4.3)m GBP1.8m

----------- ----------

Reported Results from continuing

and discontinued operations

----------- ----------

Revenue (note 5) GBP23.7m GBP77.3m

----------- ----------

Underlying operating (loss) GBP(0.8)m GBP4.4m

/ profit (1)

----------- ----------

Profit before taxation GBP2.2m GBP4.1m

----------- ----------

Basic earnings per share GBP12.9p 20.7p

---------- ----------

Net cash / (debt) GBP18.0m GBP(7.2)m

---------- ----------

(1) Underlying operating profit is calculated before exceptional

items, share based payments, and amortisation of

acquisition-related intangibles

A reconciliation of underlying operating profit to profit before

taxation is shown below:

2020 2020 2020 2019 2019 2019

------------------------- ----------- ------------- -------- ----------- ------------- ------

Continuing Discontinued Total Continuing Discontinued Total

Underlying

(loss) /

profit from

operations 121 (909) (788) 2,355 2,073 4,428

----------- ------------- -------- ----------- -------------

Exceptional

Cost of

Sales (2,535) (2,535)

Amortisation

of acquisition-related

intangibles (260) (260) (260) (260)

Charge for

share-based

payments (4) - (4) (115) (115)

Adjusted

Operating

(loss) /

profit (2,678) (909) (3,587) 1,980 2,073 4,053

----------- ------------- -------- ----------- -------------

Net finance

(costs)

/ income (224) (23) (246) (144) 901 757

--------------------------

Adjusted

(loss) /

profit before

taxation (2,902) (931) (3,833) 1,836 2,974 4,810

Other exceptional

items (1,444) 7,460 6,016 (48) (669) (717)

(Loss) /

profit before

taxation (4,346) 6,529 2,183 1,788 2,305 4,093

----------- ------------- -------- ----------- -------------

The Group implements a number of non-statutory measures which

are summarised in the tables above and in more detail within the

segmental Income Statement (note 5). These measures are used to

illustrate the impact of non-recurring and non-trading items on the

Group's financial results.

In addition to the financial key performance measures, a range

of operational non-financial key performance indicators are also

monitored at a management level covering, amongst others, new

product development and innovation. The Board receives an overview

of these as part of its board management report.

Group statutory revenue at GBP16.3m from continuing operations

was down 17% against prior year, adversely impacted by the

continued decline in consumer confidence and retailer pressures,

coupled with international pressures following the currency

devaluation in Turkey and increased US tariffs from goods shipped

from China and also the impact of COVID-19 in the last quarter of

the financial year.

The gross profit margin declined to 19.6% (2019: 35.6%). This

decline is driven by exceptional adjustments as discussed in the

Chairman's statement. Adjusting for these items Underlying Gross

Profit margin was 35.2%. As these are one off costs, margins are

expected to normalise in 2021.

Continuing operations made an underlying operating profit of

GBP0.1m, while the Group made an underlying operating loss of

GBP0.8m (2019: underlying operating profit GBP4.4m). Underlying

operating profit is shown before amortisation of intangibles,

exceptional costs and charges for share-based payments. Share

options are put in place in order to incentivise the Group's wider

management team (including the Executive Directors) and to ensure

that their interests are aligned with shareholders. At the

year-end, all previous executive share option schemes had been

settled in full. At the reporting date, new schemes are in the

process of being implemented.

The Group made a Profit Before Tax of GBP2.2m including other

exceptional items of GBP3.5m made from the disposal of the

manufacturing business of GBP8.9m offset with exceptional costs of

GBP5.4m.

The effective tax rate for the period was negative 1% (2019:

positive 11.1%) of pre-tax profits. The effective rate is below the

statutory rate of 19% mainly due to the impact of the untaxable

profit on disposal of the manufacturing division, losses carried

back to previous period and the non recognition of deferred tax

assets in relation to taxable losses carried forward. The current

year tax charge reflects standard UK rates of taxation.

Net debt and cash flow

The Group has moved from a net debt to a net cash position

primarily as a result of the net proceeds from the disposal of the

manufacturing business in August 2019. The Group's net cash

position at the year ended June 2020 was GBP18.0m (2019: net debt

GBP7.2m). Following the disposal of the manufacturing business, the

majority of the Group's trading was in GBP. Note 10 provides an

analysis of net cash.

Financing costs of GBP0.3m (2019: GBP0.4m) comprised interest

expense of GBP0.1m (2019: GBP0.26m) plus a pension plan notional

finance charge of GBP0.2m (2019: charge GBP0.13m). Finance income

in the year is interest received on cash deposits. Finance income

in the prior year was the receipt of GBP1.15m income from the

investment holding in Shanghai Colour Cosmetics Technology Company

Limited (which was disposed of as part of the sale of the

manufacturing business).

Capital expenditure in the year was limited to the design and

implementation of a new ERP system (GBP0.1m), plus purchases of

laptops and fixtures and fittings for the office (GBP0.03m).

