|

POSITRON

CORPORATION

|

|

(Exact

Name of Registrant as Specified in Its Charter)

|

|

Texas

|

000-24092

|

76-0083622

|

|

|

|

|

|

(State

or Other Jurisdiction of Incorporation)

|

(Commission

File Number)

|

(I.R.S.

Employer Identification No.)

|

|

|

|

|

|

1777

Maryland Avenue, Niagara Falls, New York

|

14305

|

|

|

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

|

(317)

576-0183

|

|

|

|

(Registrant's

Telephone Number, Including Area Code)

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory

Note

: Positron Corporation (the “Registrant”) is filing this Current Report on Form 8-K in order to disclose

and provide information regarding the Registrant since the Registrant’s last filing with the Securities and Exchange Commission

(the “Commission”) on May 10, 2016 and not previously disclosed.

Cautionary

Note Regarding Forward-Looking Statements

This

Current Report on Form 8-K may include “forward-looking” statements as defined in Section 27A of the Securities Act

of 1933 (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”),

the Private Securities Litigation Reform Act of 1995 (the “PSLRA”) or in releases made by the Securities and Exchange

Commission (“SEC”), all as may be amended from time to time. Such forward-looking statements involve known and unknown

risks, uncertainties and other important factors that could cause the actual results, performance or achievements of Positron

Corporation, or general industry or broader economic performance in global markets in which Positron operates or competes, to

differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements.

Statements that are not historical fact are forward-looking statements. Forward-looking statements can be identified by, among

other things, the use of forward-looking language, such as the words “plan,” “believe,” “expect,”

“anticipate,” “intend,” “estimate,” “project,” “may,” “will,”

“would,” “could,” “should,” “seeks,” or “scheduled to,” or other similar

words, or the negative of these terms or other variations of these terms or comparable language, or by discussion of strategy

or intentions. These cautionary statements are being made pursuant to the Securities Act, the Exchange Act and the PSLRA with

the intention of obtaining the benefits of the “safe harbor” provisions of such laws. Positron cautions investors

that any forward-looking statements made by Positron are not guarantees or indicative of future performance. Important assumptions

and other important factors that could cause actual results to differ materially from those forward-looking statements with respect

to Positron, include, but are not limited to, the risk that Positron may not successfully grow its business as expected and those

factors, risks and uncertainties that are described in periodic securities filings by Positron with the SEC. Although Positron

believes that its plans, intentions and expectations reflected in or suggested by such forward-looking statements are reasonable,

actual results could differ materially from a projection or assumption in any forward-looking statements. Positron’s future

financial condition and results of operations, as well as any forward-looking statements, are subject to change and to inherent

risks and uncertainties. The forward-looking statements contained in this press release are made only as of the date hereof, and

Positron does not have or undertake any obligation to update or revise any forward-looking statements whether as a result of new

information, subsequent events or otherwise, unless otherwise required by law.

BACKGROUND

As

previously disclosed on May 4, 2016, on August 28, 2015, three creditors of Positron Corporation (the “Registrant”)

filed an involuntary Chapter 11 petition against the Registrant in the U.S. Bankruptcy Court for the Northern District of Texas,

Lubbock Division (“Bankruptcy Court”) under Case No. 15-502015-rlj.

As

previously disclosed, the Registrant and the petitioning creditors filed a joint motion to approve a structured dismissal agreement

pursuant to bankruptcy rule 9019 on May 2, 2016. A hearing to consider approval of the structured dismissal agreement was to be

held on June 22, 2016.

The

structured dismissal agreement was not approved by the Bankruptcy Court, and on September 7, 2016 an Order for Relief was entered

by the Bankruptcy Court.

On

November 22, 2016, the Bankruptcy Court granted the Company’s motion to approve a settlement agreement whereby the Registrant

transferred all of the assets of Positron’s subsidiary Manhattan Isotope Technology, LLC to DX, LLC (“DX”) (

DX is one of the three petitioning creditors, DX, LLC. is owned by Cecil O’Brate a now former Positron shareholder) in exchange

for the forgiveness of a secured promissory note in the amount of $451,590 held by DX and the forgiveness of all claims by DX

and Jason and Suzanne Kitten. In addition to the above, Cecil O’Brate, Jason and Suzanne Kittens and the O’Brate Group

agreed to relinquish all of the shares held by them of the Registrant’s capital stock.

