Registration No. 333-45664

ICA No. 811- 10123

As filed with the Securities and Exchange Commission on

March 24, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933:

Pre-Effective Amendment No. ___

Post-Effective Amendment No.

18

and/or

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940:

Amendment No.

19

(Check Appropriate Box or Boxes)

The North Country Funds

(Exact Name of Registrant as Specified in Charter)

c/o Gemini Fund Services, LLC

80 Arkay Drive, Suite 110

Hauppauge, New York 11788

(Address of Principal Executive Offices)(Zip Code)

(631) 470-2700

(Registrant's Telephone Number, Including Area Code)

James P. Ash, Esq.

Gemini Fund Services, LLC

80 Arkay Drive, Suite 110

Hauppauge, New York 11788

(Name and Address of Agent For Service)

With a copy to

:

Brian D. McCabe, Esq.

Ropes & Gray LLP

Prudential Tower, 800 Boylston Street, Boston, Massachusetts 02199-3600

It is proposed that this filing will become effective (check appropriate box):

|

|

|

(

)

|

immediately upon filing pursuant to paragraph (b).

|

|

(X)

|

On

March 31, 2014

pursuant to paragraph (b).

|

|

( )

|

60 days after filing pursuant to paragraph (a)(1).

|

|

( )

|

on (date) pursuant to paragraph (a)(1).

|

|

( )

|

75 days after filing pursuant to paragraph (a)(2).

|

|

( )

|

on (date) pursuant to paragraph (a)(2) of Rule 485.

|

THE NORTH COUNTRY EQUITY GROWTH FUND

Ticker: NCEGX

THE NORTH COUNTRY INTERMEDIATE BOND FUND

Ticker: NCBDX

each a series of

THE NORTH COUNTRY FUNDS

Prospectus dated

March 31, 2014

This Prospectus provides important information about the North Country Equity Growth Fund (the “Growth Fund”) and the North Country Intermediate Bond Fund (the “Bond Fund”) (the “Funds”) that you ought to know before investing. Please read it carefully before investing and retain it for future reference.

An investment in The North Country Funds is not a deposit in or guaranteed by Glens Falls National Bank & Trust Company or any other bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Investment in the Funds involves the possible loss of principal invested.

These securities have not been approved or disapproved by the Securities and Exchange Commission (“SEC”) or any state securities commission nor has the SEC or any state securities commission passed upon the accuracy or adequacy of the prospectus. Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

|

|

|

|

Page

|

|

FUN FUND SUMMARY: North Country Equity Growth Fund

|

|

|

INVESTMENT OBJECTIVE

|

1

|

|

FEES AND EXPENSES OF THE FUND

|

1

|

|

PRINCIPAL INVESTMENT STRATEGIES

|

2

|

|

PRINCIPAL INVESTMENT RISKS

|

2

|

|

PERFORMANCE

|

3

|

|

MANAGEMENT

|

5

|

|

PURCHASE AND SALE OF FUND SHARES

|

5

|

|

TAX INFORMATION

|

5

|

|

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

|

5

|

|

|

|

|

FUND SUMMARY: North Country Intermediate Bond Fund

|

|

|

INVESTMENT OBJECTIVE

|

6

|

|

FEES AND EXPENSES OF THE FUND

|

6

|

|

PRINCIPAL INVESTMENT STRATEGIES

|

7

|

|

PRINCIPAL INVESTMENT RISKS

|

7

|

|

PERFORMANCE

|

8

|

|

MANAGEMENT

|

10

|

|

PURCHASE AND SALE OF FUND SHARES

|

10

|

|

TAX INFORMATION

|

10

|

|

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

|

10

|

|

|

|

|

ADDITIONAL INFORMATION ABOUT PRINCIPAL INVESTMENT

STATEGIES AND RELATED RISKS

|

|

|

PRINCIPAL INVESTMENT STRATEGIES

|

11

|

|

NON-PRINCIPAL INVESTMENT STRATEGIES

|

12

|

|

INVESTMENT RISKS

|

13

|

|

MANAGEMENT

|

16

|

|

YOUR ACCOUNT

|

18

|

|

HOW TO OPEN AN ACCOUNT AND PURCHASE SHARES

|

19

|

|

HOW TO SELL (REDEEM) SHARES

|

22

|

|

FREQUENT PURCHASES AND REDEMPTIONS OF SHARES

|

25

|

|

WHEN AND HOW NAV IS DETERMINED

|

26

|

|

DISTRIBUTIONS

|

27

|

|

FEDERAL TAX CONSIDERATIONS

|

28

|

|

FINANCIAL HIGHLIGHTS

|

29

|

|

EXCHANGE PRIVILEGE

|

32

|

|

COUNSEL AND INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

32

|

|

ORGANIZATION

|

33

|

|

FOR MORE INFORMATION

|

Back Cover

|

FUND SUMMARY – North Country Equity Growth Fund

INVESTMENT OBJECTIVE

The North Country Equity Growth Fund (the “Growth Fund”) seeks to provide investors with long-term capital appreciation.

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy and hold shares of the Growth Fund.

|

|

|

|

Growth

Fund

|

|

SHAREHOLDER TRANSACTION EXPENSES

(fees paid directly from your investment):

|

|

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of the offering price)

|

None

|

|

Maximum Deferred Sales Charge (Load)

(as a percentage of the offering price)

|

None

|

|

Maximum Sales Charge (Load) Imposed on Reinvested Dividends and other Distributions

|

None

|

|

Redemption Fee (as a percentage of the amount redeemed,

if applicable)

|

None

|

|

Exchange Fee

|

None

|

|

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment):

|

|

|

Management Fees

|

0.75%

|

|

Distribution (12b-1) Fees

|

None

|

|

Other Expenses

|

0.27%

|

|

Total Annual Operating Expenses

|

1.02%

|

Example:

This Example is intended to help you compare the cost of investing in the Growth Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Growth Fund for the time periods indicated and then redeem all of your shares at the end of these periods. The Example also assumes that your investment has a 5% rate of return each year and that the Growth Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your cost for the Growth Fund would be:

|

|

|

|

|

1 YEAR

|

3 YEARS

|

5 YEARS

|

10 YEARS

|

|

$104

|

$325

|

$563

|

$1,248

|

Portfolio Turnover:

The Growth Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Growth Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Growth Fund's performance. During the most recent fiscal year, the Growth Fund’s portfolio turnover rate was

41%

of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Growth Fund seeks to achieve its investment objective by investing at least 80% of its net assets in a diversified portfolio of equity securities of U.S. companies with mid to large-sized market capitalizations (generally considered to be in excess of $2 billion) that North Country Investment Advisers, Inc. (the “Adviser”) believes have demonstrated fundamental investment value and favorable growth prospects. Equity securities include common stocks of domestic and foreign-domiciled companies, preferred stocks, convertible preferred stocks, and American Depository Receipts (“ADRs”). The Growth Fund focuses primarily on market sectors such as Materials, Health Care, Utilities, Information Technology, Industrials, Consumer Discretionary, Consumer Staples, Financial Services, Energy and Telecommunications.

The Adviser utilizes a "growth" approach to investing and selects portfolio securities based on its analysis of various factors including price/earnings ratios, the strength or potential strength of a company's competitive position, strength of management, marketing prowess and product development capabilities.