Defined benefit pension plan

The defined benefit pension plan underwent its last triennial

valuation on 5 April 2017. The deficit on a statutory funding basis

was GBP2.6m and the Group entered into a revised deficit recovery

plan and schedule of contributions in July 2018. Under this there

is a commitment to make deficit reduction payments of GBP318k per

annum for seven years and GBP210k for a further three years, and to

pay certain administration costs and the PPF levy for the life of

the plan. This commitment will be re-assessed and is likely to be

increased once the results of the next triennial valuation at 5

April 2020 are available. At the reporting date, the April 2020

valuation is still in progress.

Accounting Standards require the discount rate used for

valuations under IAS19 'employee benefits' to be based on yields on

high quality (usually AA-rated) corporate bonds of appropriate

currency, taking into account the term of the relevant pension

plan's liabilities. Corporate bond indices are used as a proxy to

determine the discount rate. At the reporting date, the yields on

bonds of all types were lower than they were at 29 June 2019. This

has resulted in lower discount rates being adopted for accounting

purposes compared to last year. This has materially increased the

fair value of the plan liabilities as measured under IAS 19, which

combined with the anticipated investment return performance, has

translated into an increased liability under the IAS19 methodology.

For accounting purposes at 27 June 2020, the Group recognised under

IAS19 'employee benefits', a net liability of GBP13.2m (2019:

GBP9.4m).

Going Concern

As part of its normal business practice, the Group prepares

annual and longer-term plans and, in reviewing this information the

Directors have a reasonable expectation that the Company and Group

have adequate resources to continue in operational existence for

the foreseeable future. The Group has significant cash reserves of

GBP21.2m following the sale of the manufacturing business.

Accordingly, we continue to adopt the going concern basis in

preparing the annual report and accounts.

Group Statement of Comprehensive Income

For the 52 weeks ended 27 June 2020 and 52 weeks ended 29 June

2019

2020 2019

Notes GBP'000 GBP'000

Revenue 5 16,250 19,676

Cost of sales (including Exceptional costs) 6 (13,069) (12,680)

--------------------------------------------------------------------- ------ --------- ---------

Gross profit 3,181 6,996

Commercial and administrative costs (5,859) (5,016)

--------------------------------------------------------------------- ------ --------- ---------

Operating (loss) / profit before other exceptional items (2,678) 1,980

Exceptional items 6 (1,444) (48)

--------------------------------------------------------------------- ------ --------- ---------

Operating (loss) / profit (4,122) 1,932

--------------------------------------------------------------------- ------ --------- ---------

Finance income 77 -

Finance expense (301) (144)

--------------------------------------------------------------------- ------ --------- ---------

(Loss) / Profit before taxation 7 (4,346) 1,788

Taxation 8 55 (198)

--------------------------------------------------------------------- ------ --------- ---------

(Loss) / Profit for the year (4,291) 1,590

--------------------------------------------------------------------- ------ --------- ---------

Profit on Discontinued Operations after taxation 11 6,529 2,050

--------------------------------------------------------------------- ------ --------- ---------

Profit for the year 2,238 3,640

===================================================================== ====== ========= =========

Other comprehensive income/(loss):

Items that will not be reclassified subsequently to profit or loss:

Re-measurement of defined benefit liability (4,086) (4,011)

Items that will be reclassified subsequently to profit or loss:

Exchange differences on translating foreign operations (49) (35)

Loss on financial assets held at fair value - (6)

Other comprehensive loss for the year (4,135) (4,052)

--------------------------------------------------------------------- ------ --------- ---------

Total comprehensive loss for the year (1,897) (412)

===================================================================== ====== ========= =========

Profit attributable to:

--------------------------------------------------------------------- ------ --------- ---------

Equity shareholders 2,217 3,539

--------------------------------------------------------------------- ------ --------- ---------

Non-controlling interests 21 101

Total comprehensive (loss) / income attributable to:

--------------------------------------------------------------------- ------ --------- ---------

Equity shareholders (1,918) (513)

--------------------------------------------------------------------- ------ --------- ---------

Non-controlling interests 21 101

Earnings per share

- basic 9 12.9p 20.7p

- diluted 9 12.9p 20.0p

Dividends

Paid in year (GBP'000) 745 1,088

Paid in year (pence per share) 4.35p 6.35p

Proposed (GBP'000) Nil 745

Proposed (pence per share) Nil 4.35p

Group Statement of Financial Position

For the 52 weeks ended 27 June 2020, and 52 weeks ended 29 June

2019

2020 2019

Notes GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant and equipment including right of use assets 142 21

Intangible assets 11,714 12,817

Deferred tax assets 2,515 1,714

Total non-current assets 14,371 14,552

Current assets

Inventories 3,724 5,211

Trade and other receivables 3,969 3,475

Assets held for resale 11 - 22,700

Cash and cash equivalents 21,240 381

Current tax receivable 836 285

------------------------------------------------------------- ------ --------- --------

Total current assets 29,769 32,052

------------------------------------------------------------- ------ --------- --------

Total assets 44,140 46,604

------------------------------------------------------------- ------ --------- --------

LIABILITIES

Current liabilities

Trade and other payables 4,503 6,628

Interest-bearing loans and borrowings 1,029 1,139

Current tax payable - 527

------------------------------------------------------------- ------ --------- --------

Total current liabilities 5,532 8,294

------------------------------------------------------------- ------ --------- --------

