UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File No. 000-56391

Greenbriar Sustainable Living Inc.

(Translation of registrant's name into English)

632 Foster Avenue

Coquitlam, British Columbia, Canada V3J 2L7

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7) ☐

SUBMITTED HEREWITH

Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Greenbriar Sustainable Living Inc.

/s/ Jeff Ciachurski

______________________________________

Jeff Ciachurski

Chief Executive Officer

Date: May 30, 2024

NOTICE

RE: CONDENSED CONSOLIDATED INTERIM FINANCIALS STATEMENTS FOR THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

The first quarter financial statements for the three months ended March 31, 2024 and 2023 have not been reviewed by the auditors of Greenbriar Sustainable Living Inc.

GREENBRIAR SUSTAINABLE LIVING INC.

"Anthony Balic"

Anthony Balic

Chief Financial Officer

Greenbriar Sustainable Living Inc.

Condensed Consolidated Interim Financial Statements

For Three Months Ended March 31, 2024 and 2023

(Unaudited - amounts expressed in Canadian dollars, except where indicated)

Greenbriar Sustainable Living Inc.

Condensed Consolidated Interim Statements of Financial Position

As at March 31, 2024 and December 31, 2023

(amounts expressed in Canadian dollars, except where indicated)

| |

Note |

|

As at

March 31, 2024 |

|

|

As at

December 31, 2023 |

|

| Assets |

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

| Cash |

|

$ |

- |

|

$ |

47,098 |

|

| Deposits and prepaid expenses - short term |

|

|

516,933 |

|

|

507,878 |

|

| Other receivables |

|

|

5,410 |

|

|

3,476 |

|

| Marketable securities |

6 |

|

1,829,250 |

|

|

1,785,510 |

|

| Loan receivable |

4 |

|

- |

|

|

206,947 |

|

| |

|

|

2,351,593 |

|

|

2,550,909 |

|

| Non-current assets |

|

|

|

|

|

|

|

| Deposits and prepaid expenses - long term |

|

|

55,722 |

|

|

51,192 |

|

| Sage Ranch |

5 |

|

13,186,576 |

|

|

12,333,170 |

|

| Power project acquisition and development costs |

7 |

|

7,484,605 |

|

|

7,175,580 |

|

| Total assets |

|

$ |

23,078,496 |

|

$ |

22,110,851 |

|

| Liabilities |

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

| Overdraft |

|

|

40,028 |

|

|

- |

|

| Accounts payable and accrued liabilities |

8 |

|

4,353,270 |

|

|

3,822,969 |

|

| Loans payable and promissory note |

9 |

|

1,349,727 |

|

|

781,322 |

|

| Joint venture settlement obligation |

11 |

|

1,048,423 |

|

|

698,950 |

|

| Convertible debenture |

10 |

|

2,855,087 |

|

|

2,698,761 |

|

| Convertible debenture derivative |

10 |

|

993,084 |

|

|

1,027,427 |

|

| |

|

|

10,639,619 |

|

|

9,029,429 |

|

| Non-current liabilities |

|

|

|

|

|

|

|

| Joint venture settlement obligation |

11 |

|

2,719,561 |

|

|

3,298,141 |

|

| Convertible debenture |

10 |

|

798,556 |

|

|

785,129 |

|

Total liabilities

|

|

|

14,157,736 |

|

|

13,112,699 |

|

| Shareholders' equity |

|

|

|

|

|

|

|

| Share capital |

12 |

|

26,675,746 |

|

|

26,410,615 |

|

| Reserves |

12 |

|

9,311,036 |

|

|

9,405,117 |

|

| Accumulated other comprehensive income |

|

|

1,133,359 |

|

|

653,192 |

|

| Deficit |

|

|

(28,199,381 |

) |

|

(27,470,772 |

) |

| Total shareholders' equity |

|

|

8,920,760 |

|

|

8,998,152 |

|

| Total liabilities and shareholders' equity |

|

$ |

23,078,496 |

|

$ |

22,110,851 |

|

Nature of operations and going concern (note 1)

Commitments and contingencies (note 17)

Subsequent events (note 18)

Approved by the Board of Directors

| ”Jeff Ciachurski” |

Director |

”Cliff Webb” |

Director |

|

Greenbriar Sustainable Living Inc.

Condensed Consolidated Interim Statements of Loss and Comprehensive Loss

For the three months ended March 31, 2024 and 2023

(amounts expressed in Canadian dollars, except where indicated)

| |

Notes |

|

Three months ended

March 31, |

|

| |

2024 |

|

|

2023 |

|

| General and administration expenses |

|

|

|

|

|

|

|

| |

Consulting and management fees |

16 |

$ |

(265,590 |

) |

$ |

(128,796 |

) |

| |

General and administrative |

|

|

(163,045 |

) |

|

(150,037 |

) |

| |

Marketing and donations |

|

|

(14,527 |

) |

|

(30,865 |

) |

| |

Finance cost |

|

|

(139,430 |

) |

|

(5,983 |

) |

| |

Share-based payment expense |

12 |

|

- |

|

|

(131,793 |

) |

| |

Professional fees |

|

|

(112,284 |

) |

|

(163,771 |

) |

| |

|

|

(694,876 |

) |

|

(611,245 |

) |

| Other (expenses) income, net |

|

|

|

|

|

|

|

| |

Foreign exchange gain (loss) |

|

|

(84,331 |

) |

|

3,361 |

|

| |

Loss on settlement of accounts payable and accrued liabilities |

8 |

|

(8,634 |

) |

|

- |

|

| |

Interest income |

|

|

- |

|

|

22,410 |

|

| |

Fair value adjustment on derivative liability |

10 |

|

59,232 |

|

|

- |

|

| Loss |

|

|

(728,609 |

) |

|

(585,474 |

) |

| |

|

|

|

|

|

|

|

| Other comprehensive income (loss) |

|

|

|

|

|

|

|

| |

Cumulative translation adjustment |

|

|

480,167 |

|

|

(12,339 |

) |

| Total comprehensive loss |

|

$ |

(248,442 |

) |

$ |

(597,813 |

) |

| |

|

|

|

|

|

|

|

| Loss per share-basic and diluted |

|

$ |

(0.02 |

) |

$ |

(0.02 |

) |

| Weighted average shares outstanding-basic and diluted |

|

|

33,970,334 |

|

|

33,576,105 |

|

| |

|

|

|

|

|

|

|

Greenbriar Sustainable Living Inc.

