Current Report Filing (8-k)

April 28 2020 - 6:12AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 20, 2020

GLOBAL

HEALTHCARE REIT, INC.

(Exact

Name of Registrant as Specified in its Charter)

|

Utah

|

|

0-15415

|

|

87-0340206

|

(State

or other jurisdiction

of incorporation)

|

|

Commission

File Number

|

|

(I.R.S.

Employer

Identification number)

|

6800

N. 79th St., Ste. 200, Niwot, Colorado 80503

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (303) 449-2100

(Former

name or former address, if changed since last report)

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each Class

|

|

Trading

Symbol

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

[ ]

On

April 20, 2020, Global Eastman, LLC (the “Company”), a wholly owned subsidiary of Global Healthcare REIT (“Global”),

received $574,975 from Colony Bank, one of Global’s existing lenders, pursuant to the Paycheck Protection Program (the “PPP

Loan”) of the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”). The PPP Loan matures on

April 20, 2022 (the “Maturity Date”), accrues interest at 1% per annum and may be prepaid in whole or in part without

penalty. No interest payments are due within the initial six months of the PPP Loan. The interest accrued during the initial six-month

period is due and payable, together with the principal, on the Maturity Date. The Company intends to use all proceeds from the

PPP Loan to retain employees, maintain payroll and make lease and utility payments to support business continuity throughout the

COVID-19 pandemic, which amounts are intended to be eligible for forgiveness, subject to the provisions of the CARES Act.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

|

|

|

Global

Healthcare REIT, Inc.

|

|

|

|

(Registrant)

|

|

|

|

|

|

Dated:

April 24, 2020

|

|

/s/

Zvi Rhine

|

|

|

|

Zvi

Rhine, President

|

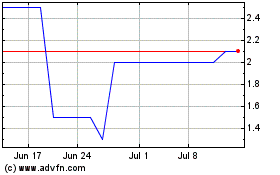

Selectis Health (PK) (USOTC:GBCS)

Historical Stock Chart

From Oct 2024 to Nov 2024

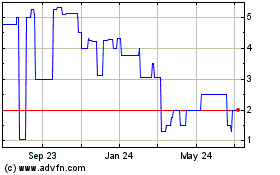

Selectis Health (PK) (USOTC:GBCS)

Historical Stock Chart

From Nov 2023 to Nov 2024