Non-current liabilities

Interest-bearing loans and borrowings 1,066 2,091

Post-retirement benefit obligations 13,237 9,417

Lease liabilities 81 -

Deferred tax liabilities 1,154 1,061

Total non-current liabilities 15,538 12,569

------------------------------------------------------------- ------ --------- --------

Total liabilities 21,070 20,863

------------------------------------------------------------- ------ --------- --------

Net assets 23,070 25,741

------------------------------------------------------------- ------ --------- --------

EQUITY

Share capital 862 857

Share premium 11,987 11,987

Revaluation of investment reserve - 1,241

Exchange reserve - (147)

Pension re-measurement reserve (10,588) (6,502)

Retained earnings 20,711 18,160

------------------------------------------------------------- ------ --------- --------

Equity attributable to holders of the parent 22,972 25,596

------------------------------------------------------------- ------ --------- --------

Non-controlling interest 98 145

------------------------------------------------------------- ------ --------- --------

Total equity 23,070 25,741

------------------------------------------------------------- ------ --------- --------

Group Statement of Changes in Equity

For the 52 weeks ending 27 June 2020 and 52 weeks ending 29 June

2019

Share Share Revaluation Exchange Pension Retained Non-controlling Total

Capital Premium of Reserve re-measurement Earnings interest Equity

investment reserve

reserve

Group GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- -------- ------------ --------- --------------- --------- ---------------- --------

Balance as at

June 2019 857 11,987 1,241 (147) (6,502) 18,160 145 25,741

----------------- -------- -------- ------------ --------- --------------- --------- ---------------- --------

Dividends - - - - - (745) (68) (813)

Issue of new

shares 5 - - - - - - 5

Non-controlling

interest - - - - - - 21 21

Share based

payments

(credit) - - - - - (162) - (162)

Realisation of

exchange

differences on

sale of

subsidiary - - - 196 - - - 196

Transactions

with owners 5 - - 196 - (907) (47) (753)

----------------- -------- -------- ------------ --------- --------------- --------- ---------------- --------

Profit for the

year - - - - - 2,217 - 2,217

Other

comprehensive

income:

Re-measurement

of defined

benefit

liability - - - - (4,086) - - (4,086)

Exchange

difference on

translating

foreign

operations - - - (49) - - - (49)

Realised profit

on asset sold - - (1,241) - - 1,241 - -

Total

comprehensive

income for the

year - - (1,241) (49) (4,086) 3,458 - (1,918)

----------------- -------- -------- ------------ --------- --------------- --------- ---------------- --------

Balance as at

June 2020 862 11,987 - - (10,588) 20,711 98 23,070

----------------- -------- -------- ------------ --------- --------------- --------- ---------------- --------

Share Share Revaluation Exchange Pension Retained Non-controlling Total

Capital Premium of Reserve re-measurement Earnings interest Equity

investment reserve

reserve

Group GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- -------- ------------ --------- --------------- --------- ---------------- --------

Balance as at

June 2018 857 11,987 1,247 (112) (2,491) 15,455 79 27,022

----------------- -------- -------- ------------ --------- --------------- --------- ---------------- --------

Dividends - - - - - (1,088) (35) (1,123)

Non-controlling

interest - - - - - - 101 101

Share based

payments charge - - - - - 254 - 254

Transactions

with owners - - - - - (834) 66 (768)

----------------- -------- -------- ------------ --------- --------------- --------- ---------------- --------

Profit for the

year - - - - - 3,539 - 3,539

Other

comprehensive

income:

Re-measurement

of defined

benefit

liability - - - - (4,011) - - (4,011)

Exchange

difference on

translating

foreign

operations - - - (35) - - - (35)

Gain on

available for

sale financial

assets - - (6) - - - - (6)

Total

comprehensive

income for the

year - - (6) (35) (4,011) 3,539 - (513)

----------------- -------- -------- ------------ --------- --------------- --------- ---------------- --------

Balance as at

June 2019 857 11,987 1,241 (147) (6,502) 18,160 145 25,741

----------------- -------- -------- ------------ --------- --------------- --------- ---------------- --------

Cash Flow Statement

For the 52 weeks ending 27 June 2020 and 53 weeks ending 29 June

2019

Group Company

2020 2019 2020 2019

GBP'000 GBP'000 GBP'000 GBP'000

Cash flow from operating activities

Profit before taxation 2,183 4,093 5,627 461

Depreciation 93 1,262 - 1,064

Amortisation 1,204 944 1,020 768

Gain on disposal of subsidiaries (8,922) - (9,015) -

Change in value of assets held for resale prior to sale in period (3,225) - (3,681) -

Finance income (77) (1,146) (149) (1,182)

Finance cost 324 389 278 382

Decrease/(Increase) in inventories 1,487 (2,129) - (877)

Decrease /(Increase) in trade and other receivables (494) 1,252 (214) (1,693)

Increase/(Decrease) in trade and other payables 923 3,059 (1,562) 7,712

(Decrease) in share-based payments provision (124) (221) (124) (221)

Contributions to defined benefit plans (318) (282) (318) (282)

Cash generated from operations (6,946) 7,221 (8,138) 6,132

------------------------------------------------------------------- -------- -------- -------- --------

Finance expense paid (128) (263) (82) (256)

Taxation paid (773) (593) (50) (197)

