Current Report Filing (8-k)

May 16 2013 - 3:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 10, 2013

THE RESERVE PETROLEUM COMPANY

(Exact name of registrant as specified in its charter)

| DELAWARE |

|

000-8157 |

|

73-0237060 |

| (State or other jurisdiction |

|

(Commission |

|

(I.R.S. Employer Identification No.) |

| of incorporation or organization |

|

File Number) |

|

|

6801 Broadway Ext., Suite 300

Oklahoma City, Oklahoma 73116-9037

(Address of principal executive offices)

(405) 848-7551

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

£Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

£Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

£Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

£Pre-commencement communications

pursuant to Rule 13c-4(c) under the Exchange Act (17 CFR 240.13c-4(c)

On May 10, 2013, The Reserve

Petroleum Company (the “Company”) became aware of a tender offer dated May 2013 for up to 7,500 shares of the Company’s

common stock at $230.00 per share (the “Tender Offer”) that is being made by Branzan Alternative Opportunities Fund,

L.L.L.P. (“Branzan”). The Company does not know whether or not the Tender Offer was sent to all stockholders of the

Company. A copy of the Tender Offer is attached to this Form 8-K as Exhibit 99.

Based on its current stockholder

list, the Company believes that Branzan owns ten shares of the Company’s common stock. If Branzan purchases 7,500 shares

in the Tender Offer, the Company believes that Branzan will own approximately 4.7% of the Company’s outstanding common stock.

On November 29, 2012, Branzan

sent a Demand for Inspection of Books and Records Pursuant to Section 220(b) of the Delaware General Corporation Law to the Company

(the “Demand Letter”). In the Demand Letter, Branzan requested the opportunity to inspect a current list of the Company’s

shareholders and their addresses and stated that it was making its request for the purposes of communicating with the Company’s

shareholders: (a) in order to solicit from other shareholders of the Company for the tender of stock, and (b) in order to influence

the policy of the Company’s management. On January 4, 2013, a representative of Branzan arrived at the Company’s offices

and was given a then current list of the Company’s stockholders pursuant to Section 220(b) of the Delaware General Corporation

Law.

The Company expresses no

opinion and is remaining neutral toward the Tender Offer. The reasons for the Company’s position are as follows: (i)

other than related to the Demand Letter and the transfer of stock related to the Tender Offer, the Company has not had any contact

with Branzan and it does not know anything about Branzan, let alone how it intends to influence the policy of the Company’s

management, and (ii) due to the fact that the stock is so thinly traded, it is not possible to establish its value.

| Item 9.01 | Financial Statements and Exhibits | |

| | | |

| (d) | Exhibits | |

| | | |

| 99 | Tender Offer dated May 2013 that is being made by Branzan

Alternative Opportunities Fund, L.L.L.P. |

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto

duly authorized.

/s/

Cameron McLain

Cameron

McLain

Principal

Executive Officer

Date:

May 16, 2013

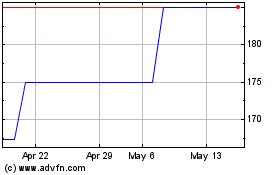

Reserve Petroleum (PK) (USOTC:RSRV)

Historical Stock Chart

From Oct 2024 to Nov 2024

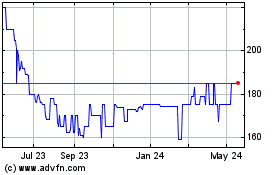

Reserve Petroleum (PK) (USOTC:RSRV)

Historical Stock Chart

From Nov 2023 to Nov 2024