Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

May 15 2023 - 7:43AM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May 2023

Commission File Number 001-34919

SUMITOMO MITSUI FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

1-2, Marunouchi 1-chome, Chiyoda-ku, Tokyo 100-0005, Japan

(Address of principal executive offices)

|

|

|

|

|

| Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: |

|

Form 20-F ☒ |

|

Form 40-F ☐ |

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE INTO THE

PROSPECTUS FORMING A PART OF SUMITOMO MITSUI FINANCIAL GROUP, INC.’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-261754) AND TO BE A PART OF SUCH PROSPECTUS

FROM THE DATE ON WHICH THIS REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

Sumitomo Mitsui Financial Group, Inc. |

|

|

|

|

|

By: |

|

/s/ Jun Okahashi |

|

|

|

|

Name: |

|

Jun Okahashi |

|

|

|

|

Title: |

|

General Manager, Financial Accounting Dept. |

Date: May 15, 2023

|

| This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the

Japanese original, the original shall prevail. Sumitomo Mitsui Financial Group, Inc. assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation. |

May 15, 2023

Sumitomo Mitsui Financial Group, Inc.

Securities code: 8316

Opinion

of SMFG’s Board of Directors on the Shareholder Proposal

Regarding the agenda of the 21st Ordinary General Meeting of

Shareholders scheduled to be held on June 29, 2023, Sumitomo Mitsui Financial Group, Inc. (the “Company”) has received a document stating shareholders’ intentions to exercise their proposal rights. The Company hereby announces

that at its Board of Directors meeting held today, it has resolved to oppose the shareholder proposal.

Simultaneously, the Company

has announced today SMBC Group’s new measures to address climate change issues. Please refer to “Strengthening Efforts against Climate Change” for more details.

| 1. |

Proposing Shareholders |

Joint proposal by three shareholders

* As one or more of the proposing shareholders are individuals, the names are withheld.

| 2. |

The Shareholder Proposal |

Please refer to the Appendix.

| 3. |

Opinion of the Board of Directors on the Shareholder Proposal and the Reasons therefor |

| |

(1) |

Opinion of the Board of Directors |

The Board of Directors opposes this shareholder proposal.

| |

(2) |

Reasons for the Opposition |

SMBC Group, including the Company, has been earnestly working on measures to address climate change issues, which it positions

as one of its most important management issues, and is already actively promoting initiatives related to what this shareholder proposal seeks (issuing and disclosing a transition plan aligned with the Paris Agreement’s 1.5 degree goal).

Furthermore, SMBC Group continuously engages in open dialogues with environmental NGOs and institutional investors, including these proposing shareholders, on measures to address climate change.

1

As a financial group that conducts business globally in a wide range of

fields, SMBC Group supports customers’ efforts to contribute to the transition to and realization of a carbon-neutral society, within the framework of the current Articles of Incorporation. We work earnestly to reduce greenhouse gas (GHG)

emissions in line with the goals of the Paris Agreement. In August 2021, SMBC Group committed to the following: to achieve net zero GHG emissions across its overall loan and investment portfolio (Financed Emissions, FE) by 2050, as well as in its

groupwide operations by 2030. In fiscal 2022, its FE reduction efforts included setting reduction targets for 2030 across the power, oil and gas and coal sectors, which are aimed at achievement of the Paris Agreement’s 1.5 degree goal. In

fiscal 2023, we plan to set reduction targets for the steel and automobile sectors as well. In accordance with the requirements of the Net-Zero Banking Alliance (*1), we are setting targets for the main

sectors that account for roughly 90% of total global GHG emissions by October 2024. Furthermore, we will reduce our balance of loans for coal power generation, a business sector especially responsible for a large amount of GHG emissions, by 50%

compared to fiscal 2020 baseline by fiscal 2030, and to zero out this balance by fiscal 2040 (*2). We also announced that we would zero out the balance of loans for the thermal coal mining sector by fiscal 2030 in countries that are members of the

Organization for Economic Co-operation and Development (OECD) and by fiscal 2040 for non-OECD countries (*3). We are working steadily toward the achievement of these

targets.

In 2021, SMBC Group formulated the “Roadmap Addressing Climate Change,” a long-term plan for tackling

climate change, clearly setting out our intent to achieve net-zero GHG emissions by 2050. Furthermore, we also formulated our “Action Plan,” which consists of short-to-medium-term concrete measures within the Roadmap. In 2022, we revised the Roadmap Addressing Climate Change, turning it into a “Transition Plan,” systemizing and disclosing the Group’s

targets and actions to achieve net zero emissions. Accordingly, through the Transition Plan, the Board of Directors has made commitments regarding the contents requested in this shareholder proposal and the Company has announced such information in

a timely manner.