The Adviser will utilize a buy and hold approach, generally maintaining its position in a company's stock without regard to day-to-day fluctuations in the market. However, the Adviser will frequently re-evaluate portfolio holdings, as it deems necessary, and will typically sell a stock when the reasons for buying or holding it no longer apply, such as a lack of performance, change in business direction, adverse changes in other factors or when the company begins to show deteriorating fundamentals.

PRINCIPAL INVESTMENT RISKS

You could lose money on your investment in the Growth Fund, or the Growth Fund may not perform as well as other possible investments. The net asset value of the Growth Fund's shares will fluctuate based on the value of the securities held in its portfolio. As with any mutual fund, there can be no guarantee that the investment objective of the Growth Fund will be achieved. An investment in the Growth Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

Market Risk.

The net asset value of the Growth Fund will fluctuate based on changes in the value of the securities in which the Growth Fund invests. The Fund invests in equity securities (such as stocks), which are generally more volatile and carry more risk than some other forms of investments. The price of equity securities can rise or fall rapidly in response to developments affecting a specific company or industry, or to changing economic, political or market conditions. Stock prices in general may decline over short or extended periods of time, lowering the value of the Growth Fund’s investments. Market prices of equity securities in broad market segments may be adversely affected by a prominent issuer having experienced losses or by the lack of earnings, by such an issuer's failure to meet the market's expectations with respect to new products or services, or even by factors wholly unrelated to the value or condition of the issuer, such as changes in interest rates.

There is also a risk that the Growth Fund's investments will underperform either the securities markets generally or particular segments of the securities markets

.

Investing in Mutual Funds.

All mutual funds carry a certain amount of risk. You may lose money on your investment in the Fund. As all investment securities are subject to inherent market risks and fluctuations in value due to earnings, economic and political conditions and other factors, the Fund cannot give any assurance that its investment objective will be achieved.

Issuer Specific Changes.

The value of an individual security can be more volatile, and can perform differently, than the market as a whole. The price of an individual issuer's securities can rise or fall dramatically in response to such things as earnings reports, news about the development of a promising product, or the changing of key management personnel.

Liquidity Risk.

The Growth Fund may invest in securities that are or become illiquid, and the Growth Fund may not be able to sell such securities at the time and/or the price the Adviser believes would be advantageous.

Manager Risk.

Investment in the Growth Fund involves the risk that the Adviser's assessment of the growth potential of specific securities may prove incorrect.

Foreign Securities Risk.

Investments in foreign securities face specific risks, which include: reduced availability of information regarding foreign companies that may be subject to different accounting, auditing and financial standards and to less stringent reporting standards and requirements, reduced liquidity, increased market risk due to regional economic and political instability, and the threat of nationalization and expropriation.

Growth Investing Risk.

"Growth" stocks can perform differently than the market as a whole and other types of stocks. The prices of growth stocks may increase or decrease significantly in response to unexpected earnings reports or other news about the issuer.

PERFORMANCE

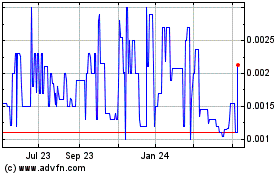

The bar chart and table that follow provide some indication of the risks of investing in the Growth Fund by showing changes in the performance of the Growth Fund from year to year and by showing how the Growth Fund's average annual returns for 1, 5 and 10 years compare with those of a broad measure of market performance. Please remember that the Growth Fund's past performance (before and after taxes) is not an indication of how the Growth Fund will perform in the future.

Annual Total Return for Years Ended December 31,

![[CHART002.GIF]](http://content.edgar-online.com/edgar_conv_img/2014/03/24/0000910472-14-001280_CHART002.GIF)

During the periods shown in the bar chart above, the Growth Fund's best quarterly performance was 14.39% (quarter ended June 30, 2009) and its lowest quarterly performance was -22.59% (quarter ended December 31, 2008). For the fiscal quarter ended February 28,

2014,

the return for the Growth Fund was

4.20%.

AVERAGE ANNUAL TOTAL RETURNS

(FOR THE PERIODS ENDED DECEMBER 31,

2013)

|

|

|

|

|

|

1 YEAR

|

5 YEARS

|

10 YEARS

|

|

Growth Fund

|

|

|

|

|

Return before taxes

|

32.67%

|

15.37%

|

5.93%

|

|

Return after taxes on distributions

|

31.79%

|

15.03%

|

5.73%

|

|

Return after taxes on distributions and sale of Fund shares

|

19.17%

|

12.38%

|

4.76%

|

|

S&P 500 Index (reflects no deduction for fees, expenses or taxes)

|

32.39%

|

17.94%

|

7.41%

|

|

Lipper Large Cap Core Index

|

31.82%

|

17.07%

|

6.71%

|

The after-tax returns in the returns table above were calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns are not relevant to investors who hold shares of the Growth Fund through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In certain cases, after-tax returns may be higher than the other return figures for the same period. A higher after-tax return results when a capital loss occurs upon redemption and translates into an assumed tax deduction that benefits the shareholdtyle="margin:0px" align=justify>

MANAGEMENT

North Country Investment Advisers, Inc.

is the Growth Fund’s investment adviser. Manuel S. Orta, CTFA, serves as the Growth Fund’s portfolio manager. Mr. Orta, Vice President and Investment

Department Manager

of Glens Falls National Bank (“GFNB”) and Vice President and Portfolio Manager of the Adviser, has served as the Growth Fund’s portfolio manager since May 1, 2012.

PURCHASE AND SALE OF FUND SHARES

The Growth Fund accepts investments in the following minimum amounts:

|

|

|

|

Type of Account

|

Minimum Initial Investment

|

Minimum Subsequent Investment

|

|

Individual, Sole proprietorship or

Joint accounts

|

$1,000

|

$100

|

|

Corporate, partnership or trust accounts

|

$1,000

|

$100

|

|

Uniform Gift or Transfer to a

Minor Accounts (UGMA, UTMA)

|

$500

|

$100

|

|

Individual Retirement Accounts (IRA)

|

$500

|

$100

|

You may purchase and redeem shares of the Growth Fund on any day that the New York Stock Exchange is open for trading, by mail as indicated below, by telephone (888-350-2990), or through a financial intermediary.

via Regular Mail

via Overnight Mail

The North Country

The North Country Funds

c/o Gemini Fund Services, LLC

c/o Gemini Fund Services, LLC

P.O. Box 541150

17605 Wright Street, Suite 2

Omaha, NE 68154

Omaha, NE 68130

TAX INFORMATION

The Growth Fund intends to distribute net investment income and net realized capital gains, if any, to shareholders. These distributions are generally taxable to you as ordinary income or capital gains, unless you are investing through an IRA, 401(k) plan or other tax-advantaged investment account. If you are investing through a tax-advantaged account, you may be taxed upon withdrawals from that account.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase the Growth Fund through a broker-dealer or other financial intermediary (such as a bank), the Growth Fund and its related companies may pay the intermediary for the sale of Growth Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Growth Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

FUND SUMMARY – North Country Intermediate Bond Fund

INVESTMENT OBJECTIVE

The investment objective of the North Country Intermediate Bond Fund (the “Bond Fund”) is to provide investors with total return based primarily on current income with minimum fluctuation of principal value.

