0001530746

false

0001530746

2023-10-18

2023-10-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of The Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): October

18, 2023

| Kaya Holdings, Inc. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

333-177532 |

|

90-0898007 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

916 Middle River Drive, Suite 316,

Fort Lauderdale, FL |

|

|

33304 |

|

| (Address of principal executive offices) |

|

|

(Zip Code) |

|

| Registrant’s telephone number including area code: (954) 892-6911 |

| (Former name or former address if changed since last report.) |

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of Company under any of the following

provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b))

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| None |

|

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

As used in this Current

Report on Form 8-K (the “Report ”), the terms “KAYS,” the “Company,” “we

,” “us” and “our” refer to Kaya Holdings, Inc. and its owned and controlled subsidiaries,

unless the context indicates otherwise.

Item 8.01 Other Events.

On October 18, 2023, the Company issued

a press release announcing that it had closed an additional round of non-dilutive financing targeted to complete its

planned Portland, Oregon psilocybin treatment center, The Sacred Mushroom™.

A copy of the press release is included

as Exhibit 99.1 to this Report.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

| Dated: October 23, 2023 |

KAYA HOLDINGS, INC. |

| |

|

|

| |

By: |

/s/ Craig Frank |

| |

|

Craig Frank,

Chief Executive Officer |

Exhibit 99.1

Kaya Holdings (OTCQB:KAYS) Closes Additional Round

of Non-Dilutive Bridge Financing Targeted to Complete The Sacred Mushroom™ Psilocybin Treatment Center

KAYS’ Oregon Based Psilocybin Treatment Center

is on track to be the first of its kind operated by a U.S. Public Company

FT. LAUDERDALE, FL /October 18, 2023 / Kaya

Holdings, Inc., ("KAYS" or the "Company") (OTCQB:KAYS) announced today that

it has closed an additional round of bridge financing targeted to complete KAYS’ planned psilocybin treatment center in Portland,

Oregon. The facility will operate under the name “The Sacred Mushroom™.

Total funds

received from our bridge financing since the first installment was received in June 2023, are $600,000, with no commissions or fees associated

with the financing. The funds are not convertible into KAYS stock. $100K of the funds are in the form of short-term financing with repayment

due March 15, 2023, and $500K is due to be repaid from 10% of KAYS’ revenues quarterly, with any unpaid balance due June 30, 2025.

View from The Sacred Mushroom™ - Mount Hood

can be seen

above the Portland, Oregon skyline from our 7th

floor facility.

We believe that

KAYS is presently the only U.S. public company engaged in securing an Oregon Health Authority (“OHA”) license to open a psilocybin

treatment center, aiming to create a setting that is unmatched by any other facility and providing access to relief from treatment resistant

mental health conditions, including depression, anxiety, additions, and eating disorders.

Approximately every 40 seconds someone in the world

commits suicide.

Psilocybin may soon be available as a mainstream

medical treatment for treatment resistant depression (TRD) and other mental health diseases, potentially providing a new lease on life

for millions worldwide for whom current medications

do not work.

Our Treatment Model

A recently published report on psilocybin treatment

prices in Oregon showed that Initial prices for one facility range from $300 for a group micro dose session to $3,500 for an individual

high-dose session, with another facility pricing first-time full dose treatments at $15,000 (these prices do not include the cost of the

psilocybin, which can run from $300 to $500).

KAYS expects its planned model facility to offer a

superior setting, broader activity and treatment options, integrated cultivation and processing, and accessible pricing, thereby enabling

us to deliver a superior treatment experience at a much lower price than the competition, while still achieving profitability.

The Sacred Mushroom™ has approximately 11,000

sq ft. and will provide visitors with access to our microdosing café, private treatment rooms and group session areas, and activity

zones with yoga, listening stations, journaling chairs, and art expression for distinctive, effective, and positive psilocybin treatments.

Timeline

KAYS expects to complete its initial license application

within the next 30 days, and subject to OHA approval, intends to bring the facility online within 90 days. KAYS plans to operate The Sacred

Mushroom™ as part of its Fifth Dimension Therapeutics, Inc. subsidiary (“FDT”), which also plans to work cooperatively

with select pharmaceutical companies to maximize the curative potential of psilocybin.

