General Electric Marginally Beats - Analyst Blog

January 18 2013 - 6:04AM

Zacks

Despite continued macroeconomic headwinds, General

Electric (GE) reported strong fourth quarter 2012 results

with operating earnings of $4.7 billion or 44 cents per share

compared to $4.1 billion or 39 cents in the year-ago quarter,

representing a year-over-year increase of 13%.

This was the eleventh consecutive quarter in which the company

witnessed double-digit growth in operating earnings. The operating

earnings for the reported quarter were marginally above the Zacks

Consensus Estimate of 43 cents.

On a GAAP basis, the company reported quarterly earnings of $4.3

billion or 41 cents per share from continuing operations compared

to $4.0 billion or 37 cents in fourth quarter 2011. For full year

2012, operating earnings were $16.1 billion or $1.52 per share

compared to $14.9 billion or $1.31 in the prior year. GAAP earnings

for 2012 were $14.7 billion or $1.39 per share from continuing

operations compared to $14.2 billion or $1.24 in 2011.

Revenues

Revenues for the quarter came in at $39.3 billion for the quarter,

reflecting a 4% rise year over year. While industrial segment

revenue grew 4%, GE Capital revenue surged 2% year over year.

Strong performance of the Industrial portfolio was driven by solid

contributions from the Oil & Gas and Aviation segments,

partially offset by Transportation segment. Revenues for the

reported quarter exceeded the Zacks Consensus Estimate of $38.4

billion.

For full year 2012, revenues were relatively flat compared to the

previous year at $147.4 billion. While industrial segment revenue

grew 8%, GE Capital revenue dipped 6% year over year. Strong

performance of the Industrial portfolio during the year was driven

by solid contributions from all the segments, particularly Energy

Management and Transportation. Revenues for full year 2012 exceeded

the Zacks Consensus Estimate of $147.0 billion.

Infrastructure orders for the reported quarter increased 2% year

over year to $28.5 billion, with ratio of equipment orders received

to orders billed (book-to-bill) being 1.2. Total backlog of

equipment and services at quarter-end reached a record level of

$210 billion. During fourth quarter 2012, General Electric received

orders from Petrobras Argentina SA (PZE) for $0.4

billion of turbomachinery.

The company also penned a $0.2 billion contract to supply

sub-sea production equipment to the Lianzi project of

Chevron Corporation (CVX) and $0.4 billion worth

of wind turbines to Renova Energia in Brazil. In addition, CFM

International procured an agreement from Alaska Airlines for 50 new

Boeing 737 aircraft engines. CFM International is a 50-50 joint

venture between Snecma S.A., a French multinational aircraft

manufacturer and subsidiary of Safran SA (SAFRY),

and GE Aviation Systems.

The company witnessed strong revenue growth during the year from

Russia, Latin America, Australia/New Zealand, China, Sub-Saharan

Africa and ASEAN countries. At the same time, the company launched

new products like FlexEfficiency™ 60, a new power plant technology

with turbines; and the Tier 4 Evolution® Series, reportedly the

most fuel-efficient freight locomotive in its history.

Revenue by Segment

General Electric reorganized its Energy Infrastructure segment into

three separate segments effective Oct 1, 2012, namely – Power &

Water, Oil & Gas, and Energy Management. Consequently, the

company presently has eight operating segments: Power & Water,

Oil & Gas, Energy Management, Aviation, Healthcare,

Transportation, Home & Business Solutions, and GE Capital.

During the reported quarter, Oil & Gas and Aviation recorded

the highest revenue growth year over year at 11% each, followed by

Power & Water, Home & Business Solutions, and GE Capital at

2% each. However, Transportation and Energy Management segments

posted a revenue decline of 7% and 1% respectively for the

quarter.

For full year 2012, the trend was slightly different with all

segments, except GE Capital reporting revenue growth.

Transportation and Energy Management segments posted a revenue

increase of 15% each for the year, followed by Oil & Gas (12%),

Power & Water (10%), Aviation (6%), Home & Business

Solutions (4%), and Healthcare (1%). GE Capital revenue dipped 6%

year over year

Margins, Balance Sheet and Cash Flow

Total operating income for the reported quarter grew 11% year over

as all the segments recorded healthy profits, the notable among

them being Energy Management (36%), Aviation (22%) and Oil &

Gas (14%). Total operating income for full year 2012 surged 11%

year over as all the segments recorded solid profits, the most

impressive among them being Energy Management (68%), Transportation

(36%), and Home & Business Solutions (31%).

Cash generated from operating activities for full year 2012 was

$17.8 billion, up 48% from the prior-year period. Cash and cash

equivalents were $77 billion at year-end 2012. The company

repurchased $2.1 billion worth of stock during the reported

quarter, bringing its tally for the year to $5.2 billion. During

2012, General Electric returned $12.4 billion to investors through

dividend payouts and buybacks. The company also raised its

quarterly dividend by 12% to 19 cents per share, the fifth such

increase in three years.

Outlook

With a healthy growth in both the top- and bottom-line, solid

operating margins, and strong order backlogs, General Electric

expects to continue its bull run in 2013 and simultaneously benefit

the shareholders with increased dividend payouts. We also remain

encouraged by the growth momentum and maintain our Neutral

recommendation on the stock, which currently has Zacks Rank #4

(Sell).

CHEVRON CORP (CVX): Free Stock Analysis Report

GENL ELECTRIC (GE): Free Stock Analysis Report

PETROBRAS EGY (PZE): Free Stock Analysis Report

(SAFRY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

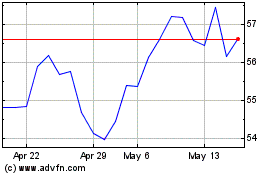

Safran (PK) (USOTC:SAFRY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Safran (PK) (USOTC:SAFRY)

Historical Stock Chart

From Jan 2024 to Jan 2025