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy and hold shares of the Bond Fund.

|

|

|

|

Bond

Fund

|

|

SHAREHOLDER TRANSACTION EXPENSES

(fees paid directly from your investment):

|

|

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of the offering price)

|

None

|

|

Maximum Deferred Sales Charge (Load)

(as a percentage of the offering price)

|

None

|

|

Maximum Sales Charge (Load) Imposed on Reinvested Dividends and other Distributions

|

None

|

|

Redemption Fee (as a percentage of the amount redeemed,

if applicable)

|

None

|

|

Exchange Fee

|

None

|

|

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment):

|

|

|

Management Fees

|

0.50%

|

|

Distribution (12b-1) Fees

|

None

|

|

Other Expenses

|

0.36%

|

|

Acquired Fund Fees and Expenses

|

0.01%

|

|

Total Annual Operating Expenses

(1)

|

0.87%

|

(1)

Total Annual Fund Operating Expenses may not correlate to the ratios of expenses to average net assets in the Financial Highlights section of this Prospectus. The ratios reflect only the direct operating expenses of the Fund and do not include fees and expenses of any acquired funds.

Example:

This Example is intended to help you compare the cost of investing in the Bond Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Bond Fund for the time periods indicated and then redeem all of your shares at the end of these periods. The Example also assumes that your investment has a 5% rate of return each year and that the Bond Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your cost for the Bond Fund would be:

|

|

|

|

|

1 YEAR

|

3 YEARS

|

5 YEARS

|

10 YEARS

|

|

$89

|

$278

|

$482

|

$1,073

|

Portfolio Turnover:

The Bond Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Bond Fund's performance. During the most recent fiscal year, the Bond Fund’s portfolio turnover rate was

29%

of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Bond Fund will invest at least 80% of its net assets plus borrowings in bonds. The Bond Fund seeks to achieve its investment objective by investing substantially all of its net assets in U.S. dollar denominated investment grade bonds or debt securities. These may include corporate and U.S. government bonds and mortgage-backed securities. Portfolio securities shall be rated within the top four ratings categories by nationally recognized statistical ratings organizations (“NRSROs”) such as Moody's Investors Services, Inc. (“Moody’s”) and Standard & Poor's Financial Services LLC (“S&P”), when purchased. The Bond Fund intends to maintain an investment portfolio with a dollar-weighted average quality of "A" or better and a dollar-weighted average maturity between 1 and 10 years.

The Bond Fund will invest in corporate bonds without regard to industry or sector based on the Adviser's analysis of each target security's structural and repayment features, current pricing and trading opportunities as well as the credit quality of the issuer.

The Adviser may sell an obligation held by the Fund when the reasons for buying or holding it no longer apply. If the rating on an obligation held by the Bond Fund is reduced below the Bond Fund's ratings requirements, the Adviser will sell the obligation only when it is in the best interests of the Bond Fund's shareholders to do so.

PRINCIPAL INVESTMENT RISKS

You could lose money on your investment in the Bond Fund, or the Bond Fund may not perform as well as other possible investments. The net asset value of the Bond Fund's shares will fluctuate based on the value of the securities held in its portfolio. As with any mutual fund, there can be no guarantee that the investment objective of the Bond Fund will be achieved. An investment in the Bond Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

Interest Rate Risk.

Debt securities have varying levels of sensitivity to changes in interest rates. In general, the price of a debt security will fall when interest rates rise and will rise when interest rates fall. Securities with longer maturities and mortgage securities are generally more sensitive to interest rate changes although they usually offer higher yields to compensate investors for the greater risks. The longer the maturity of the security, the greater the impact a change in interest rates generally has on the security's price. In addition, short-term and long-term interest rates do not necessarily move in the same amount or the same direction. Short-term securities tend to react to changes in short-term interest rates and long-term securities tend to react to changes in long-term interest rates.

Credit Risk.

Fixed income securities rated in the fourth classification by Moody's (Baa) and S&P (BBB) may be purchased by the Bond Fund. These securities have speculative characteristics and changes in economic conditions or other circumstances are more likely to lead to a weakened capacity of those issuers to make principal or interest payments, as compared to issuers of more highly rated securities. With respect to U.S.

government securities, which are securities issued by the U.S. government or one of its agencies or instrumentalities, some, but not all, U.S. government securities are guaranteed as to principal and interest and are backed by the full faith and credit of the federal government. Other U.S. government securities are backed by the issuer’s right to borrow from the U.S. Treasury, and some are backed only by the credit of the issuing organization.

Extension Risk.

The Bond Fund is subject to the risk that an issuer will exercise its right to pay principal on an obligation held by the Bond Fund (such as mortgage-backed securities) later than expected. This may happen when there is a rise in interest rates. These events may lengthen the duration (i.e. interest rate sensitivity) and potentially reduce the value of these securities.

Market Risk.

The net asset value of the Bond Fund will fluctuate based on changes in the value of the securities in which the Bond Fund invests. Although equity investments generally have greater price volatility than fixed income investments, under certain market conditions fixed income investments may have comparable or greater price volatility. Market prices of investments held by the Bond Fund can rise or fall rapidly in response to developments affecting a specific company or industry, or to changing economic, political or market conditions. Bond prices in general may decline over short or extended periods of time, lowering the value of the Bond Fund’s investments. The market price of fixed income securities may decline due to changes in interest rates or other factors affecting markets generally. There is also a risk that the Bond Fund's investments will underperform either the securities markets generally or particular segments of the securities markets.

Liquidity Risk.

The Bond Fund may invest in securities that are or become illiquid, and the Bond Fund may not be able to sell such securities at the time and/or the price the Adviser believes would be advantageous.

Issuer Specific Changes.

The value of an individual security can be more volatile, and can perform differently, than the market as a whole. The price of an individual issuer's securities can rise or fall dramatically in response to such things as earnings reports, news about the development of a promising product, or the changing of key management personnel.

Mortgage-backed Securities and Prepayment Risk.

Certain portfolio securities of the Bond Fund, such as mortgage-backed securities, are subject to the risk of unscheduled prepayments resulting from a decline in interest rates. These prepayments may have to be reinvested at a lower rate of return. As a result, these securities may have less potential for capital appreciation during periods of declining interest rates than other securities of comparable maturities, although they may have a similar risk of decline in market value during periods of rising interest rates.

Manager Risk.

Investment in the Bond Fund involves the risk that the Adviser's assessment of the performance or value of a specific security may prove incorrect.

Credit Rating Agency Risk.

Credit ratings are determined by credit rating agencies such as S&P and Moody's. Any shortcomings or inefficiencies in credit rating agencies' processes for determining credit ratings may adversely affect the credit ratings of securities held by the Bond Fund and, as a result, may adversely affect those securities' perceived or actual credit risk.

Investing in Mutual Funds.

All mutual funds carry a certain amount of risk. You may lose money on your investment in the Fund. As all investment securities are subject to inherent market risks and fluctuations in value due to earnings, economic and political conditions and other factors, the Fund cannot give any assurance that its investment objective will be achieved.

Foreign Securities Risk.

Investments in foreign securities face specific risks, which include: reduced availability of information regarding foreign companies, that may be subject to different accounting, auditing and financial standards and to less stringent reporting standards and requirements, reduced liquidity, increased market risk due to regional economic and political instability, and the threat of nationalization and expropriation.

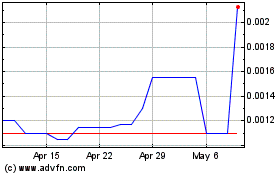

PERFORMANCE

The bar chart and table that follow provide some indication of the risks of investing in the Bond Fund by showing changes in the performance of the Bond Fund from year to year and by showing how the Bond Fund's average annual returns for 1, 5 and 10 years compare with those of a broad measure of market performance. Please remember that the Bond Fund's past performance (before and after taxes) is not an indication of the Fund’s future performance.

