SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

[ ]

Preliminary Information Statement

[ ]

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

[X]

Definitive Information Statement

Band Rep Management, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box)

[X]

No fee required.

[ ]

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

[ ]

Fee paid previously with preliminary materials.

[ ]

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

Band Rep Management, Inc.

[insert logo]

5481 Middleport Crescent, Mississauga, Ontario, L4Z 3V2 Canada

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

This Information Statement is first being furnished on or about March 5, 2014 to the holders of record as of the close of business on March 5, 2014 of the common stock of Band Rep Management, Inc., a Nevada corporation (“Band Rep Management”).

The Board of Directors of Band Rep Management and 1 stockholder holding an aggregate of 6,000,000 shares of common stock issued and outstanding as of February 6, 2014, have approved and consented in writing to the actions described below. Such approval and consent constitute the approval and consent of a majority of the total number of shares of outstanding common stock and are sufficient under the Nevada Revised Statutes (“NRS”) and Band Rep Management

’

s Articles of Incorporation and Bylaws to approve the actions. Accordingly, the actions will not be submitted to the other stockholders of Band Rep Management for a vote, and this Information Statement is being furnished to stockholders to provide them with certain information concerning the action in accordance with the requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the regulations promulgated thereunder, including Regulation 14C.

ACTIONS BY BOARD OF DIRECTORS

AND

CONSENTING STOCKHOLDER

GENERAL

Band Rep Management will pay all costs associated with the distribution of this Information Statement, including the costs of printing and mailing. Band Rep Management will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending this Information Statement to the beneficial owners of Band Rep Management

’

s common stock.

Band Rep Management will only deliver one Information Statement to multiple security holders sharing an address unless Band Rep Management has received contrary instructions from one or more of the security holders. Upon written or oral request, Band Rep Management will promptly deliver a separate copy of this Information Statement and any future annual reports and information statements to any security holder at a shared address to which a single copy of this Information Statement was delivered, or deliver a single copy of this Information Statement and any future annual reports and information statements to any security holder or holders sharing an address to which multiple copies are now delivered. You should direct any such requests to the following address: Band Rep Management, Inc., 5481 Middleport Crescent, Mississauga, Ontario, L4Z 3V2 Canada, Attention: President. Mr. Sergio Galli may also be reached by telephone at (775) 321-8207.

INFORMATION ON CONSENTING STOCKHOLDERS

Pursuant to Band Rep Management

’

s Bylaws and the Nevada Revised Statutes (“NRS”), a vote by the holders of at least a majority of Band Rep Management

’

s outstanding capital stock is required to effect the action described herein. Band Rep Management

’

s Articles of Incorporation does not authorize cumulative voting. As of the record date, Band Rep Management had [insert shares I&O] shares of common stock issued and outstanding. The voting power representing not less than 51% shares of common stock is required to pass any stockholder resolutions. The consenting stockholder is the record and beneficial owner of [insert control block] shares of common stock, which represents approximately 95.7% of the issued and outstanding shares of Band Rep Management

’

s common stock. Pursuant to Chapter 78.320 of the NRS, the consenting stockholder voted, with the Board of Directors, in favor of the actions described herein in a joint written consent, dated February 6, 2014. No consideration was paid for the consent. The consenting stockholder

’

s name, affiliation with Band Rep Management, and their beneficial holding are as follows:

|

|

|

| |

|

Name

|

Beneficial Holder and Affiliation

|

Shares Beneficially Held

|

Percentage

|

|

Sergio Galli

|

President, Treasurer, Secretary, Director, and Greater than 10% holder of common stock

|

6,000,000 shares of common stock

|

95.7%

|

INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

None.

PROPOSALS BY SECURITY HOLDERS

None.

