Hedge Funds' Bets Against U.K. Blue Chips at Highest Since 2010

January 27 2016 - 2:20PM

Dow Jones News

By Laurence Fletcher

Hedge funds' bets against U.K. blue-chip stocks have risen to

their highest level in more than five years, another sign of the

bearish sentiment gripping investors this month.

Short interest, a measure of bets taken on falling prices, in

FTSE 100 stocks has risen to more than 1.8% of total shares in the

market, its highest level since June 2010, according to figures

from data group Markit.

A pickup in short interest in recent months comes as markets

have sold off sharply on fears that a slowdown in China's economy

will weigh on global growth. The FTSE 100, for instance, has fallen

5% so far this month.

"Definitely, the bears are out," said Simon Colvin, research

analyst at Markit. "We've only seen short sellers add to

positions."

Short interest was a little over 1% at the start of last year,

according to the data.

Years of rising markets in the U.S. and Europe, fueled by

central banks' money printing and ultralow interest rates, made

many funds wary of running big negative bets.

However, some feel conditions have now changed.

"The shorting environment is much improved," said Robert Duggan,

partner at SkyBridge Capital, which invests in hedge funds and runs

$13.1 billion in assets. "With the end of quantitative easing in

the U.S., we've seen the removal of a major headwind to shorting

stocks."

He has put money into equity hedge funds that run more short

bets.

Supermarket J Sainsbury had the most short bets against it, as

measured by percentage of shares on loan, with funds including

Lansdowne Partners, Marshall Wace and Discovery Capital Management

running negative bets, according to regulatory filings.

Miner Anglo American, against which Odey Asset Management and

Key Group are running short positions, as well as fashion house

Burberry Group and engine maker Rolls-Royce, which in November cut

profit expectations, are also among the most-shorted stocks.

A handful of hedge funds have found reasons to be bearish for

some time.

In October, Odey founder Crispin Odey told the Journal that he

expected major stock markets to lose around 40%.

And London-based Lansdowne Partners, one of the world's biggest

equity hedge funds, said in a note to investors the same month that

during 2015 they had not put on any new bets on rising stocks of

any scale, while they had spotted at least 10 new attractive bets

on falling stocks.

Write to Laurence Fletcher at laurence.fletcher@wsj.com

(END) Dow Jones Newswires

January 27, 2016 14:05 ET (19:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

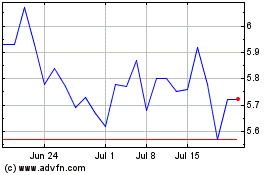

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jul 2023 to Jul 2024