Annual Total Return for Years Ended December 31,

![[CHART1002.GIF]](http://content.edgar-online.com/edgar_conv_img/2014/03/24/0000910472-14-001280_CHART1002.GIF)

During the periods shown in the bar chart above, the Bond Fund's best quarterly performance was 4.01% (quarter ended June 30, 2009) and its lowest quarterly performance was -4.63% (quarter ended September 30, 2008). For the fiscal quarter ended February 28,

2014,

the return for the Bond Fund was

0.79%.

AVERAGE ANNUAL TOTAL RETURNS

(FOR THE PERIODS ENDED DECEMBER 31,

2013)

|

|

|

|

|

|

1 YEAR

|

5 YEARS

|

10 YEARS

|

|

Bond Fund

|

|

|

|

|

Return before taxes

|

-1.31%

|

3.68%

|

2.85%

|

|

Return after taxes on distributions

|

-2.23%

|

2.67%

|

1.66%

|

|

Return after taxes on distributions

and sale of Fund shares

|

-0.74%

|

2.47%

|

1.75%

|

|

BofA Merrill Lynch 1-10 Year AAA-A US Corporate & Government Index

(reflects no deduction for fees, expenses or taxes)

|

-1.21%

|

3.24%

|

3.81%

|

|

Lipper

Short-Intermediate Investment Grade Debt Index

|

-0.15%

|

5.22%

|

3.68%

|

The after-tax returns in the returns table above were calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns are not relevant to investors who hold shares of the Bond Fund through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In certain cases, after-tax returns may be higher than the other return figures for the same period. A higher after-tax return results when a capital loss occurs upon redemption and translates into an assumed tax deduction that benefits the shareholder.

MANAGEMENT

North Country Investment Advisers, Inc.

is the Bond Fund’s investment adviser (the “Adviser”). Peter M. Capozzola, CFA,

President of the Adviser, has served as the portfolio manager of the Bond Fund since March 1, 2003.

PURCHASE AND SALE OF FUND SHARES

The Bond Fund accepts investment in the following minimum amounts:

|

|

|

|

Type of Account

|

Minimum Initial Investment

|

Minimum Subsequent Investment

|

|

Individual, Sole proprietorship or

Joint accounts

|

$1,000

|

$100

|

|

Corporate, partnership or trust accounts

|

$1,000

|

$100

|

|

Uniform Gift or Transfer to a

Minor Accounts (UGMA, UTMA)

|

$500

|

$100

|

|

Individual Retirement Accounts (IRA)

|

$500

|

$100

|

You may purchase and redeem shares of the Bond Fund on any day that the New York Stock Exchange is open, by mail as indicated below, by telephone (888-350-2990), or through a financial intermediary.

via Regular Mail

via Overnight Mail

The North Country Funds

The North Country Funds

c/o Gemini Fund Services, LLC

c/o Gemini Fund Services, LLC

P.O. Box 541150

17605 Wright Street, Suite 2

Omaha, NE 68154

Omaha, NE 68130

TAX INFORMATION

The Bond Fund intends to distribute net investment income and net realized capital gains, if any, to shareholders. These distributions are generally taxable to you as ordinary income or capital gains, unless you are investing through an IRA, 401(k) plan or other tax-advantaged investment account. If you are investing through a tax-advantaged account, you may be taxed upon withdrawals from that account.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase the Bond Fund through a broker-dealer or other financial intermediary (such as a bank), the Bond Fund and its related companies may pay the intermediary for the sale of Bond Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Bond Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

ADDITIONAL INFORMATION ABOUT INVESTMENT

STRATEGIES AND RELATED RISKS

The following discussion provides additional information about the investment strategies and risks of each Fund. Each Fund’s investment objective is a fundamental policy and cannot be changed without the approval of a majority of a Fund's outstanding shares.

PRINCIPAL INVESTMENT STRATEGIES

GROWTH FUND

To achieve its investment objective, the Growth Fund invests at least 80% of its net assets in a diversified portfolio of equity securities of U.S. companies with mid to large-sized market capitalizations (generally considered to be in excess of $2 billion) that have demonstrated fundamental investment value and the potential for long-term growth. The Growth Fund is subject to a formal policy that it will invest at least 80% of its net assets plus borrowings in equity securities. This policy will not be changed without 60 days’ notice to shareholders. Equity securities include common stocks of domestic and foreign-domiciled companies, preferred stocks, convertible preferred stocks, and American Depository Receipts (“ADRs”). For liquidity purposes or pending the investment in securities in furtherance of its investment objective, the Fund may invest up to 20% of its net assets in U.S. Government securities, repurchase agreements and high quality short-term debt and money market instruments.

The Adviser selects portfolio securities for investment by the Fund based primarily on its analysis of various factors which influence the issuer's fundamental investment value and prospects for long-term growth. The Adviser determines the investment value of each portfolio security by screening certain financial indicators such as the price-to-earnings ratio, the return on equity, and cash flow using proprietary quantitative techniques. The Adviser also considers the strength or potential strength of a company's competitive position, strength of management, marketing prowess and product development capabilities in order to evaluate a company's growth prospects.

The Growth Fund will not concentrate in any particular industry. The Adviser intends to invest the Growth Fund's portfolio among numerous industries in companies that have consistent operating histories, strong management teams and favorable growth prospects.

The Growth Fund focuses primarily on market sectors such as Materials, Health Care, Utilities, Information Technology, Industrials, Consumer Discretionary, Consumer Staples, Financial Services, Energy and Telecommunications. The Adviser, in its sole discretion, determines which and to what extent each sector is to be represented in the Growth Fund's portfolio and will purchase or sell portfolio securities if it believes that a particular sector should or should not be included in the Growth Fund's investments. However, the extent to which the Adviser invests in any particular sector will be governed, to a large degree, by market conditions.

The Adviser will utilize a buy and hold approach, generally maintaining its position in a company's stock without regard to day-to-day fluctuations in the market. However, the Adviser will frequently re-evaluate portfolio holdings, as it deems necessary, and will typically sell a stock when the reasons for buying or holding it no longer apply, such as a lack of performance, change in business direction, adverse changes in other factors or when the company begins to show deteriorating fundamentals.

The frequency of the Growth Fund's portfolio transactions will vary from year to year. Since the Growth Fund's investment policies emphasize long-term investment in the securities of companies with favorable growth prospects, the Adviser does not anticipate frequent changes in investments and the Growth Fund's portfolio turnover rate is expected to be relatively low.

BOND FUND

The Bond Fund seeks to provide investors with total return based primarily on current income with minimum fluctuation of principal value. The Bond Fund generally invests substantially all of its net assets, without regard to market sector or industry, in U.S. dollar-denominated investment grade bonds or debt securities issued by corporate entities, the U.S. government, or its agencies or instrumentalities and municipalities. These may include certain mortgage-backed securities. The Bond Fund will invest at least 80% of its net assets plus borrowings in bonds. This policy will not be changed without 60 days' notice to shareholders.

The Bond Fund uses the BofA Merrill Lynch 1-10 Year AAA-A U.S. Corporate & Government Index

(1)

(the “Index”) as a general guide in structuring the Bond Fund and selecting its investments with respect to average quality and maturity and manages the Bond Fund to have interest rate and credit risk characteristics that are similar to that of the Index. Portfolio securities are rated within the top four ratings categories by NRSROs such as Moody's and S&P when purchased. The Bond Fund intends to maintain an investment portfolio with a dollar-weighted average quality of "A" or better and a dollar-weighted average maturity between 1 and 10 years. In determining a security's maturity for purposes of calculating the Bond Fund's average maturity, an estimate of the average time for its principal to be paid may be used. This can be substantially shorter than its stated maturity.

