Rolls-Royce Full-Year Pretax Profit Falls; Dividend Cut 39%

February 12 2016 - 2:46AM

Dow Jones News

By Robert Wall

LONDON--Rolls-Royce Holdings PLC on Friday slashed its proposed

full-year dividend 39%, the first cut in more than 20 years, as it

reported a decline in 2015 full-year profit.

Rolls-Royce's closely watched underlying profit before

tax--which excludes changes in the value of currency hedges--fell

to GBP1.4 billion ($2 billion) last year, following an 8% retreat

in 2014. Underlying sales declined 1% to GBP13.4 billion.

Net profit, including the revaluation of currency hedges, rose

to GBP83 million, after a big currency hit in the prior year.

Rolls-Royce said it proposed a full-year dividend of 14.1 pence,

down from to 23.1 pence a year earlier. The final payment to

shareholders was cut 50% to 7.1 pence from 14.1 pence. It is only

the second dividend cut for the company since it was privatized in

1987.

The company left its guidance unchanged after warning in

November that profit this year would face a GBP650 million

headwind.

Rolls-Royce long ago split from the luxury car maker of the same

name, and makes the majority of its profit selling aircraft engines

for large, commercial jets, like Boeing Co.'s 787 Dreamliner and

Airbus Group SE's A380.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

February 12, 2016 02:31 ET (07:31 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

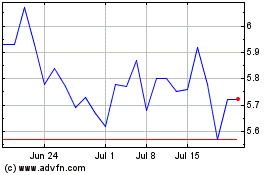

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jul 2023 to Jul 2024