OFFERING

CIRCULAR

SmartMetric,

Inc.

500,000,000

Shares of Common Stock

This

Post-Qualification Offering Circular Amendment No. 2 amends the Offering Statement of SmartMetric, Inc., a Nevada corporation, qualified

on May 15, 2023, and as may be amended and supplemented from time to time (collectively, the “Offering Circular”), to:

(a) extend the offering period to October 12, 2024; and (b) change the offering price of the Offered Shares to $0.0003-0.001 per share

(the price to be fixed by a post-qualification supplement).

By this

Offering Circular, SmartMetric, Inc., a Nevada corporation, is offering for sale a maximum of 500,000,000 shares of its common stock

(the “Offered Shares”), at a fixed price of $0.0003-0.001 per share, pursuant to Tier 2 of Regulation A of the United

States Securities and Exchange Commission (the “SEC”). A minimum purchase of $5,000 of the Offered Shares is required in

this offering; any additional purchase must be in an amount of at least $1,000. This offering is being conducted on a best-efforts basis,

which means that there is no minimum number of Offered Shares that must be sold by us for this offering to close; thus, we may receive

no or minimal proceeds from this offering. All proceeds from this offering will become immediately available to us and may be used as

they are accepted. Purchasers of the Offered Shares will not be entitled to a refund and could lose their entire investments. Please

see the “Risk Factors” section, beginning on page 3, for a discussion of the risks associated with a purchase of the Offered

Shares.

We estimate

that this offering will commence within two days of SEC qualification; this offering will terminate at the earliest of (a) the date on

which the maximum offering has been sold, (b) August 29, 2024, or (c) the date on which this offering is earlier terminated by us, in

our sole discretion. (See “Plan of Distribution”).

| Title of Securities Offered |

|

Number

of Shares |

|

Price to

Public |

|

Commissions(1) |

|

Proceeds to

Company(2) |

| Common Stock |

|

500,000,000 |

|

$0.0003-0.001 |

|

$-0- |

|

$150,000-500,000 |

|

(1) |

We may offer the

Offered Shares through registered broker-dealers and we may pay finders. However, information as to any such broker-dealer or finder

shall be disclosed in an amendment to this Offering Circular. |

|

(2) |

Does not account for

the payment of expenses of this offering estimated at $20,000. See “Plan of Distribution.” |

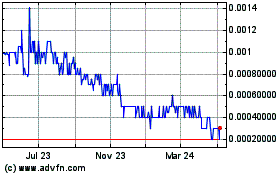

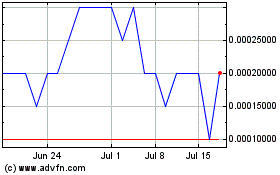

Our

common stock is quoted in the over-the-counter under the symbol “SMME” in the OTC Pink marketplace of OTC Link. On October

19, 2023, the closing price of our common stock was $0.0006 per share.

Investing

in the Offered Shares is speculative and involves substantial risks, including the superior voting rights of our outstanding shares of

Class B Convertible Preferred Stock, which preclude current and future owners of our common stock, including the Offered Shares, from

influencing any corporate decision. The Class B Convertible Preferred Stock has the following voting rights: the outstanding shares of

Series B Convertible Preferred Stock are entitled to vote on any matter with the holders of common stock voting together as one (1) class

and shall have that number of votes (identical in every other respect to the voting rights of the holder of common stock entitled to

vote at any regular or special meeting of Stockholders) equal to that number of common shares which is not less than 51% of the vote

required to approve any action. Our CEO and Chairman, as the owner of all outstanding shares of the Class B Convertible Preferred Stock,

will, therefore, be able to control the management and affairs of our company, as well as matters requiring the approval by our shareholders,

including the election of directors, any merger, consolidation or sale of all or substantially all of our assets, and any other significant

corporate transaction. (See “Risk Factors—Risks Related to a Purchase of the Offered Shares”). You should purchase

Offered Shares only if you can afford a complete loss of your investment. See Risk Factors, beginning on page 3, for a discussion of

certain risks that you should consider before purchasing any of the Offered Shares.

THE

SEC DOES NOT PASS UPON THE MERITS OF, OR GIVE ITS APPROVAL TO, ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS

UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO

AN EXEMPTION FROM REGISTRATION WITH THE SEC. HOWEVER, THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE

EXEMPT FROM REGISTRATION.

The

use of projections or forecasts in this offering is prohibited. No person is permitted to make any oral or written predictions about

the benefits you will receive from an investment in Offered Shares.

No

sale may be made to you in this offering, if you do not satisfy the investor suitability standards described in this Offering Circular

under “Plan of Distribution—State Law Exemption and Offerings to ‘Qualified Purchasers’” (page 17). Before

making any representation that you satisfy the established investor suitability standards, we encourage you to review Rule 251(d)(2)(i)(C)

of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

This

Offering Circular follows the disclosure format of Form S-1, pursuant to the General Instructions of Part II(a)(1)(ii) of Form 1-A.

The date of this Post-Qualification

Offering Circular Amendment No. 2 is October 20, 2023.

TABLE

OF CONTENTS

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The

information contained in this Offering Circular includes some statements that are not historical and that are considered forward-looking

statements. Such forward-looking statements include, but are not limited to, statements regarding our development plans for our business;

our strategies and business outlook; anticipated development of our company; and various other matters (including contingent liabilities

and obligations and changes in accounting policies, standards and interpretations). These forward-looking statements express our expectations,

hopes, beliefs and intentions regarding the future. In addition, without limiting the foregoing, any statements that refer to projections,

forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

The words anticipates, believes, continue, could, estimates, expects, intends, may, might, plans, possible, potential, predicts, projects,

seeks, should, will, would and similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing,

may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The

forward-looking statements contained in this Offering Circular are based on current expectations and beliefs concerning future developments

that are difficult to predict. We cannot guarantee future performance, or that future developments affecting our company will be as currently

anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other

assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking

statements.

All

forward-looking statements attributable to us are expressly qualified in their entirety by these risks and uncertainties. These risks

and uncertainties, along with others, are also described below in the Risk Factors section. Should one or more of these risks or uncertainties

materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these

forward-looking statements. You should not place undue reliance on any forward-looking statements and should not make an investment decision

based solely on these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

OFFERING

CIRCULAR SUMMARY

The

following summary highlights material information contained in this Offering Circular. This summary does not contain all of the information

you should consider before purchasing our common stock. Before making an investment decision, you should read this Offering Circular

carefully, including the Risk Factors section and the consolidated financial statements and the notes thereto. Unless otherwise indicated,

the terms “we”, “us” and “our” refer and relate to SmartMetric, Inc., a Nevada corporation, including

its subsidiaries.

