Current Report Filing (8-k)

March 07 2019 - 4:52PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 17

, 2019

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

333-99455

|

|

32-0027992

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

17330 Preston Road, Unit 200, Dallas, Texas 75252

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including area code:

(469)

319-1300

15950 N. Dallas Parkway, Ste 400, Dallas, Texas 75248

|

Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01. Entry into a Material Definitive Agreement

On February 17, 2019, Sky Petroleum, Inc.. (the “

Company

”) entered into an Agreement Contract for the Sale and Purchase of Libyan Crude Oil FOB (the “

Agreement

”) by and between the Company and National Oil Corporation (Benghazi-Libya) (the “

National Oil Corporation (Libya)

”). The material terms of the Agreement are as follows:

|

(a)

|

National Oil Corporation (Libya), with full authority, agreed to supply and deliver Libyan Light Crude Oil of the Grade

specified in the Agreement (the “

Oil

”).

|

|

(b)

|

The quantity of crude oil to be sold and delivered under the Agreement is 3,000,000 bbls per month plus or minus five percent

(+/- 5%) in the Company’s option with partial shipment permitted.

|

|

(c)

|

If the Company fails to initiate shipping process within 90 days from signing the agreement, the contract is considered

cancelled and National Oil Corporation (Libya) has no financial obligation under the Agreement. The term of the contact is 2 years, with a possible extension of further 3years.

|

|

(d)

|

National Oil Corporation (Libya) shall deliver the Oil on board the Vessel nominated by the Company.

|

|

(e)

|

The Company shall pay for each Barrel of Oil delivered FOB one safe port/berth, Libya, the Official Selling Price, NOC

declared price on Platts, Thomson Reuters for each exported oil blend (OSP) to Dated Brent (5 days around BL) minus a negotiated discount (the “

Price

”). The crude type is Sarir/Messla blend with API gravity 37.9, and sulfur content 0.128.

|

|

(f)

|

The Company and National Oil Corporation (Libya) shall comply with inspections for quality and quantity control.

|

|

(g)

|

The Company shall pay the Price for the Oil multiplied by the quantity delivered by means of an irrevocable confirmed

assignment of proceeds from a documentary standby letter of credit issued by the End User’s bank on terms acceptable to the Company to the National Oil Corporation (Libya)’s bank.

|

|

(h)

|

National Oil Corporation (Libya) agrees to work with the Company and its agents to insure all below documents are compliant

with buyer Assignment of Proceeds. The Assignment of Proceeds shall: (i) provide for National Oil Corporation (Libya) to present the original documents; and (ii) cover 100% of the FOB value of the Cargo and will allow a tolerance of

plus/minus 5% (+/- 5%) in both quantity and amount. All charges relating to the opening of the Assignment of Proceeds shall be for the Company’s account. All other charges to be for National Oil Corporation (Libya)’s account.

|

|

(i)

|

The Company and National Oil Corporation (Libya) shall follow certain procedures for the loading and delivery of the Oil.

|

|

(j)

|

National Oil Corporation (Libya) shall indemnify the Company for certain losses arising from breach of the National Oil

Corporation (Libya)’s delivery procedure obligations.

|

|

(k)

|

The Agreement is governed by U.K Law to the exclusion of any other law, which may be imputed in accordance with choice of law

rules applicable in any jurisdiction. The United Nations Convention on Contracts for the International Sale of Goods of Vienna, 11 April 1980, shall not apply to the Agreement.

|

Under the terms of the Agreement, the Company irrevocably agreed on a firm commitment basis to purchase and load the crude oil from the

National Oil Corporation (Libya).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to

be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SKY PETROLEUM, INC.

|

|

Dated: March 7, 2019

|

By:

/s/ Karim Jobanputra

Karim Jobanputra

Chief Executive Officer

|

|

|

|

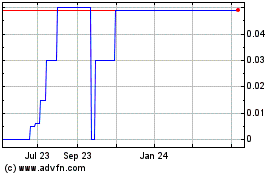

Sky Petroleum (CE) (USOTC:SKPI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sky Petroleum (CE) (USOTC:SKPI)

Historical Stock Chart

From Feb 2024 to Feb 2025