On

March 27, 2017, the Registrant filed a Plan of Reorganization (“Plan”) and Disclosure Statement (the “Disclosure

Statement”) with the Bankruptcy Court. The Plan was solicited by the Registrant and approved by the four classes entitled

to vote on the Plan: Class 1-Claim of Tradex Global Advisors LLC (“Tradex”); Class 3-Priority Wage Claims; Class 5-General

Unsecured Claims; and Class 6-General Unsecured Claims-Insider Notes of the Registrant.

On

April 26, 2017, following a confirmation hearing, the Bankruptcy Court entered an order (“Confirmation Order”) confirming

the Registrant’s amended Plan.

The

following is a summary of the material terms of the Plan (capitalized terms used but not defined in this Current Report on Form

8-K have the meaning set forth in the Plan):

The

Plan provided for the payment of administrative and certain priority claims in full, payment of $125,000 to Tradex from the sale

of the Registrant’s real property located in Westmont, IL (“Westmont Real Property”), payment in full of priority

wage claims in Class 3 over a period of thirty six (36) months, a distribution of a total of $50,000 to Class 5 General Unsecured

Claims over a period of thirty six (36) months (representing approximately a 5% distribution) and granting Class 6 General Unsecured

Claims-Insider Notes an option to convert their notes to equity in the Reorganized Company. All payments and distributions under

the Plan were funded by the sale of the Westmont Real Property and by the going forward business operations of the Registrant.

On

October 4, 2017, the Registrant was granted a Final Decree for Reorganization in Texas Court (the “Final Decree”).

The Final Decree set forth a schedule for repayment of obligations which is currently being met. All shareholder classes remained

intact, except Cecil O’Brate whose 3,276,298 shares were returned to the Registrant’s treasury in connection with

the DX settlement.

Item

1.01. Entry into a Material Definitive Agreement

On

April 26, 2017, the Bankruptcy Court entered into an order confirming the Company’s Amended Plan of Reorganization. The

terms of the Plan are more fully set forth in Item 1.03 below and are incorporated herein by reference.

Item 1.03.

Bankruptcy or Receivership.

As

previously disclosed on May 4, 2016, on August 28, 2015, three creditors of Positron Corporation (the “Registrant”)

filed an involuntary Chapter 11 petition against the Registrant in the U.S. Bankruptcy Court for the Northern District of Texas,

Lubbock Division (“Bankruptcy Court”) under Case No. 15-502015-rlj.

As

previously disclosed, the Registrant and the petitioning creditors filed a joint motion to approve a structured dismissal agreement

pursuant to bankruptcy rule 9019 on May 2, 2016. A hearing to consider approval of the structured dismissal agreement was to be

held on June 22, 2016.

The

structured dismissal agreement was not approved by the Bankruptcy Court, and on September 7, 2016 an Order for Relief was entered

by the Bankruptcy Court.

On

March 27, 2017, the Registrant filed a Plan of Reorganization (“Plan”) and Disclosure Statement (the “Disclosure

Statement”) with the Bankruptcy Court.

The

Plan was solicited by the Registrant and approved by the four classes entitled to vote on the Plan: Class 1-Claim of Tradex Global

Advisors LLC (“Tradex”); Class 3-Priority Wage Claims; Class 5-General Unsecured Claims; and Class 6-General Unsecured

Claims-Insider Notes of the Registrant.

On

April 26, 2017, following a confirmation hearing, the Bankruptcy Court entered an order (“Confirmation Order”) confirming

the Registrant’s amended Plan.

