false

0001320760

0001320760

2024-11-14

2024-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

November 14, 2024

Date of Report (Date of earliest event reported)

TSS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-33627

|

20-2027651

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

|

110 E. Old Settlers Road, Round Rock, Texas 78664

|

|

(Address of principal executive offices and zip code)

|

|

(512) 310-1000

|

|

(Registrant’s telephone number, including area code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2 below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 Par Value

|

|

TSSI

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

On Thursday, November 14, 2024, TSS, Inc. (the “Company”), issued a press release reporting certain financial results of the Company for the three and nine months ended September 30, 2024. A copy of the press release is being furnished herewith as Exhibit 99.1.

The Company’s press release contains non-GAAP financial measures. Pursuant to the requirements of Regulation G, the Company has provided reconciliations within the press release of the non-GAAP financial measures to the most directly comparable GAAP financial measures. Disclosure regarding definitions of these measures used by the Company and why the Company’s management believes the measures provide useful information to investors is also included in the press release.

The Company will conduct a conference call to discuss its financial results on Thursday, November 14, 2024, at 5:00 p.m. Eastern Time.

The information in this Report, including Exhibit 99.1 attached hereto, is furnished pursuant to Item 2.02 of this Current Report on Form 8-K. Such information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

This report may contain “forward-looking statements” – that is, statements related to future – not past – events, plans, and prospects. In this context, forward-looking statements may address matters such as our expected future business and financial performance, and often contain words such as “guidance,” “prospects,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “should,” or “will.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Particular uncertainties that could adversely or positively affect the Company's future results include: we may not have sufficient resources to fund our business and may need to issue debt or equity to obtain additional funding; our reliance on a significant portion of our revenues from a limited number of customers and our ability to diversify our customer base; risks relating to operating in a highly competitive industry; risks relating to supply chain challenges; risk related to changes in labor market conditions; risks related to the implementation of a new enterprise resource IT system; risk related to the development of our procurement and reseller services business; risks relating to rapid technological, structural, and competitive changes affecting the industries we serve; risks involved in properly managing complex projects; risks relating to the possible cancellation of customer contracts on short notice; risks relating our ability to continue to implement our strategy, including having sufficient financial resources to carry out that strategy; and other risks and uncertainties disclosed in our filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the fiscal year ended December 31, 2023. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

S I G N A T U R E S

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

TSS, INC.

|

| |

|

|

| |

|

|

| |

|

|

| |

By:

|

/s/ Daniel M. Chism

|

| |

|

Daniel M. Chism

|

| |

|

Chief Financial Officer

|

Date: November 14, 2024

Exhibit 99.1

TSS, INC. REPORTS THIRD QUARTER REVENUE OF $70.1 MILLION, UP 689%

Net Income Increases 1,166% to $2.6 Million; EPS of $0.10, Up from $0.01

Signs Multi-Year Agreement with Large Customer for AI Rack Integration

Moving and Expanding Factory to Address Accelerating Demand for AI-Enabled Technologies

Uplists to The Nasdaq Capital Market

ROUND ROCK, TEXAS – Nov. 14, 2024 – TSS, Inc. (NASDAQ: TSSI), a data center services company that integrates AI and other high-performance computing infrastructure and software and provides related data center services, today reported results for its third quarter and nine-month period ended September 30, 2024.

“We are pleased to report a dramatic increase in earnings in the third quarter, both sequentially and year-over-year,” said Darryll Dewan, CEO of TSS. “This is the first quarter that includes a full period of revenue for AI-enabled server rack integrations at meaningful volumes. Even more encouraging is the recent signing of an agreement with one of our largest customers to build similar volumes of AI-enabled racks for the next several years. To address both the anticipated volume and the ever-increasing power demands expected from the next several generations of AI racks, we plan to relocate from our current integration facility to a new, larger facility in the area in early 2025.”

Dewan continued, "As we expand our physical footprint with a new state-of-the-art facility, we have also elevated our market presence by transitioning from the OTC Markets to the Nasdaq Capital Market today. This dual relocation strategy – both operational and financial – positions TSS to better serve our growing customer base while providing our shareholders with enhanced visibility and liquidity on a premier technology-focused exchange."

Dewan added, “Further accelerating our earnings growth, we delivered a significant increase in procurement revenues in the third quarter, up over 1,000% compared to the third quarter of last year. In the third quarter, procurement revenues alone exceeded the entire company’s total revenues for all of 2023. This business carries modest margins and provides a nice contribution to the quarter’s operating margin, given minimal overhead costs.”