DISSENTERS RIGHTS OF APPRAISAL

None.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of February 6, 2014, certain information regarding the ownership of Band Rep Management

’

s capital stock by each director and executive officer of Band Rep Management, each person who is known to Band Rep Management to be a beneficial owner of more than 5% of any class of Band Rep Management

’

s voting stock, and by all officers and directors of Band Rep Management as a group. Unless otherwise indicated below, to Band Rep Management

’

s knowledge, all persons listed below have sole voting and investing power with respect to their shares of capital stock, except to the extent authority is shared by spouses under applicable community property laws.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (“SEC”) and generally includes voting or investment power with respect to securities. Shares of common stock subject to options, warrants or convertible securities exercisable or convertible within 60 days of February 6, 2014 are deemed outstanding for computing the percentage of the person or entity holding such options, warrants or convertible securities but are not deemed outstanding for computing the percentage of any other person, and is based on 6,267,500 shares of common stock issued and outstanding on a fully diluted basis, as of February 6, 2014.

|

|

| |

|

NAME AND ADDRESS OF BENEFICIAL OWNER (1)

|

AMOUNT AND NATURE OF BENEFICIAL OWNERSHIP

|

PERCENT OF CLASS (2)

|

|

Sergio Galli(3)

President, CEO, CFO, Secretary, Treasurer, Director and greater than 10% holder of common stock

|

6,000,000 (common stock)

|

95.7%

|

|

|

|

|

|

All officers and directors as a group

(1 person)

|

6,000,000 (common stock)

|

95.7%

|

(1) Unless otherwise noted, the address of each person listed is c/o Band Rep Management, Inc., 5481 Middleport Crescent, Mississauga, Ontario, L4Z 3V2 Canada.

(2) This table is based on 6,267,500 shares of common stock issued and outstanding on February 6, 2014.

(3) Appointed President, Secretary, Treasurer and Director on May 4, 2012.

EXECUTIVE COMPENSATION

The following tables set forth certain information about compensation paid, earned or accrued for services by our President and all other executive officers (collectively, the “Named Executive Officers”) in the fiscal years ended May 31, 2012 and 2013:

Summary Compensation Table

|

|

|

|

|

|

|

|

|

| |

|

Name and

Principal Position

|

Year

|

Salary

($)

|

Bonus

($)

|

Stock

Awards

($) *

|

Option

Awards

($) *

|

Non-Equity

Incentive Plan

Compensation

($)

|

Nonqualified

Deferred

Compensation

($)

|

All Other

Compensation

($)

|

Total

($)

|

|

Sergio Galli; President, Secretary, Treasurer and Director (1)

|

2013

2012

|

-0-

-0-

|

-0-

|

-0-

-0-

|

-0-

-0-

|

-0-

-0-

|

-0-

|

-0-

-0-

|

-0-

-0-

|

(1) Appointed President, Secretary, Treasurer and Director on May 4, 2012.

Employment Agreements

The Company has no employment agreements or other agreements with any officer.

|

Name

|

Option Awards

|

Stock Awards

|

Equity Incentive Plan Awards:

|

|

|

|

|

Equity Incentive Plan Awards:

|

Equity Incentive Plan Awards:

|

|

|

Number of Securities Underlying Unexercised Options

(#)

Exercisable

|

Number of Securities Underlying Unexercised Options

(#)

Unexercisable

|

Number of Securities Underlying Unexercised Unearned Options

(#)

|

Option Exercise Price

($)

|

Option Expiration

Date

|

Number of Shares or Units of Stock That Have Not Vested

(#)

|

Market Value of Shares or Units of Stock That Have Not Vested

($)

|

Number of Unearned Shares, Units or Other Rights That Have Not Vested

(#)

|

Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested

($)

|

|

Sergio Galli(1)

|

-0-

|

-0-

|

-0-

|

-0-

|

N/A

|

-0-

|

-0-

|

-0-

|

-0-

|

Other Compensation

There are no annuity, pension or retirement benefits proposed to be paid to officers, directors, or employees of our company in the event of retirement at normal retirement date as there was no existing plan as of February 17, 2014 provided for or contributed to by our company.

Director Compensation

The following table sets forth director compensation as of the fiscal year ended May 31, 2013:

|

|

|

|

|

|

|

| |

|

Name

|

Fees

Earned

or Paid

in Cash

($)

|

Stock

Awards

($)

|

Option

Awards

($)

|

Non-Equity

Incentive Plan

Compensation

($)

|

Nonqualified

Deferred

Compensation

Earnings

($)

|

All Other

Compensation

($)

|

Total

($)

|

|

Sergio Galli(1)

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

(1) Appointed President, Secretary, Treasurer and Director on May 4, 2012.