Our

Company

SmartMetric,

Inc. was incorporated pursuant to the laws of Nevada on December 18, 2002. “SmartMetric is a development stage company engaged

in the technology industry. SmartMetric’s main products are a fingerprint sensor activated payments card and security card with

a finger sensor and fully functional fingerprint reader embedded inside the card. The SmartMetric biometric cards have a rechargeable

battery allowing for portable biometric identification and card activation. This card is referred to as a biometric card or the SmartMetric

Biometric Card.” (See “Business”).

Offering

Summary

| Securities

Offered |

|

The

Offered Shares, 500,000,000 shares of common stock, are being offered by our company. |

| |

|

|

| Offering

Price Per Share |

|

$0.0003-0.001

per Offered Share. |

| |

|

|

| Shares

Outstanding Before This Offering |

|

2,401,186,371

shares of common stock issued and outstanding as of the date of this Offering Circular. |

| |

|

|

| Shares

Outstanding After This Offering |

|

2,901,186,371

shares of common stock issued and outstanding, assuming a maximum offering hereunder. |

| |

|

|

| Minimum

Number of Shares to Be Sold in This Offering |

|

None |

| |

|

|

| Disparate

Voting Rights |

|

Our

outstanding shares of Class B Convertible Preferred Stock possess superior voting rights, which preclude current and future owners

of our common stock, including the Offered Shares, from influencing any corporate decision. The Class B Convertible Preferred Stock

has the following voting rights: the outstanding shares of Series B Convertible Preferred Stock are entitled to vote on any matter

with the holders of common stock voting together as one (1) class and shall have that number of votes (identical in every other respect

to the voting rights of the holder of common stock entitled to vote at any regular or special meeting of Stockholders) equal to that

number of common shares which is not less than 51% of the vote required to approve any action. Our CEO and Chairman, Chaya Hendrick,

as the owner of all of the outstanding shares of the Class B Convertible Preferred Stock, will, therefore, be able to control the

management and affairs of our company, as well as matters requiring the approval by our shareholders, including the election of directors,

any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate transaction. (See

“Risk Factors—Risks Related to a Purchase of the Offered Shares” and “Security Ownership of Certain Beneficial

Owners and Management”). |

| |

|

|

| Investor

Suitability Standards |

|

The

Offered Shares are being offered and sold only to “qualified purchasers” (as defined in Regulation A under the Securities

Act). “Qualified purchasers” include: (a) “accredited investors” under Rule 501(a) of Regulation D and

(b) all other investors so long as their investment in the Offered Shares does not represent more than 10% of the greater of their

annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural

persons). |

| |

|

|

| Market

for our Common Stock |

|

Our

common stock is quoted in the over-the-counter market under the symbol “SMME” in the OTC Pink marketplace of OTC Link. |

| |

|

|

| Termination

of this Offering |

|

This

offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year

from this offering being qualified by the SEC and (c) the date on which this offering is earlier terminated by us, in our sole discretion.

(See “Plan of Distribution”). |

| |

|

|

| Use

of Proceeds |

|

We

will apply the proceeds of this offering for repayment of indebtedness, equipment purchases, stadium deposits, general and administrative

expenses and working capital. (See “Use of Proceeds”). |

| |

|

|

| Risk

Factors |

|

An

investment in the Offered Shares involves a high degree of risk and should not be purchased by investors who cannot afford the loss

of their entire investments. You should carefully consider the information included in the Risk Factors section of this Offering

Circular, as well as the other information contained in this Offering Circular, prior to making an investment decision regarding

the Offered Shares. |

| |

|

|

| Corporate

Information |

|

Our

principal executive offices are located at 3960 Howard Hughes Parkway, Suite 500, Las Vegas, Nevada 89169; our telephone number is

(702) 990-3687; our corporate website is located at www.smartmetric.com. No information found on our company’s website is part

of this Offering Circular. |

Continuing

Reporting Requirements Under Regulation A

We

are required to file periodic and other reports with the SEC, pursuant to the requirements of Section 13(a) of the Securities Exchange

Act of 1934. Our continuing reporting obligations under Regulation A are deemed to be satisfied, as long as we comply with our Section 13(a)

reporting requirements.

RISK

FACTORS

An

investment in the Offered Shares involves substantial risks. You should carefully consider the following risk factors, in addition to

the other information contained in this Offering Circular, before purchasing any of the Offered Shares. The occurrence of any of the

following risks might cause you to lose a significant part of your investment. The risks and uncertainties discussed below are not the

only ones we face, but do represent those risks and uncertainties that we believe are most significant to our business, operating results,

prospects and financial condition. Some statements in this Offering Circular, including statements in the following risk factors, constitute

forward-looking statements. (See “Cautionary Statement Regarding Forward-Looking Statements”).

Risks

Related to Our Company

There

is a substantial doubt about our ability to continue as a going concern. The report of our independent auditors that accompanies

our consolidated financial statements includes an explanatory paragraph indicating there is a substantial doubt about our ability to

continue as a going concern, citing our need for additional capital for the future planned expansion of our activities and to service

our ordinary course activities (which may include servicing of indebtedness). The inclusion of a going concern explanatory paragraph

in the report of our independent auditors will make it more difficult for us to secure additional financing or enter into strategic relationships

on terms acceptable to us, if at all, and likely will materially and adversely affect the terms of any financing that we might obtain.

Our financial statements do not include any adjustments that may result from the outcome of this uncertainty.

We are an early-stage

company, have no product revenues, are not profitable and may never be profitable. At June 30, 2023, we had an accumulated deficit

of $31,431,438. Our net loss available to common shareholders for the two most recent fiscal years ended June 30, 2023 and 2022,

were $935,396 and $1,636,677, respectively.

We

have never made any sales and have never generated revenues and we anticipate none will be generated for the foreseeable future. We expect

to incur significant operating losses for the foreseeable future as we continue the development of our products. Accordingly, we will

need additional capital to fund our continuing operations and any expansion plans. Since we do not generate any revenue, the most likely

source of such additional capital is the sale of our securities. To the extent that we raise additional capital by issuing equity securities,

our stockholders are likely to experience dilution with regard to their percentage ownership of the company, which may be significant.

If we raise additional capital by incurring debt, we could incur significant interest expense and become subject to covenants that could

affect the manner in which we conduct our business, including securing such debt obligations with our assets.

We

had net cash used in operating activities of $247,140 and $1,002,769 for the years ended June 30, 2023 and 2022, respectively. Any

losses in the future could cause the quoted price of our common stock to decline or have a material adverse effect on our financial condition,

our ability to pay our debts as they become due, and on our cash flows.