Third Quarter Financial and Recent Business Highlights:

(Results are unaudited; all comparisons are to Third Quarter 2023)

| |

●

|

Revenues of $70.1 million, up 689%

|

| |

o

|

Systems integration revenues of $7.6 million, up 361%

|

| |

o

|

Facility management revenues of $2.0 million, up 8%

|

| |

o

|

Procurement revenues of $60.5 million, up 1,016%

|

| |

●

|

Gross profit of $7.9 million, up 179%, driven by growth in higher margin services and significant growth in Procurement revenues

|

| |

●

|

Net income of $2.6 million, up 1,166%

|

| |

●

|

Diluted EPS of $0.10, up compared to $0.01

|

| |

●

|

Adjusted EBITDA of $4.3 million, up 358%

|

| |

●

|

Signed a multi-year agreement with one of the company’s largest customers to provide integration services for AI-enabled racks

|

| |

●

|

Appointed industry veteran Michael Fahy as an independent director to the company’s Board

|

Year-to-Date 2024 Financial Highlights

(Results are unaudited; all comparisons are to the First Nine Months of 2023)

| |

●

|

Revenues of $98.2 million, up 227%

|

| |

o

|

Systems integration revenues of $14.7 million, up 121%

|

| |

o

|

Facility management revenues of $6.4 million, up 14%

|

| |

o

|

Procurement revenues of $77.0 million, up 334%

|

| |

●

|

Gross profit of $15.1 million, up 96% on growth in all service lines

|

| |

●

|

Net income of $4.1 million compared to a net loss of ($262,000)

|

| |

●

|

Diluted EPS of $0.16, up compared to ($0.01)

|

| |

●

|

Adjusted EBITDA of $6.7 million, up 291%

|

Dewan continued, “Our performance in the third quarter and the first nine months of 2024 is a direct result of superior operating execution. Year-to-date, we have delivered $98 million in total revenues, more than three times the amount compared to the same period last year, and effectively leveraged our expense structure to grow the bottom line at an even faster pace. The recent signing of a multi-year agreement with one of our largest customers to integrate AI-enabled racks fundamentally changes the earnings potential of the company. Importantly, this agreement increases our visibility into future opportunities and delivery requirements in this rapidly evolving space and provides a strong foundation from which we can continue to grow profitably.”

Dewan concluded, “We are bullish on the outlook for our business with revenue and profit trajectories that are promising over the long-term. Keeping in mind the timing of orders and the mix of services we provide can fluctuate quarter-to-quarter, the multi-year agreement we secured with one of our largest customers will reduce variability and provide greater certainty in our earnings stream. Based on our current visibility, we expect results through the first half of 2025 to be similar to our second and third quarters of 2024.”

Quarterly Conference Call Details

The Company will host a conference call to discuss the third quarter 2024 financial results on Thursday, November 14, 2024, at 5:00 PM Eastern. To participate on the conference call, please dial 888-506-0062 toll free from the U.S. or Canada. Other international callers may access the call at 1-973-528-0011. The event ID number is 754577.

A replay will be available until November 28, 2024. To access the replay, dial 1-877-481-4010 or 1-919-882-2331. When prompted, enter Conference Passcode 51424.

Investors may also access a live audio webcast of this conference call and replay the call for one year following the webcast, at https://www.webcaster4.com/Webcast/Page/2294/51424. Please allow approximately four hours following completion of the call for the recorded webcast to be available. A link to this recorded webcast will also be provided on our website at https://tssiusa.com/.

About Non-GAAP Financial Measures

Adjusted EBITDA is a supplemental financial measure not defined under Generally Accepted Accounting Principles (GAAP). We define Adjusted EBITDA as net income (loss) before net interest expense, income taxes, depreciation and amortization, impairment loss on goodwill and other intangibles, stock-based compensation, provision for bad debts and certain extraordinary items. We present Adjusted EBITDA because we believe this supplemental measure of operating performance is helpful in comparing our operating results across reporting periods on a consistent basis by excluding items that may, or could, have a disproportionately positive or negative impact on our results of operations in any particular period. We also use Adjusted EBITDA as a factor in evaluating the performance of certain management personnel when determining incentive compensation.

Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies. Adjusted EBITDA, while providing useful information, should not be considered in isolation or as an alternative to net income or cash flows as determined under GAAP. Consistent with Regulation G under the U.S. federal securities laws, Adjusted EBITDA has been reconciled to the nearest GAAP measure, and this reconciliation is located under the heading “Adjusted EBITDA Reconciliation” following the Consolidated Statements of Operations included in this press release.

