Current Report Filing (8-k)

March 13 2023 - 8:33AM

Edgar (US Regulatory)

0001530746

false

0001530746

2023-02-28

2023-02-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of The Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): February

28, 2023

| Kaya Holdings, Inc. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

333-177532 |

|

90-0898007 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

916 Middle River Drive, Suite 316,

Fort Lauderdale, FL |

|

|

33304 |

|

| (Address of principal executive offices) |

|

|

(Zip Code) |

|

| Registrant’s telephone number including area code: (954) 892-6911 |

| (Former name or former address if changed since last report.) |

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of Company under any of the following

provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b))

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| None |

|

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 2.01 | Completion of Acquisition or Disposition of Assets |

As previously reported in our Quarterly Report on

Form 10-Q for the quarter ended September 30, 2023, the Company entered into an agreement (the “CVC Agreement”) with

CVC International, Inc. (“CVC”), an institutional investor who holds certain of the Company’s Convertible Promissory

Notes (the “Notes”), one of which was secured by a $500,000 mortgage on the property the Company owned in Lebanon,

Oregon, which the Company intended to develop as a cannabis grow and production facility (the “Property”).

Pursuant to the CVC Agreement, CVC released its $500,000

mortgage lien on the Property, to enable the Company to sell the Property and utilize the proceeds therefrom for the benefit of the Company

and its shareholders, without having to repay CVC the $500,000 Note held by CVC.

Additionally, CVC agreed to advance certain sums against

the sale of the Property (“Advances”), which included $150,000 advanced at the time the CVC Agreement was entered into

and an $120,000 which was advanced to the Company on November 10, 2022. The advances bear interest at the rate of 10% per annum and are

convertible into shares of our common stock at $0.08 per share, subject to market adjustment.

On February 28, 2023 we sold the Property for a price

of $769,500, less commissions and customary closing costs. The net proceeds of the sale were used to repay the advances and an additional

short-term loan of $100,000 (plus interest due of $5,000). After such repayments, the Company realized net proceeds of approximately $302,000,000.

Additionally, the Company has entered into an asset

purchase agreement for the sale of its Salem Retail Cannabis Store (“Store 2”) for $210,000.00, less a 6% closing commission

and minor closing expenses. The purchase price has been deposited in escrow, with a closing anticipated to occur prior to the end of March

2023, subject to the receipt of approval from the Oregon Liquor Control and Cannabis Commission.

The Company intends to utilize the net proceeds of

approximately $500,000 from both the sale of the Property and Store 2, for general working capital including the resolution of its three

non-performing store leases in South Oregon, the development of its planned Oregon Psilocybin business and planned Florida hybrid Ketamine

Clinic and Telehealth business, as well as for the enhancement of its Portland Kaya Shack Retail Cannabis store to create a streamlined

model designed to facilitate franchising efforts and development of its international projects.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

| Dated: March 13, 2023 |

KAYA HOLDINGS, INC. |

| |

|

|

| |

By: |

/s/ Craig Frank |

| |

|

Craig Frank,

Chief Executive Officer |

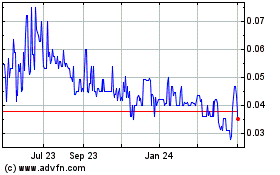

Kaya (QB) (USOTC:KAYS)

Historical Stock Chart

From Dec 2024 to Jan 2025

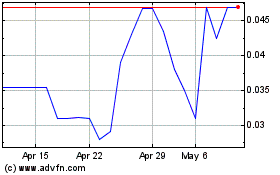

Kaya (QB) (USOTC:KAYS)

Historical Stock Chart

From Jan 2024 to Jan 2025