To

date, we have generated only losses, which are expected to continue for the foreseeable future. Our net loss available to common

shareholders for the two most recent fiscal years ended June 30, 2023 and 2022, were $935,396 and $1,636,677, respectively. We may

not be able to achieve expected results, including any guidance or outlook it may provide from time to time. We may continue to incur

losses and may be unable to achieve profitability. We cannot assure you that our net losses and negative cash flow will not accelerate

and surpass our expectations, nor can we assure you that we will ever generate any net income or positive cash flow.

We may not be able

to continue as a going concern if we do not obtain additional financing by March 31, 2024. Since our inception, we have

funded our operations primarily through the sale of our securities. Our cash and cash equivalents balance at June 30, 2023, was $20,012.

Based on our current expected level of operating expenditures, we expect to only be able to fund our operations through approximately

February 28, 2024, at which time we will need additional capital. Our ability to continue as a going concern is wholly dependent upon

obtaining sufficient capital to fund our operations. We have no committed sources of additional capital and our access to capital funding

is always uncertain. Accordingly, despite our ability to secure capital in the past, we cannot assure you that we will be able to secure

additional capital through financing transactions, including issuance of debt, or through other means. In the event that we are not able

to secure additional funding, we may be forced to curtail operations, cease operations altogether or file for bankruptcy.

As of June 30,

2023, we owed Chaya Hendrick, our CEO, $769,309 in deferred officer salary, of which the failure to pay could result in Chaya Hendrick’s

termination of employment, the result of which would materially harm our business. At June 30, 2023, we had not paid $769,309

in salary owed to Chaya Hendrick, our CEO, pursuant to Chaya Hendrick’s employment agreement with us. While Chaya Hendrick continues

to support our company and continues to serve as our CEO, President and Chairman of the Board of Directors, there can be no assurances

that this will continue if we fail to pay back salaries and future salary owed. Additionally, as of July 1, 2017, all prior and

future deferred salary owed will bear interest at a rate of 7% per annum. In the event Chaya Hendrick terminates employment for lack

of payment, we believe such loss would cause irreparable harm to our product development and would materially harm our business prospects.

Additionally, there can be no assurances that Chaya Hendrick would not attempt to foreclose on our assets in order to satisfy such debt

obligations.

Raising

capital may be difficult as a result of our history of losses and limited operating history in our current stage of development.

When making investment decisions, investors typically look at a company’s management, earnings and historical performance in evaluating

the risks and operations of the business and the business’s future prospects. Our history of losses and relatively limited operating

history in our current stage of development makes such evaluation, as well as any estimation of our future performance, substantially

more difficult. As a result, investors may be unwilling to invest in us or on terms or conditions which are acceptable. If we are unable

to secure additional financing, we may need to materially scale back our business plan and/or operations or cease operations altogether.

We

have a limited operating history as a company and may not be able to effectively operate our business. Our limited staff and

operating history mean that there is a high degree of uncertainty regarding our ability to:

|

● |

develop our technologies

and proposed products; |

|

● |

identify,

hire, and retain the needed personnel to implement our business plan and sell our products; |

|

● |

Manage

our growth and/or successfully scale our business; or |

|

● |

respond

to competition. |

No

assurances can be given as to exactly when, if at all, we will be able to fully develop, and take the necessary steps to derive any revenues

from our proposed products.

Our

business depends upon our ability to keep pace with the latest technological changes, and our failure to do so could make us less competitive

in our industry. The market for our services is characterized by rapid change and technological improvements. Failure to respond

in a timely and cost-effective way to these technological developments may result in serious harm to our business and operating results.

As a result, our success will depend, in part, on our ability to develop and market service offerings that respond in a timely manner

to the technological advances of available to our customers, evolving industry standards and changing preferences.

Our

potential competitors have significantly greater resources than we have, which may make competing

difficult. We compete against numerous companies, many of which have substantially

greater resources than we have. Several such competitors have large teams of engineers and

scientists that attempt to develop products and technologies similar to ours. Companies such

as Gemalto, Giesecke & Devrient, IDEMIA, as well as others, have substantially greater

financial, research, manufacturing and marketing resources than we do. As a result, such

competitors may find it easier to compete in our industry and bring competing products to

market.

Our

key personnel and directors are critical to our business, and such key personnel may not remain with our company in the future.

We depend on the continued employment of our President and CEO, Chaya Hendrick and technical contracted personnel. If any of these key

personnel were to leave and not be replaced with sufficiently qualified and experienced personnel, our business could be adversely affected.

In particular, our current strategy to penetrate the market for contactless logical access identification and transaction solutions is

heavily dependent on the vision, leadership and experience of our President and CEO, Chaya Hendrick.

Our

continued success will depend, to a significant extent, upon the performance and contributions of Chaya Hendrick and upon our ability

to attract motivate and retain highly qualified management personnel and employees. We depend on Chaya Hendrick to effectively manage

our business in a highly competitive environment. If one or more of our key officers join a competitor or form a competing company, we

may experience interruptions in product development, delays in bringing products to market, difficulties in our relationships with customers

and loss of additional personnel, which could significantly harm our business, financial condition, operating results and projected growth.

We

currently employ a part-time Chief Financial Officer, Mr. Jay Needelman, who is also a member of the Company’s Board of Directors.

The loss of services of any of our key management personnel, whether through resignation or other causes, the reduced services of our

part-time Chief Financial Officer, or the inability to attract qualified personnel as needed, could prevent us from adequately executing

our business strategy.

Rapid

technological changes could make our services or products less attractive. The smart card, biometric identification and personal

identification industries are characterized by rapid technological change, frequent new product innovations, changes in customer requirements

and expectations and evolving industry standards. If we are unable to keep pace with these changes, our business may be harmed. Products

using new technologies, or emerging industry standards, could make our technologies less attractive. In addition, we may face unforeseen

problems when developing our products, which could harm our business. Furthermore, our competitors may have access to technologies not

available to us, which may enable them to produce products of greater interest to consumers or at a more competitive cost.

Sales

of our products depend on the development of emerging applications in their target markets and on diversifying and expanding our customer

base in new markets and geographic regions, all of which may be financially burdensome or unsuccessful. Our intent is to market

and sell our products primarily to the private sector while addressing emerging applications that have not yet reached a stage of mass

adoption or deployment. The market for some of these solutions (electronic biometric fingerprinting) is at an early stage of deployment

in the private sector compared to other forms of services that try to identify a person through simpler means (by their name, social

security number, etc.) Additionally, we have a strategy of expanding sales of existing products into new geographic markets. Our target

market initially will be South America and Australia. In the event that we are unable to adequately develop our applications or gain

traction in these emerging markets, or that the cost of the foregoing is too great, our business may be harmed.

