false

0001527702

0001527702

2025-01-31

2025-01-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): January

31, 2025

iQSTEL Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55984 |

45-2808620 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| |

|

|

300 Aragon Avenue, Suite 375

Coral Gables, FL 33134 |

33134 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (954) 951-8191

|

________________________________________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| |

[ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

|

| |

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

SECTION 5 – Corporate Governance and Management

Item 5.07 Submission of Matters to a Vote of Security Holders.

On January 31, 2025, we held our 2024 Annual Meeting

of the shareholders, at which the shareholders voted on the matters disclosed in our definitive Proxy Statement on Schedule 14A filed

with the Securities and Exchange Commission on December 27, 2024. The final voting results for the matters submitted to a vote of the

shareholders were as follows:

Proposal No. 1 - Election of Directors

Our shareholders elected the persons listed below

for a one-year term expiring at our 2025 Annual Meeting or until their respective successors are duly elected and qualified:

| |

FOR | |

AGAINST | |

ABSTAIN |

| Leandro Jose Iglesias |

| 240,535,472 | | |

| 0 | | |

| 1,775,405 | |

| Alvaro Quintana Cardona |

| 240,543,441 | | |

| 0 | | |

| 1,767,436 | |

| Italo Segnini |

| 237,857,350 | | |

| 0 | | |

| 4,453,527 | |

| Jose Antonio Barreto |

| 237,853,805 | | |

| 0 | | |

| 4,457,072 | |

| Raul Perez |

| 237,829,978 | | |

| 0 | | |

| 4,480,899 | |

Proposal No. 2 – Ratification of Independent Registered Public

Accounting Firm

Our shareholders ratified the appointment of Urish Popeck & Co., LLC

as the Company’s independent registered public accounting firm for fiscal 2024.

| FOR | |

AGAINST | |

ABSTAIN |

| | 310,159,915 | | |

| 661,341 | | |

| 2,521,111 | |

We have received votes amounting to over 51% of the shareholders and sufficient

to pass both proposals.

SECTION 8 - Other Events

Item 8.01 Other Events

At the annual meeting, we used a slideshow presentation. A copy of the

presentation is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Item 8.01 of this Current Report

on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in

such a filing.

SECTION 9 Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

iQSTEL Inc.

/s/ Leandro Iglesias

Leandro Iglesias

Chief Executive Officer

Date February 4, 2025

January 31 st , 2025 at 10:00 a.m. (EST) Shareholders Dz Meeting

This presentation has been prepared by iQSTEL Inc . (“we,” “us,” “our,” “iQSTEL” or the “Company”) . This presentation does not constitute an offer of any securities for sale . Any securities offered privately will not be or have not been registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements, nor shall there be any offer or sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction . The information set forth herein does not purport to be complete or to contain all of the information you may desire . Statements contained herein are made as of the date of this presentation unless stated otherwise, and neither this presentation, nor any sale of securities, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date or that information will be updated or revised to reflect information that subsequently becomes available or changes occurring after the date hereof . This presentation contains forward - looking statements . These forward - looking statements should not be used to make an investment decision . The words ‘believe,’ ‘expect,’ ‘may,’ ‘strategy,’ ‘future,’ ‘likely,’ ‘goal,’ ‘plan,’ 'estimate,' 'possible' and 'seeking' and similar expressions identify forward - looking statements, which speak only as to the date the statement was made . All statements other than statements of historical facts included in this presentation regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward - looking statements . Examples of forward - looking statements include, among others, statements we make regarding our recent acquisitions and joint venture projects, the plans and objectives of management for future operations, including plans relating to the development of new products or services, and our future financial performance . Forward - looking statements are neither historical facts nor assurances of future performance . Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions . Because forward - looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control . Our actual results and financial condition may differ materially from those indicated in the forward - looking statements . Therefore, you should not rely on any of these forward - looking statements . Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward - looking statements include, among others, competition within the industries in which we operate, the timing, cost and success or failure of new product and service introductions and developments, our ability to attract and retain qualified personnel, maintaining our intellectual property rights and litigation involving intellectual property rights, legislative, regulatory and economic developments, and the other risks and uncertainties described in the Risk Factors and in Management's Discussion and Analysis of Financial Condition and Results of Operations sections of our most recently filed Annual Report on Form 10 - K and any subsequently filed Quarterly Report(s) on Form 10 - Q . Any forward - looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which it is made . We undertake no obligation to publicly update any forward - looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise . 2

• Introduction • Our Story: From Inception to Innovation • Explosive Growth and Strong Momentum • Strategic Growth Drivers • Selective and Strategic Acquisitions • Our Worldwide Operation • Our Customers: Major Telecom Players Globally • Our Telecom Strategic Focus On High - Margin SMS Services • A Brilliant Future and Strategic Growth • Enhancing Shareholder Value • Preparing For Nasdaq: A Strategic Approach • Strategic Initiatives For Nasdaq Uplisting • Path to $1 Billion in Revenue • Funding and the Road Ahead • Market Cap - Upside Opportunity • A Call to iQSTEL’s Future 3