About TSS, Inc.

TSS specializes in simplifying the complex. The TSS mission is to streamline the integration and deployment of high-performance computing infrastructure and software, ensuring that end users quickly receive and efficiently utilize the necessary technology. Known for flexibility, the company builds, integrates, and deploys custom, high-volume solutions that empower data centers and catalyze the digital transformation of generative AI and other leading-edge technologies essential for modern computing, data, and business needs. TSS's reputation is built on passion and experience, quality, and fast time to value. As trusted partners of the world's leading data center technology providers, the company manages and deploys billions of dollars in technology each year. For more information, visit www.tssiusa.com.

Forward Looking Statements

This press release may contain “forward-looking statements” -- that is, statements related to future -- not past -- events, plans, and prospects. In this context, forward-looking statements may address matters such as our expected future business and financial performance, and often contain words such as “guidance,” “prospects,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “should,” or “will.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Particular uncertainties that could adversely or positively affect the Company's future results include: we may not have sufficient resources to fund our business and may need to issue debt or equity to obtain additional funding; our reliance on a significant portion of our revenues from a limited number of customers and our ability to diversify our customer base; risks relating to operating in a highly competitive industry; risks relating to supply chain challenges; risk related to changes in labor market conditions; risks related to the implementation of a new enterprise resource IT system; risks related to the development of our procurement services business; risks relating to rapid technological, structural, and competitive changes affecting the industries we serve; risks involved in properly managing complex projects; risks relating to the possible cancellation of customer contracts on short notice; risks relating to our ability to continue to implement our strategy, including having sufficient financial resources to carry out that strategy; and other risks and uncertainties disclosed in our filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the fiscal year ended December 31, 2023. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements.

Contacts:

Hayden IR

James Carbonara (646) 755-7412

Brett Maas (646) 536-7331

tssi@haydenir.com |

TSS, Inc.

Danny Chism, CFO

(512) 310-4908

dchism@tssiusa.com |

-- Tables Follow --

TSS, Inc.

Consolidated Balance Sheets

(In thousands except par values)

| |

|

September 30,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

(unaudited)

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

46,448 |

|

|

$ |

11,831 |

|

|

Contract and other receivables, net

|

|

|

7,955 |

|

|

|

3,527 |

|

|

Costs and estimated earnings in excess of billings on uncompleted contracts

|

|

|

190 |

|

|

|

1,310 |

|

|

Inventories, net

|

|

|

4.983 |

|

|

|

2,343 |

|

|

Prepaid expenses and other current assets

|

|

|

371 |

|

|

|

302 |

|

|

Total current assets

|

|

|

59,947 |

|

|

|

19,313 |

|

|

Property and equipment, net

|

|

|

2,062 |

|

|

|

628 |

|

|

Lease right-of-use assets

|

|

|

3,605 |

|

|

|

4,062 |

|

|

Goodwill

|

|

|

780 |

|

|

|

780 |

|

|

Other assets

|

|

|

888 |

|

|

|

817 |

|

|

Total assets

|

|

$ |

67,282 |

|

|

$ |

25,600 |

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

$ |

51,927 |

|

|

$ |

14,362 |

|

|

Deferred revenues, current

|

|

|

2,923 |

|

|

|

3,370 |

|

|

Current portion of lease liabilities

|

|

|

774 |

|

|

|

688 |

|

|

Total current liabilities

|

|

|

55,624 |

|

|

|

18,420 |

|

|

Deferred revenues, non-current

|

|

|

908 |

|

|

|

- |

|

|

Non-current portion of lease liabilities

|

|

|

3,096 |

|

|

|

3,631 |

|

|

Total liabilities

|

|

|

59,628 |

|

|

|

22,051 |

|

|

Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Preferred stock, $.0001 par value; 1,000 shares authorized at September 30, 2024 and December 31, 2023; none issued

|

|

|

- |

|

|

|

- |

|

|

Common stock, $.0001 par value; 49,000 shares authorized at September 30, 2024 and December 31, 2023; 24,086 and 23,533 issued; 22,019 and 21,771 outstanding at September 30, 2024 and December 31, 2023, respectively

|

|

|

2 |

|

|

|

2 |

|

|

Additional paid-in capital

|

|

|

72,899 |

|

|

|

72,103 |

|

|

Treasury stock 2,056 and 1,762 shares at cost at September 30, 2024 and December 31, 2023

|

|

|

(2,999 |

) |

|

|

(2,245 |

) |

|

Accumulated deficit

|

|

|

(62,248 |

) |

|

|

(66,311 |

) |

|

Total stockholders' equity

|

|

|

7,654 |

|

|

|

3,549 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

67,282 |

|

|

$ |

25,600 |

|

TSS, Inc.