Directors of our company who are also employees do not receive cash compensation for their services as directors or members of the committees of the Board of Directors. All directors may be reimbursed for their reasonable expenses incurred in connection with attending meetings of the Board of Directors or management committees.

Securities Authorized for Issuance under Equity Compensation Plans

Band Rep Management has no equity compensation plans.

CHANGE IN CONTROL

To the knowledge of management, there are no present arrangements or pledges of securities of Band Rep Management which may result in a change in control of Band Rep Management.

NOTICE TO STOCKHOLDERS OF ACTION APPROVED BY CONSENTING STOCKHOLDER

The following action was taken based upon the unanimous recommendation of the Board of Directors and the written consent of the consenting stockholders:

I.

AMENDMENT TO THE ARTICLES OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED COMMON STOCK

On February 6, 2014 the Board of Directors the consenting stockholders adopted and approved a resolution to effect an amendment to our Articles of Incorporation to increase the number of shares of authorized common stock from 75,000,000 shares of common stock, par value $0.001 per share, to 200,000,000 shares of common stock, par value $0.001 per share. Such amendment is referred to herein as the “Authorized Shares Amendment.”

Currently, Band Rep Management has 75,000,000 shares of common stock authorized, of which 6,267,500 shares are issued and outstanding. As a result of the Authorized Shares Amendment, Band Rep Management will have 200,000,000 shares of shares of common stock authorized for issuance, of which 193,732,500 will be available for issuance.

Any additional issuance of common stock could, under certain circumstances, have the effect of delaying or preventing a change in control of Band Rep Management by increasing the number of outstanding shares entitled to vote and by increasing the number of votes required to approve a change in control of Band Rep Management. Shares of common stock could be issued, or rights to purchase such shares could be issued, to render more difficult or discourage an attempt to obtain control of Band Rep Management by means of a tender offer, proxy contest, merger or otherwise. The ability of the Board of the Directors to issue such additional shares of common stock could discourage an attempt by a party to acquire control of Band Rep Management by tender offer or other means. Such issuances could therefore deprive stockholders of benefits that could result from such an attempt, such as the realization of a premium over the market price that such an attempt could cause. Moreover, the issuance of such additional shares of common stock to persons interests aligned with that of the Board of Directors could make it more difficult to remove incumbent managers and directors from office even if such change were to be favorable to stockholders generally.

While the increase in the number of shares of common stock authorized may have anti-takeover ramifications, the Board of Directors believes that the financial flexibility offered by the amendment outweighs any disadvantages. To the extent that the increase in the number of shares of common stock authorized may have anti-takeover effects, the amendment may encourage persons seeking to acquire Band Rep Management to negotiate directly with the Board of Directors, enabling the Board of Directors to consider a proposed transaction in a manner that best serves the stockholders

’

interests.

The Board believes that it is advisable and in the best interests of Band Rep Management to have available additional authorized but unissued shares of common stock in an amount adequate to provide for Band Rep Management

’

s future needs. The unissued shares of common stock will be available for issuance from time to time as may be deemed advisable or required for various purposes, including the issuance of shares in connection with financing or acquisition transactions. Band Rep Management has no present plans or commitments for the issuance or use of the proposed additional shares of common stock in connection with any financing.

The Authorized Shares Amendment is not intended to have any anti-takeover effect and is not part of any series of anti-takeover measures contained in any debt instruments or the Articles of Incorporation or the Bylaws of Band Rep Management in effect on the date of this Information Statement. However, Band Rep Management stockholders should note that the availability of additional authorized and unissued shares of common stock could make any attempt to gain control of Band Rep Management or the Board of Directors more difficult or time consuming and that the availability of additional authorized and unissued shares might make it more difficult to remove management. Band Rep Management is not aware of any proposed attempt to take over Band Rep Management or of any attempt to acquire a large block of Band Rep Management

’

s stock. Band Rep Management has no present intention to use the increased number of authorized common stock for anti-takeover purposes.