In buying and selling portfolio securities for the Bond Fund, the Adviser also considers a security's structural features such as duration, the amount of any premium or discount, repayment or distribution schedules, and callable dates in the context of current market conditions and short-term trading opportunities. The Adviser may sell an obligation held by the Bond Fund when the reasons for buying or holding it no longer apply. However, the Bond Fund may not necessarily dispose of a security when its rating is reduced below its rating at the time of purchase, although the Adviser will consider such reduction in its determination of whether the Bond Fund should continue to hold the security in its portfolio.

___________________________

(1)

The Fund is neither affiliated with nor endorsed by BofA Merrill Lynch.

NON-PRINCIPAL INVESTMENT STRATEGIES

Temporary Defensive Positions.

Each Fund may, from time to time, take temporary defensive positions that are inconsistent with its principal investment strategies in attempting to respond to adverse market, economic, political or other conditions. Such investments include various short-term instruments. If either Fund takes a temporary defensive position at the wrong time, the position would have an adverse impact on that Fund's performance. The Fund may not achieve its investment objective when taking such a position. The Funds reserve the right to invest all of their assets in temporary defensive positions.

Active and Frequent Trading.

Each Fund may trade securities actively, which could increase its transaction costs (thereby lowering its performance) and may increase the amount of taxes that you pay. Frequent and active trading may cause adverse tax consequences for shareholders by increasing the amount of a Fund's realized capital gains, which in turn may result in increased taxable distributions to shareholders, and by increasing the proportion of the Fund’s realized capital gains that are short-term capital gains, which when distributed are generally taxable to shareholders at ordinary income rates.

Illiquid Securities

. Each Fund may invest up to 15% of its respective net assets in illiquid securities. A domestically traded security that is not registered under the Securities Act of 1933 will not be considered illiquid if the Adviser determines that an adequate investment trading market exists for that security. However, there can be no assurance that a liquid market will exist for any security at a particular time.

Securities Lending

. Each Fund may lend its portfolio securities to broker-dealers in amounts equaling no more than 33-1/3% of that Fund's total assets for money management purposes. These transactions will be fully collateralized at all times with cash and/or high quality, short-term debt obligations.

Borrowing

. Each Fund may borrow money from banks for temporary or emergency purposes in order to meet redemption requests. The Funds do not use borrowing as a principal investment strategy. To reduce its indebtedness, a Fund may have to sell a portion of its investments at a time

when it may be disadvantageous to do so. In addition, interest paid by a Fund on borrowed funds would decrease the net earnings of the Fund.

Repurchase Agreements

. Each Fund may enter into repurchase agreements collateralized by the securities in which it may invest. A repurchase agreement involves the purchase by the Fund of securities with the condition that the original seller (a bank or broker-dealer) will buy back the same securities ("collateral") at a predetermined price or yield.

INVESTMENT RISKS

PRINCIPAL INVESTMENT RISKS SPECIFIC TO THE GROWTH FUND AND THE BOND FUND

Investing in Mutual Funds

.

All mutual funds carry a certain amount of risk. You may lose money on your investment in either of the Funds. As all investment securities are subject to inherent market risks and fluctuations in value due to earnings, economic and political conditions and other factors, neither Fund can give any assurance that its investment objective will be achieved.

Issuer Specific Changes

. The value of an individual security can be more volatile, and can perform differently, than the market as a whole. The price of an individual issuer’s securities can rise or fall dramatically in response to such things as earnings reports, news about the development of a promising product, or the changing of key management personnel. Lower-quality debt securities tend to be more sensitive to these changes in the financial condition of an issuer, changes in the specific economic or political conditions that affect a particular type of security or issuer, and changes in general economic or political conditions can affect the credit quality or value of an issuer's securities.

Foreign Securities Risk

.

Each Fund may invest in the securities of foreign domiciled companies through the purchase of ADRs or the purchase of U.S. dollar denominated foreign securities that are traded in U.S. markets. Investments in foreign securities face specific risks, which include: reduced availability of information regarding foreign companies, foreign companies may be subject to different accounting, auditing and financial standards and to less stringent reporting standards and requirements, reduced liquidity as a result of inadequate trading volume, the difficulty in obtaining or enforcing a judgment abroad, increased market risk due to regional economic and political instability, foreign withholding taxes, the threat of nationalization and expropriation and an increased potential for corrupt business practices in certain foreign countries.

Liquidity Risk.

The Funds may invest in securities that are or become illiquid. A Fund may not be able to sell these illiquid investments at the times and/or the prices the Adviser believes to be advantageous. Investments in derivatives, non-U.S. investments, restricted securities, securities having small market capitalizations, and securities having substantial market and/or credit and counterparty risk tend to involve greater liquidity risk. Additionally, the market for certain investments may become illiquid under adverse market or economic conditions independent of any specific adverse changes in the conditions of a particular issuer. In such cases, a Fund, due to limitations on investments in illiquid securities and the difficulty in purchasing and selling such securities or instruments, may decline in value or be unable to achieve its desired level of exposure to a certain issuer or sector.

Market Risk.

The net asset value of

each

Fund will fluctuate based on changes in the value of the securities in which the Fund invests.

Although equity investments generally have greater price volatility than fixed income investments, under certain market conditions fixed income investments may have comparable or greater price volatility. Market prices of investments held by a Fund

can rise or fall rapidly in response to developments affecting a specific company or industry, or to changing economic, political or market conditions. Stock

and/or bond

prices in general may decline over short or extended periods of time, lowering the value of

a

Fund’s investments. Market prices of equity securities in broad market segments may be adversely affected by a prominent issuer having experienced losses or by the lack of earnings, by such an issuer's failure to meet the market's expectations with respect to new products or services, or even by factors wholly unrelated to the value or condition of the issuer, such as changes in interest rates.

The market price of fixed income securities, as well as equity securities and other types of investments, may decline due to changes in interest rates or other factors affecting markets generally.

There is also a risk that

a

Fund's investments will underperform either the securities markets generally or particular segments of the securities markets.

Manager Risk

.

Investment in the

Growth

Fund involves the risk that the Adviser's assessment of the growth potential of specific securities may prove incorrect.

Investment in the Bond Fund involves the risk that the Adviser's assessment of the performance or value of a specific security may prove incorrect.

PRINCIPAL INVESTMENT RISKS SPECIFIC TO THE GROWTH FUND

Growth Investing Risk.

"Growth" stocks can perform differently than the market as a whole and other types of stocks. The prices of growth stocks may increase or decrease significantly in response to unexpected earnings reports or other news about the issuer.

PRINCIPAL INVESTMENT RISKS SPECIFIC TO THE BOND FUND

Interest Rate Risk

.

Debt securities have varying levels of sensitivity to changes in interest rates. In general, the price of a debt security will fall when interest rates rise and will rise when interest rates fall. Securities with longer maturities and mortgage securities are generally more sensitive to interest rate changes although they usually offer higher yields to compensate investors for the greater risks. The longer the maturity of the security, the greater the impact a change in interest rates generally has on the security's price. In addition, short-term and long-term interest rates do not necessarily move in the same amount or the same direction. Short-term securities tend to react to changes in short-term interest rates and long-term securities tend to react to changes in long-term interest rates.