Condensed Consolidated Statements of Operations

(In thousands except per-share values, unaudited)

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Results of Operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Procurement

|

|

$ |

60,484 |

|

|

$ |

5,422 |

|

|

$ |

77,022 |

|

|

$ |

17,741 |

|

|

Facilities management

|

|

|

1,954 |

|

|

|

1,803 |

|

|

|

6,384 |

|

|

|

5,604 |

|

|

Systems integration

|

|

|

7,630 |

|

|

|

1,655 |

|

|

|

14,713 |

|

|

|

6,646 |

|

|

Total revenues

|

|

|

70,068 |

|

|

|

8,880 |

|

|

|

98,119 |

|

|

|

29,991 |

|

|

Cost of revenues

|

|

|

62,181 |

|

|

|

6,050 |

|

|

|

82,982 |

|

|

|

22,253 |

|

|

Gross profit

|

|

|

7,887 |

|

|

|

2,830 |

|

|

|

15,137 |

|

|

|

7,738 |

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

3,885 |

|

|

|

2,043 |

|

|

|

8,993 |

|

|

|

6,464 |

|

|

Depreciation and amortization

|

|

|

208 |

|

|

|

72 |

|

|

|

397 |

|

|

|

249 |

|

|

Total operating costs

|

|

|

4,093 |

|

|

|

2,115 |

|

|

|

9,390 |

|

|

|

6,713 |

|

|

Operating income

|

|

|

3,794 |

|

|

|

715 |

|

|

|

5,747 |

|

|

|

1,025 |

|

|

Interest expense, net

|

|

|

1,128 |

|

|

|

482 |

|

|

|

1,628 |

|

|

|

1,242 |

|

|

Income (loss) before income taxes

|

|

|

2,666 |

|

|

|

233 |

|

|

|

4,119 |

|

|

|

(217 |

) |

|

Income tax expense

|

|

|

20 |

|

|

|

24 |

|

|

|

56 |

|

|

|

45 |

|

|

Net income (loss)

|

|

$ |

2,646 |

|

|

$ |

209 |

|

|

$ |

4,063 |

|

|

$ |

(262 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per common share - Basic

|

|

$ |

0.12 |

|

|

$ |

0.01 |

|

|

$ |

0.18 |

|

|

$ |

(0.01 |

) |

|

Earnings (loss) per common share - Diluted

|

|

$ |

0.10 |

|

|

$ |

0.01 |

|

|

$ |

0.16 |

|

|

$ |

(0.01 |

) |

TSS, Inc.

Adjusted EBITDA Reconciliation (GAAP to non-GAAP)

(In thousands, unaudited)

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

2,646 |

|

|

$ |

209 |

|

|

$ |

4,063 |

|

|

$ |

(262 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

1,128 |

|

|

|

482 |

|

|

|

1,628 |

|

|

|

1,242 |

|

|

Depreciation and amortization

|

|

|

208 |

|

|

|

72 |

|

|

|

397 |

|

|

|

249 |

|

|

Income tax expense

|

|

|

20 |

|

|

|

24 |

|

|

|

56 |

|

|

|

45 |

|

|

EBITDA

|

|

$ |

4,002 |

|

|

$ |

787 |

|

|

$ |

6,144 |

|

|

$ |

1,274 |

|

|

Stock based compensation

|

|

|

299 |

|

|

|

153 |

|

|

|

604 |

|

|

|

452 |

|

|

Adjusted EBITDA

|

|

$ |

4,301 |

|

|

$ |

940 |

|

|

$ |

6,748 |

|

|

$ |

1,726 |

|

v3.24.3

Document And Entity Information

|

Nov. 14, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

TSS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 14, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-33627

|

| Entity, Tax Identification Number |

20-2027651

|

| Entity, Address, Address Line One |

110 E. Old Settlers Road

|

| Entity, Address, City or Town |

Round Rock

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

78664

|

| City Area Code |

512

|

| Local Phone Number |

310-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

TSSI

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001320760

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

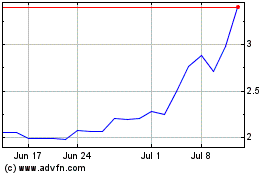

TSS (QB) (USOTC:TSSI)

Historical Stock Chart

From Dec 2024 to Jan 2025

TSS (QB) (USOTC:TSSI)

Historical Stock Chart

From Jan 2024 to Jan 2025