SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 21, 2015

NORTH BAY RESOURCES INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

000-54213

(Commission File Number)

83-0402389

(IRS Employer Identification No.)

3995 Yerkes Road

Collegeville, Pennsylvania 19426

(Address of principal executive offices and Zip Code)

(215) 661-1100

Registrant's telephone number, including area code

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

Information included in this Form 8-K may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This information may involve known and unknown risks, uncertainties and other factors which may cause the Company’s actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe the Company’s future plans, strategies and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or the negative of these words or other variations on these words or comparable terminology. These forward-looking statements are based on assumptions that may be incorrect, and there can be no assurance that any projections included in these forward-looking statements will come to pass. The Company’s actual results could differ materially from those expressed or implied by the forward-looking statements as a result of various factors. Except as required by applicable laws, the Company undertakes no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

Item 1.01 Entry Into a Material Definitive Agreement

Item 2.03 Creation of a Direct Financial Obligation

Effective July 24, 2015, the Registrant issued a $100,000 Convertible Promissory Note ("the Zaco Note") to Zaco Investments LLC ("Zaco", or “the Lender”). The Zaco Note has a maturity date of twelve (12) months from the Effective Date, and accrues interest at 5% per annum.

The Principal Sum due to the Lender shall be prorated based on the consideration actually paid by the Lender, as well as any other interest or fees, such that the Registrant is only required to repay the amount funded and the Registrant is not required to repay any unfunded portion of the Zaco Note. The initial tranche received from this transaction was $10,000. Use of funds is for expenses incurred preparing the Ruby Mine for the restart of operations.

The Company retains the option of pre-paying the Zaco Note at no penalty. Unless the Zaco Note is repaid in cash within 180 days, the Lender has the right to convert all or part of the outstanding and unpaid Principal Sum and accrued interest (and any other fees) into shares of fully paid and non-assessable shares of common stock of the Registrant. The Conversion Price is at a 20% discount to the average of the two lowest volume weighted average prices (VWAP) on the previous fifteen (15) trading days prior to the date of Conversion.

The Zaco Note referred to above (and the shares of common stock underlying them) is exempt from registration pursuant to Section 4(2) of the Securities Act of 1933, as amended.

The foregoing is not a complete summary of the terms of the Zaco Note described herein and reference is made to the complete text of the Agreement as Exhibit 10.1 to this Current Report on Form 8-K, and hereby incorporated by reference.

Item 3.02 Unregistered Sales of Equity Securities

On July 21, 2015, the Registrant accepted a conversion notice from Tangiers Investors LP, ("Tangiers") to partially satisfy a $750,000 Convertible Promissory Note Agreement ("the Note") dated October 2, 2012 with Tangiers. 60,714,286 shares were subsequently issued to satisfy $4,250 of the outstanding principal and interest in accordance with the terms of the Note, as amended on December 5, 2014. As of the date of this report the remaining amount currently outstanding on the Note, including accrued interest, is now $423,747.

On July 23, 2015, the Registrant received two conversion notices from RLS Premiere Financial LLC ("RLS ") to partially satisfy a $125,000 Convertible Promissory Note Agreement ("the RLS Note") dated August 7, 2014 with RLS. An aggregate of 30,000,000 shares were subsequently authorized to satisfy $2,400 of the outstanding principal in accordance with the terms of the RLS Note. As of the date of this report the remaining amount currently outstanding on the RLS Note is $12,400.

On July 24, 2015, the Registrant accepted a conversion notice from JMJ Financial, ("JMJ") to partially satisfy a $550,000 Promissory Note ("the JMJ Note") dated July 11, 2012 with JMJ. 33,490,000 shares were subsequently issued to satisfy $2,344 of the outstanding principal and interest in accordance with the terms of the JMJ Note. As of the date of this report the remaining amount currently outstanding on the JMJ Note, including accrued interest, is now $65,929.

Tangiers, RLS, and JMJ are each an “accredited investor” as defined under Rule 501 of Regulation D. The Company believes that these transactions are exempt from registration with the Securities and Exchange Commission pursuant to Section 4(2) of the Securities Act of 1933, as amended.

The above described executed Notes are attached hereto and incorporated by reference as Exhibits 10.2 through 10.5.

As of the date of this report the Registrant has 734,808,543 shares of its common stock issued and outstanding and 734,650,433 shares in the public float.

