Wolters Kluwer 2013 Third-Quarter Trading Update

November 06 2013 - 2:06AM

Wolters Kluwer, a global leader in

professional information services, today released its scheduled 2013 third

quarter trading update.

Highlights

* Full-year 2013 guidance reiterated.

* Nine-month revenues up +2% at constant currencies and up +1% organically.

* Electronic and service subscription revenues (56% of revenues) up 5%

organically.

* Leading, growing positions (44% of revenues) achieved organic growth of

6% or higher.

* North America and Asia Pacific driving growth, offsetting decline in

Europe.

* Nine-month ordinary EBITA margin broadly in line with prior period,

following margin improvement in third quarter.

* Nine-month ordinary free cash flow increased at constant currencies,

benefitting from timing.

* Nine-month acquisition spend, less divestiture proceeds after tax, was

approx. €120 million.

* Net-debt-to-EBITDA 2.5x as of September 30, on track for 2.5x or better by

year-end 2013.

* Further progress on rebalancing portfolio with recent agreement to divest

certain publishing assets in the Netherlands.

Nancy McKinstry, CEO and Chairman of the Executive Board, commented:

"Our leading, high growth positions achieved strong organic revenue growth in

the third quarter, supporting the positive organic revenue growth for the group

as a whole. We made further progress on transforming our portfolio through

focused investment in growth and divestitures of non-core assets in Europe.

Early benefits from efficiency programs are helping offset wage inflation,

restructuring costs and the effect of dilutive disposals. We remain confident in

delivering our guidance for the full year."

Third Quarter Developments

Third-quarter revenues from continuing operations increased 4% at constant

currencies and grew 2% on an organic basis. The effect of acquisitions on

revenues was partly offset by divestitures in the third quarter. Total recurring

revenues (76% of total) saw positive organic growth despite expected reductions

in print subscriptions. Corporate Legal Services (CLS) transactional revenue

maintained robust growth, but the rate of decline in Financial Services (FS)

transactions, most notably mortage refinancings, deteriorated in the quarter.

Books and other cyclical revenue streams continued to be negatively affected by

weak demand.

The ordinary EBITA margin improved in the third quarter compared to a year ago

and was broadly in line with the prior year for the nine-month period. Wage

inflation, restructuring costs, organic investment, dilutive disposals and the

effect of a weaker U.S. Dollar were largely balanced by mix shift and cost

savings.

Within the Legal & Regulatory division, Corporate Legal Services (CLS) delivered

strong organic growth in the quarter, supported by new customer onboarding at

TyMetrix (legal spend software) and continued growth in CLS transactional

revenues. CLS transactional revenues grew despite slowing U.S. commercial

lending markets and face a tough comparable in the fourth quarter following a

late year rise in M&A volumes in 2012. In September, CLS acquired CitizenHawk, a

leader in online brand protection. In our other North American Legal &

Regulatory operations, legal education book sales were below expectations as

U.S. law school enrollments saw further decline. Good growth in legal online

solutions, such as RBSource for securities lawyers, partially mitigated this

impact. In Europe, organic revenue trends remain weak in most countries, as

expected, particularly for print products. Our outlook for the full year is

overall unchanged: we expect organic growth in North America to be more than

offset by declines in Europe, with the divisional margin contracting mainly as a

result of wage inflation, disposals and restructuring costs.

In Tax & Accounting, our North American business achieved positive organic

growth, as robust performance in tax software was partially offset by reduced

revenues from bank products and print formats. Despite the still challenging

economic environment, our European Tax & Accounting business also saw positive

organic growth in the quarter, as good growth in tax and accounting software

more than offset ongoing declines in print subscriptions, books, training, and

other cyclical activities. Asia Pacific scored several key clients wins with its

corporate tax compliance module, CCH Integrator, but was impacted by lower book

sales. ProSoft in Brazil, acquired in May 2013, is performing well and in line

with expectations. We continue to expect the division's organic growth and

margin this year to be similar to the prior year.

In Health, Clinical Solutions sustained double-digit organic revenue growth in

the third quarter, driven by strong performances from UpToDate, Pharmacy

OneSource, and Medicom. Health Language, acquired in January, is performing to

plan, delivering double-digit revenue growth. Medical Research revenues were

broadly stable, as growth in online subscriptions were offset by lower print

subscriptions. Professional & Education achieved solid organic growth in the

quarter benefitting from timing of orders and supported by growth in digital

learning solutions, such as PrepU. Health is on track to see good organic growth

and margin improvement for the full year.

Financial & Compliance Services saw organic revenue decline and margin

contraction in the third quarter. Finance, Risk & Compliance organic growth

decelerated in the quarter due to delays in the implementation of banking

regulations. Audit achieved robust organic growth in the quarter, despite an

ongoing product rationalisation program. Originations is facing a market-wide

downcycle in U.S. mortgage refinancing volumes which started in the second

quarter. As a result, FS transaction revenues declined organically by 6% in the

third quarter against double-digit growth in the comparable period last year.

Conditions for our European Transport Services business remain challenging as

anticipated and restructuring is underway. Given current trends, we now expect

the division to see modest decline in organic revenues and margin in the full

year.

Cash Flow, Acquisitions, Divestitures, and Net Debt

Nine-month cash conversion was, as expected, lower than a year ago due to

working capital outflows. Nine-month ordinary free cash flow increased at

constant currencies, due mainly to lower cash taxes as a result of timing. Our

full-year guidance for ordinary free cash flow remains unchanged at >= €475

million on the basis of constant exchange rates.