Effective Date

Under Rule 14c-2, promulgated pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Authorized Shares Amendment shall be effective twenty (20) days after this Information Statement is mailed to stockholders of Band Rep Management. We anticipate the effective date to be on or about March 25, 2014.

II. APPROVAL TO

AMEND THE ARTICLES OF INCORPORATION TO EFFECT A 187:1 FORWARD STOCK SPLIT

On February 6, 2014 the Board of Directors and the consenting stockholder adopted and approved a resolution to effect an amendment to our Articles of Incorporation to effect a forward split of all issued and outstanding shares of common stock, at a ratio of 187:1 (the "Forward Stock Split"). The Forward Stock Split shall be effective twenty (20) days after this Information Statement is mailed to stockholders of Band Rep Management.

A table illustrating the Forward Stock Split and the amendment to increase the number of shares of common stock in Band Rep Management's Certificate of Incorporation (discussed below) is as follows:

|

|

|

|

| |

|

|

NUMBER OF SHARES OF COMMON STOCK ISSUED AND OUTSTANDING

|

NUMBER OF SHARES AUTHORIZED IN CERTIFICATE OF INCORPORATION

|

NUMBER OF SHARES OF COMMON STOCK AUTHORIZED AND RESERVED FOR ISSUANCE

|

NUMBER OF SHARES OF COMMON STOCK AUTHORIZED BUT UNRESERVED FOR ISSUANCE

|

|

Before Forward Stock

Split and amendment to

Certificate of

Incorporation

|

588,356

1

|

75,000,000

|

-0-

|

74,411,644

|

|

After Forward Stock

Split and amendment to

Certificate of

Incorporation

|

110,022,572

|

200,000,000

|

-0-

|

89,977,428

|

The Board of Directors also reserves the right, notwithstanding stockholder

approval and without further action by stockholders, to not proceed with the Forward Stock Split if the Board of Directors, in its sole discretion, determines that the Forward Stock Split is no longer in our best interests and that of our stockholders. The Board of Directors may consider a variety of factors in determining whether or not to implement the Forward Stock Split, including, but not limited to, overall trends in the stock market, recent changes and anticipated trends in the per share market price of the common stock, business and transactional developments, and our actual and projected financial performance.

Though the Forward Stock Split will not change the number of authorized shares of common stock, the Board of Directors and the consenting stockholder have also approved a resolution to effect an amendment to our Articles of Incorporation to increase the number of authorized shares of common stock from 75,000,000 to 200,000,000, as discussed in more detail above. Except for any changes as a result of the treatment of fractional shares, each stockholder of Band Rep Management will hold the same percentage of common stock outstanding immediately following the Forward Stock Split as such stockholder held immediately prior to the split.

PURPOSE

The Board of Directors believed that it was in the best interests of Band Rep Management to implement the Forward Stock Split on the basis that the low number of issued and outstanding shares of common stock of Band Rep Management would likely not appeal to brokerage firms and that, when trading, the current projected per share price level of our common stock will reduce the effective marketability of our common stock because of the reluctance of many brokerage firms to recommend stock to their clients or to act as market-makers for issuers which do not have a sufficient number of shares of common stock issued and outstanding.

CERTAIN RISKS ASSOCIATED WITH THE FORWARD STOCK SPLIT

THERE CAN BE NO ASSURANCE THAT THE TOTAL PROJECTED MARKET CAPITALIZATION OF BAND REP MANAGEMENT'S COMMON STOCK AFTER THE PROPOSED FORWARD STOCK SPLIT WILL BE EQUAL TO OR GREATER THAN THE TOTAL PROJECTED MARKET CAPITALIZATION BEFORE THE PROPOSED FORWARD STOCK SPLIT OR THAT THE PER SHARE PRICE OF BAND REP MANAGEMENT'S COMMON STOCK FOLLOWING THE FORWARD STOCK SPLIT WILL EITHER EXCEED OR REMAIN HIGHER THAN THE CURRENT ANTICIPATED PER SHARE.