Consolidated Statements of Changes in Shareholders’ Equity

For the three months ended March 31, 2024 and 2023

(amounts expressed in Canadian dollars, except where indicated)

| |

Notes |

Shares |

|

Share

capital |

|

|

Option

reserves |

|

|

Warrants

reserves |

|

|

Share

subscription

proceeds

receive |

|

|

Convertible

debenture

reserves |

|

|

Accumulated

other

comprehensive

income |

|

|

Deficit |

|

|

Total

Shareholders'

Equity |

|

| Balance at December 31, 2023 |

|

34,078,355 |

$ |

26,410,615 |

|

$ |

4,911,526 |

|

$ |

4,456,372 |

|

$ |

- |

|

$ |

37,219 |

|

$ |

653,192 |

|

$ |

(27,470,772 |

) |

$ |

8,998,152 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss for the period |

|

- |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(728,609 |

) |

|

(728,609 |

) |

| Options exercised |

12 |

150,000 |

|

256,500 |

|

|

(91,500 |

) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

165,000 |

|

| Warrants exercised |

12 |

11,000 |

|

8,631 |

|

|

- |

|

|

(2,581 |

) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

6,050 |

|

| Cumulative translation adjustment |

|

- |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

480,167 |

|

|

- |

|

|

480,167 |

|

| Balance at March 31, 2024 |

|

34,239,355 |

$ |

26,675,746 |

|

$ |

4,820,026 |

|

$ |

4,453,791 |

|

$ |

- |

|

$ |

37,219 |

|

$ |

1,133,359 |

|

$ |

(28,199,381 |

) |

$ |

8,920,760 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2022 |

|

33,474,855 |

$ |

25,490,912 |

|

$ |

4,008,171 |

|

$ |

3,789,197 |

|

$ |

- - |

|

$ |

- |

|

$ |

1,033,389 |

|

$ |

(24,842,524 |

) |

$ |

9,479,145 |

|

| Loss for the period |

|

- |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(585,474 |

) |

|

(585,474 |

) |

| Options exercised |

12 |

238,500 |

|

652,335 |

|

|

(272,835 |

) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

379,500 |

|

| Share-based payment expense |

12 |

- |

|

- |

|

|

131,793 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

131,793 |

|

| Cumulative translation adjustment |

|

- |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(12,339 |

) |

|

- |

|

|

(12,339 |

) |

| Shares subscription proceeds received |

|

- |

|

- |

|

|

- |

|

|

- |

|

|

150,000 |

|

|

- |

|

|

- |

|

|

- |

|

|

150,000 |

|

| Balance at March 31, 2023 |

|

33,713,355 |

$ |

26,143,247 |

|

$ |

3,867,129 |

|

$ |

3,789,197 |

|

$ |

15,000 - |

|

$ |

- |

|

$ |

1,021,050 |

|

$ |

(25,427,998 |

) |

$ |

9,542,625 |

|

The accompanying notes are an integral part of these consolidated financial statements.

Greenbriar Sustainable Living Inc.

Consolidated Statements of Cash Flows

For the three months ended March 31, 2024 and 2023

(amounts expressed in Canadian dollars, except where indicated)

| |

Note |

|

Three months ended March 31, |

|

| |

2024 |

|

|

2023 |

|

| Cash used from operating activities |

|

|

|

|

|

|

|

| Loss for the period |

|

$ |

(728,609 |

) |

$ |

(585,474 |

) |

| Items not affecting cash |

|

|

|

|

|

|

|

| Unrealized foreign exchange gain (loss) |

|

|

84,331 |

|

|

(3,361 |

) |

| Loss on settlement of account payable and accrued liabilities |

8 |

|

8,634 |

|

|

- |

|

| Share-based payment expense |

12 |

|

- |

|

|

131,793 |

|

| Accrued interest income |

|

|

- |

|

|

(22,410 |

) |

| Accretion on convertible debenture |

10 |

|

103,248 |

|

|

- |

|

| Fair value of derivative liability |

10 |

|

(59,232 |

) |

|

- |

|

| |

|

|

(591,628 |

) |

|

(479,452 |

) |

| Change in non-cash operating working capital |

|

|

|

|

|

|

|

| Decrease (increase) in receivables and prepaid expenses |

|

|

(15,519 |

) |

|

(25,865 |

) |

| Increase (decrease) in accounts payable and accrued liabilities |

|

|

200,179 |

|

|

128,479 |

|

| |

|

|

(406,968 |

) |

|

(376,838 |

) |

| Cash flows used in investing activities |

|

|

|

|

|

|

|

| Sage ranch |

5 |

|

(92,868 |

) |

|

(225,794 |

) |

| Power project development and construction costs |

7 |

|

(108,340 |

) |

|

(12,167 |

) |

| |

|

|

(201,208 |

) |

|

(237,961 |

) |

| Cash flows used in financing activities |

|

|

|

|

|

|

|

| Cash paid on executive loans interest |

|

|

(44,000 |

) |

|

- |

|

| Cash received on executive loans |

|

|

- |

|

|

60,899 |

|

| Subscription received in advance |

|

|

- |

|

|

150,000 |

|

| Options exercises |

12 |

|

165,000 |

|

|

379,500 |

|

| Warrants exercises |

12 |

|

6,050 |

|

|

- |

|

| Cash received from shareholder |

9 |

|

550,000 |

|

|

- |

|

| Related company loan |

4 |

|

- |

|

|

17,000 |

|

| Repayment of joint venture settlement obligation |

11 |

|

(156,000 |

) |

|

- |

|

| |

|

|

521,050 |

|

|

607,399 |

|

| Increase (decrease) in cash |

|

$ |

(87,126 |

) |

$ |

(7,400 |

) |

| Cash - beginning of year |

|

|

47,098 |

|

|

24,950 |

|

| Cash - end of period |

|

$ |

(40,028 |

) |

$ |

17,550 |

|

The accompanying notes are an integral part of these consolidated financial statements.

| Supplemental cash flow information |

|

2024 |

|

|

2023 |

|

| |

|

$ |

|

|

$ |

|

| Accrued investment property through accounts payable |

|

551,277 |

|

|

552,583 |

|

| Accrued power project development costs through accounts payable |

|

108,414 |

|

|

12,854 |

|

| Reclass from loan receivable to joint venture settlement obligation |

|

362,947 |

|

|

- |

|

| Cash interest paid |

|

- |

|

|

- |

|

| Taxes paid |

|

- |

|

|

- |

|

1 Nature of operations and going concern

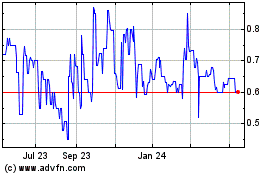

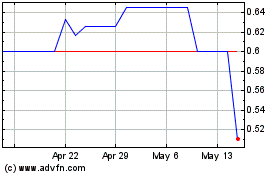

Greenbriar Sustainable Living Inc. (formerly "Greenbriar Capital Corp.") ("Greenbriar" or the "Company") is a leading developer of entry-level housing, renewable energy, green technology and sustainable investment projects. Greenbriar was incorporated under the British Columbia Business Corporations Act on April 2, 2009 and is a real estate issuer on the TSX Venture Exchange. The Company's registered records office is located at Suite 1500 - 1055 West Georgia Street, Vancouver, BC, V6E 4N7. The Company is listed as a Tier 2 real estate issuer. The Company's shares trade on the exchange under the symbol "GRB". The Company changed its name from Greenbriar Capital Corp. to Greenbriar Sustainable Living Inc. effective November 15, 2023.

These consolidated financial statements have been prepared on the basis that the Company is a going concern, which assumes that the Company will be able to realize its assets and discharge its liabilities in the normal course of business. The nature of the Company's primary business is the acquisition, management, development, and possible sale of real estate and renewable energy projects. The Company had a loss of $728,609 (2023 - $585,474) for the three months ended March 31, 2024. As at March 31, 2024, the Company had an accumulated deficit of $28,199,381 (deficit of December 31, 2023 - $27,470,772) and a working capital deficiency of $8,288,026 (December 31, 2023 - deficiency of $6,478,520). To date, the Company has no history of earning revenues. If the Company is unable to raise any additional funds to undertake planned development, it could have a material adverse effect on its financial condition. These events and conditions indicate that a material uncertainty exists that raises substantial doubt on the Company's ability to continue as a going concern. If the going concern basis were not appropriate for these consolidated financial statements, then significant adjustments would be necessary in the carrying value of assets and liabilities, the reported expenses, and the classifications used in the statement of financial position. These adjustments may be material.