Credit Risk

.

Fixed income securities rated in the fourth classification by Moody's (Baa) and S&P (BBB) may be purchased by the Bond Fund. These securities have speculative characteristics and changes in economic conditions or other circumstances are more likely to lead to a weakened capacity of those issuers to make principal or interest payments, as compared to issuers of more highly rated securities.

With respect to U.S. government securities, which are securities issued by the U.S. government or one of its agencies or instrumentalities, some, but not all, U.S. government securities are guaranteed as to principal and interest and are backed by the full faith and credit of the federal government. Other U.S. government securities are backed by the issuer’s right to borrow from the U.S. Treasury, and some are backed only by the credit of the issuing organization.

Credit Rating Agency Risk.

Credit ratings are determined by credit rating agencies such as S&P, and Moody's. Any shortcomings or inefficiencies in credit rating agencies' processes for determining credit ratings may adversely affect the credit ratings of securities held by the Bond Fund and, as a result, may adversely affect those securities' perceived or actual credit risk. For example, credit ratings evaluate the safety of principal and interest payments, not the market value risk of bonds. Also, credit rating agencies may fail to change credit ratings in a timely manner to reflect subsequent events.

Extension Risk

.

The Bond Fund is subject to the risk that an issuer will exercise its right to pay principal on an obligation held by the Bond Fund (such as mortgage-backed securities) later than expected. This may happen when there is a rise in interest rates. These events may lengthen the duration (i.e. interest rate sensitivity) and potentially reduce the value of these securities.

Mortgage-Backed Securities and Prepayment Risk

.

Certain types of debt securities, such as mortgage-backed securities, have yield and maturity characteristics corresponding to underlying assets. Unlike traditional debt securities, which may pay a fixed rate of interest until maturity when the entire principal amount comes due, payments on certain mortgage-backed securities may include both interest and a partial payment of principal. Besides the scheduled repayment of principal, payments of principal may result from the voluntary prepayment, refinancing, or foreclosure of the underlying mortgage loans.

Securities subject to prepayment are less effective than other types of securities as a means of "locking in" attractive long-term interest rates. One reason is the need to reinvest prepayments of principal; another is the possibility of significant unscheduled prepayments resulting from declines in interest rates. These prepayments may have to be reinvested at lower rates. As a result, these securities may have less potential for capital appreciation during periods of declining interest rates than other securities of comparable maturities, although they may have a similar risk of decline in market value during periods of rising interest rates. Prepayments may also significantly shorten the effective maturities of these securities, especially during periods of declining interest rates. Conversely, during periods of rising interest rates, a reduction in prepayments may increase the effective maturities of these securities, subjecting them to a greater risk of decline in market value in response to rising interest rates than traditional debt securities, and, therefore, potentially increasing the volatility of the Bond Fund.

At times, some of the mortgage-backed securities in which the Bond Fund may invest will have higher than market interest rates and therefore will be purchased at a premium above their par value. Prepayments may cause losses in securities purchased at a premium, as unscheduled prepayments, which are made at par, will cause the Bond Fund to experience a loss equal to any unamortized premium.

In addition, the value of mortgage-backed securities will be influenced by the factors affecting the housing market and the mortgages underlying such securities. As a result, during periods of difficult or frozen credit markets, swings in interest rates, or deteriorating economic conditions, mortgage-backed securities may decline in value, face valuation difficulties, become more volatile and/or become illiquid.

NON-PRINCIPAL INVESTMENT RISKS SPECIFIC TO THE GROWTH FUND AND BOND FUND

Securities Lending Risk.

Securities lending transactions involve risk to a Fund if the other party should default on its obligation and the Fund is delayed or prevented from recovering the securities lent. In the event the original borrower defaults on its obligation to return lent securities, the Fund will seek to sell the collateral, which could involve costs or delays. To the extent proceeds from the sale of collateral are less than the repurchase price, a Fund would suffer a loss and you could lose money on your investment.

Borrowing Ris

k

. If a Fund borrows money, the Fund may have to sell a portion of its investments at a time

when it may be disadvantageous to do so in order to reduce its indebtedness. In addition, interest paid by a Fund on borrowed funds would decrease the net earnings of the Fund.

Repurchase Agreement Risk

.

Repurchase agreements involve certain risks not associated with direct investments in securities. In the event the original seller defaults on its obligation to repurchase, the Fund will seek to sell the collateral, which could involve costs or delays. To the extent proceeds from the sale of collateral are less than the repurchase price, the Fund would suffer a loss.

PORTFOLIO HOLDINGS.

The Funds’ policies and procedures with respect to the disclosure of the Funds’ portfolio securities holdings are available in the Statement of Additional Information, which may be requested free of charge by calling (888) 350-2990.

MANAGEMENT

The business of the Funds is managed under the direction of the Board of Trustees (the "Board") of the Trust. The Board formulates the general policies of each Fund and meets periodically to review each Fund's performance, monitor investment activities and practices, and discuss other matters affecting the Funds.

THE ADVISER

The Adviser has been retained under an Investment Advisory Agreement with The North Country Funds (the “Trust”), on behalf of each Fund, to serve as the investment adviser to each Fund, subject to the authority of the Board. The Adviser is registered as an investment adviser with the SEC. The Adviser's principal office is located at 250 Glen Street, Glens Falls, New York 12801.

The Adviser is a wholly-owned subsidiary of Glens Falls National Bank & Trust Company ("GFNB"), the adviser to the GFNB Special Equity Fund #1 and GFNB Special Fixed Income Fund #1 ("Predecessor Funds"), the collective investment trusts sponsored by GFNB that were converted into the Growth Fund and Bond Fund, respectively. Founded in 1851, GFNB is a nationally-chartered commercial bank headquartered in Glens Falls, New York, which provides a wide variety of banking and advisory services to private clients

and retirement plans. As of December 31,

2013,

GFNB provides personal, corporate and institutional banking, investment management and custodial services for accounts having an aggregate market value in excess of $

982

million under active management through its Trust and Investment Division.

Under the terms of the Investment Advisory Agreement between the Trust and the Adviser, the Adviser conducts investment research and management for each Fund and is responsible for the purchase and sale of securities for each Fund's portfolio. The Adviser provides each Fund with investment advice, supervises each Fund's management and investment programs and provides investment advisory facilities and executive and supervisory personnel for managing the investments and effectuating portfolio transactions. The Adviser also furnishes, at its own expense, all necessary administrative services, office space, equipment and clerical personnel for servicing the investments of each Fund. In addition, the Adviser pays the salaries and fees of all officers of the Trust who are affiliated with the Adviser.

A discussion regarding the basis for the Board’s approval of the Investment Advisory Agreement of the Funds is available in the Funds’ most recent semi-annual report to shareholders for the period ended May 31.

PORTFOLIO MANAGERS

Manuel (“Mickey”) S. Orta,

the portfolio manager of the Growth Fund since May 1, 2012, is primarily responsible for the management and day-to-day implementation of the Growth Fund's investment strategies. Mr. Orta, Vice President and Portfolio Manager of the Adviser, is also Vice President and Investment Department Manager of GFNB. He serves on the Investment Policy Committee of both GFNB and the Adviser.