There can be no assurance that the market price per new share of Band Rep Management

’

s common stock (the "New Shares") after the Forward Stock Split will rise or remain constant in proportion to the reduction in the number of old shares of Band Rep Management common stock (the "Old Shares") outstanding before the Forward Stock Split.

Accordingly, the total market capitalization of Band Rep Management's common stock after the proposed Forward Stock Split may be lower than the total market capitalization before the proposed Forward Stock Split and, in the future, the market price of Band Rep Management's common stock following the Forward Stock Split may not exceed or remain higher than the market price prior to the proposed Forward Stock Split. In many cases, the total market capitalization of a company following a Forward Stock Split is lower than the total market capitalization before the Forward Stock Split.

____________________________

1

On February 7, 201, Sergio Galli, Band Rep Management's majority stockholder, redeemed 5,679,144 shares of 6.000,000 shares of common stock held by him, and Band Rep Management retired such 5,679,144 shares into its authorized common stock. Band Rep Management is not holding such shares in treasury. Mr. Galli's redemption of 5,679,144 shares did not result in a change in control of Band Rep Management, as Mr. Galli still holds a majority of the issued and outstanding shares of common stock after the redemption.

THERE CAN BE NO ASSURANCE THAT THE FORWARD STOCK SPLIT WILL RESULT IN A PER SHARE PRICE THAT WILL ATTRACT INVESTORS. A DECLINE IN THE MARKET PRICE FOR BAND REP MANAGEMENT'S COMMON STOCK AFTER THE FORWARD STOCK SPLIT MAY RESULT IN A GREATER PERCENTAGE DECLINE THAN WOULD OCCUR IN THE ABSENCE OF A FORWARD STOCK SPLIT.

The market price of Band Rep Management's common stock will also be based on Band Rep Management

’

s performance and other factors, some of which are unrelated to the number of shares outstanding. If the Forward Stock Split is effected and the market price of Band Rep Management's common stock declines, the percentage decline as an absolute number and as a percentage of Band Rep Management's overall market capitalization may be greater than would occur in the absence of a forward stock split. In many cases, both the total market capitalization of a company and the market price of a share of such company's common stock following a forward stock split are lower than they were before the Forward Stock Split.

BAND REP MANAGEMENT'S COMMON STOCK TRADES AS A "PENNY STOCK" CLASSIFICATION WHICH LIMITS THE LIQUIDITY FOR BAND REP MANAGEMENT'S COMMON STOCK.

Band Rep Management's stock is subject to "penny stock" rules as defined in Exchange Act Rule 3a51-1. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Band Rep Management's common stock is subject to these penny stock rules. Transaction costs associated with purchases and sales of penny stocks are likely to be higher than those for other securities. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

As a result, all brokers or dealers involved in a transaction in which Band Rep Management's shares are sold to any buyer, other than an established customer or "accredited investor," must make a special written determination. These Exchange Act rules may limit the ability or willingness of brokers and other market participants to make a market in our shares and may limit the ability of Band Rep Management's stockholders to sell in the secondary market, through brokers, dealers or otherwise. Band Rep Management also understands that many brokerage firms will discourage their customers from trading in shares falling within the "penny stock" definition due to the added regulatory and disclosure burdens imposed by these Exchange Act rules. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the common shares in the United States and stockholders may find it more difficult to sell their shares. An orderly market is not assured or implied as to Band Rep Management's common stock. Nor are there any assurances as to the existence of market makers or broker/dealers for Band Rep Management's common stock.

PRINCIPAL EFFECTS OF THE FORWARD STOCK SPLIT

In addition to those risk factors noted above, the Forward Stock Split will have the following effects:

GENERAL CORPORATE CHANGE - (i) one (1) Old Share owned by a stockholder would be exchanged for one hundred and eighty seven (187) New Shares, and (ii) the number of shares of Band Rep Management's common stock issued and outstanding will be increased proportionately based on the Forward Stock Split. If approved and effected, the Forward Stock Split will be effected simultaneously for all of Band Rep Management's common stock. While the intent is for the proposed Forward Stock Split to affect all of Band Rep Management's stockholders uniformly, the process of rounding up when any of Band Rep Management's stockholders own a fractional share will result in a non-material change in each stockholder's percentage ownership interest in Band Rep Management.