Recent global issues, including the ongoing COVID-19 pandemic and political conflict in other regions have adversely affected workplaces, economies, supply chains, and financial markets globally. It is not possible for the Company to predict the duration or magnitude of the adverse results of these issues and their effects on the Company's business or results of operations this time.

2 Basis of presentation

These unaudited condensed consolidated interim financial statements have been prepared in accordance with IAS 34 - Interim Financial Reporting as issued by the International Accounting Standards Board ("IASB"). Accordingly, certain disclosures included in annual financial statements prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the IASB have been condensed or omitted and these unaudited condensed interim consolidated financial statements should be read in conjunction with the Company's audited consolidated financial statements for the year ended December 31, 2023.

The Company's management makes judgments in its process of applying the Company's accounting policies in the preparation of its unaudited interim condensed consolidated financial statements. In addition, the preparation of the financial data requires that the Company's management make assumptions and estimates of the effects of uncertain future events on the carrying amounts of the Company's assets and liabilities at the end of the reporting period and the reported amounts of revenues and expenses during the reporting period. Actual results may differ from those estimates as the estimation process is inherently uncertain. Estimates are reviewed on an ongoing basis based on historical experience and other factors that are considered to be relevant under the circumstances. Revisions to estimates and the resulting effects on the carrying amounts of the Company's assets and liabilities are accounted for prospectively. The critical judgments and estimates applied in the preparation of the Company's unaudited condensed interim consolidated financial statements are consistent with those applied and disclosed in the Company's consolidated financial statements for the year ended December 31, 2023. In addition, other than noted below, the accounting policies applied in these unaudited condensed interim consolidated financial statements are consistent with those applied and disclosed in the Company's audited financial statements for the year ended December 31, 2023. The Company's interim results are not necessarily indicative of its results for a full year.

The Company's interim results are not necessarily indicative of its results for a full year.

These unaudited condensed consolidated interim financial statements were approved by the Board of Directors on May 30, 2024.

3 Material accounting policies

The preparation of these consolidated financial statements in conformity with IFRS requires management to make judgments and estimates and form assumptions that affect the reporting amounts of assets and liabilities at the date of the financial statements and reported amounts of revenues and expenses during the reporting period.

On an ongoing basis, management evaluates its judgments and estimates in relation to assets, liabilities, revenue, and expenses. Management uses historical experience and various other factors it believes to be reasonable under the given circumstances as the basis for its judgments and estimates. Actual outcomes may differ from these estimates under different assumptions and conditions. Revisions to estimates and the resulting effects on the carrying amounts of the Company's assets and liabilities are accounted for prospectively.

Key areas of judgment

Functional currency

The functional currency for the Company and its subsidiaries is the currency of the primary economic environment in which each operates. The Company's functional and local currency is the Canadian dollar. The functional currency of the Company's subsidiaries is the US dollar. The determination of functional currency may require certain judgments to determent the primary economic environment. The Company reconsiders the functional currency used when there is a change in events and conditions which determined the primary economic environment.

Assets' carrying values and impairment charges

In determining carrying values and impairment charges the Company looks at recoverable amounts, defined as the higher of value in use or fair value less cost to sell in the case of assets, and at objective evidence that identifies significant or prolonged decline of fair value on financial assets indicating impairment. These determinations and their individual assumptions require that management make a decision based on the best available information at each reporting period.

Going concern of operations

These consolidated financial statements do not give effect to adjustments, if any, that would be necessary should the Company be unable to continue as a going concern. If the going concern assumption was not used, then the adjustments required to report the Company's assets and liabilities on a liquidation basis could be material to these financial statements.

Marketable securities

The determination of the fair value requires significant judgement by the Company, on the date of purchase, and at each reporting date thereafter, consistent with fair value accounting guidance in accordance with IFRS 13, Fair Value Measurement.

Tax

Uncertainties exist with respect to the interpretation of complex tax regulations and the amount and timing of future taxable income. Deferred tax assets are recognized for all unused tax losses to the extent that it is probable that taxable earnings will be available against which the losses can be utilized. Significant management judgment is required to determine the amount of deferred tax assets that can be recognized, based upon the likely timing and the level of future taxable earnings together with future tax planning strategies.

Key sources of estimation uncertainty

Share-based payments

Amounts recorded for share-based payments are subject to the inputs used in the Black-Scholes option pricing model, including estimates such as volatility, forfeiture, dividend yield and expected option life.

Convertible debentures

Convertible debentures are separated into their liability and equity components on the statement of financial position. The liability component is initially recognized at fair value, calculated as the net present value of the liability, using estimated interest rates based upon non-convertible debentures issued by comparable issuers, and accounted for at amortized cost using the effective interest rate method.

Derivative Liability

The Company measures the fair value of the derivative by reference to the fair value on the convertible debenture issuance date with an estimated life ending on the convertible debenture maturity date and revalues them at each reporting date. In determining the fair value for the derivative liability, the Company used the Geometric Brownain motion model with the following assumptions: annualized volatility rate; market price of shares at the reporting date; risk-free interest rate; the remaining expected life of the embedded derivatives and an exchange rate at the reporting date. Changes to these estimates could result in the fair value of the derivative liability being less than or greater than the amount recorded.

Joint venture settlement obligation

The liability is initially recognized at fair value, calculated as the net present value of the liability, using estimated interest rates based upon debt issued by comparable issuers, and accounted for at amortized cost using the effective interest rate method.

4 Loan Receivable

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| Opening balance |

$ |

206,947 |

|

$ |

644,990 |

|

| Funds received, net of advances granted |

|

156,000 |

|

|

(467,976 |

) |

| Interest receivable |

|

- |

|

|

29,933 |

|

| Reclassed to offset joint venture settlement obligation (note 11) |

|

(362,947 |

) |

|

- |

|

| Ending receivable balance - classified as current |

$ |

- |

|

$ |

206,947 |

|

As at March 31, 2024, the Company had a loan receivable of $nil (December 31, 2023 - $206,947) from Captiva Verde Wellness Corp. ("Captiva") which represents a non-arm's length transaction as the CEO of the Company, Jeffrey Ciachurski, is also the CEO of Captiva and the CEO of the Company amd Anthony Balic, is also the CFO of Captiva and the CFO of the Company.

On April 20, 2022, the Company entered into a promissory note with Captiva for $775,000 which accrued interest at the rate of 8% per annum for a term of 24 months. The promissory note matures on April 20, 2024. Under the terms of the note, additional advances may be extended subject to the same terms and conditions. As at March 31, 2024, interest income of $nil (December 31, 2023 - $29,933) has been accrued. During the period ended March 31, 2024, the Company and Captiva agreed to net the receivable against the joint venture settlement obligation.

5 Sage Ranch

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| Opening balance |

$ |

12,333,170 |

|

$ |

5,456,419 |

|

| Land appraisal & related fees |

|

417,187 |

|

|

1,638,531 |

|

| Captiva Joint Venture Settlement |

|

- |

|

|

3,811,504 |

|

| Accretion (note 11) |

|

133,840 |

|

|

185,587 |

|

| Water rights |

|

- |

|

|

1,376,556 |

|

| Unrealized foreign exchange |

|

302,379 |

|

|

(135,427 |

) |

| |

$ |

13,186,576 |

|

$ |

12,333,170 |

|

On September 27, 2011, the Company acquired property in Tehachapi, California (the "Sage Ranch Project" or "Tehachapi Property") with the intent to develop a residential subdivision. The Company applies the cost model for its investment property and has recorded $nil depreciation as the project is still under development.