Continuing

disruption in the global financial markets may adversely impact customers and customer spending patterns. Continuing disruption

in the global financial markets as a result of the ongoing global financial uncertainty may cause consumers, businesses and governments

to defer purchases in response to tighter credit, decreased cash availability and declining consumer confidence. Accordingly, demand

for our products could decrease and differ materially from their current expectations. Further, some of our customers may require substantial

financing in order to fund their operations and make purchases from us. The inability of these customers to obtain sufficient credit

to finance purchases of our products and meet their payment obligations to us or possible insolvencies of our customers could result

in decreased customer demand, an impaired ability for us to collect on outstanding accounts receivable, significant delays in accounts

receivable payments, and significant write-offs of accounts receivable, each of which could adversely impact our financial results.

Our

quarter-to-quarter performance may vary substantially, and this variance, as well as general

market conditions, may cause our stock price to fluctuate greatly and even potentially expose

us to litigation. We have been unable to generate significant revenues under our

business plan and we cannot accurately estimate future revenue and operating expenses based

on historical performance. Our quarterly operating results may vary significantly based on

many factors, including:

|

● |

Fluctuating

demand for our potential products; |

|

● |

Announcements

or implementation by our competitors of new products; |

|

● |

Amount

and timing of our costs related to our marketing efforts or other initiatives; |

|

● |

Timing

and amounts relating to the expansion of our operations; |

|

● |

Our

ability to enter into, renegotiate or renew key agreements; |

|

● |

Timing

and amounts relating to the expansion of our operations; or |

|

● |

Economic

conditions specific to our industry, as well as general economic conditions. |

Our

current and future expense estimates are based, in large part, on estimates of future revenue, which is difficult to predict. We expect

to make significant operating and capital expenditures in connection with the development of our plan of business. We may be unable to,

or may elect not to, adjust spending quickly enough to offset any unexpected revenue shortfall. If our increased expenses were not accompanied

by increased revenue in the same quarter, our quarterly operating results would be harmed.

It

is possible that the Coronavirus (“Covid-19”) pandemic could cause long-lasting stock market volatility and weakness, as

well as long-lasting recessionary effects on the United States and/or global economies. Should the negative economic impact caused

by the COVID-19 pandemic result in continuing long-term economic weakness in the United States and/or globally, our ability to expand

our business would be severely negatively impacted. It is possible that our company would not be able to sustain during any such long-term

economic weakness. The COVID-19 pandemic has, to date, had minimal impact on our operations.

If

we fail to effectively manage our growth, and effectively develop our business, our business will be harmed. Failure to manage

growth of operations could harm our business. To date, a significant amount of activities and resources have been directed at developing

our business plan and potential related products. In order to effectively manage growth, we must:

|

● |

Continue

to develop an effective planning and management process to implement our business strategy; |

|

● |

Hire,

train and integrate new personnel in all areas of our business; and |

|

● |

Increase

capital investments. |

We

cannot assure you that we will be able to accomplish these tasks or effectively manage our growth.

We

are subject to the risks frequently experienced by smaller reporting companies. The likelihood of our success must be considered

in light of the risks frequently encountered by smaller reporting companies. These risks include our potential inability to:

|

● |

Establish

product sales and marketing capabilities. |

|

● |

Identify,

attract, retain, and motivate qualified personnel. |

|

● |

Maintain

our reputation and build trust with consumers. |

|

● |

Attract

sufficient capital resources to develop our business. |

Our

Board of Directors may change our policies without shareholder approval. Our policies, including any policies with respect to

investments, leverage, financing, growth, debt and capitalization, will be determined by our Board of Directors or officers to whom our

Board of Directors delegate such authority. Our Board of Directors will also establish the amount of any dividends or other distributions

that we may pay to our shareholders. Our Board of Directors or officers to which such decisions are delegated will have the ability to

amend or revise these and our other policies at any time without shareholder vote. Accordingly, our shareholders will not be entitled

to approve changes in our policies, which policy changes may have a material adverse effect on our financial condition and results of

operations.

Risks

Related to Our Intellectual Property

If

we are not able to adequately protect our intellectual property, we may not be able to compete effectively. Our ability to compete

depends in part upon the strength of our proprietary rights in our technologies, brands and content. The efforts we have taken to protect

our intellectual property and proprietary rights may not be sufficient or effective at stopping unauthorized use of our intellectual

property and proprietary rights. In addition, effective trademark, patent, copyright, and trade secret protection may not be available

or cost-effective in every country in which our products are made available. There may be instances where we are not able to fully protect

or utilize our intellectual property in a manner that maximizes competitive advantage. If we are unable to protect our intellectual property

and proprietary rights from unauthorized use, the value of our products may be reduced, which could negatively impact our business. Our

inability to obtain appropriate protections for our intellectual property may also allow competitors to enter our markets and produce

or sell the same or similar products. In addition, protecting our intellectual property and other proprietary rights is expensive and

diverts critical managerial resources. If any of the foregoing were to occur, or if we are otherwise unable to protect our intellectual

property and proprietary rights, our business and financial results could be adversely affected. If we are forced to resort to legal

proceedings to enforce our intellectual property rights, the proceedings could be burdensome and expensive. In addition, our proprietary

rights could be at risk if we are unsuccessful in, or cannot afford to pursue, those proceedings.

We

may incur substantial costs as a result of litigation or other proceedings relating to patent and other intellectual property rights

and we may be unable to protect our rights to, or use of, our technology. Some or all of our patent applications may not issue

as patents, or the claims of any issued patents may not afford meaningful protection for our technologies or products. In addition, patents

issued to us or our licensors, if any, may be challenged and subsequently narrowed, invalidated, or circumvented. Patent litigation is

widespread in our industry and could harm our business. Litigation might be necessary to protect our patent position or to determine

the scope and validity of third-party proprietary rights. If we choose to go to court to stop someone else from using the inventions

claimed in our patents, that individual or company would have the right to ask the court to rule that such patents are invalid and/or

should not be enforced against that third party. These lawsuits are costly and we may not have the required resources to pursue such

litigation or to protect our patent rights. In addition, there is a risk that the court might decide that these patents are not valid

and that we do not have the right to stop the other party from using the inventions. There is also the risk that, even if the validity

of these patents is upheld, the court could refuse to stop the other party on the grounds that such other party’s activities do

not infringe on our rights contained in these patents.

Furthermore,

a third party may claim that we are using inventions covered by their patent rights and may go to court to stop us from engaging in our

normal operations and activities, including making or selling our product candidates. These lawsuits are costly and could materially

increase our operating expenses and divert the attention of managerial and technical personnel. There is a risk that a court would decide

that we are infringing the third party’s patents and would order us to stop the activities covered by the patents. In addition,

there is a risk that a court would order us to pay the other party damages for having violated the other party’s patents. It is

not always clear to industry participants, including us, which patents cover various types of products or methods of use. The coverage

of patents is subject to interpretation by the courts, and the interpretation is not always uniform.