Mr. Orta has 15 years of banking and portfolio management experience. He joined the Investment Department of GFNB in 2006 where he serves as a portfolio manager in the Investment Department for individual and corporate retirement plans, personal trust, investment management accounts, foundations and not-for-profit relationships. Mr. Orta holds a Bachelor's degree in Economics and Finance from Plattsburgh State University and has earned the Certified Trust & Financial Advisor (CTFA) designation from the Institute of Certified Bankers. Mr. Orta has also earned a degree in Portfolio Management through the New York Institute of Finance.

Peter M. Capozzola, CFA

is President of the Adviser and is the portfolio manager of the Bond Fund. Mr. Capozzola has been employed as a Portfolio Manager with GFNB since August 2002, and is a Vice President and Investment Officer of GFNB, managing investments for individuals, trusts, endowments, foundations and pension plans. Since March 1, 2003, Mr. Capozzola has been primarily responsible for the management and day-to-day implementation of the Bond Fund's investment strategies. He serves on the Investment Policy Committee of both GFNB and the Adviser.

Prior to joining GFNB, Mr. Capozzola served as the Compliance Officer and Comptroller at another trust company. Mr. Capozzola received a Bachelor of Arts degree in Business Economics from the State University of New York at Oneonta and earned an MBA in Investment and Portfolio Management from the Lubin Graduate School of Pace University in New York City. Mr. Capozzola also holds the Chartered Financial Analyst (CFA) designation awarded by the CFA Institute.

ADVISORY FEE

In consideration for the services rendered by the Adviser, the Funds paid the Adviser as follows:

Percentage of average daily net

assets for the fiscal year ended

11/30/13

Growth Fund……………………

0.75%

Bond Fund………………………

0.50%

The Statement of Additional Information provides information about the portfolio managers’ compensation, other accounts managed by each portfolio manager, and each portfolio manager’s ownership of shares in each Fund he manages.

ADMINISTRATOR and TRANSFER AGENT

The Funds’ administrator and transfer agent is Gemini Fund Services, LLC ("GFS" or the "Administrator" or "Transfer Agent"), which has its principal office at 80 Arkay Drive, Suite 110, Hauppauge, New York 11788. GFS is primarily in the business of providing administrative, fund accounting and transfer agency services to retail and institutional mutual funds.

GFS provides administrative, executive and regulatory services to each Fund. It supervises the preparation of each Fund's tax returns and coordinates the preparation of reports to and filings with the SEC and various state securities authorities, subject to the supervision of the Trust’s Board of Trustees. GFS's transfer agency service is located at 17605 Wright Street, Suite 2, Omaha, NE 68130.

DISTRIBUTOR

Northern Lights Distributors, LLC ("the Distributor"), an affiliate of GFS, has entered into a distribution agreement with the Trust to serve as the principal underwriter for each Fund and the distributor for each Fund's shares. The Distributor is located at 17605 Wright Street, Omaha, NE 68130.

YOUR ACCOUNT

TYPES OF ACCOUNTS

If you are making an initial investment in a Fund, you will need to open an account. You may establish the following types of accounts:

Individual, Sole Proprietorship and Joint Accounts

. Individual and sole proprietorship accounts are owned by one person; joint accounts can have two or more owners. All owners of the joint account must sign written instructions to purchase or redeem shares or to change account information exactly as their names appear on the account. If you elect telephone privileges, however, redemption requests by telephone may be made by any one of the joint account owners.

Uniform Gift or Transfer to Minor Accounts (UGMA, UTMA)

. Depending on the laws of your state, you can set up a custodial account under the Uniform Gift (or Transfers) to Minors Act.

These custodial accounts provide a way to give money to a child and obtain tax benefits. To open a UGMA or UTMA account, you must include the minor's social security number on the application and the custodian, or trustee, of the UGMA or UTMA must sign instructions in a manner indicating trustee capacity.

Corporate and Partnership Accounts

. To open a corporate or partnership account, or to send instructions to the Fund, the following documents are required:

·

For corporations, a corporate resolution signed by an authorized person with a signature guarantee.

·

For partnerships, a certification for a partnership agreement, or the pages from the partnership agreement that identify the general partners.

·

An authorized officer of the corporation or other legal entity must sign the application.

Trust Accounts

. The trust must be established before you can open a trust account. To open the account you must include the name of each trustee, the name of the trust and provide a certification of trust, or the pages from the trust document that identify the trustee(s).

Retirement Accounts

. Each Fund offers IRA accounts, including traditional IRA, Roth IRA, Rollover IRA, Education IRA, SIMPLE IRA, SEP IRA and Keogh accounts. Fund shares may also be an appropriate investment for other retirement plans. Before investing in any IRA or other retirement plan, you should consult your tax advisor. Whenever making an investment in an IRA, be sure to indicate the year for which the contribution is made.

HOW TO OPEN AN ACCOUNT AND PURCHASE SHARES

Once you have chosen the type of account and the Funds in which you wish to invest, you are ready to establish an account.

Anti-Money Laundering and Customer Identification Programs

To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. When completing a new account application form, we will ask for your name, address, date of birth, social security number/Tax ID number and other information that will allow us to identify you. We may also ask to see other identifying documents. Until you provide the information or documents we need, we may not be able to open an account or effect any additional transactions for you.

When opening an account for a foreign business, enterprise or a non-U.S. person that does not have an identification number, we require alternative government-issued documentation certifying the existence of the person, business or enterprise.

General Information

The Funds do not issue share certificates. You will receive quarterly statements and a confirmation of each transaction. You should verify the accuracy of all transactions in your account as soon as you receive your confirmation.

During unusual market conditions, a Fund may temporarily suspend or discontinue any service or privilege.

Each Fund reserves the right, in its sole discretion, to reject any application to purchase shares. Applications will not be accepted unless they are accompanied by a check drawn on a U.S. bank, thrift institution, or credit union in U.S. funds for the full amount of the shares to be purchased. After you open an account, you may purchase additional shares by sending a check together with written instructions stating the name(s) on the account and the account number (see mailing addresses below). Make all checks payable to the Fund. The Fund will not accept payment in cash, including cashier's checks or money orders. Also, to prevent check fraud, the Fund will not accept third party checks, U.S. Treasury checks, credit card checks or starter checks for the purchase of shares.

Note: Gemini Fund Services, LLC, the Fund's transfer agent, will charge a $25 fee against a shareholder's account, in addition to any loss sustained by the Fund, for any check returned to the transfer agent for insufficient funds.

Minimum Initial Purchases:

Each Fund accepts investments in the following minimum amounts:

|

|

|

|

Type of Account

|

Minimum Initial Investment

|

Minimum Subsequent Investment

|

|

Individual, Sole proprietorship or

Joint accounts

|

$1,000

|

$100

|

|

Corporate, partnership or trust accounts

|

$1,000

|

$100

|

|

Uniform Gift or Transfer to a

Minor Accounts (UGMA, UTMA)

|

$500

|

$100

|

|

Individual Retirement Accounts (IRA)

|

$500

|

$100

|

The Trust or Adviser may waive or lower these minimums in certain cases.

You must complete and sign an application for each type of account you open with each Fund.

Method of Purchase

By Mail

You may open an account by mailing a completed and signed account application, together with a check, to:

via Regular Mail

via Overnight Mail

The North Country Funds

The North Country Funds

c/o Gemini Fund Services, LLC

c/o Gemini Fund Services, LLC

P.O. Box 541150

17605 Wright Street, Suite 2

Omaha, NE 68154

Omaha, NE 68130

By Telephone

Once an account has been established, you may purchase additional shares by telephone, by calling (888) 350-2990.