On October 6, 2018, the Company entered into an agreement to sell a 50% undivided interest in the Sage Ranch Project to Captiva, which represents a non-arm's length transaction. The Company received 10,687,500 common shares of Captiva which had a fair value of $1,068,750 and $112,500 in cash for total consideration of $1,181,250 ("Sale Agreement").

On August 10, 2020, the Company entered into an option and joint venture agreement (the "Option and Joint Venture Agreement") with Captiva amending the terms of the Sale Agreement.

Pursuant to the terms of the Option and Joint Venture Agreement, Captiva's 50% interest in the Sage Ranch Project was converted into an option to earn (the "Option") a 50% net profits interest in the Tehachapi Property by:

1. Captiva paying the Company a cash payment of $112,500 (the "Cash Payment") (Captiva satisfied this payment in 2018 under the terms of the Sale Agreement);

2. Captiva issuing the Company common shares (the "Share Payment") (Captiva satisfied this payment in 2018 through the issuance of 10,687,500 common shares under the terms of the Sale Agreement); and

3. Captiva funding the applicable permitting and development costs for the Sage Ranch Project (Captiva was in default on such funding obligations).

Captiva had until the earlier of: (i) August 20, 2025 and (ii) the date the Company receives final approval from the City of Tehachapi (and other required regulatory approval) to build houses on the Tehachapi Property, to exercise the Option.

If Captiva made the payments summarized above by the required time, Captiva would have exercised the Option and automatically acquired a 50% net profits interest in and to the Sage Ranch Project. If Captiva exercised the Option, then Captiva and the Company would have immediately entered into a joint venture (the "Joint Venture") pursuant to the terms of the Option and Joint Venture Agreement. Pursuant to the terms of the Joint Venture, the Company and the Captiva were required to evenly split all net profits derived from the Sage Ranch Project.

On June 22, 2023 and amended on August 21, 2023, the Company entered into an agreement with Captiva whereby the Company will pay Captiva $5,591,588 in 48 equal monthly installments of $116,491 starting on August 22, 2024, with the last payment on June 1, 2028. Amounts payable to Captiva under the agreement relate to the reimbursement of costs incurred by Captiva under the Option. Subsequent to the amount being repaid, Captiva will no longer have any further net profits interest in and to the Sage Ranch Project. During the year ended December 31, 2023, the present value of $3,811,504 of these future payments was discounted at a rate of 13.43%. During the period ended March 31, 2024, $133,840 (December 31, 2023 $185,587) of accretion has been accrued to the project (Note 11).

On November 13, 2023, the Sage Ranch Project received Planning Commission approval for the Sage Ranch Precise Development Plan ("PDP").

During the year ended December 31, 2023, the Company entered into an option agreement to purchase up to 115 acre-feet of water rights at USD $29,260 per acre-feet and as part of the agreement paid a $1,376,556 non-refundable deposit. During the period ended March 31, 2024, the Company has not purchased any water rights under this option agreements.

The fair value of the development project as a whole is not possible to reliably estimate as of yet, given we have not yet received all necessary permits or begun construction.

6 Marketable securities and investment in associate

| |

|

December 31, 2023

Fair value |

|

|

Acquired |

|

|

Disposed |

|

|

Gain/(Loss) |

|

|

March 31,

2024

Fair value |

|

| Green Matters |

|

1,785,510 |

|

|

- |

|

|

- |

|

|

43,740 |

|

|

1,829,250 |

|

| Total |

$ |

1,785,510 |

|

$ |

- |

|

$ |

- |

|

$ |

43,740 |

|

$ |

1,829,250 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

December 31, 2022

Fair value |

|

|

Acquired |

|

|

Disposed |

|

|

FX Adjusted |

|

|

December 31,

2023

Fair value |

|

| Green Matters |

$ |

1,819,800 |

|

$ |

- |

|

$ |

- |

|

$ |

(34,290 |

) |

$ |

1,785,510 |

|

| Total |

$ |

1,819,800 |

|

$ |

- |

|

$ |

- |

|

$ |

(34,290 |

) |

$ |

1,785,510 |

|

As at March 31, 2024, the Company held 900,000 (December 31, 2023 - 900,000) shares in Green Matters Technologies Inc. ("Green Matters") which is a private Canadian corporation. As at March 31, 2024, the shares were valued at USD $1.50 (December 31, 2023 - USD $1.50)

7 Power project acquisition and development costs

| |

|

Development Costs |

|

|

Acquisition Costs |

|

|

Total |

|

| December 31, 2022 |

$ |

5,308,549 |

|

$ |

1,693,000 |

|

$ |

7,001,549 |

|

| Additions |

|

342,323 |

|

|

- |

|

|

342,323 |

|

| Unrealized foreign exchange |

|

(128,542 |

) |

|

(39,750 |

) |

|

(168,292 |

) |

| December 31, 2023 |

$ |

5,522,330 |

|

$ |

1,653,250 |

|

$ |

7,175,580 |

|

| Additions |

|

133,242 |

|

|

- |

|

|

133,242 |

|

| Unrealized foreign exchange |

|

135,283 |

|

|

40,500 |

|

|

175,783 |

|

| March 31, 2024 |

|

5,790,855 |

|

|

1,693,750 |

|

|

7,484,605 |

|

Montalva Project

In April 2013, the Company entered into a 50/50 arrangement to create AG Solar One LLC ("AG Solar") with Alterra Power Corp. ("Alterra") (the "Arrangement"). The Arrangement was created to develop 100 Megawatts ("MW's") of solar generation capacity in Puerto Rico under a Master Renewable Power Purchasing and Operating Agreement ("PPOA"), dated December 20, 2011, and amended on March 16, 2012 (the "Master Agreement"), with Puerto Rico Electric Power Authority ("PREPA") which the partnership through its wholly owned subsidiary, PBJL Energy Corporation ("PBJL"), currently has rights to.

On July 12, 2013, the Company signed a Membership Interest Purchase and Sale Agreement ("MIPSA") with Magma Energy (U.S.) Corp. ("Magma"), a subsidiary of Alterra, and amended on October 11, 2013 whereby the Company will purchase from Alterra its 50% interest in and to the shares of AG Solar. The consideration was US $1.25 Million. The Company completed the MIPSA on September 12, 2014 (the "Acquisition Date"), the Company now owns 100% of AG Solar .

Under the terms of the Master Agreement, the Company filed its 100 MW AC Montalva Solar Project with PREPA ("Montalva" or the "Montalva Project")) on September 5, 2013, requesting an interconnection evaluation and issuance of a project specific PPOA for Montalva. After numerous delays by PREPA and failed attempts by the Company requesting the interconnection evaluation and issuance of a project specific PPOA for Montalva, the Company filed a Notice of Default under the Master Agreement with PREPA on September 24, 2014. PREPA responded to the Notice of Default on November 3, 2014, taking the position that it had other PPOAs issued that would exceed its system renewable capacity and could not accept any additional renewable projects and further had met its obligations under the Master Agreement.