Because

some patent applications in the United States may be maintained in secrecy until the patents are issued, patent applications in the United

States and many foreign jurisdictions are typically not published until eighteen months after filing, and publications in the scientific

literature often lag behind actual discoveries, we cannot be certain that others have not filed patent applications for technology covered

by our issued patents or that we were the first to invent the technology. Our competitors may have filed, and may in the future file,

patent applications covering technology similar to ours. Any such patent application may have priority over our patent applications and

could further require us to obtain rights to issued patents covering such technologies.

If

another party has filed a United States patent application on inventions similar to ours, we may have to participate in an interference

or other proceeding in the U.S. Patent and Trademark Office, or the PTO, or a court to determine priority of invention in the United

States. The costs of these proceedings could be substantial, and it is possible that such efforts would be unsuccessful, resulting in

a loss of our United States patent position with respect to such inventions.

Some

of our competitors may be able to sustain the costs of complex patent litigation more effectively than we can because they have substantially

greater resources. In addition, any uncertainties resulting from the initiation and continuation of any litigation could have a material

adverse effect on our ability to raise the capital necessary to continue our operations.

Risks

Relating to Market Approval and Government Regulations

Compliance

with regulation of corporate governance and public disclosure diverts time and attention away from revenue generating activities.

Our management team invests significant time and financial resources to comply with existing standards for public companies, which has

led to management time and attention from developing our business to compliance activities which could have an adverse effect on our

business.

Our

technology relies on our ability to gain the acceptance and approval of large banking / credit card institutions, the failure to do so

may materially harm our business. In the event that our SmartMetric Biometric Card does not gain acceptance/approval amongst

the large card issuing institutions in the United States and abroad, our cards will not be provided for use to customers. We currently

have no plans to open our own bank/credit card issuing institution and accordingly, we plan to rely on our ability to have our products

accepted within the banking/credit card industries. Our failure to do so will have a material impact on our ability to generate revenues

and continue to operate our business.

Risks

Relating to the Development and Manufacturing of Our Products

We

currently rely on third party manufacturers and suppliers for certain components of our product; with such parties being, to some extent,

outside of our control. We currently have limited internal manufacturing capability and intend to rely on third party contract

manufacturers or suppliers for the foreseeable future. Accordingly, factors outside of our control may result in material manufacturing

delays and product shortages, which could delay or otherwise negatively impact our manufacturing and product development plans. Should

we be forced to manufacture our proposed products, we cannot give any assurance that we would be able to develop internal manufacturing

capabilities. In the event that we seek third party suppliers or alternative manufacturers, they may require us to purchase a minimum

amount of materials or could require other unfavorable terms. Any such event could materially impact our business prospects and could

delay the development and manufacturing of our products. Moreover, we cannot give any assurance that the contract manufacturers or suppliers

that we select will be able to supply our products in a timely or cost-effective manner or in accordance with our specifications.

We

have a limited number of suppliers of key components and may experience difficulties in obtaining components for which there is significant

demand, which would materially impact our business prospects. We rely upon a limited number of suppliers for some key components

of our products. Our reliance on a limited number of suppliers may expose us to various risks including, without limitation, an inadequate

supply of components, price increases, late deliveries, and poor component quality. In addition, some of the basic components we use

in our products, such as biometric fingerprint devices and various smart card technologies may at any time be in great demand. This could

result in components not being available to us in a timely manner or at all, particularly if larger companies have ordered more significant

volumes of those components, or in higher prices being charged for components. Disruption or termination of the supply of components

or software used in our products could delay shipments of these products. The following delays/factors from our third-party suppliers

could have a material adverse effect on our business and operating results and could also damage relationships with current and prospective

customers:

|

● |

Difficulties

in staffing; |

|

● |

Adequate

resources of qualified technicians, engineers/assemblers, and programmers; |

|

● |

Potentially

adverse tax consequences; |

|

● |

Unexpected

changes in regulatory requirements; |

|

● |

Tariffs

and other trade barriers; |

|

● |

Political

and economic instability; and |

|

● |

Late

delivery of our products. |

We

utilize third party manufacturing plants for silicon for the manufacturing our products, which, in the event of growth would need to

use large quantities of silicon, for which raw material shortages may occur. While we currently use silicon in our products,

and no shortage currently exists of these materials, there can be no assurances that there will not be a shortage in the future, which

may materially impact our manufacturing capabilities, growth prospects, and ability to generate revenue in the future.

Risks

Related to a Purchase of the Offered Shares

Our

CEO and Chairman, as the sole holder of our Series B Convertible Preferred Stock, controls our company. Chaya Hendrick, our CEO

and Chairman, holds (via shares in her name or shares in the name of an entity she controls – Applied Cryptography, Inc. (“ACI”))

all 610,000 shares of Series B Convertible Preferred Stock outstanding. The outstanding shares of Series B Convertible Preferred Stock

are entitled to vote on any matter with the holders of common stock voting together as one (1) class and shall have that number of votes

(identical in every other respect to the voting rights of the holder of common stock entitled to vote at any regular or special meeting

of Stockholders) equal to that number of common shares which is not less than 51% of the vote required to approve any action, which Nevada

law provides may or must be approved by vote or consent of the common shares or the holders of other securities entitled to vote, if

any. Each share of Series B Convertible Preferred Stock is convertible, at the option of the holder, into fifty (50) shares of common

stock upon the satisfaction of certain conditions and for purposes of determining a quorum of a shareholder meeting, the outstanding

shares of Series B Convertible Preferred Stock shall be deemed the equivalent of 51% of all shares of the Company’s Common Stock

entitled to vote at such meetings. Accordingly, Ms. Hendrick can (without the approval of our other shareholders) elect our entire Board

of Directors and determine the outcome of various matters submitted to shareholders for approval, including fundamental corporate transactions.

Voting control by Ms. Hendrick may discourage certain types of transactions involving an actual or potential change in control of us,

including transactions in which the holders of our common stock might receive a premium for their shares over prevailing market prices.

Our

board of directors has broad discretion to issue additional securities. We are authorized under our certificate of incorporation

to issue up to 5,005,000,000 shares consisting of 5,000,000,000 shares of common stock and 5,000,000 “blank check” shares

of preferred stock [we intend to increase the number of authorized shares of common stock to 10,000,000,000 in November 2023]. Shares

of our blank check preferred stock provide the board of directors with broad authority to determine voting, dividend, conversion, and

other rights. As of the date of this Offering Circular, we have issued and outstanding 2,401,186,371 shares of common stock; 610,000

shares of Series B Convertible Preferred Stock that are convertible into 30,500,000 shares of common stock at the election of the holder;

and 17,300 shares of Series C Convertible Preferred Stock. Additionally, we have 45,997,852 shares of common stock reserved upon the

exercise of outstanding purchase warrants. Accordingly, as of the date of this Officer Circular, we are entitled to issue up to 2,568,313,629

[7,568,313,629 after the increase in the authorized shares of common stock] additional shares of common stock, and 4,372,700 additional

shares of “blank check” preferred stock. Our board may generally issue those common and preferred shares, or convertible

securities to purchase those shares, without further approval by our shareholders. Any additional preferred shares we may issue could

have such rights, preferences, privileges, and restrictions as may be designated from time-to-time by our board, including preferential

dividend rights, voting rights, conversion rights, redemption rights and liquidation provisions.