Our portfolio of services is reflecting our core Telecommunications Business and our transition to a Technological corporation 4

FOUNDERS’ BACKGROUND • Alvaro Quintana (Telecom Italia’s DIGITEL) • Leandro Jose Iglesias (Verizon’s Cantv) • 50+ years combined experience in telecom. FOUNDATION OF IQSTEL • Co - founded Etelix in 2008. • Etelix valuation was $4 million in 2018. • Transitioned to a publicly traded company in 2018. • Established leadership in international telecom. 5

6

ACQUISITIONS & VENTURES • 11 ventures & acquisitions since 2018 • Focus on telecom companies and top executives REVENUE CONTRIBUTION • Up to $2 million anticipated from cost reductions • Growing revenue base without significant new costs 7

WHAT HAS BEEN OUR APPROACH • Targeting high - value acquisitions and top executives and customer relations • Adding High Margin products as SMS services • Expanding international footprint . QXTEL generated $85 million in net revenue and $950,000 in EBITDA in 2024 8

We maintain more than 600 network interconnections around the world, delivering international voice, SMS, and connectivity services that form the core of our business. 9

10

Generate 8% gross profit. TELECOM GROWTH STRATEGY Focus on high - margin SMS services Acquisition of QXTEL for SMS portfolio Growing SMS Generate 20% gross profit. VOICE 11

VISION FOR SUCCESS • Bright Future : iQSTEL is on a path to exceptional growth, with a strong foundation for long - term success . • Business Platform : Over the past few years, we have built a robust platform to offer high - margin products and services . • High - Tech Focus : Core strategy is to develop innovative, high - margin products in emerging sectors . 12

EMERGING SECTORS • AI - Driven Services : Developing artificial intelligence solutions to stay at the forefront of innovation . Market size is estimated in $ 196 billion with a CAGR of 36 % ( 1 ) . • Fintech : Expanding into financial technology to diversify and strengthen revenue streams . Market is estimated in $ 167 billion with a CAGR of 25 % ( 2 ) . • Cybersecurity : Providing robust protection with advanced cybersecurity solutions for telecom and business clients . Market is valued in $ 222 billion with a CAGR of 12 % ( 1 ) . STRATEGIC ADVANTAGE • Cross - Selling Opportunities : Leveraging existing relationships with major telecom clients to drive cross - selling and maximize revenue potential . Sources: (1) Grand View Research, (2) Market Data Forecast 13

STRATEGY • Consolidation of divisions, synergies and cost reduction • Comprehensive rebranding strategy • Taking advantage of our business platform selling High Tech – High Margin products (Cybersecurity) • Nasdaq uplisting EXPECTED BENEFITS • EBITDA growth • Added credibility, Enhanced exposure • Increasing the Gross Margin • Broader access to investors 14

REQUIREMENTS MET • Stockholders’ Equity $8M (*)$5M • Market Value of Unrestricted Publicly Held Shares $40.3m (*)$15M • Operating History 6 years (*)2 years • Unrestricted Publicly Held Shares 196 million (*)1 million • Unrestricted Round Lot Shareholders +10K (*)300 Corporate Governance • Independent Board of Directors • Audit, Compensation, and Ethics Committees REMAINING REQUIREMENT • Achieving minimum price per share (*) minimun required by Nasdaq 15

KEY INITIATIVES • Developing our Enhanced Shareholders Value Strategies • Engage an Investment Bank • Complete a new acquisition (M&A) prior to Nasdaq Listing, adding Revenue and Positive Ebitda 16

AMBITIOUS PLAN • $ 340 million in revenue by 2025 . • $ 3 Million EBITDA from our operating business by 2025 . • One acquisition prior to Nasdaq listing. • $ 1 billion revenue goal with eight - digit positive EBITDA by 2027 . 17

2024 $1.364 (preliminary accounting) 18

19

VISION Telecom, • Thriving in Fintech, AI and Cybersecurity • Building a long - term, successful company • Building $ 1 Billion company, with 8 - digit EBITDA for 2027 20

Leandro Jose Iglesias CEO & Chairman Alvaro Quintana CFO investors@iqstel.com Management holds the equivalent of 40 . 5 million common shares through a combination of common and preferred shares .

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

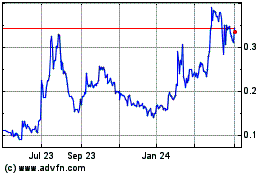

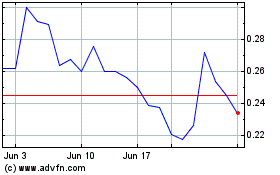

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Jan 2025 to Feb 2025

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Feb 2024 to Feb 2025