On May 15, 2015, the Company, filed a legal action against PREPA in the courts of Puerto Rico in order to protect and enforce its rights under the Master Agreement. On September 9, 2016, the Superior Court of Puerto Rico denied an application by PREPA to have the case for contractual enforcement and damages dismissed. The Company may now proceed to have the court enforce the agreement, or in lieu of enforcement, direct PREPA to pay US $210 Million in monetary damages, or both. In May of 2018 the Company filed a US Federal RICO lawsuit seeking US $951 Million in damages from PREPA.

On February 6, 2019, the Company announced that PREPA wanted to re-open negotiations to move forward the Montalva Project. The Company met with PREPA representatives in 2019 and commenced negotiations.

On May 19, 2020, the Company announced that it has reached agreement with the PREPA on a 25-year PPOA for the development, construction, and operation of the Montalva Project. On May 28, 2020, the Governing Board of PREPA approved the contract.

On August 7, 2020, the Company received unanimous approval from the Puerto Rico Energy Bureau and the Montalva PPOA moved on to final approval by the Puerto Rico Financial Oversight and Management Board (FOMB). On February 26, 2021, the FOMB approved two projects and excluded the approval of the Montalva Project. The Company began the process of seeking avenues to have the FOMB decision overturned or to have the FOMB approve the projects approved by PREPA. As part of this process, the Company together with PREPA entered into negotiations in front of the Puerto Rico Energy Bureau ( "PREB").

On October 3, 2023, the Company announced that further to many years of litigation with the PREPA in both the Commonwealth and US Federal Courts, plus litigation in front of the PREB, both parties have executed a formal settlement agreement beneficial to both parties.

The agreement will then head to the FOMB for approval. The perfunctory technical work on interconnection with Luma Energy, LLC, who is the power company responsible for power distribution and power transmission in the Commonwealth of Puerto Rico, will happen after PREB and FOMB approval.

Land Lease Option Agreements

Included in the power project development and construction costs balance for AG Solar are costs related to land lease option payments.

The below Montalva and Lajas Farm Option Agreements provide the option to enter into a series of land leases with a term of twenty-five years and such leases may be extended for up to four additional consecutive periods of five years each, at the Company's option, for the purposes of the Company developing the Montalva Project.

The Company entered into an option agreement dated September 9, 2013, which gives the Company the exclusive right and option to lease land in Puerto Rico (the "Montalva Option Agreement"). On December 1, 2013, the Company entered into an option agreement with renewal options which gives the Company the exclusive right and option to lease an additional site in Puerto Rico for the Montalva Project ("Original Lajas Farm Option"). On January 1, 2014, the Company entered into two additional option agreements for five years each (the "Secondary Lajas Farm Option"), which gives the Company the exclusive right and option to lease additional land in Lajas, Puerto Rico to further expand the Montalva Project (collectively, the "Lajas Farm Option Agreements").

On various dates since execution of the land lease option agreement, the parties have executed separate amendments to extend the expiration date. During the period ended March 31, 2024, the Company entered into additional extension agreements extending the option term on all agreements to December 31, 2024 and agreeing to make future payments totalling US$221,000. During the period ending March 31, 2024, the Company made payment totalling USD$65,000 (December 31, 2023 - USD$105,667), related to extension agreements.

8 Accounts payable and accrued liabilities

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| Accounts payable |

$ |

1,453,084 |

|

$ |

905,340 |

|

| Accrued liabilities |

|

2,119,422 |

|

|

2,141,336 |

|

| Accrued interest |

|

780,764 |

|

|

776,293 |

|

| Total accounts payable and accrued liabilities |

$ |

4,353,270 |

|

$ |

3,822.969 |

|

During the period ended March 31, 2024, the Company recorded a loss on reversal of accounts payable of $8,634 (December 31, 2023- $321,115 of gain). During the period ended March 31, 2024, the Company settled $nil (December 31, 2023 - $64,000) in accounts payable through the issuance of units in a private placement (Note 12).

9 Loans payable

| Shareholder loans |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| Principal opening balance |

$ |

499,631 |

|

$ |

460,496 |

|

| Net Addition |

|

550,000 |

|

|

50,000 |

|

| Unrealized foreign exchange |

|

12,239 |

|

|

(10,865 |

) |

| Principal ending balance |

$ |

1,061,870 |

|

$ |

499,631 |

|

In September 2014, the Company received two loans from an independent shareholder that bear interest of 10% per annum, compounded monthly, are non-secured and are due on demand. During the years ended December 31, 2023 and 2022, the Company received additional loans from a shareholder which are unsecured, non-interest bearing loans which are due on demand. As at March 31, 2024, total accrued interest was $227,515 (December 31, 2023 - $213,057) and was included in account payables and accrued liabilities.

| Director loans |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| Principal opening balance |

$ |

251,691 |

|

$ |

257,742 |

|

| Repayment |

|

- |

|

|

- |

|

| Unrealized foreign exchange |

|

6,166 |

|

|

(6,051 |

) |

| Principal ending balance |

$ |

257,857 |

|

$ |

251,691 |

|

The loans bear interest of between 10% and 12% per annum, are non-secured, and are repayable on demand. As at March 31, 2024, total interest accrued was $549,118 (December 31, 2023 - $515,790) and was included in account payables and accrued liabilities.

| Executive loans |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| Principal opening balance |

$ |

- |

|

$ |

- |

|

| Addition loan |

|

- |

|

|

60,626 |

|

| Net repayments |

|

- |

|

|

(60,626 |

) |

| Unrealized foreign exchange |

|

- |

|

|

- |

|

| Principal ending balance |

$ |

- |

|

$ |

- |

|

As at March 31, 2024, the Company had outstanding loans from the CEO and the CEO's spouse of $nil (December 31, 2023 - $nil). The loans bore interest between 10% and 12% per annum, were non-secured and were due on demand. During the year ended December 31, 2023, the Company received additional loans from an executive which are unsecured and repaid during the year. As at March 31, 2024, the principal of the loan was repaid, total interest accrued was $4,131 (December 31, 2023 - $47,446) and was included in account payables and accrued liabilities.

| Promissory note |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| Principal opening balance |

$ |

- |

|

$ |

- |

|

| Additions |

|

30,000 |

|

|

30,000 |

|

| Settled by shares |

|

- |

|

|

- |

|

| Principal ending balance |

$ |

30,000 |

|

$ |

30,000 |

|

During the year ended December 31, 2023, the Company received a $30,000 promissory that is non-interest bearing, non-secured and is due on demand.

10 Convertible debenture

On June 30, 2023, the Company issued $1,000,000 unsecured convertible debenture. The debenture bears interest at 12% per annum, calculated and paid quarterly commencing on the date of issuance and matures on June 30, 2026. The debenture holder can convert all or any portion of the outstanding principal amount into common shares of the Company, at a price of $1.25 per common share. As part of the terms of the offering, the debenture holder has been issued 460,000 detachable warrants which were valued using a Black Scholes Model. Each warrant entitles the holder to acquire one common share of the Company at an exercise price of $1.30 per common share, subject to adjustment in certain events, and expiring on June 30, 2026 (Note 12).

Based on the discount factor of 13.5% over the debenture's term of three years used to determine the fair value of the debenture, the conversion feature was classified as equity and was assigned a residual value of $37,219. Transaction costs, including the fair value of detachable warrants, were allocated to the liability and equity components in proportion to the allocation of gross proceeds. Accretion for the debenture for the period ended March 31, 2024 was $13,427 (December 31, 2023-$25,415). Interest for the debenture for the period ended March 31, 2024 was $30,208 (December 31, 2023-$72,586).