------------------------------------------------------------------- -------- -------- -------- --------

Net cash flow from operating activities (7,847) 6,365 (8,270) 5,679

------------------------------------------------------------------- -------- -------- -------- --------

Cash flow from investing activities

Investment income received - 1,146 - 1,182

Purchase of property, plant and equipment (28) (1,088) - (900)

Purchase of intangible assets (101) (699) - (699)

Proceeds from the sale of subsidiaries 35,255 35,255

Cost associated with disposal of subsidiaries (1,315) - (1,315) -

Net cash flow from investing activities 33,811 (641) 33,940 (417)

------------------------------------------------------------------- -------- -------- -------- --------

Cash flow from financing activities

Movements in invoice discounting facility (3,187) (4,027) (3,592) (3,637)

Finance income received 77 - 149 -

Repayment of loans (1,135) (1,127) (1,135) (1,127)

Lease payments (52) - - -

Issue of new shares 5 - 5 -

Dividends paid (813) (1,123) (745) (1,088)

------------------------------------------------------------------- -------- -------- -------- --------

Net cash flow from financing activities (5,105) (6,277) (5,318) (5,852)

------------------------------------------------------------------- -------- -------- -------- --------

Net increase / (decrease) in cash and cash equivalents 20,859 (553) 20,352 (590)

Cash and cash equivalents at beginning of year 381 934 147 737

------------------------------------------------------------------- -------- -------- -------- --------

Cash and cash equivalents at end of year 21,240 381 20,499 147

------------------------------------------------------------------- -------- -------- -------- --------

Notes to the Accounts

1. Statutory Accounts

The financial information does not constitute statutory accounts

as defined in section 435 of the Companies Act 2006, but has been

extracted from the statutory accounts for the year ended June 2020

on which an unqualified audit report has been issued and which will

be delivered to the Registrar following their adoption at the

Annual General Meeting.

The statutory accounts for the financial year ended June 2019

have been delivered to the Registrar of Companies with an

unqualified audit report and did not contain a statement under

section 498 of the Companies Act 2006.

Copies of the 2020 Annual Report and Accounts will be posted to

shareholders with the notice of the Annual General Meeting. Further

copies may be obtained by contacting the Company Secretary at Brand

Architekts Group plc, 8 Waldegrave Rd, Teddington, TW11 8GT. An

electronic copy will be available on the Group's web site (

www.brandarchitektsplc.com ).

2. Basis of preparation

The Group has prepared its consolidated financial statements in

accordance with International Financial Reporting Standards (IFRS)

as adopted by the European Union and also in accordance with IFRS

issued by the International Accounting Standards Board. These

financial statements have been prepared under the historical cost

convention, modified to include the revaluation of certain

non-current assets and financial instruments.

The Directors have considered trading and cash flow forecasts

prepared for the Group, and based on these, and the confirmed

banking facilities, are satisfied that the Group will continue to

be able to meet its liabilities as they fall due for at least one

year from the date of signing of these accounts. On this basis,

they consider it appropriate to adopt the going concern basis in

the preparation of these accounts.

The consolidated financial statements are presented in sterling

and all values are rounded to the nearest thousand (GBP'000) except

where otherwise indicated.

3. Discontinued activities

As a result of the disposal of the manufacturing business

(completed 23 August 2019), these operations have been disclosed as

discontinued and the related assets classified as held for sale at

the prior year end.

4. Basis of consolidation

The Group financial statements consolidate the financial

statements of the Company and its subsidiary undertakings. The

results and net assets of undertakings acquired or disposed of

during a financial year are included in the Group Statement of

Comprehensive Income and Group Statement of Financial Position from

the effective date of acquisition or to the effective date of

disposal. Subsidiary undertakings have been consolidated using the

purchase method of accounting. In accordance with the exemptions

given by section 408 of the Companies Act 2006, the Company has not

presented its own Statement of Comprehensive Income. The Company's

profit after tax for the year to June 2020 was GBP5.518m (2019:

profit after tax GBP0.487m).

The Group financial statements consolidate those of the parent

company and all of its subsidiaries as of June 2020. The parent

controls a subsidiary if it is exposed, or has rights, to variable

returns from its involvement with the subsidiary and has the

ability to affect those returns through its power over the

subsidiary. All subsidiaries have a reporting date of June.

All transactions and balances between Group companies are

eliminated on consolidation, including unrealised gains and losses

on transactions between Group companies. Amounts reported in the

financial statements of subsidiaries have been adjusted where

necessary to ensure consistency with the accounting policies

adopted by the Group.

Profit or loss and other comprehensive income of subsidiaries

acquired or disposed of during the year are recognised from the

effective date of acquisition, or up to the effective date of

disposal, as applicable.

5. Segmental analysis

During the year, the reportable segments of the Group were

aggregated as follows:

-- Brands - we leverage our skilled resources to develop and

market a growing portfolio of Brand Architekts Group owned and

managed Brands. These include organically developed MR. and Tru,

plus the acquisitions of The Real Shaving Company (in 2015), the

portfolio of Brands included in The Brand Architekts acquisition

(in 2016) and the Fish brand acquired during 2018.

-- Manufacturing - the contracted development, formulation and

production of quality products for many of the world's leading

personal care and beauty Brands. Disposal of the manufacturing

business completed on the 23 August 2019.