By Wire

After you have obtained an account number, you may purchase shares of a Fund by wiring federal funds. Please call the Fund at (888) 350-2990 to receive wiring instructions and to notify the Fund that a wire transfer is coming. Any commercial bank can transfer same-day funds by wire. The Fund will normally accept wired funds for investment on the day of receipt provided that such funds are received by the Fund’s designated bank before the close of regular trading on the NYSE. Your bank may charge you a fee for wiring same-day funds.

Automatic Investment Plans

You may invest a specified amount of money in a Fund once or twice a month or once quarterly on specified dates. These payments are taken from your bank account by automated clearinghouse ("ACH") payment.

To open an Automatic Investment Plan account, call or write to us to request an "Automatic Investment" form. Complete and sign the form, and return it to us along with a voided check for the bank account from which payments will be made.

Transactions Through Third Parties

If you invest through a broker or other financial institution, the policies and fees charged by that institution may be different than those of the Funds. Banks, brokers, retirement plans and financial advisors may charge transaction fees and may set different minimum investments or limitations on buying or selling shares. Consult a representative of your financial institution or retirement plan for further information.

How to Pay for Your Purchase of Shares

You may purchase shares of a Fund by check, ACH, or wire. All payments must be in U.S. dollars.

Checks

. All checks must be drawn on U.S. banks and made payable to "North Country Funds". No other method of check payment is acceptable (for instance, you may not pay by traveler’s check).

ACH Payments

. Instruct your financial institution to make an ACH payment to us. These payments typically take two days. Your financial institution may charge you a fee for this service.

Wires

. Call the Fund at (888) 350-2990 to receive wiring instructions and to notify the Fund that a wire transfer is coming. Your financial institution may charge you a fee for this service.

Limitations on Purchases

The Trust reserves the right to refuse any purchase request, particularly requests that could adversely affect a Fund or its operations. This includes those from any individual or group who, in the Trust's view, is likely to engage in excessive trading. Trading is generally considered excessive if a substantive exchange or redemption occurs within 30 days of the purchase of Fund shares. Please see the Trust’s policy on frequent purchases and redemptions of Fund shares in the Section entitled How to Sell (Redeem) Shares.

Canceled or Failed Payments

The Trust accepts checks and ACH transfers at full value subject to collection. If your payment for shares is not received or you pay with a check or ACH transfer that does not clear, your purchase will be canceled. You will be responsible for any losses or expenses incurred by the Fund whose shares you are purchasing or the Transfer Agent and the Fund may redeem other shares you own in the account as reimbursement. If you purchase your shares by check, the Fund may delay sending the proceeds from your redemption request until your check has cleared. This could take up to 15 calendar days from the purchase date. Each Fund and its agents have the right to reject or cancel any purchase or exchange due to nonpayment. If we cancel your purchase due to non-payment, you will be responsible for any loss the relevant Fund incurs. We will not accept cash or third-party checks for the purchase of shares.

HOW TO SELL (REDEEM) SHARES

You have the right to sell ("redeem") all or any part of your shares subject to certain restrictions. Shares may be purchased by electronic bank transfer, by check, or by wire. You may receive redemption proceeds by electronic bank transfer or by check. Selling your shares in a Fund is referred to as a "redemption" because the Fund buys back its shares. We will redeem your shares at the net asset value next computed following receipt of your completed redemption request as described below. See "Redemption Procedures" below. In an effort to mitigate the risk of identity theft, the Funds will not permit redemption proceeds to be paid to someone other than the registered owner of the account.

We will mail your redemption proceeds to your current address or transmit them electronically to your designated bank account. We will generally send your redemption to you within seven days after we receive your redemption request. During unusual market conditions, a Fund may suspend redemptions or postpone the payment of redemption proceeds, to the extent permitted under the Federal securities laws. If you purchase your shares by check, a Fund may delay sending the proceeds from your redemption request until your check has cleared. This could take up to 15 calendar days from the date of purchase.

Neither Fund can accept requests that specify a certain date for redemption or which specify any other special conditions. Please call (888) 350-2990 for further information. We will not process your mailed redemption request if it is not in proper form ("Redemption Procedures"). However, we will notify you if your redemption request is not in proper form.

Redemption Procedures

By Mail

To redeem shares by mail, prepare a written request in proper form which must include:

·

Your name(s) and signature(s);

·

The name of the Fund, and your account number;

·

The dollar amount or number of shares you want to redeem;

·

How and where to send your proceeds;

·

A Medallion Signature Guarantee, if required (see "Signature Guarantee Requirements" below); and

·

Any other legal documents required for redemption requests by corporations, partnerships or trusts.

Mail your request and documentation to:

via Regular Mail

via Overnight Mail

The North Country Funds

The North Country Funds

c/o Gemini Fund Services, LLC

c/o Gemini Fund Services, LLC

P.O. Box 541150

17605 Wright Street, Suite 2

Omaha, NE 68154

Omaha, NE 68130

By Wire

You may only request payment of your redemption proceeds by wire if you have previously elected wire redemption privileges on your account application or a separate form. A $15 fee will be charged to send the redemption proceeds by wire.

Wire requests are only available if your redemption is for $10,000 or more.

To request a wire redemption, mail or call us with your request (See "By Mail"). If you wish to make your wire request by telephone, however, you must have previously elected telephone redemption privileges.

By Telephone

We accept redemption requests by telephone only if you have elected telephone redemption privileges on your account application or a separate form.

To redeem shares by telephone, call us with your request. You will need to provide your account number and the exact name(s) in which the account is registered. We may also require a password or additional forms of identification.

Your proceeds will be mailed to you or wired to you (if you have elected wire redemption privileges - See "By Wire" above)

Telephone redemptions are easy and convenient, but this account option involves a risk of loss from unauthorized or fraudulent transactions. We will take reasonable precautions to protect your account from fraud. You should do the same by keeping your account information private and by reviewing immediately any account statement and transaction confirmations that you receive. Neither the Funds nor the Transfer Agent will be responsible for any losses due to telephone fraud, so long as we have taken reasonable steps to verify the caller's identity.

Automatic Redemption

If you own shares of a Fund with an aggregated value of at least $10,000, you may request a specified amount of money from your account once a month or once a quarter on a specified date. These payments are sent from your account to a designated bank account in your name by ACH payment. Automatic requests must be for at least $100.

To set up periodic redemptions automatically, call or write us for an "Automatic Redemption" form. You should complete the form and mail it to us with a voided check for the account into which you would like the redemption proceeds deposited.

Medallion Signature Guarantee Requirements

To protect you and the Trust against fraud, signatures on certain requests must have a "Medallion Signature Guarantee." A Medallion Signature Guarantee verifies the authenticity of your signature. You can obtain one from most banking institutions or securities brokers, but NOT from a notary public.

For requests made in writing a Medallion Signature Guarantee is required for any of the following:

·

Redemption of over $50,000 worth of shares;

·

Changes to a record name or address of an account;

·

Redemption from an account for which the address or account registration has changed within the last 30 days;

·

Sending proceeds to any address, brokerage firm or bank account that is in your name, but not in our records;

·

Changes to automatic investment or redemption programs, distribution options, telephone or wire redemption privileges or any other election in connection with your account.

Small Accounts

If the value of your account falls below $500 ($250 for UGMA and IRA accounts), a Fund may ask you to increase your balance. If the account value is still below $500 after 30 days, the Fund may close your account and send you the proceeds. The Funds will not close your account if it falls below $500 solely as a result of a reduction in your account's market value.

Redemption in Kind