2

Under the Companies Act of Japan, the Articles of Incorporation shall

stipulate the basic framework of a company, such as its business purpose and institutional design by resolution at a general meeting of shareholders. On the other hand, considering that the Companies Act leaves decisions on business execution to the

board of directors or executive officers delegated by the board of directors so as to enable the company to act promptly and exercise expert business judgement, it is inappropriate to stipulate matters concerning individual and specific business

execution in the Articles of Incorporation. The proposal seeks to stipulate in the Articles of Incorporation the issuance and disclosure of a transition plan aligned with the Paris Agreement’s goal, which is an instance of individual and

specific business execution. The Company will continue to flexibly review and revise its measures to address climate change issues, including the Transition Plan, in the light of the ever-changing situation, and to disclose those measures

appropriately. Since amendments to the Articles of Incorporation require a special resolution at the General Meeting of Shareholders, if this proposal is approved, the added provision would remain in effect until the Articles of Incorporation are

amended and this would make it difficult for the Company to respond and adjust flexibly even in the event of changes in rules and frameworks concerning ESG, or major changes in social conditions, such as wars or large-scale natural disasters.

Additionally, provisions of the Articles of Incorporations which depends on subjective judgements, such as determining “credible pathways” and “considering the full range of scope 3 ” as required by this shareholder proposal, are

unclear as to their legally binding effect, and therefore introduce risks to legal certainty.

For the reasons above, the

Board of Directors opposes the proposed amendments to the Articles of Incorporation.

| |

*1 |

|

Net-Zero Banking Alliance |

An

international initiative launched in April 2021 under the leadership of the United Nations Environment Programme Finance Initiative (UNEP FI) aiming at net-zero GHG emissions from investment and loan

portfolios by 2050, through the establishment of scientifically based medium- to long-term GHG emissions reduction targets and the corresponding progress reports.

| |

*2 |

|

This does not include projects which are deemed to contribute to the transition to a decarbonized society. The

Group’s scope of the target for fiscal 2030 is project financing. The scope of the targets for fiscal 2040 are project financing and corporate financing tied to facilities. |

| |

*3 |

|

This does not include projects which contribute to the business transformation from fossil fuel use. It

applies to all loans including corporate financing. |

3

SMBC Group’s “Net Zero Transition Plan” is as follows.

4

(Appendix)

The Shareholder Proposal

(The following

“Details of the proposal” and “Reasons for the proposal” are an English translation of the original text described in a form submitted by the shareholders.)

The Proposal

Partial amendment to the Articles of Incorporation

(issuing and disclosing a transition plan to align lending and investment portfolios with the Paris Agreement’s 1.5 degree goal requiring net zero emissions by 2050)

| 1. |

Details of the proposal |

The following clause shall be added to the Articles of Incorporation:

|

|

|

| Chapter: |

|

“Transition Plan (Portfolio Alignment)” |

| Clause: |

|

“Issuing and disclosing a transition plan to align lending and investment portfolios with the Paris Agreement’s 1.5 degree goal requiring net zero emissions by 2050” |

| 1. |

In order to fulfil the Company’s commitment to net zero emissions by 2050 in its lending and investment

portfolios, the Company shall set and disclose a transition plan to align its portfolios, in the short-, medium- and long-term, with credible pathways to net zero emissions by 2050 or sooner, including strategic policy commitments and targets for

significant GHG-intensive sectors within its portfolios, considering the full range of Scope 3 value chain emissions. |

| 2. |

The Company shall report on its progress against such a transition plan and targets in its annual reporting.

|

| 2. |

Reasons for the proposal |

This proposal requests that the Company disclose information required for shareholders to determine the integrity of the Company’s plans

to achieve its net zero emissions by 2050 commitment, and for the Company to appropriately manage climate change risks, and maintain and increase the Company’s long-term corporate value.

The Company is exposed to substantial financial risk, given its significant involvement in carbon-intensive sectors such as fossil fuels.

However, the Company has not set and disclosed sufficient targets or policy commitments to align its exposures to the most GHG-intensive sectors with a net zero emissions by 2050 pathway.

5

It is, therefore, critical for the Company to ensure the integrity of its climate goals and

transition plans by setting and disclosing such targets and strategic policy commitments, which should align with the trajectories and key conclusions of credible net zero emissions by 2050 scenarios, such as the International Energy Agency’s.

Global peers of the Company are already disclosing this type of information.

The disclosure this proposal seeks is commonly expected among

investors through the Task Force on Climate-related Financial Disclosures (TCFD), and international standard setting initiatives such as the Net Zero Banking Alliance.

6

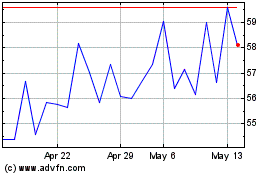

Sumitomo Mitsui Finl (PK) (USOTC:SMFNF)

Historical Stock Chart

From Nov 2024 to Dec 2024

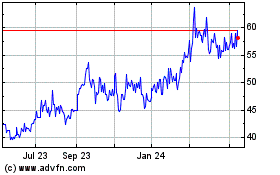

Sumitomo Mitsui Finl (PK) (USOTC:SMFNF)

Historical Stock Chart

From Dec 2023 to Dec 2024