-- Eliminations and Central Costs. Other Group-wide activities

and expenses, including defined benefit pension costs, share-based

payment expenses / (credits), amortisation of acquisition-related

intangibles, interest, taxation and eliminations of intersegment

items, are presented within 'Eliminations and central costs'.

This is the basis on which the Group presents its operating

results to the Directors, which is considered to be the Chief

Operating Decision Maker (CODM) for the purposes of IFRS 8.

Comparative full year numbers have been presented on the same

basis.

IFRS15 requires the disaggregation of revenue into categories

that depict how the nature, timing, amount and uncertainty of

revenue and cash flows are affected by economic factors. The

Directors have considered how the Group's revenue might be

disaggregated in order to meet the requirements of IFRS15 and has

concluded that the activity and geographical segmentation

disclosures set out below represent the most appropriate categories

of disaggregation.

a) Principal measures of profit and loss - Income Statement

segmental information for 52 weeks ending 27 June 2020 and 52 weeks

ending 29 June 2019:

52 weeks ended Brands Manufacturing Eliminations Total 2019

27 June 2020 and Central

Costs

Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ------------------------------ ----------------------------- -------------------------------- -------------------------------- ---------------------------

UK revenue 13,796 4,841 - 18,637 52,144

International

revenue 2,454 2,639 - 5,093 25,194

--------------------- ------------------------------ ----------------------------- -------------------------------- -------------------------------- ---------------------------

Revenue - External 16,250 7,480 - 23,730 77,338

Revenue - Internal 5 444 (449) - -

--------------------- ------------------------------ ----------------------------- -------------------------------- -------------------------------- ---------------------------

Total Revenue 16,255 7,924 (449) 23,730 77,338

--------------------- ------------------------------ ----------------------------- -------------------------------- -------------------------------- ---------------------------

Discontinued

Operation - (7,924) 444 (7,480) (57,662)

--------------------- ------------------------------ ----------------------------- -------------------------------- -------------------------------- ---------------------------

Total Revenue

Continuing

Operations 16,255 - (5) 16,250 19,676

--------------------- ------------------------------ ----------------------------- -------------------------------- -------------------------------- ---------------------------

Underlying (loss)

/ profit from

operations* 1,204 (909) (1,083) (788) 4,428

--------------------- ------------------------------ ----------------------------- -------------------------------- -------------------------------- ---------------------------

Charge for

share-based

payments - - (4) (4) (115)

Amortisation of

acquisition-related

intangibles - - (260) (260) (260)

Exceptional items

included in cost

of sales (Note

3) (2,535) - - (2,535) -

Other Exceptional

items (Note 3) (176) 7,460 (1,268) 6,016 (717)

Net borrowing costs (46) (22) (178) (246) 757

--------------------- ------------------------------ ----------------------------- -------------------------------- -------------------------------- ---------------------------

Tax charge on

discontinued

operations - - - - (255)

--------------------- ------------------------------ ----------------------------- -------------------------------- -------------------------------- ---------------------------

Segment Profit

included in

Discontinued

Operations - (6,529) - (6,529) (2,050)

--------------------- ------------------------------ ----------------------------- -------------------------------- -------------------------------- ---------------------------

(Loss) / Profit

before taxation (1,553) - (2,793) (4,346) 1,788

--------------------- ------------------------------ ----------------------------- -------------------------------- -------------------------------- ---------------------------

Tax credit /

(charge) 328 - (273) 55 (198)

--------------------- ------------------------------ ----------------------------- -------------------------------- -------------------------------- ---------------------------

Profit for the

period from

continuing

activities (1,225) - (3,066) (4,291) 1,590

--------------------- ------------------------------ ----------------------------- -------------------------------- -------------------------------- ---------------------------

*The underlying profit net of eliminations and central costs are

as follows:

Continuing Discontinued Total

operations operations

- Brands - Manufacturing

GBP'000 GBP'000 GBP'000

Underlying profit / (loss) from

operations - operating segments 1,204 (909) 295

Eliminations and central costs (1,083) - (1,083)

------------ ----------------- --------

Underlying profit /(loss) from operations 121 (909) (788)

52 weeks ended 30 Eliminations and 2018

June 2019 Brands Manufacturing Central Costs Total Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ------------------------- ----------------------- -------------------- ------------------------ ------------------------

UK revenue 16,381 35,763 - 52,144 51,253

International

revenue 3,220 21,974 - 25,194 22,692

--------------------- ------------------------- ----------------------- -------------------- ------------------------ ------------------------

Revenue - External 19,601 57,737 - 77,338 73,945

Revenue - Internal 75 4,235 (4,310) - -

--------------------- ------------------------- ----------------------- -------------------- ------------------------ ------------------------

Total revenue 19,676 61,972 (4,310) 77,338 73,945

Discontinued

Operation - (61,972) 4,310 (57,662) (52,860)

--------------------- ------------------------- ----------------------- -------------------- ------------------------ ------------------------

Total Revenue

Continuing

Operations 19,676 - - 19,676 21,085

--------------------- ------------------------- ----------------------- -------------------- ------------------------ ------------------------

