Swallowfield PLC Trading Update and Notice of Results (7423D)

July 11 2016 - 2:00AM

UK Regulatory

TIDMSWL

RNS Number : 7423D

Swallowfield PLC

11 July 2016

Swallowfield plc

("Swallowfield" or the "Company")

Trading update

and

notice of results

Swallowfield plc, a market leader in the development,

formulation, and supply of personal care and beauty products, whose

customers include many of the world's leading brands, today

provides an update on trading for the 52 weeks ended on 25 June

2016.

Trading

The Board is pleased to announce that we anticipate full year

profitability will be towards the upper end of expectations.

Overall revenues for the full year are expected to show growth

of 10% (10.4% on a constant currency basis) to approximately

GBP54.4m. Revenues have been bolstered by the strong performance of

innovative new products introduced during the last financial year

and our developing 'owned brands' portfolio. This has also enabled

us to show strong year-on-year growth in contribution margin, as

well as to invest in commercial and technical resources to sustain

future growth.

Our balance sheet continued to strengthen with improved control

of working capital leading to a net debt position of GBP4.3m as at

25 June 2016, which is ahead of expectations, and compares

favourably to the prior year at GBP5.4m. This figure is after

absorbing growth related investments in capital equipment and

inventory to support our owned brands.

Strategic development

The acquisition of The Brand Architekts Ltd ("Brand Architekts")

was completed on 28 June 2016 and therefore had no impact on the

financial year just ended. Work has already started on

opportunities to accelerate the impressive growth of the acquired

business, as we bring the complementary capabilities and resources

of Swallowfield and Brand Architekts together. We are pleased to

report that initial feedback from key customers and suppliers has

been positive and supportive.

Notice of results

The Company expects to announce its results for the 52 weeks

ended 25 June 2016 on Tuesday 20 September 2016.

Chris How, Chief Executive of Swallowfield, commented:

"This has been a busy and successful year for the Group with the

continued execution of our stated strategy driving strong sales

growth and increased profitability.

Whilst we are mindful of the broader economic and political

environment as a result of the EU referendum, we are confident that

our clear strategy leaves us well placed to navigate any potential

macro uncertainty that may lie ahead. The growth momentum in our

core business along with our owned brands portfolio (now including

the brands from Brand Architekts) has given us a more balanced and

resilient business model going forward."

For further information, please contact:

Swallowfield plc

01823 662

Chris How Chief Executive Officer 241

01823 662

Mark Warren Group Finance Director 241

Nic Hellyer/ Jen 0207 496

Boorer/ Alex Price N+1 Singer 3000

Josh Royston /

Hilary Buchanan Alma PR 07780 901979

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTAKFDDFBKDNOK

(END) Dow Jones Newswires

July 11, 2016 02:00 ET (06:00 GMT)

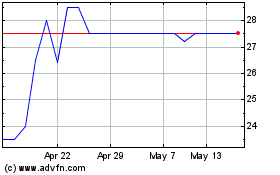

Brand Architekts (LSE:BAR)

Historical Stock Chart

From Sep 2024 to Oct 2024

Brand Architekts (LSE:BAR)

Historical Stock Chart

From Oct 2023 to Oct 2024