Item 9.01 Financial Statements and Exhibits

(c) Exhibits

|

10.1

|

|

|

10.2

|

Twenty-Four Month Convertible Promissory Note with Tangiers Investors, LP dated October 2, 2012, as previously filed with the Company’s filing of Form 8-K, SEC file number 000-54213, filed on October 3, 2012, and incorporated by this reference as an exhibit to this Form 8-K

|

|

10.3

|

Master Loan and Security Agreement with Tangiers Investors dated December 5, 2014, as previously filed with the Company’s filing of Form 8-K, SEC file number 000-54213, filed on December 12, 2014, and incorporated by this reference as an exhibit to this Form 8-K

|

|

10.4

|

Twelve Month Convertible Promissory Note with RLS Premiere Financial LLC dated August 7, 2014, as previously filed with the Company’s filing of Form 8-K, SEC file number 000-54213, filed on August 12, 2014, and incorporated by this reference as an exhibit to this Form 8-K

|

|

10.5

|

Twelve Month Convertible Promissory Note with JMJ Financial dated July 11, 2012, as previously filed with the Company’s filing of Form 8-K, SEC file number 000-54213, filed on July 13, 2012, and incorporated by this reference as an exhibit to this Form 8-K

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

NORTH BAY RESOURCES INC.

(Registrant)

By: /s/ Perry Leopold

Perry Leopold

Chief Executive Officer

Dated: July 28, 2015

Exhibit 10.1

$100,000 PROMISSORY NOTE

FOR VALUE RECEIVED, North Bay Resources Inc., a Delaware corporation (the “Borrower”) promises to pay to Zaco Investments LLC or its Assignees (the “Lender”) the Principal Sum along with the Interest Rate and any other fees according to the terms herein. This Note will become effective only upon execution by both parties and delivery of the first payment of Consideration by the Lender (the “Effective Date”).

The Principal Sum is $100,000 (one hundred thousand) plus accrued and unpaid interest of 5% per annum and any other fees. The Lender shall pay $10,000 of Consideration upon closing of this Note. The Lender may pay additional Consideration to the Borrower in such amounts and at such dates as Lender and Borrower may mutually agree on. THE PRINCIPAL SUM DUE TO LENDER SHALL BE PRORATED BASED ON THE CONSIDERATION ACTUALLY PAID BY LENDER SUCH THAT THE BORROWER IS ONLY REQUIRED TO REPAY THE AMOUNT FUNDED AND THE BORROWER IS NOT REQUIRED TO REPAY ANY UNFUNDED PORTION OF THIS NOTE. The Maturity Date is one year from the Effective Date of each payment (the “Maturity Date”) and is the date upon which the Principal Sum of this Note, as well as any unpaid interest and other fees, shall be due and payable. The Conversion Price is 80% of the average of the two (2) lowest volume weighted average price (VWAP) in the fifteen (15) trading days previous to the conversion. Unless otherwise agreed in writing by both parties, at no time will the Lender convert any amount of the Note into common stock that would result in the Lender owning more than 4.99% of the common stock outstanding.

1. Conversion. The Lender has the right, at any time 180 days after the Effective Date, at its election, to convert all or part of the outstanding and unpaid Principal Sum and accrued interest (and any other fees) into shares of fully paid and non-assessable shares of common stock of the Borrower as per this conversion formula: Number of shares receivable upon conversion equals the dollar conversion amount divided by the Conversion Price. Conversions may be delivered to Borrower by method of Lender’s choice (including but not limited to email, facsimile, mail, overnight courier, or personal delivery), and all conversions shall be cashless and not require further payment from the Lender. If no objection is delivered from Borrower to Lender regarding any variable or calculation of the conversion notice within 24 hours of delivery of the conversion notice, the Borrower shall have been thereafter deemed to have irrevocably confirmed and irrevocably ratified such notice of conversion and waived any objection thereto. The Borrower shall deliver the shares from any conversion to Lender (in any name directed by Lender) within 3(three) business days of conversion notice delivery.

2. Prepayment. At any time prior to conversion, the Borrower may prepay the outstanding principal of the note plus any accrued interest at no penalty.

3. Default. The following are events of default under this Note: (i) the Borrower shall fail to pay any principal under the Note when due and payable (or payable by conversion) thereunder; or (ii) the Borrower shall fail to pay any interest or any other amount under the Note when due and payable (or payable by conversion) thereunder; or (iii) a receiver, trustee or other similar official shall be appointed over the Borrower or a material part of its assets and such appointment shall remain uncontested for twenty (20) days or shall not be dismissed or discharged within sixty (60) days; or (iv) the Borrower shall become insolvent or generally fails to pay, or admits in writing its inability to pay, its debts as they become due, subject to applicable grace periods, if any; or (v) the Borrower shall make a general assignment for the benefit of creditors; or (vi) the Borrower shall file a petition for relief under any bankruptcy, insolvency or similar law (domestic or foreign); or (vii) an involuntary proceeding shall be commenced or filed against the Borrower; or (viii) the Borrower shall become delinquent in its filing requirements as a fully-reporting issuer registered with the SEC.