Underlying profit

from operations* 3,619 2,515 (1,706) 4,428 5,470

Charge for

share-based

payments - - (115) (115) (297)

Amortisation of

acquisition-related

intangibles - - (260) (260) (197)

Other Exceptional

items (Note 3) - (669) (48) (717) (279)

Net borrowing costs - 901 (144) 757 (173)

Tax charge on

discontinued

operations - (255) - (255) (438)

--------------------- ------------------------- ----------------------- -------------------- ------------------------ ------------------------

Segment Profit

included in

Discontinued

Operations - (2,492) 442 (2,050) (1,701)

--------------------- ------------------------- ----------------------- -------------------- ------------------------ ------------------------

Profit before

taxation 3,619 - (1,831) 1,788 2,385

Tax charge (198) (198) (453)

--------------------- ------------------------- ----------------------- -------------------- ------------------------ ------------------------

Profit for the

period from

continuing

activities 3,619 - (2,029) 1,590 1,932

--------------------- ------------------------- ----------------------- -------------------- ------------------------ ------------------------

*The underlying profit net of eliminations and central costs are

as follows:

Continuing Discontinued Total

operations operations

- Brands - Manufacturing

GBP'000 GBP'000 GBP'000

Underlying profit from operations

- operating segments 3,619 2,515 6,134

Eliminations and central costs (1,264) (442) (1,706)

------------ ----------------- --------

Underlying profit from operations 2,355 2,073 4,428

The segmental Income Statement disclosures are measured in

accordance with the Group's accounting policies.

Inter segment revenue earned by Manufacturing from sales to

Brands is determined on commercial trading terms as if Brands were

a third-party customer, prior to disposal.

All defined benefit pension costs and share-based payment

expenses are recognised for internal reporting to the CODM as part

of Group-wide activities and are included within 'Eliminations and

central costs' above. Other costs, such as Group insurance and

auditors' remuneration which are incurred on a Group-wide basis are

recharged by the head office to segments on a reasonable and

consistent basis for all periods presented, and are included within

segment results above.

b) Other Income Statement segmental information

The following additional items are included in the measures of

underlying profit and loss reported to the CODM and are included

within (a) above:

52 weeks ended 27 June 2020 Eliminations and

Brands Manufacturing Central Costs Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ -------------- ---------------------- ------------------------ -----------------

Depreciation 93 - - 93

Amortisation / impairment* 16 - 1,188 1,204

* Impairment losses of GBP924,000 in Central Costs is included in

Exceptional Items

52 weeks ended 29 June 2019 Eliminations and

Brands Manufacturing Central Costs Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ -------------- ---------------------- ------------------------ -----------------

Depreciation 13 1,249 - 1,262

Amortisation - 684 260 944

c) Principal measures of assets and liabilities

The Groups assets and liabilities are managed centrally by the

CODM and consequently there is no reconciliation between the

Group's assets per the statement of financial position and the

segment assets. All assets and liabilities in relation to the

contract manufacturing division were sold during the period.

d) Additional entity-wide disclosures

The distribution of the Group's external revenue by destination

is shown below:

Geographical segments 52 weeks ended 52 weeks ended

27 June 2020 29 June 2019

GBP'000 GBP'000

--------------- ---------------

UK 18,637 52,144

Other European Union countries 2,683 17,482

Rest of the World 2,410 7,712

--------------- ---------------

23,730 77,338

--------------- ---------------

Geographical segments - Continuing Operations 52 weeks ended 52 weeks ended

27 June 2020 29 June 2019

GBP'000 GBP'000

--------------- ---------------

UK 13,796 16,456

Other European Union countries 541 609

Rest of the World 1,913 2,611

--------------- ---------------

16,250 19,676

--------------- ---------------

In the 52 weeks ended 27 June 2020, the Group had three

customers from Continuing Operations (being the Brands division)

that exceeded 10% of total revenues, being 26%, 13% and 11%

respectively. In the 52 weeks ended 29 June 2019, the Group had

three customers that exceeded 10% of total revenues from Continuing

Operations, being 26%, 15% and 11% respectively.

At 2020 year end the Group had non-current assets held overseas

of GBPnil (2019: GBP2,247,000).

6. Exceptional items

Exceptional charges / (credits) from Continuing

Operations: 52 weeks ended 52 weeks ended

27 June 2020 29 June 2019

GBP'000 GBP'000

--------------- ---------------

Included within Cost of sales:

Inventory related 2,535 -

--------------- ---------------

Other exceptional items:

Impairment / amortisation of

RSC 928 -

Severance costs (including social

security costs) 311 -

Consultancy fees 205 -

Write back of contingent consideration - (240)

GMP equalisation - 288

--------------- ---------------

1,444 48

--------------- ---------------

Total exceptional items from Continuing

Operations 3,979 48

--------------- ---------------

As discussed in the Chairman's statement, as part of the

business transformation to focus on Owned Brands business with a

new management team, a number of decisions were taken to reshape

the brand portfolio, triggering adjustments to these brands and

related inventory. This resulted in an exceptional charge of

GBP2.5m which includes provisions for payments due to manufacturers

for inventory not expected to be utilised and changes in estimates

surrounding the valuation of inventory. These are considered one

off and exceptional.