KAYS SHAREHOLDERS AND OTHER INTERESTED PARTIES

- PLEASE UPDATE YOUR CONTACT INFORMATION

We routinely receive calls and emails from shareholders

asking us questions about KAYS, so we are asking all KAYS shareholders to email us and confirm their contact info. Please email info@kayaholdings.com with

"KAYS shareholder update" in the subject line and include your name, address, phone number and number of shares you own so that

we may make sure you receive all updates and can respond to any shareholder inquiries. If you would like to speak to someone at the Company,

please call ore text 954-480-3960 and someone will get right back to you.

About Kaya Holdings, Inc. (www.kayaholdings.com)

Kaya Holdings, Inc is a “mind care” company

with operations in medical/recreational cannabis and pending operations in the emerging psilocybin sector. KAYS is a fully reporting,

US-based publicly traded company, listed for trading on the over-the-counter market under the symbol KAYS.

In 2014 KAYS became the first US public company to

own and operate a medical cannabis dispensary (in Portland, Oregon). The Company still operates the original Kaya Shack™ cannabis

dispensary while seeking to shift our cannabis operations to serve the European Union. KAYS has interests in three medical cannabis licenses

(2 in Greece, 1 in Israel) to advance this effort.

Resuming its role as innovator and trend setter, the

Company is again breaking ground in the United States with the planned introduction of psilocybin treatment centers through our majority

owned subsidiary, Fifth Dimension Therapeutics, Inc. (“FDT”).

KAYS subsidiaries include:

Fifth Dimension Therapeutics, Inc.

serves as the Company's operating branch in the psychedelic treatment sector, including operation of mushroom cultivation facilities and

The Scared Mushroom™ treatment centers.

Marijuana Holdings Americas, Inc.

owns the Kaya Shack™ brand of licensed medical and recreational marijuana stores (www.kayashack.com) and the Kaya Farms™ brand

of cannabis production and processing operations in the United States.

Kaya Brands International, Inc.,

serves as the vehicle for the Company's non-U.S. operations including cultivation activities under development in Greece and Israel.

Kaya Brands USA, Inc.

owns a wide range of proprietary brands of cannabis extracts, oils, pre-rolls, topicals, edibles and beverages, cannaceuticals and related

accessories.

Important Disclosure

KAYS is planning execution of its stated business

objectives in accordance with current understanding of state and local laws and federal enforcement policies and priorities as it relates

to psychedelics and cannabis. Potential investors and shareholders are cautioned that KAYS and subsidiaries including FDT will obtain

advice of counsel prior to actualizing any portion of their business plan (including but not limited to license applications for the cultivation,

distribution or sale of marijuana and psychedelic products, engaging in said activities or acquiring existing production/sales operations).

Advice of counsel with regard to specific activities of KAYS, federal, state or local legal action or changes in federal government policy

and/or state and local laws may adversely affect business operations and shareholder value. Additionally, the launch of The Sacred Mushroom™

Psilocybin Treatment Center is dependent, among other matters, on final Oregon Health Authority (“OHA”) licensing and receipt

of final financing from our investors.

Forward-Looking Statements

This press release includes statements that may constitute

"forward-looking" statements, usually containing the words "believe," "estimate," "project," "expect"

or similar statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking

statements inherently involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements.

Factors that would cause or contribute to such differences include, but are not limited to, acceptance of the Company's current and future

products and services in the marketplace, the ability of the Company to develop effective new products and receive regulatory approvals

of such products, competitive factors, dependence upon third-party vendors, and other risks detailed in the Company's periodic report

filings with the Securities and Exchange Commission. By making these forward-looking statements, the Company undertakes no obligation

to update these statements for revisions or changes after the date of this release.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

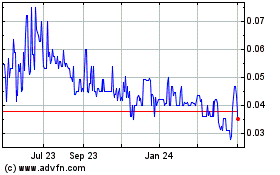

Kaya (QB) (USOTC:KAYS)

Historical Stock Chart

From Dec 2024 to Jan 2025

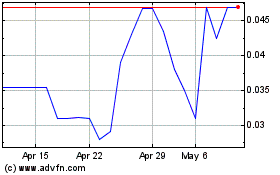

Kaya (QB) (USOTC:KAYS)

Historical Stock Chart

From Jan 2024 to Jan 2025