It

is likely that we will issue additional securities to raise capital in order to further our business plans. It is also likely that we

will issue additional securities to directors, officers, employees, and consultants as compensatory grants in connection with their services.

Any issuances could be made at a price that reflects a discount to, or a premium from, the then-current market price of our common stock.

These issuances would dilute the percentage ownership interest of our current shareholders, which would have the effect of reducing your

influence on matters on which our stockholders vote and might dilute the net tangible book value per share of our common stock.

Failure

to maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect

on our business and operating results and stockholders could lose confidence in our financial reporting. Effective internal controls

are necessary for us to provide reliable financial reports and effectively prevent fraud. If we cannot provide reliable financial reports

or prevent fraud, our operating results could be harmed. Failure to achieve and maintain an effective internal control environment, regardless

of whether we are required to maintain such controls, could also cause investors to lose confidence in our reported financial information,

which could have a material adverse effect on our stock price. The Company’s management assessed the design and operating effectiveness

of internal control over financial reporting as of June 30, 2023, based on the framework set forth in Internal Control-Integrated Framework

issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on that assessment, management concluded that,

during the period covered by this report, such internal controls and procedures were not effective as of June 30, 2023.

We

have not paid dividends on our common stock in the past and do not expect to pay dividends on our common stock for the foreseeable future.

Any return on investment may be limited to the value of our common stock. No cash dividends have been paid on our common stock.

We expect that any income received from operations will be devoted to our future operations and growth. We do not expect to pay cash

dividends on our common stock in the near future. Payment of dividends would depend upon our profitability at the time, cash available

for those dividends, and other factors as our board of directors may consider relevant. If we do not pay dividends, our common stock

may be less valuable because a return on an investor’s investment will only occur if our stock price appreciates.

The

requirements of being a public company may strain our resources, divert management’s attention, and affect our ability to attract

and retain qualified board members. The Exchange Act requires, among other things, that we file annual, quarterly, and current

reports with respect to our business and financial condition. The Sarbanes-Oxley Act requires, among other things, that we maintain effective

disclosure controls and procedures and internal controls for financial reporting. For example, Section 404 of the Sarbanes-Oxley

Act of 2002 requires that our management report on, and our independent auditors attest to, the effectiveness of our internal controls

structure and procedures for financial reporting. Section 404 compliance may divert internal resources and will take a significant

amount of time and effort to complete. We may not be able to successfully complete the procedures and certification and attestation requirements

of Section 404 by the time we will be required to do so. If we fail to do so, or if in the future our chief executive officer, chief

financial officer or independent registered public accounting firm determines that our internal controls over financial reporting are

not effective as defined under Section 404, we could be subject to sanctions or investigations by the SEC or other regulatory authorities.

Furthermore, investor perceptions of our company may suffer, and this could cause a decline in the market price of our common stock.

Irrespective of compliance with Section 404, any failure of our internal controls could have a material adverse effect on our stated

results of operations and harm our reputation. If we are unable to implement these changes effectively or efficiently, it could harm

our operations, financial reporting or financial results and could result in an adverse opinion on internal controls from our independent

auditors. We may need to hire a number of additional employees with public accounting and disclosure experience in order to meet our

ongoing obligations as a public company, which will increase costs. Our management team and other personnel will need to devote a substantial

amount of time to new compliance initiatives and to meeting the obligations that are associated with being a public company, which may

divert attention from other business concerns, which could have a material adverse effect on our business, financial condition, and results

of operations. In addition, because our management team has limited experience managing a public company, we may not successfully or

efficiently manage our transition into a public company.

We

may seek capital that may result in shareholder dilution or that may have rights senior to those of our common stock, including the Offered

Shares. From time to time, we may seek to obtain additional capital, either through equity, equity-linked or debt securities.

The decision to obtain additional capital will depend on, among other factors, our business plans, operating performance and condition

of the capital markets. If we raise additional funds through the issuance of equity, equity-linked or debt securities, those securities

may have rights, preferences or privileges senior to the rights of our common stock, which could negatively affect the market price of

our common stock or cause our shareholders to experience dilution.

Shares

eligible for future sale may adversely affect the market. From time to time, certain of our shareholders may be eligible to sell

all or some of their shares of common stock by means of ordinary brokerage transactions in the open market pursuant to Rule 144,

promulgated under the Securities Act, subject to certain limitations. In general, a non-affiliate stockholder who has satisfied a six-month

holding period may, under certain circumstances, sell its shares, without limitation. Any substantial sale of the our common stock pursuant

to Rule 144, pursuant to any resale prospectus or pursuant to this Offering Circular may have a material adverse effect on the market

price of our common stock.

We

do not intend to pay dividends on our common stock. We intend to retain earnings, if any, to provide funds for the implementation

of our business strategy. We do not intend to declare or pay any dividends in the foreseeable future. Therefore, there can be no assurance

that holders of our common stock will receive cash, stock or other dividends on their shares of our common stock, until we have funds

which our Board of Directors determines can be allocated to dividends.

Our

common stock has been, and may in the future be, a “Penny Stock” and subject to specific rules governing its sale to investors.

The SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant

to our Common Stock, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than

$5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a

broker or dealer approve a person’s account for transactions in penny stocks; and the broker or dealer receive from the investor

a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In

order to approve a person’s account for transactions in penny stocks, the broker or dealer must obtain financial information and

investment experience objectives of the person; and make a reasonable determination that the transactions in penny stocks are suitable

for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of

transactions in penny stocks.

The

broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to

the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination;

and that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally,

brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more

difficult for investors sell shares of our common stock.

Disclosure

also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions

payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies

available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent

price information for the penny stock held in the account and information on the limited market in penny stocks.

There

is limited trading activity in our common stock and there is no assurance that an active market will develop in the future. Although

our common stock is currently quoted on the OTC Pink marketplace of OTC Link (an interdealer electronic quotation system operated by

OTC Markets Group, Inc.) under the symbol “SMME”, trading of our common stock may be extremely sporadic. For example, several

days may pass before any shares may be traded. As a result, an investor may find it difficult to dispose of, or to obtain accurate quotations

of the price of our common stock. There can be no assurance that a more active market for our common stock will develop, or if one should

develop, there is no assurance that it will be sustained. This severely limits the liquidity of our common stock, and would likely have

a material adverse effect on the market price of our common stock and on our ability to raise additional capital.