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| Opening balance |

$ |

785,129 |

|

$ |

- |

|

| Principal issued |

|

- |

|

|

1,000,000 |

|

| Equity portion |

|

- |

|

|

(37,219 |

) |

| Capitalized transaction costs |

|

- |

|

|

(17,641 |

) |

| Detachable warrants |

|

- |

|

|

(185,426 |

) |

| Accretion |

|

13,427 |

|

|

25,415 |

|

| Ending balance, classified as long-term |

|

798,556 |

|

$ |

785,129 |

|

On December 13, 2023, the Company issued a USD$3,000,000 unsecured convertible debenture. As part of the issuance, the Company received USD $2,640,000 in cash and USD $360,000 was retained by the investor as prepaid interest. The debenture bears interest at 12% per annum, calculated and paid quarterly commencing on the date of issuance and will mature 36 months from the date of issuance on January 11, 2027. The debenture holder can convert all or any portion of the outstanding principal amount into common shares of the Company at a price of $1.25 per common share. As part of the terms of the offering, the debenture holder has been issued 900,000 detachable warrants which have been valued using a Black Scholes model. Each warrant entitles the holder to acquire one common share of the Company at an exercise price of $1.30 per common share, subject to adjustment in certain events, for a period expiring on January 11, 2027 (Note 12).

The Company estimated the fair value of the embedded derivative, representing the conversion option, by reference to a Geometric Brownain motion model. Based on the following key weighted average inputs: annualized volatility of 65.13% per annum, risk free rate of 3.57% over the Debenture's term of three years, the USD/CAD annualized volatility of 7.28% per annum, the fair value of the derivative liability was $1,171,660 at recognition and $1,027,427 at year-end. The debenture was then allocated the residual balance and transaction costs, including the detachable warrants, were allocated to the liability and embedded derivative in proportion to the allocation of gross proceeds. Transactions costs of $87,781 allocated to the embedded derivative were expensed as incurred. As at March 31, 2024, the fair value of the ended derivative was $993,084

| Convertible Debenture |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| Opening balance |

$ |

2,698,761 |

|

$ |

- |

|

| Principal issued |

|

- |

|

|

4,068,300 |

|

| Capitalized transaction costs |

|

- |

|

|

(4,058 |

) |

| Detachable warrants |

|

- |

|

|

(212,959 |

) |

| Derivative liability |

|

- |

|

|

(1,171,660 |

) |

| Accretion |

|

89,821 |

|

|

87,050 |

|

| Foreign exchange |

|

66,505 |

|

|

(67,912 |

) |

| Ending balance, classified as short-term |

$ |

2,855,087 |

|

$ |

2,698,761 |

|

| Derivative Liability |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| Opening balance |

$ |

1,027,427 |

|

$ |

- |

|

| Original valuation |

|

- |

|

|

1,171,660 |

|

| Foreign exchange |

|

24,889 |

|

|

(26,585 |

) |

| Fair value adjustment |

|

(59,232 |

) |

|

(117,648 |

) |

| Ending balance, classified as short-term |

$ |

993,084 |

|

$ |

1,027,427 |

|

11 Joint venture settlement obligation

On June 22, 2023 and amended on August 21, 2023, the Company entered into an agreement with Captiva to settle the outstanding joint-venture agreement on Sage Ranch between the Company and Captiva, whereby the Company will pay Captiva $5,591,588 in 48 equal monthly installments of $116,491 starting on July 1, 2024, with the last payment on June 1, 2028. Subsequent to the amount being repaid, Captiva will no longer have any further net profits interest in and to the Sage Ranch Project. During the year ended December 31, 2023, the present value of $3,811,504 of these future payments was calculated using a discount rate of 13.43% and $185,587 of accretion was capitalized to the Sage Ranch Project as a borrowing cost. During the period ended March 31, 2024, $133,840 of accretion has been capitalized to the Sage Ranch Project as a borrowing cost (Note 5). During the period ended March 31, 2024, the Company and Captiva agreed to net the Company's receivable of $362,947 from Captiva against the joint venture settlement obligation (note 4).

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| Opening balance |

$ |

3,997,091 |

|

$ |

- |

|

| Joint-venture settlement obligation |

|

- |

|

|

3,811,504 |

|

| Accretion |

|

133,840 |

|

|

185,587 |

|

| Reclass from loan receivable (note 4) |

|

(362,947 |

) |

|

- |

|

| Ending balance |

$ |

3,767,984 |

|

$ |

3,997,091 |

|

| Classified as current |

$ |

1,048,423 |

|

$ |

698,950 |

|

| Classified at non-current |

$ |

2,719,561 |

|

$ |

3,298,141 |

|

12 Share capital and reserves

a. Authorized and outstanding

As at March 31, 2024, the Company had unlimited authorized common shares without par value and 34,239,355 common issued and outstanding (December 31, 2023 - 34,078,355).

b. Share issuances

Fiscal 2024

- During the period ended March 31, 2024, the Company issued 11,000 common shares as a result of warrant exercises and received gross proceeds of $6,050.

- During the period ended March 31, 2024, the Company issued 150,000 common shares as a result of option exercises and received gross proceeds of $165,000.

Fiscal 2023

- On May 10, 2023, the Company closed a non-brokered private placement and issued 360,000 units at a price of $1.25 per unit for gross proceeds of $386,000 and a reduction of accounts payable of $64,000. Each unit is comprised of one common share and one share purchase warrant. Each warrant entitles the holder to acquire one additional share at a price of $1.50 until May 10, 2028. The Company incurred $7,482 in share issuance costs as part of the transaction.

- During the year, 238,500 options were exercised for gross proceeds of $379,500.

- During the year, 5,000 warrants were exercised for gross proceeds of $7,500.

c. Stock options

The Board of Directors may grant options to purchase shares from time to time, subject to the aggregate number of common shares of the Company issuable under all outstanding stock options of the Company not exceeding 10% of the issued and outstanding common shares of the Company at the time of the grant. The options are exercisable over a period established at the time of issuance to buy shares of the Company for a period not exceeding ten years, at a price not less than the minimum price permitted by the exchange. The vesting schedule for an option, if any, shall be determined by the Board of Directors at the time of issuance.

- In addition to the Stock Option Plan, the Company has established a Performance Share Plan dated effective May 6, 2021, in connection with the issue of the Performance Shares under the Sandford Solar Projects Consulting Agreement. Mr. Sandford is the only participant under the Performance Share Plan. It is contemplated that the Company will issue 100,000 Performance Shares on a project achieving a commercial operations date (the date solar power is delivered to a buyer under a power purchase agreement), up to a currently approved maximum of 2,600,000 Performance Shares.

- On February 9, 2023, the Company issued 75,000 incentive stock options to a consultant of the Company exercisable at $1.50 per share for a period of 3 years. The fair value of the share options was estimated at $40,105 on the date of grant using the Black-Scholes option pricing model, with the following assumptions: expected option life of 3 years, expected stock price volatility 86.36%, dividend payment during life of option was nil, risk free interest rate 3.67%, weighted average fair value per option $0.53, share price $1.08.

- On February 9, 2023, the Company issued 150,000 incentive stock options to a consultant of the Company exercisable at $1.10 per share for a period of 3 years. The fair value of the share options was estimated at $91,688 on the date of grant using the Black-Scholes option pricing model, with the following assumptions: expected option life of 3 years, expected stock price volatility 86.36%, dividend payment during life of option was nil, risk free interest rate 3.67%, weighted average fair value per option $0.61, share price $1.08.