The Forward Stock Split does not materially affect the proportionate equity interest in Band Rep Management of any stockholder of common stock or the relative rights, preferences, privileges or priorities of any such stockholder.

FRACTIONAL SHARES - Any fractional shares of common stock resulting from the Forward Stock Split will "round up" to the nearest whole number. No cash will be paid to any stockholders of fractional interests in Band Rep Management.

AUTHORIZED SHARES - The Forward Stock Split will not change the number of authorized shares of common stock of Band Rep Management, as states in Band Rep Management's Articles of Incorporation, as amended.

ACCOUNTING MATTERS - The Forward Stock Split will not affect the par value of Band Rep Management's common stock. As a result, as of the effective time of the Forward Stock Split, the stated capital on Band Rep Management's balance sheet attributable to Band Rep Management's common stock will be increased proportionately based on the Forward Stock Split ratio, and the additional paid-in capital account will be credited with the amount by which the stated capital is increased. The per share net income or loss and net book value of Band Rep Management's common stock will be restated because there will be a greater number shares of Band Rep Management's common stock outstanding.

PROCEDURE FOR EFFECTING THE FORWARD STOCK SPLIT AND EXCHANGE OF STOCK CERTIFICATES

Upon effectiveness of the Forward Stock Split, each outstanding share of Band Rep Management will automatically be converted on the effective date at the applicable Forward Stock Split ratio. It will not be necessary for stockholders of Band Rep Management to exchange their existing stock certificates.

Certain of Band Rep Management

’

s registered stockholders of common stock may hold some or all of their shares electronically in book-entry form with our transfer agent. These stockholders do not have stock certificates evidencing their ownership of our common stock. They are, however, provided with a statement reflecting the number of shares registered in their accounts. If a stockholder holds registered shares in book-entry form with our transfer agent, no action needs to be taken to receive post-Forward Stock Split shares or cash payment in lieu of any fractional share interest, if applicable. If a stockholder is entitled to post-Forward Stock Split shares, a transaction statement will automatically be sent to the stockholder's address of record indicating the number of shares of common stock held following the Forward Stock Split.

FEDERAL INCOME TAX CONSEQUENCES OF THE FORWARD STOCK SPLIT

The following is a summary of certain material federal income tax consequences of the Forward Stock Split. It does not purport to be a complete discussion of all of the possible federal income tax consequences of the Forward Stock Split and is included for general information only. Further, it does not address any state, local or foreign income or other tax consequences. Also, it does not address the tax consequences to stockholders that are subject to special tax rules, such as banks, insurance companies, regulated investment companies, personal holding companies, foreign entities, non-resident alien individuals, broker-dealers and tax-exempt entities. The discussion is based on the provisions of the United States federal income tax law as of the date hereof, which is subject to change retroactively as well as prospectively. This summary also assumes that the Old Shares were, and the New Shares will be, held as a "capital asset," as defined in the Internal Revenue Code of 1986, as amended (i.e., generally, property held for investment). The tax treatment of a stockholder may vary depending upon the particular facts and circumstances of such stockholder. Each stockholder is urged to consult with such stockholder's own tax advisor with respect to the tax consequences of the Forward Stock Split.

No gain or loss should be recognized by a stockholder upon such stockholder's exchange of Old Shares for New Shares pursuant to the Forward Stock Split. The aggregate tax basis of the New Shares received in the Forward Stock Split (including any fraction of a New Share deemed to have been received) will be the same as the stockholder's aggregate tax basis in the Old Shares exchanged therefor. The stockholder's holding period for the New Shares will include the period during which the stockholder held the Old Shares surrendered in the Forward Stock Split.