Other exceptional items includes GBP0.9m impairment of the RSC

brand, GBP0.3m cost in relation to the departure in September of

the former Chief Executive Officer and GBP0.2m exceptional

consultancy fees following the reorganisation of the group.

The prior year exceptional items charge represents a provision

of GBP0.3m made in respect to the GMP equalisation on the Group's

DB Pension scheme and write back of contingent consideration from

the acquisition of Fish which was not required to be paid.

Exceptional charges / (credits) from Discontinued

Operations (note 11): 52 weeks ended 52 weeks ended

27 June 2020 29 June 2019

GBP'000 GBP'000

--------------- ---------------

Other exceptional items:

Profit on disposal of the manufacturing

division (8,922) -

Deal related costs - 669

Bonus payments 1,116 -

Inventory write offs and disposal

costs 346 -

(7,460) 669

--------------- ---------------

The year ended 27 June 2020 exceptional items income includes

GBP8.9m profit on disposal of the manufacturing business, GBP1.1m

employee bonuses paid out following disposal of the manufacturing

business, and GBP0.3m relating to inventory disposals which were

intrinsically linked with the manufacturing division.

Exceptional items included within the prior year related to the

disposal of the manufacturing business of GBP0.7m

7. Profit before taxation

2020 2019

GBP'000 GBP'000

(a) This is stated after charging/ (crediting)

Depreciation of property, plant and equipment of purchased assets 93 1,262

Amortisation of intangible assets 276 944

Impairment of intangible assets (classified as exceptional - Note 3) 928 -

Research 177 1,039

Foreign exchange (gains) / losses 3 (37)

Gain on disposal of subsidiaries 8,922 -

Amounts expensed for short term and low value leases 5 -

(b) Auditors' remuneration

Audit services:

Audit of the Company financial statements 41 35

Audit of subsidiary undertakings 11 12

Audit related services:

Interim review 7 -

Other non-audit services:

Corporate finance advice 9 -

8. Taxation

2020 2019

(a) Analysis of tax charge in the year GBP'000 GBP'000

UK corporation tax:

- on profit for the year 14 528

- adjustment in respect of previous years (323) (171)

-foreign tax - 77

Total current tax (credit)/charge (309) 434

-------- --------

Deferred tax:

-current year (credit) (283) (28)

-prior year charge/(credit) 115 47

-effect of tax rate change on opening balance (122) -

-non-recognition of deferred tax asset for losses 544 -

Total deferred tax (credit)/charge 254 19

-------- --------

Tax (credit)/charge (55) 453

-------- --------

Total tax credit of GBP55,000 (2019: tax charge GBP453,000)

comprised tax credit on ongoing operations of GBP55,000 (2019: tax

charge GBP198,000) plus tax on discontinued operations of GBPnil

(2019: tax charge GBP255,000).

(b) Factors affecting total tax charge for the year

The tax assessed on the profit before taxation for the year is

lower (2019: lower) than the standard rate of UK corporation tax of

19.00% (2019: 19.00%). The differences are reconciled below:

2020 2019

GBP'000 GBP'000

Profit before taxation (from continuing and discontinued activities) 2,183 4,093

-------- --------

Tax at the applicable rate of 19.00% (2019: 19.00%) 415 778

Effect of:

Adjustment in respect of previous years (208) (124)

Income not taxable for tax purposes (806) -

Adjustment to deferred tax - (7)

Deferred tax asset not recognised on taxable losses 544

Differences between UK and foreign tax rates - 10

Permanent differences and other - (168)

R&D tax credit - (36)

Actual tax charge (55) 453

-------- --------

The group has tax losses of GBP2.9m (2019: GBPnil) which have

not been recognised as there is no certainty that they can be

utilised.

9. Earnings per share

2020 2019

Basic and Diluted

Profit for the year attributable to equity holders (GBP'000) 2,217 3,539

(Loss) / Profit for the year (GBP'000) continuing operations attributable to equity

holders (4,312) 1,489

Basic weighted average number of ordinary shares in issue during the year 17,143,646 17,135,542

Diluted number of shares 17,143,646 17,659,183

------------- -------------

Basic earnings per share 12.9p 20.7p

------------- -------------

Diluted earnings per share 12.9p 20.0p

------------- -------------

Basic (loss) / earnings per share continuing operations (25.2)p 8.7p

------------- -------------

Diluted (loss) / earnings per share continuing operations (25.2)p 8.4p

------------- -------------

Basic earnings per share has been calculated by dividing the

profit for each financial year by the weighted average number of

ordinary shares in issue at 27 June 2020 and 29 June 2019

respectively.