- On November 15, 2023, the Company issued 1,200,000 incentive stock options to certain directors and officers of the Company exercisable at $1.10 per share for a period of 5 years. The fair value of the share options was estimated at $902,816 on the date of grant using the Black-Scholes option pricing model, with the following assumptions: expected option life of 5 years, expected stock price volatility 83.79%, dividend payment during life of option was nil, risk free interest rate 3.88%, weighted average fair value per option $0.75, share price $1.10.

- On November 30, 2023, the Company issued 200,000 incentive stock options to an officer of the Company exercisable at $1.10 per share for a period of 5 years. The fair value of the share options was estimated at $141,581 on the date of grant using the Black-Scholes option pricing model, with the following assumptions: expected option life of 5 years, expected stock price volatility 83.80%, dividend payment during life of option was nil, risk free interest rate 3.64%, weighted average fair value per option $0.71, share price $1.05.

Total stock options granted during the period ended March 31, 2024 were nil (December 31, 2023 - 1,625,000). Total share-based payment expense recognized for the fair value of share options granted and vested during the period ended March 31, 2024 was $nil (2023 - $131,793).

A summary of stock option information as at March 31, 2024, December 31, 2023 is as follows:

| |

|

Marach 31, 2024 |

|

|

December 31, 2023 |

|

| |

|

Number of shares

|

|

|

Weighted average

exercise price |

|

|

Number of shares

|

|

|

Weighted average

exercise price |

|

| Outstanding - beginning of year |

|

3,391,500 |

|

$ |

1.21 |

|

|

2,710,000 |

|

$ |

1.35 |

|

| Granted |

|

- |

|

|

- |

|

|

1,625,000 |

|

|

1.12 |

|

| Exercised |

|

(150,000 |

) |

|

1.10 |

|

|

(238,500 |

) |

|

1.43 |

|

| Expired |

|

(66,500 |

) |

|

2.00 |

|

|

(705,000 |

) |

|

1.47 |

|

| Outstanding - end of period |

|

3,175,000 |

|

$ |

1.19 |

|

|

3,391,500 |

|

$ |

1.21 |

|

The following table discloses the number of options and vested options outstanding as at March 31, 2024:

| |

Number of

options

outstanding and

exercisable |

|

|

Weighted average

exercise price |

|

|

Weighted average

remaining

contractual life

(years) |

|

| |

250,000 |

|

|

$1.00 |

|

|

0.03 |

|

| |

350,000 |

|

|

1.35 |

|

|

0.27 |

|

| |

500,000 |

|

|

1.25 |

|

|

0.82 |

|

| |

100,000 |

|

|

1.15 |

|

|

1.23 |

|

| |

500,000 |

|

|

1.35 |

|

|

1.53 |

|

| |

75,000 |

|

|

1.50 |

|

|

2.11 |

|

| |

1,200,000 |

|

|

1.10 |

|

|

4.63 |

|

| |

200,000 |

|

|

1.10 |

|

|

4.67 |

|

| |

3,175,000 |

|

|

$1.19 |

|

|

2.53 |

|

d. Warrants

Fiscal 2024

- On January 11, 2024, the Company issued 900,000 warrants as part of convertible debt financing. Each warrant entitles the holder to acquire one common share of the Company at an exercise price of $1.30 per common share for a period expiring on January 11, 2027. The fair value of these warrants at the date of grant was estimated at $299,099 using a black-scholes calculation. The warrants were valued using the Black-Scholes option pricing model with the following assumptions: a 3 year expected life; 67.30% volatility; risk-free interest rate of 3.79%; and a dividend yield of 0%.

Fiscal 2023

- On May 10, 2023, the Company issued 360,000 warrants as part of a private placement. Each warrant entitles the holder to acquire one additional share at a price of $1.50 until May 10, 2028. The fair value of the warrants at the date of grant was estimated at $184,998 using the proportionate allocation method. The warrants were valued using the Black-Scholes option pricing model with the following assumptions: a 5 year expected life; 100.18% volatility; risk-free interest rate of 2.99%; and a dividend yield of 0%.

- On June 30, 2023, as part of the terms of the convertible debenture offering, the Company issued 460,000 detachable warrants, with each warrant entitling the holder to acquire one common share of the Company at an exercise price of $1.30 per common share, for a period expiring on June 30, 2026.The fair value of these warrants at the date of grant was estimated at $185,426 using a black-scholes calculation. The warrants were valued using the Black-Scholes option pricing model with the following assumptions: a 3 year expected life; 68.58% volatility; risk-free interest rate of 4.21%; and a dividend yield of 0%.

- On December 13, 2023, as part of the terms of the convertible debenture offering, the Company agreed to issue 900,000 detachable warrants, with each warrant entitling the holder to acquire one common share of the Company at an exercise price of $1.30 per common share, subject to adjustment in certain events, for a period expiring on January 11, 2027. The fair value of these warrants at the date of grant was estimated at $299,099 using a black-scholes calculation. The warrants were valued using the Black-Scholes option pricing model with the following assumptions: a 3 year expected life; 67.30% volatility; risk-free interest rate of 3.79%; and a dividend yield of 0%. These warrants were issued on January 11, 2024.

The following table discloses the number of warrants outstanding as at:

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| |

|

Number of shares

|

|

|

Weighted average

exercise price |

|

|

Number of shares

|

|

|

Weighted average

exercise price |

|

| Outstanding - beginning of year |

|

4,757,926 |

|

$ |

1.31 |

|

|

5,371,896 |

|

$ |

1.49 |

|

| Granted |

|

900,000 |

|

|

1.30 |

|

|

820,000 |

|

|

1.39 |

|

| Exercised |

|

(11,000 |

) |

|

0.55 |

|

|

(5,000 |

) |

|

1.50 |

|

| Expired |

|

- |

|

|

- |

|

|

(1,428,970 |

) |

|

2.03 |

|

| Outstanding - end of period |

|

5,646,926 |

|

$ |

1.31 |

|

|

4,757,926 |

|

$ |

1.31 |

|

| Outstanding warrants |

Expiry Date |

Exercise price |

| 520,000 |

April 24, 2024 |

$0.55 |

| 1,909,000 |

March 28, 2025 |

$1.35 |

| 577,000 |

November 29, 2025 |

$1.50 |

| 925,926 |

December 13, 2025 |

$1.46 |

| 355,000 |

May 3, 2028 |

$1.50 |

| 460,000 |

June 30, 2026 |

$1.30 |

| 900,000 |

January 11, 2027 |

$1.30 |

| 5,646,926 |

|

|

e. Convertible equity reserve

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| Opening balance |

$ |

37,219 |

|

$ |

- |

|

| Equity reserve related to convertible debenture (note 10) |

|

- |

|

|

37,219 |

|

| Ending balance |

$ |

37,219 |

|

$ |

37,219 |

|

On June 30, 2023, the Company issued an $1,000,000 unsecured convertible debenture. The debenture bears interest at 12% per annum, calculated and paid quarterly commencing on the date of issuance and matures on June 30, 2026. The debenture holder can convert all or any portion of the outstanding principal amount into common shares of the Company, at a price of $1.25 per common share. Based on the discount factor of 13.5% over the debenture's term of three years used to determine the fair value of the debenture, the conversion feature was classified as equity and was assigned a residual value of $37,219.

