Current Report Filing (8-k)

February 28 2020 - 12:54PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION

13 OR 15(d) OF THE

SECURITIES EXCHANGE

ACT OF 1934

Date of report (Date of

earliest event reported): February 26, 2020

ZOOMPASS HOLDINGS, INC.

(Exact Name of Registrant

as Specified in Charter)

|

Nevada

|

333-203997

|

30-0796392

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

2455 Cawthra Rd, Unit

75

Mississauga, ON

L5A3P1, CANADA

(Address of Principal Executive

Offices)

(Zip Code)

647-406-1199

(Registrant's telephone

number, including area code)

N/A

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Trading Symbols

|

Name of Exchange on Which Registered

|

|

Common

|

MCTC

|

None

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if

the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive

Agreement

As previously disclosed on October 22, 2018,

in a Form 8-K for Zoompass Holdings, Inc. (the “Company”), the Company and Virtublock Global Corp. (“Virtublock”)

entered into that certain Stock Purchase Agreement, dated October 17, 2018, pursuant to which the Company purchased certain business

assets that represents a business from Virtublock (the “Assets”) in consideration of the issuance of 44,911,724

shares of Company common stock (the “Stock Purchase Agreement”). Virtublock is controlled by Mahmoud Hashem, a former

officer and director of the Company.

Following entry into the Stock Purchase Agreement,

the Company determined that the Assets should be deemed impaired because such Assets have a market price less than the value initially

listed on the Company's balance sheet or assumed/set forth in the Stock Purchase Agreement.

As a result of such impairment, the parties

entered into a General Release agreement, dated November 29, 2019, pursuant to which the Stock Purchase Agreement was deemed cancelled,

each party acknowledged and agreed that no party has or shall have any claim with respect to intellectual property, software or

other assets owned by any other party and that no agreements exist or remain unsatisfied with respect to the transfer of any asset

from a releasing party to any other party, and Virtublock assigned and transferred the 44,911,724 shares of common stock of the

Company to the Company for cancellation. As a result such shares were cancelled and the total outstanding shares of the Company

was reduced from 116,095,498 to 71,183,774, as of February 27, 2020. This reversal of the 44,911,724 shares of common stock will

be recognized in the Q4 financials of Zoompass Holdings Inc.

Zoompass Holdings Inc, complete a transaction

with a third party Canadian entity which resulted in the issuance of 3,319,162 shares. These shares were part of an assignment

agreement to retire debt owed to the former CEO of Zommpass.

Item 3.02 Unregistered Sales of Equity Securities.

On February 26, 2020,

the sole director of Zoompass Holdings, Inc. (the “Company”), approved the issuance of approximately 3,250,000 shares

of common stock to officers and directors and a consultant for services, effective March 1, 2020, as follows:

|

Steve Roberts

|

1,000,000 shares*

|

|

|

|

|

Emanuel (Manny) Bettencourt

|

2,000,000 shares

|

|

|

|

|

Scott Kline

|

160,000 shares

|

* Mr. Roberts’ share issuance remains

subject to ratification by the full board following appointment of additional directors to fill vacancies described below.

These securities qualified

for exemption under Section 4(2) of the Securities Act since the issuance of securities by us did not involve a public offering.

The offering was not a “public offering” as defined in Section 4(2) due to the insubstantial number of persons involved

in the deal, size of the offering, manner of the offering and number of securities offered. We did not undertake an offering in

which we sold a high number of securities to a high number of investors. In addition, these shareholders had the necessary investment

intent as required by Section 4(2) of the Securities Act since the purchasers agreed to and received share certificates bearing

a legend stating that such securities are restricted pursuant to Rule 144 of the Securities Act. This restriction ensures that

these securities would not be immediately redistributed into the market and therefore not be part of a “public offering.”

Based on an analysis of the above factors, we have met the requirements to qualify for exemption under Section 4(2) of the Securities

Act.

Item 5.02 Departure

of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers.

On February 26, 2020, Steven Roberts, the sole

director of the Company appointed Emanuel (Manny) Bettencourt and Mahendra Naik to fill vacancies on the Board of Directors, each

effective March 1, 2020. Mr. Roberts will remain on the Board of Directors as Chairman.

Also, effective March 1, 2020, Mr. Roberts

resigned as interim Chief Executive Office and appointed Mr. Bettencourt as Chief Executive Officer and interim Chief Financial

Officer and interim Secretary. The Board intends to fill the CFO and Secretary positions as soon as possible.

Emanuel (Manny) A. Bettencourt

Mr. Bettnecourt has been the Chairman &

CEO of Sensor Technologies Inc. since December 2019. He has also been the Executive Chairman of W2E technology Corp. since January

2018, and Managing Director of First Principles Group Inc. since May 2002. From January 2018 until November 2018, Mr. Bettencourt

was CEO and Founder of Demand Power Group Inc. Previously, he served as CFO of Distinct Infrastructure Group from August 2015 through

December 2017.

Mr. Bettencourt is a graduate of the University

of Toronto at Mississauga (B.COMM 1995) and holds both a CPA, CA designation.

Mahendra Naik

From 1981 through 1990 Mr. Naik served as Audit

Assistant at Pricewaterhouse Coopers (PWC). From 1990 to present , Mr. Naik served as the President at FinSec Services Inc. From

1990 through 2020, Mr. Naik served as Chief Financial Officer, Director, member of Audit, Compensation and Special committees at

IAMGOLD Corporation. From 2005 to present Mr. Naik served as Chairman of the Board at Fortune Minerals Limited. From 2000 through

2014 Mr. Naik served as Chief Financial Officer and Senior Business Executive at Fundeco Inc. Mr. Naik earned his Bachelors of

Commerce Degree in 1985 from the University of Toronto, in Ontario.

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

ZOOMPASS

HOLDINGS, INC.

|

|

|

|

|

|

|

|

Dated: February 28, 2020

|

|

|

|

|

|

|

|

By:

/s/ Steve Roberts

|

|

|

|

Steve

Roberts Interim Chief Executive Office

|

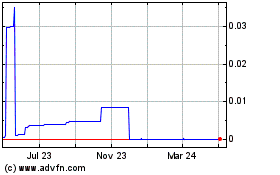

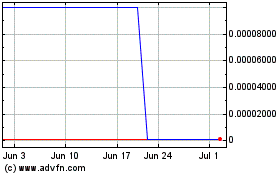

Zoompass (CE) (USOTC:ZPAS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Zoompass (CE) (USOTC:ZPAS)

Historical Stock Chart

From Dec 2023 to Dec 2024