10. Notes to cash flow statement

GROUP

(a) Reconciliation of cash and cash equivalents to movement in net cash / (debt):

2020 2019

GBP'000 GBP'000

Increase / (Decrease) in cash and cash

equivalents 20,859 (553)

Net cash outflow from decrease in borrowings 4,322 5,154

------------- ---------

Change in net cash / (debt) 25,181 4,601

Opening net (debt) (7,168) (11,769)

------------- ---------

Closing net cash / (debt) 18,013 (7,168)

------------- ---------

(b) Analysis of net cash / (debt): Closing 2019 Cash Flow Non-Cash Movement Closing 2020

GBP'000 GBP'000 GBP'000 GBP'000

Cash at bank and in hand 381 20,858 1 21,240

CID facility (4,319) 3,187 - (1,132)

Borrowings due within one year (1,139) 110 - (1,029)

Borrowings due after one year (2,091) 1,025 - (1,066)

------------- ---------- ------------------ ---------------

(7,168) 25,180 1 18,013

------------- ---------- ------------------ ---------------

COMPANY

(a) Reconciliation of cash and cash equivalents to movement in net cash / (debt):

2020 2019

GBP'000 GBP'000

Increase / (Decrease) in cash and cash

equivalents 20,352 (590)

Net cash outflow / (inflow) from decrease /

(increase) in borrowings 4,727 4,764

------------- ----------

Change in net cash / (debt) 25,079 4,174

Opening net cash / (debt) (6,675) (10,849)

------------- ----------

Closing net cash / (debt) 18,404 (6,675)

(b) Analysis of net cash /

(debt): Closing 2019 Cash Flow Non-Cash Movement Closing 2020

GBP'000 GBP'000 GBP'000 GBP'000

Cash at bank and in hand 147 20,352 - 20,499

Secured debt facility (3,592) 3,592 - -

Borrowings due within one year (1,139) 110 - (1,029)

Borrowings due after one year (2,091) 1,025 - (1,066)

------------- ---------- ------------------ -------------

(6,675) 25,079 - 18,404

------------- ---------- ------------------ -------------

11. Discontinued operations

On 23 August 2019, the Group sold its 100% interest in Curzon

Supplies Ltd for consideration of GBP35,255,000 (completing the

disposal of the manufacturing division) which is the only operation

presented as discontinued operations in 2019. Curzon Supplies Ltd

was incorporated in March 2019. Assets relating to the

manufacturing division, along with the related investments in

Swallowfield Consumer Products Limited, Swallowfield SARL,

Swallowfield s.r.o. and Swallowfield Inc, were transferred to

Curzon Supplies Ltd prior to its disposal.

Profit on disposal Group

At Disposal

23 August

2019

GBP'000

Property, plant and equipment 11,338

Intangible fixed assets 695

Equity instruments held at fair

value 1,558

Inventories 9,724

Trade and other receivables 13,196

Trade and other payables (10,025)

Deferred tax liability (561)

Post-retirement pension obligations

* (1,103)

Realisation of exchange differences 196

25,018

--------------

Deal costs 1,315

Profit on disposal ** 8,922

Satisfied by:

Cash consideration 35,255

* Post-retirement pension scheme obligations figure of GBP1,103,000

in this table relates to reassessment of annual uprating of pension

liabilities.

** Profit on disposal increased by GBP161,000 compared to the

interim accounts owing mainly to recovery of VAT on deal related

costs and changes in consideration following agreement on the

final completion accounts.

Result of discontinued operations 2020 2019

GBP'000 GBP'000

Revenue 7,480 57,663

Expenses other than finance costs (8,389) (55,835)

(Finance Costs) / Investment Income (22) 1,146

Exceptional costs (1,462) (669)

Profit on disposal of manufacturing

business 8,922 -

Tax expense - (255)

Profit for the year 6,529 2,050

----------- -----------

Included in 2020 Exceptional costs in discontinued operations

are GBP1,116,000 employee bonuses paid out following disposal

of the manufacturing business and GBP346,000 relating to specific

branded inventory write offs that were intrinsically linked to

the manufacturing division.

Included in 2019 Exceptional costs in discontinued operations

are restructuring charges of GBP535,000 and deal fees of GBP88,000.

No tax charge has been allocated to discontinued operations as

the division was loss making, excluding the profit on disposal,

in the period from 30 June 2019 to disposal. These taxable losses

were transferred with the trade.

Earnings per share from discontinued

operations: 2020 2019

GBP GBP

Basic earnings per share 38.1 12.6

Diluted earnings per share 38.1 11.6

Cashflow in respect of discontinued

activities 2020 2019

GBP000 GBP000

Operating cash flows (5,761) 6,717

Investing cash flows 35,255 (602)

Financing cash flows (3,592) (3,637)

-------- --------

Total cash flows 25,902 2,478

-------- --------

Assets held for sale Group Company

2020 2019 2019 2019

GBP'000 GBP'000 GBP'000 GBP'000

Property, plant and equipment - 11,190 - 10,329

Intangible fixed assets - 779 - 779

Equity instruments held at fair

value - 1,385 - 1,385

Inventories - 10,743 - 10,743

Trade and other receivables - 13,966 - 13,962

Trade and other payables - (14,800) - (14,550)

Deferred tax liability - (563) - (497)

- 22,700 - 22,151

------------------------------------------- --------- -------- ---------

Annual Report

This report will also be available from the Company's registered

office and on the Company's website www.brandarchitektsplc.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SESFDWESSESU

(END) Dow Jones Newswires

September 28, 2020 02:00 ET (06:00 GMT)

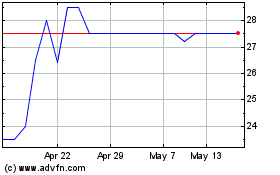

Brand Architekts (LSE:BAR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Brand Architekts (LSE:BAR)

Historical Stock Chart

From Nov 2023 to Nov 2024