The

market for our common stock may be volatile; you could lose all or part of your investment in the Offered Shares. The market

price of our common stock may fluctuate substantially and will depend on a number of factors many of which are beyond our control and

may not be related to our operating performance. These fluctuations could cause you to lose all or part of your investment in the Offered

Shares, since you might be unable to sell your Offered Shares at or above the price you pay for the Offered Shares. Factors that could

cause fluctuations in the market price of our common stock include, but are not limited to, the following:

|

● |

price

and volume fluctuations in the overall stock market from time to time; |

|

● |

volatility

in the market prices and trading volumes of sports and music memorabilia stocks; |

|

● |

changes

in operating performance and stock market valuations of other sports and music memorabilia-related companies generally, or those

in our industry, in particular; |

|

● |

sales

of shares of our common stock by us or our shareholders; |

|

● |

failure

of securities analysts to maintain coverage of us, changes in financial estimates by securities analysts who follow our company,

or our failure to meet these estimates or the expectations of investors; |

|

● |

the

financial projections we may provide to the public, any changes in those projections or our failure to meet those projections; |

|

● |

announcements

by us or our competitors of new products or services; |

|

● |

the

public’s reaction to our press releases, other public announcements and filings with the SEC; |

|

● |

rumors

and market speculation involving us or other companies in our industry; |

|

● |

actual

or anticipated changes in our operating results or fluctuations in our operating results; |

|

● |

actual

or anticipated developments in our business, our competitors’ businesses or the competitive landscape generally; |

|

● |

litigation

involving us and/or our industry, or investigations by regulators into our operations or those of our competitors; |

|

● |

developments

or disputes concerning our intellectual property or other proprietary rights; |

|

● |

announced

or completed acquisitions of businesses or technologies by us or our competitors; |

|

● |

new

laws or regulations or new interpretations of existing laws or regulations applicable to our business; |

|

● |

changes

in accounting standards, policies, guidelines, interpretations or principles; |

|

● |

any

significant change in our management; and |

|

● |

general

economic conditions and slow or negative growth of our markets. |

In

addition, in the past, following periods of volatility in the overall market and the market price of a particular company’s securities,

securities class action litigation has often been instituted against these companies. This litigation, if instituted against us, could

result in substantial costs and a diversion of our management’s attention and resources.

Applicable

regulatory requirements, including those contained in and issued under the Sarbanes-Oxley Act of 2002, may make it difficult for us to

retain or attract qualified officers and directors, which could adversely affect the management of our business and our ability to obtain

or retain listing of our common stock. We may be unable to attract and retain those qualified officers, directors and members

of board committees required to provide for effective management because of the rules and regulations that govern publicly held companies,

including, but not limited to, certifications by principal executive officers. The enactment of the Sarbanes-Oxley Act has resulted in

the issuance of a series of related rules and regulations and the strengthening of existing rules and regulations by the SEC, as well

as the adoption of new and more stringent rules by the stock exchanges. The perceived increased personal risk associated with these changes

may deter qualified individuals from accepting roles as directors and executive officers.

Further,

some of these changes heighten the requirements for board or committee membership, particularly with respect to an individual’s

independence from the corporation and level of experience in finance and accounting matters. While certain board and committee requirements

may not apply to us as an OTC listed company, we intend to explore voluntarily complying with some of these requirements. We may have

difficulty attracting and retaining directors with the requisite qualifications. If we are unable to attract and retain qualified officers

and directors, the management of our business and our ability to obtain or retain listing of our shares of common stock on any stock

exchange (assuming we elect to seek and are successful in obtaining such listing) could be adversely affected.

If

we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or detect

fraud, and, consequently, investors could lose confidence in our financial reporting and this may decrease the trading price of our common

stock. We must maintain effective internal controls to provide reliable financial reports and detect fraud. We have been assessing

our internal controls to identify areas that need improvement. We are in the process of implementing changes to internal controls, but

have not yet completed implementing these changes. Failure to implement these changes to our internal controls or any others that it

identifies as necessary to maintain an effective system of internal controls could harm our operating results and cause investors to

lose confidence in our reported financial information. Any such loss of confidence would have a negative effect on the trading price

of our stock.

A

material weakness in internal controls may remain undetected for a longer period, because of our exemption from the auditor attestation

requirements under Section 404(b) of Sarbanes-Oxley. Our Annual Report on Form 10-K does not include an attestation

report of our independent registered public accounting firm regarding internal control over financial reporting. Our management’s

report was not subject to attestation by our registered public accounting firm, pursuant to rules of the SEC that permit us to provide

only management’s attestation with respect thereto. As a result, any material weakness in our internal controls may remain undetected

for a longer period.

You

will suffer dilution in the net tangible book value of the Offered Shares you purchase in this offering. If you acquire any Offered

Shares, you will suffer immediate dilution, due to the lower book value per share of our common stock compared to the purchase price

of the Offered Shares in this offering. (See “Dilution”).

Future

issuances of debt securities and equity securities could negatively affect the market price of shares of our common stock and, in the

case of equity securities, may be dilutive to existing shareholders. In the future, we may issue debt or equity securities or

incur other financial obligations, including stock dividends. Upon liquidation, it is possible that holders of our debt securities and

other loans and preferred stock would receive a distribution of our available assets before common shareholders. We are not required

to offer any such additional debt or equity securities to existing shareholders on a preemptive basis. Therefore, additional common stock

issuances, directly or through convertible or exchangeable securities, warrants or options, would dilute the holdings of our existing

common shareholders and such issuances, or the perception of such issuances, could reduce the market price of shares of our common stock.

As

an issuer of penny stock, the protection provided by the federal securities laws relating to forward-looking statements does not apply

to us. Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files

reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, we will not have

the benefit of this safe harbor protection, in the event of any legal action based upon a claim that the material provided by us contained

a material misstatement of fact or was misleading in any material respect because of our failure to include any statements necessary

to make the statements not misleading. Such an action could hurt our financial condition.

DILUTION

Dilution

in net tangible book value per share to purchasers of our common stock in this offering represents the difference between the amount

per share paid by purchasers of the Offered Shares in this offering and the pro forma as adjusted net tangible book value per share immediately

after completion of this offering. In this offering, dilution is attributable primarily to our relatively low net tangible book value

per share.

If you purchase Offered

Shares in this offering, your investment will be diluted to the extent of the difference between your purchase price per Offered Share

and the net pro forma as adjusted tangible book value per share of our common stock after this offering. Our net tangible book value

as of June 30, 2023, was $(2,756,583), or $(0.0012) per share.