In the nine months to September 30, acquisition spending less after tax disposal

proceeds amounted to approximately €120 million. On September 30, we completed

the disposal of our French healthcare assets, which were part of the Pharma

divestment program initiated in 2011 and recorded in discontinued operations. In

October, we reached agreement on the divestiture of certain publishing

activities in The Netherlands. Annual revenues of these Dutch activities and

those of the U.S. disposal announced in the first half represent approximately

1% of group continuing revenues in 2012. We continue to expect the impact of

divestitures to be slightly dilutive to earnings in 2013 partially offsetting

earnings enhancing acquisitions.

Twelve month rolling net-debt-to-EBITDA was 2.5x at the end of the third

quarter, improving from 2.6x reported for 30 June 2013. We expect net-debt-to-

EBITDA to be at or better than our target of 2.5x by year-end 2013.

Full-Year 2013 Outlook

Our full year outlook remains unchanged from the guidance set out in February.

The table below provides our outlook for the continuing operations in 2013.

Guidance for ordinary free cash flow and diluted ordinary earnings per share

(EPS) is based on constant exchange rates. Wolters Kluwer generates more than

half of its revenue and ordinary EBITA in North America. As a rule of thumb,

based on our 2012 currency profile, a 1 U.S. cent move in the average EUR/USD

exchange rate for the year causes an opposite 1 euro-cent change in diluted

ordinary EPS. (The average EUR/USD rate during the first nine months of 2013 was

1.32, compared to 1.28 in the first nine months of 2012. The closing rate at

September 30 was 1.35).

Outlook

-------------------------------------------------------------------------------

Performance indicators 2013 Guidance

-------------------------------------------------------------------------------

Ordinary EBITA margin 21.5-22.0%

Ordinary free cash flow >= €475 million

Return on invested capital >= 8%

Diluted ordinary EPS Low single-digit growth

-------------------------------------------------------------------------------

Guidance for ordinary free cash flow and diluted ordinary EPS is in constant

currencies (EUR/USD 1.29).

Guidance reflects IFRS 11, IAS 19R and removal of the pension financing credit

or charge from benchmark figures, and includes the estimated impact of

performance share issuance offset by share repurchases.

Ordinary net financing results, which exclude the pension financing credit or

charge, are expected to be approximately €130 million in constant currencies,

reflecting the negative carry caused by early refinancing of our bonds due in

2014. The benchmark effective tax rate on ordinary income before tax is expected

to be broadly in line with the benchmark tax rate of 2012 (27.8%).

About Wolters Kluwer

Wolters Kluwer is a global leader in professional information services.

Professionals in the areas of legal, business, tax, accounting, finance, audit,

risk, compliance and healthcare rely on Wolters Kluwer's market leading

information-enabled tools and software solutions to manage their business

efficiently, deliver results to their clients, and succeed in an ever more

dynamic world. Wolters Kluwer reported 2012 annual revenues of €3.6 billion. The

group employs over 19,000 people worldwide and maintains operations in over 40

countries across Europe, North America, Asia Pacific and Latin America. The

company is headquartered in Alphen aan den Rijn, the Netherlands. Wolters Kluwer

shares are listed on NYSE Euronext Amsterdam (WKL) and are included in the AEX

and Euronext 100 indices. Wolters Kluwer has a sponsored Level 1 American

Depositary Receipt program. The ADRs are traded on the over-the-counter market

in the U.S. (WTKWY).

For more information about our products and organization, visit

www.wolterskluwer.com, follow @Wolters_Kluwer on Twitter, or search for Wolters

Kluwer videos on YouTube.

Financial Calendar

February 19, 2014 Full-Year 2013 Results

Media Investors/Analysts

Caroline Wouters Meg Geldens

Corporate Communications Investor Relations

t + 31 (0)172 641 459 t + 31 (0)172 641 407

press@wolterskluwer.com ir@wolterskluwer.com

Forward-looking Statements

This press release contains forward-looking statements. These statements may be

identified by words such as "expect", "should", "could", "shall" and similar

expressions. Wolters Kluwer cautions that such forward-looking statements are

qualified by certain risks and uncertainties that could cause actual results and

events to differ materially from what is contemplated by the forward-looking

statements. Factors which could cause actual results to differ from these

forward-looking statements may include, without limitation, general economic

conditions; conditions in the markets in which Wolters Kluwer is engaged;

behavior of customers, suppliers, and competitors; technological developments;

the implementation and execution of new ICT systems or outsourcing; and legal,

tax, and regulatory rules affecting Wolters Kluwer's businesses, as well as

risks related to mergers, acquisitions, and divestments. In addition, financial

risks such as currency movements, interest rate fluctuations, liquidity, and

credit risks could influence future results. The foregoing list of factors

should not be construed as exhaustive. Wolters Kluwer disclaims any intention or

obligation to publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise.

PDF version of Press Release: http://hugin.info/130682/R/1740820/584701.pdf

[HUG#1740820]

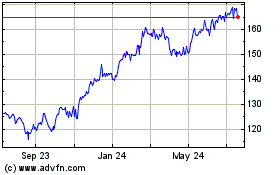

Wolters Kluwer (PK) (USOTC:WTKWY)

Historical Stock Chart

From May 2024 to Jun 2024

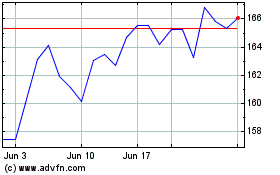

Wolters Kluwer (PK) (USOTC:WTKWY)

Historical Stock Chart

From Jun 2023 to Jun 2024