TO ENSURE COMPLIANCE WITH TREASURY DEPARTMENT CIRCULAR 230, STOCKHOLDERS ARE HEREBY NOTIFIED THAT: (A) ANY DISCUSSION OF FEDERAL TAX ISSUES IN THIS INFORMATION STATEMENT IS NOT INTENDED OR WRITTEN TO BE RELIED UPON, AND CANNOT BE RELIED UPON BY STOCKHOLDERS FOR THE PURPOSE OF AVOIDING PENALTIES THAT MAY BE IMPOSED ON STOCKHOLDERS UNDER THE INTERNAL REVENUE CODE; (B) SUCH DISCUSSION IS INCLUDED HEREIN BY THE COMPANY IN CONNECTION WITH THE PROMOTION OR MARKETING (WITHIN THE MEANING OF CIRCULAR 230) BY THE COMPANY OF THE TRANSACTIONS OR MATTERS ADDRESSED HEREIN; AND (C) STOCKHOLDERS SHOULD SEEK ADVICE BASED ON THEIR PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

Band Rep Management's view regarding the tax consequences of the Forward Stock Split is not binding on the Internal Revenue Service or the courts. Accordingly, each stockholder should consult with his or her own tax advisor with respect to all of the potential tax consequences to him or her of the Forward Stock Split.

Effective Date

Under Rule 14c-2, promulgated pursuant to the Exchange Act, the Preferred Stock Amendment shall be effective twenty (20) days after this Information Statement is mailed to stockholders of Band Rep Management. We anticipate the effective date to be on or about March 25, 2014.

ADDITIONAL INFORMATION

We are subject to the informational requirements of the Exchange Act, and in accordance therewith file reports, proxy statements and other information including annual and quarterly reports on Form 10-K and 10-Q with the SEC. Copies of these documents can be obtained upon written request addressed to the SEC, Public Reference Section, 100 F Street, N.E., Washington, D.C., 20549, at prescribed rates. The SEC also maintains a web site on the Internet (http://www.sec.gov) where reports, proxy and information statements and other information regarding issuers that file electronically with the SEC through the Electronic Data Gathering, Analysis and Retrieval System may be obtained free of charge.

STATEMENT OF ADDITIONAL INFORMATION

Band Rep Management

’

s Annual Report on Form 10-K for the year ended May 31, 2013 and filed with the SEC August 26, 2013; Quarterly Report on Form 10-Q for the quarter ended August 31, 2013 and filed with the SEC October 21, 2013; Amendment No.

1 to

Quarterly Report on Form 10-Q for the quarter ended August 31, 2013 and filed with the SEC November 8, 2013; and Quarterly Report on Form 10-Q for the quarter ended November 30, 2013 and filed with the SEC January 14, 2014 have been incorporated herein by this reference.

Band Rep Management will provide without charge to each person, including any beneficial owner of such person, to whom a copy of this Information Statement has been delivered, on written or oral request, a copy of any and all of the documents referred to above that have been or may be incorporated by reference herein other than exhibits to such documents (unless such exhibits are specifically incorporated by reference herein).

All documents filed by Band Rep Management pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the date of this Information Statement shall be deemed to be incorporated by reference herein and to be a part hereof from the date of filing of such documents. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Information Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Information Statement.

COMPANY CONTACT INFORMATION

All inquiries regarding Band Rep Management should be addressed to Sergio Galli, President, at Band Rep Management

’

s principal executive offices, at: Band Rep Management, Inc., 5481 Middleport Crescent, Mississauga, Ontario, L4Z 3V2 Canada. Mr. Sergio Galli may also be reached by telephone at (775) 321-8207.

8

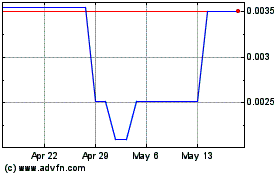

Sky Century Investment (PK) (USOTC:SKYI)

Historical Stock Chart

From Apr 2024 to May 2024

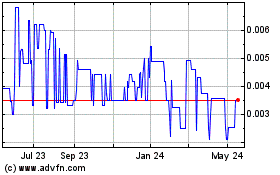

Sky Century Investment (PK) (USOTC:SKYI)

Historical Stock Chart

From May 2023 to May 2024