The

following is a summary of the material terms of the Plan (capitalized terms used but not defined in this Current Report on Form

8-K have the meaning set forth in the Plan):

The

Plan provided for the payment of administrative and certain priority claims in full, payment of $125,000 to Tradex from the sale

of the Registrant’s real property located in Westmont, IL (“Westmont Real Property”), payment in full of priority

wage claims in Class 3 over a period of thirty six (36) months, a distribution of a total of $50,000 to Class 5 General Unsecured

Claims over a period of thirty six (36) months (representing approximately a 5% distribution) and granting Class 6 General Unsecured

Claims-Insider Notes an option to convert their notes to equity in the Reorganized Company. All payments and distributions under

the Plan were funded by the sale of the Westmont Real Property and by the going forward business operations of the Registrant.

On

October 4, 2017, the Registrant was granted a Final Decree for Reorganization in Texas Court (the “Final Decree”).

The Final Decree set forth a schedule for repayment of obligations which is currently being met. All shareholders class remained

intact, except for the O’Brate Group and the Kittens whose 3,276,298 shares were returned to the Registrant’s treasury.

Item

2.02. Disposition of Assets

On

April 17, 2017, the Registrant sold its Westmont Real Property. The terms of the sale of the Westmont Real Property are more fully

set forth in Item 1.03 above and are incorporated herein by reference.

Item

5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

On

or about February 27, 2018, a majority of the Registrant’s shareholders voted to remove Corey N. Conn as the Registrant’s

sole member of the Board of Directors. Also on that date, Adel Abdullah was appointed to the Board of Directors.

On

or about March 16, 2018, Corey N. Conn was terminated as the Registrant’s Chief Financial Officer and/or from any other

office he may have had as of that date. Also on March 16, 2018, Adel Abdullah was appointed the Registrant’s President.

On

May 25, 2018, Aaron Hargrave was appointed Vice President of the Registrant.

Adel

Abdullah, 45, President and Director

Prior

to his appointment as Director on February 27, 2018 and since 2006, Mr. Abdullah served as the Registrant’s Director of

Service & Operations where he lead all technical and clinical efforts of the Registrant’s PET Systems, business operations

and services. Mr. Abdullah has degree in Aerospace and Mechanical Engineering from University of Arizona. The Registrant believes

as a result of Mr. Abdullah’s twenty three (23) years of experience in medical imaging and technology in multiple capacities

and years of services with the Company, he is very qualified for the appointed position.

Aaron

Hargrave, 32, Vice President

Prior

to his appointment as Vice President on May 25, 2018 and since 2010, Mr. Hargrave served as the Registrant’s Clinical Applications

Specialist, where he lead training, support, and clinical efforts of the Registrant’s PET Systems and Software. Mr. Hargrave

has degree in Nuclear Medicine Technology from University at Buffalo. The Registrant believes as a result of Mr. Hargrave’s

ten (10) years of experience in medical imaging and applications and years of service with the Company, he is qualified for the

appointed position.

Item

5.07. Submission of Matters to a Vote of Security holders.

The

disclosures set forth in Item 5.02 are hereby incorporated by reference to this Item 5.07.

Item 9.01 Financial

Statements and Exhibits

(d)

Exhibits

.

SIGNATURES

PURSUANT

TO THE REQUIREMENTS OF THE SECURITIES EXCHANGE ACT OF 1934, THE REGISTRANT HAS DULY CAUSED THIS REPORT TO BE SIGNED ON ITS BEHALF

BY THE UNDERSIGNED THEREUNTO DULY AUTHORIZED.

|

|

POSITRON

CORPORATION

|

|

|

|

|

|

|

|

Date:

July 31, 2018

|

By:

|

/s/ Adel Abdullah

|

|

|

|

|

Name:

Adel Abdullah

Title:

President, Director

|

|

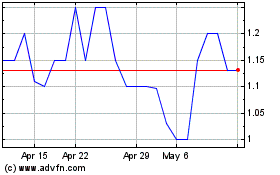

Positron (PK) (USOTC:POSC)

Historical Stock Chart

From Feb 2025 to Mar 2025

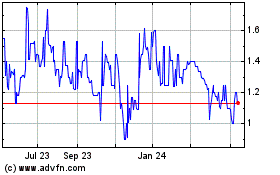

Positron (PK) (USOTC:POSC)

Historical Stock Chart

From Mar 2024 to Mar 2025