4. Remedies. In the event of any default, the outstanding principal amount of this Note, plus accrued but unpaid interest, liquidated damages, fees and other amounts owing in respect thereof through the date of acceleration, shall become, at the Lender’s election, immediately due and payable in cash at the Mandatory Default Amount. The Mandatory Default Amount means the greater of (i) the outstanding principal amount of this Note, plus all accrued and unpaid interest, liquidated damages, fees and other amounts hereon, divided by the Conversion Price on the date the Mandatory Default Amount is either demanded or paid in full, whichever has a lower Conversion Price, multiplied by the VWAP on the date the Mandatory Default Amount is either demanded or paid in full, whichever has a higher VWAP, or (ii) 125% of the outstanding principal amount of this Note, plus 100% of accrued and unpaid interest, liquidated damages, fees and other amounts hereon. Commencing five (5) days after the occurrence of any event of default that results in the eventual acceleration of this Note, the interest rate on this Note shall accrue at an interest rate equal to the lesser of 12% per annum or the maximum rate permitted under applicable law. In connection with such acceleration described herein, the Lender need not provide, and the Borrower hereby waives, any presentment, demand, protest or other notice of any kind, and the Lender may immediately and without expiration of any grace period enforce any and all of its rights and remedies hereunder and all other remedies available to it under applicable law. Such acceleration may be rescinded and annulled by Lender at any time prior to payment hereunder and the Lender shall have all rights as a holder of the note until such time, if any, as the Lender receives full payment pursuant to this Section 3. No such rescission or annulment shall affect any subsequent event of default or impair any right consequent thereon. Nothing herein shall limit Lender’s right to pursue any other remedies available to it at law or in equity including, without limitation, a decree of specific performance and/or injunctive relief with respect to the Borrower’s failure to timely deliver certificates representing shares of Common Stock upon conversion of the Note as required pursuant to the terms hereof.

5. No Shorting. Lender agrees that so long as this Note from Borrower to Lender remains outstanding, Lender will not enter into or effect “short sales” of the Common Stock or hedging transaction which establishes a net short position with respect to the Common Stock of Borrower. Borrower acknowledges and agrees that upon delivery of a conversion notice by Lender, Lender immediately owns the shares of Common Stock described in the conversion notice and any sale of those shares issuable under such conversion notice would not be considered short sales.

6. Assignability. The Borrower may not assign this Note. This Note will be binding upon the Borrower and its successors and will inure to the benefit of the Lender and its successors and assigns and may be assigned by the Lender to anyone of its choosing without Borrower’s approval.

7. Governing Law. This Note will be governed by, and construed and enforced in accordance with, the laws of the State of Delaware, without regard to the conflict of laws principles thereof. Both parties and the individuals signing this Agreement agree to submit to the jurisdiction of such courts.

8. Delivery of Process by Lender to Borrower. In the event of any action or proceeding by Lender against Borrower, and only by Lender against Borrower, service of copies of summons and/or complaint and/or any other process which may be served in any such action or proceeding may be made by Lender via U.S. Mail, overnight delivery service such as FedEx or UPS, email, fax, or process server, or by mailing or otherwise delivering a copy of such process to the Borrower at its last known attorney as set forth in its most recent SEC filing.

9. Attorney Fees. In the event any attorney is employed by either party to this Note with regard to any legal or equitable action, arbitration or other proceeding brought by such party for the enforcement of this Note or because of an alleged dispute, breach, default or misrepresentation in connection with any of the provisions of this Note, the prevailing party in such proceeding will be entitled to recover from the other party reasonable attorneys' fees and other costs and expenses incurred, in addition to any other relief to which the prevailing party may be entitled.

10. Opinion of Counsel. In the event that an opinion of counsel is needed for any matter related to this Note, Lender shall have any such opinion provided by its counsel.

11. Notices. Any notice required or permitted hereunder (including Conversion Notices) must be in writing and either personally served, sent by facsimile or email transmission, or sent by overnight courier. Notices will be deemed effectively delivered at the time of transmission if by facsimile or email, and if by overnight courier the business day after such notice is deposited with the courier service for delivery.

|

Borrower:

|

Lender:

|

| |

|

| |

|

|

/s/ Perry Leopold

|

/s/ Mushinge Mumena

|

|

Perry Leopold

|

Mushinge Mumena

|

|

North Bay Resources Inc.

|

Zaco Investments LLC

|

|

Chief Executive Officer

|

|

| |

|

|

Date: 7/24/15

|

Date: 7/24/15

|

| |

|

| |

|

| |

|

| |

|

| |

/s/ Hothan Muntanga

|

| |

Hothan Muntanga

|

| |

Chief Executive Officer

|

| |

Zaco Investments LLC

|

| |

|

| |

Date: 7/24/15

|

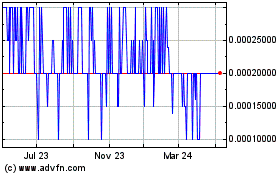

North Bay Resources (PK) (USOTC:NBRI)

Historical Stock Chart

From Oct 2024 to Nov 2024

North Bay Resources (PK) (USOTC:NBRI)

Historical Stock Chart

From Nov 2023 to Nov 2024