Without taking into account

issuances of our common stock occurring after June 30, 2023, the tables below illustrate the dilution to purchasers of Offered Shares

in this offering, on a pro forma basis, assuming 100%, 75%, 50% and 25% of the Offered Shares are sold.

| Assuming the Sale of 100% of the Offered Shares |

|

|

|

| Offering price per share |

|

$ |

0.0003-0.001 |

|

| Net tangible book value per share as of June 30, 2023 |

|

$ |

(0.0012 |

) |

| Increase in net tangible book value per share after giving effect to this offering |

|

$ |

0.0003-0.0004 |

|

| Pro forma net tangible book value per share as of June 30, 2023 |

|

$ |

(0.0009)-(0.0008 |

) |

| Dilution in net tangible book value per share to purchasers of Offered Shares in this offering |

|

$ |

0.0013-0.0018 |

|

| Assuming the Sale of 75% of the Offered Shares |

|

|

|

| Offering price per share |

|

$ |

0.0003-0.001 |

|

| Net tangible book value per share as of June 30, 2023 |

|

$ |

(0.0012 |

) |

| Increase in net tangible book value per share after giving effect to this offering |

|

$ |

0.0002-0.0003 |

|

| Pro forma net tangible book value per share as of June 30, 2023 |

|

$ |

(0.0010)-(0.0009 |

) |

| Dilution in net tangible book value per share to purchasers of Offered Shares in this offering |

|

$ |

0.0014-0.0019 |

|

| Assuming the Sale of 50% of the Offered Shares |

|

|

|

| Offering price per share |

|

$ |

0.0003-0.001 |

|

| Net tangible book value per share as of June 30, 2023 |

|

$ |

(0.0012 |

) |

| Increase in net tangible book value per share after giving effect to this offering |

|

$ |

0.0001-0.0002 |

) |

| Pro forma net tangible book value per share as of June 30, 2023 |

|

$ |

(0.0011)-(0.0010 |

) |

| Dilution in net tangible book value per share to purchasers of Offered Shares in this offering |

|

$ |

0.0015-0.0020 |

|

| Assuming the Sale of 25% of the Offered Shares |

|

|

|

| Offering price per share |

|

$ |

0.0003-0.001 |

|

| Net tangible book value per share as of June 30, 2023 |

|

$ |

(0.0012 |

) |

| Increase in net tangible book value per share after giving effect to this offering |

|

$ |

0.0000-0.0001 |

|

| Pro forma net tangible book value per share as of June 30, 2023 |

|

$ |

(0.0012)-(0.0011) |

|

| Dilution in net tangible book value per share to purchasers of Offered Shares in this offering |

|

$ |

0.0016-0.0021 |

|

USE

OF PROCEEDS

The

table below sets forth the estimated proceeds we would derive from this offering, assuming the sale of 25%, 50%, 75% and 100% of the

Offered Shares and assuming the payment of no sales commissions or finder’s fees. There is, of course, no guaranty that we will

be successful in selling any of the Offered Shares in this offering.

| |

|

Assumed

Percentage of Offered Shares

Sold in This Offering |

|

| |

|

25% |

|

|

50% |

|

|

75% |

|

|

100% |

|

| Offered

Shares sold |

|

|

125,000,000 |

|

|

|

250,000,000 |

|

|

|

375,000,000 |

|

|

|

500,000,000 |

|

| Gross

proceeds |

|

$ |

37,500-125,000 |

|

|

$ |

75,000-250,000 |

|

|

$ |

112,500-375,000 |

|

|

$ |

150,000-500,000 |

|

| Offering

expenses |

|

|

20,000 |

|

|

|

20,000 |

|

|

|

20,000 |

|

|

|

20,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

proceeds |

|

$ |

17,500-105,000 |

|

|

$ |

55,000-230,000 |

|

|

$ |

92,500-355,000 |

|

|

$ |

130,000-480,000 |

|

The

table below sets forth the manner in which we intend to apply the net proceeds derived by us in this offering, assuming the sale of 25%,

50%, 75% and 100% of the Offered Shares. All amounts set forth below are estimates.

| |

|

Use of Proceeds for

Assumed Percentage of Offered Shares

Sold in This Offering |

|

| |

|

25% |

|

|

50% |

|

|

75% |

|

|

100% |

|

| Product

Testing |

|

$ |

15,000-30,000 |

|

|

$ |

30,000-70,000 |

|

|

$ |

55,000-115,000 |

|

|

$ |

75,000-190,000 |

|

| Sales

and Marketing Expense |

|

|

1,500-30,000 |

|

|

|

20,000-70,000 |

|

|

|

27,500-115,000 |

|

|

|

35,000-190,000 |

|

| Working

Capital |

|

|

1,000-45,000 |

|

|

|

5,000-90,000 |

|

|

|

10,000-125,000 |

|

|

|

20,000-150,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL |

|

$ |

17,500-105,000 |

|

|

$ |

55,000-230,000 |

|

|

$ |

92,500-355,000 |

|

|

$ |

130,000-480,000 |

|

We

reserve the right to change the foregoing use of proceeds, should our management believe it to be in the best interest of our company.

The allocations of the proceeds of this offering presented above constitute the current estimates of our management and are based on

our current plans, assumptions made with respect to the industry in which we currently or, in the future, expect to operate, general

economic conditions and our future revenue and expenditure estimates.

Investors

are cautioned that expenditures may vary substantially from the estimates presented above. Investors must rely on the judgment of our

management, who will have broad discretion regarding the application of the proceeds of this offering. The amounts and timing of our

actual expenditures will depend upon numerous factors, including market conditions, cash generated by our operations (if any), business

developments and the rate of our growth. We may find it necessary or advisable to use portions of the proceeds of this offering for other

purposes.

In

the event we do not obtain the entire offering amount hereunder, we may attempt to obtain additional funds through private offerings

of our securities or by borrowing funds. Currently, we do not have any committed sources of financing.

PLAN

OF DISTRIBUTION

In

General

Our

company is offering a maximum of 500,000,000 Offered Shares on a best-efforts basis, at a fixed price of $0.0003-0.001 per Offered

Share; any funds derived from this offering will be immediately available to us for our use. There will be no refunds. This offering

will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this

offering being qualified by the SEC or (c) the date on which this offering is earlier terminated by us, in our sole discretion.

There

is no minimum number of Offered Shares that we are required to sell in this offering. All funds derived by us from this offering will

be immediately available for use by us, in accordance with the uses set forth in the Use of Proceeds section of this Offering Circular.

No funds will be placed in an escrow account during the offering period and no funds will be returned, once an investor’s subscription

agreement has been accepted by us.

We

intend to sell the Offered Shares in this offering through the efforts of our Chief Executive Officer, Chaya Hendrick. Ms. Hendrick will

not receive any compensation for offering or selling the Offered Shares. We believe that Ms. Hendrick is exempt from registration as

a broker-dealer under the provisions of Rule 3a4-1 promulgated under the Securities Exchange Act of 1934 (the Exchange Act). In