13 Financial instruments

The Company examines the various financial instrument risks to which it is exposed and assesses the impact and likelihood of those risks.

The following tables summarize the valuation of the Company's financial assets and liabilities reported at fair value by the fair value hierarchy levels:

| |

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| |

Fair Value

Hierarchy |

|

Fair value

$ |

|

|

Fair value

$ |

|

| Financial assets |

|

|

|

|

|

|

|

| Fair value through profit and loss ("FVTPL") |

|

|

|

|

|

|

|

| Cash |

Level 1 |

|

- |

|

|

47,098 |

|

| Marketable securities |

Level 2 |

|

1,829,250 |

|

|

1,785,510 |

|

| Financial liabilities |

|

|

|

|

|

|

|

| Other financial liabilities |

|

|

|

|

|

|

|

| Overdraft |

Level 1 |

|

40,028 |

|

|

|

|

| Convertible debenture derivative |

Level 3 |

|

993,084 |

|

|

1,027,427 |

|

Fair value

Financial instruments measured at fair value are grouped into Level 1 to 3 based on the degree to which fair value is observable:

Level 1 - quoted prices in active markets for identical securities

Level 2 - significant observable inputs other than quoted prices included in Level 1

Level 3 - significant unobservable inputs.

Convertible debenture derivative is considered to be a Level 3 classification as certain inputs are not based on observable market data. See Note 10 for details on inputs utilized in the valuation.

The Company did not move any instruments between levels of the fair value hierarchy during the period ended March 31, 2024, and December 31, 2023.

The Company's financial instruments include cash, marketable securities, other receivables, related party loan receivable, accounts payable and accrued liabilities, loan payable and promissory notes, joint venture settlement obligation, convertible debentures and convertible debenture derivatives. The carrying values of other receivables, related company loan receivable and accounts payable and accrued liabilities and loan payable and promissory notes approximate their fair values due to their relatively short periods to maturity.

The fair value of the marketable securities is based on recent transaction prices.

The fair value of the joint venture settlement obligation and convertible debentures are initially recorded at fair value and are evaluated by the Company based on level 2 inputs such as discounted future interest and principal payments using current market interest rates of instruments using similar terms. These instruments are subsequently measured through amortized cost, with accretion and interest income recognized through the statement of loss and comprehensive loss.

Interest rate risk

Interest rate risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market interest rates. The Company is exposed to interest rates through the interest earned on cash balances, deposits, convertible debentures and loans; however, management does not believe this exposure is significant as most items are at fixed interest rates.

Credit risk

The Company is exposed to credit risk through its cash, which is held in large Canadian financial institutions with high credit rating, other receivables and the loan receivable. The Company believes the credit risk is insignificant for the cash and other receivables and moderate for the loan receivable with Captiva. The Company's exposure is limited to amounts reported within the statement of financial position.

Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company manages liquidity risk through the management of its capital structure. In order to meet its financial obligations, the Company will need to generate cash flow from the sale or otherwise disposition of property or raise additional funds. The following table summarizes the remaining contractual maturities of the Company's financial liabilities and operating commitments:

| |

|

Less than 1 year |

|

|

Over 1 year |

|

|

Total |

|

| Overdraft |

$ |

40,028 |

|

$ |

- |

|

$ |

40,028 |

|

| Accounts payable and accrued liabilities |

|

4,353,270 |

|

|

- |

|

|

4,353,270 |

|

| Loan payables and promissory notes |

|

1,349,727 |

|

|

- |

|

|

1,349,727 |

|

| Joint venture settlement obligation |

|

1,048,423 |

|

|

2,719,561 |

|

|

3,767,984 |

|

| Convertible debenture |

|

- |

|

|

3,653,643 |

|

|

3,653,643 |

|

| Convertible debenture derivative |

|

- |

|

|

993,084 |

|

|

993,084 |

|

| Total |

$ |

6,791,448 |

|

$ |

7,366,288 |

|

$ |

14,157,736 |

|

Foreign exchange risk

The Company operates in Canada and the United States and is exposed to foreign exchange risk arising from transactions denominated in foreign currencies.

The operating results and the financial position of the Company are reported in Canadian dollars. Fluctuations of the operating currencies in relation to the Canadian dollar will have an impact upon the reported results of the Company and may also affect the value of the Company's assets and liabilities.

The Company's financial assets and liabilities as at March 31, 2024 are denominated in Canadian Dollars and United States Dollars and are set out in the following table:

| |

|

Canadian Dollars |

|

|

US Dollars |

|

|

Total |

|

| Financial assets |

|

|

|

|

|

|

|

|

|

| Other receivables |

|

5,410 |

|

|

- |

|

|

5,410 |

|

| Marketable securities |

|

- |

|

|

1,829,250 |

|

|

1,829,250 |

|

| |

|

5,410 |

|

|

1,829,250 |

|

|

1,834,660 |

|

| Financial liabilities |

|

|

|

|

|

|

|

|

|

| Overdraft |

$ |

6,302 |

|

$ |

(46,330 |

) |

$ |

(40,028 |

) |

| Accounts payable and accrued liabilities |

|

(554,600 |

) |

|

(3,838,697 |

) |

|

(4,393,297 |

) |

| Loan payable |

|

(30,000 |

) |

|

(1,319,727 |

) |

|

(1,349,727 |

) |

| Joint venture settlement obligation |

|

(4,130,931 |

) |

|

- |

|

|

(4,130,931 |

) |

| Convertible debenture |

|

(798,556 |

) |

|

(2,855,087 |

) |

|

(3,653,643 |

) |

| Convertible debenture derivative |

|

- |

|

|

(993,084 |

) |

|

(993,084 |

) |

| Net financial liabilities |

$ |

(5,502,375 |

) |

$ |

(7,223,675 |

) |

$ |

(12,726,050 |

) |

The Company's financial assets and liabilities as at December 31, 2023 are denominated in Canadian Dollars and United States Dollars and are set out in the following table:

| |

|

Canadian Dollars |

|

|

US Dollars |

|

|

Total |

|

| Financial assets |

|

|

|

|

|

|

|

|

|

| Cash |

$ |

14,936 |

|

$ |

32,162 |

|

$ |

47,098 |

|

| Other receivables |

|

3,476 |

|

|

- |

|

|

3,476 |

|

| Related company loan receivable |

|

206,947 |

|

|

- |

|

|

206,947 |

|

| Marketable securities |

|

- |

|

|

1,785,510 |

|

|

1,785,510 |

|

| |

|

225,359 |

|

|

1,817,672 |

|

|

2,043,031 |

|

| Financial liabilities |

|

|

|

|

|

|

|

|

|

| Accounts payable and accrued liabilities |

$ |

(285,915 |

) |

$ |

(3,537,054 |

) |

$ |

(3,822,969 |

) |

| Loan payable |

|

(30,000 |

) |

|

(751,322 |

) |

|

(781,322 |

) |

| Joint venture settlement obligation |

|

(3,997,091 |

) |

|

- |

|

|

(3,997,091 |

) |

| Convertible debenture |

|

(785,129 |

) |

|

(2,698,761 |

) |

|

(3,483,890 |

) |

| Convertible debenture derivative |

|

- |

|

|

(1,027,427 |

) |

|

(1,027,427 |

) |

| Net financial liabilities |

$ |

(4,872,776 |

) |

$ |

(6,196,892 |

) |

$ |

(11,069,668 |

) |