Current Report Filing (8-k)

February 23 2023 - 8:33AM

Edgar (US Regulatory)

0000919175

false

0000919175

2023-02-21

2023-02-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 21, 2023

SUGARMADE,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-23446 |

|

94-3008888 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

20529

E. Walnut Drive N.

Walnut,

CA |

|

91789 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (888) 982-1628

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01 Regulation FD Disclosure.

On

February 23, 2023, Sugarmade, Inc. (the “Company”) issued a press release discussing certain business developments. A copy

of this press release is attached hereto as Exhibit 99.1 and incorporated herein by reference. The information contained in the website

is not a part of this Current Report on Form 8-K.

The

information included in Item 7.01 to this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or

the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The information set forth under this

Item 7.01 shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K.

Item

8.01. Other Events.

On

February 21, 2023, Sugarmade, Inc. (the “Company”) entered into a letter of intent (the “LOI”) by and between

the Company and both Treasure Mountain Holdings (“Treasure Mountain”) and Victorville Treasure Holdings (“Victorville”),

both real estate owners. Under the terms of the LOI, the Company and the sellers agreed to enter into an acquisition agreement pursuant

to which the Company would acquire the two entities in exchange for a combination of cash and equity. The result of the proposed transactions

would be the creation of a legacy OTC company engaged in legal cannabis activities and a new, potentially NASDAQ listed company involved

in hospitality, entertainment, and multimedia flex-makerspace operations, not associated with cannabis.

The

purchase price of the two entities would aggregate to $70,000,000, payable in cash, the assumption of existing mortgages and issuance

of equity.

Within

the ensuing 60-day LOI period, the parties will explore the best deployment of these acquired assets, examine the auditability of the

to-be-acquired entities, and commence the engagement of lawyers, auditors and investment bankers to support this project.

The

Company has agreed to a commitment fee of $500,000, payable in the form of 2,500,000,000 restricted shares, once the LOI remains uncancelled

at the conclusion of the Due Diligence Period.

A

definitive agreement will follow upon satisfaction of the contingencies, but the parties acknowledge that there is the possibility that

the conditions may not be met. The Parties mutually agreed that the LOI would be valid for a period of sixty (60) days from the date

of signing, which was February 21, 2023, after which the terms of the LOI would no longer be valid. Therefore, the LOI would expire on

April 23, 2023, unless amended to extend the term of the LOI.

Item

9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

SUGARMADE,

INC. |

| |

|

| Date:

February 23, 2023 |

By: |

/s/

Jimmy Chan |

| |

Name: |

Jimmy

Chan |

| |

Title: |

Chief

Executive Officer and Chief Financial Officer |

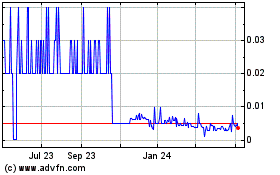

Sugarmade (PK) (USOTC:SGMD)

Historical Stock Chart

From Aug 2024 to Sep 2024

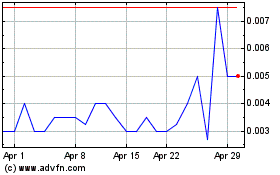

Sugarmade (PK) (USOTC:SGMD)

Historical Stock Chart

From Sep 2023 to Sep 2024