Mutual Fund Summary Prospectus (497k)

September 30 2013 - 4:47PM

Edgar (US Regulatory)

Summary Prospectus September 30, 2013

PNC Large Cap Core Equity Fund

(effective October 1, 2013, to be renamed PNC Large Cap Core Fund)

Class I – PLEIX

Before you invest, you may want to review the Fund's Prospectus, which contains more information about the Fund and its risks. You can find the Fund's Prospectus, Statement of Additional Information and other information about the Fund online at www.pncfunds.com/Forms_Literature/Prospectuses/default.fs. You may also obtain this information at no additional cost by calling 1-800-622-FUND (3863) or by sending an e-mail request to pncfundfulfillment@pnc.com. The Fund's Prospectus and Statement of Additional Information, both dated September 30, 2013, and as supplemented from time to time, are incorporated by reference into this Summary Prospectus.

INVESTMENT OBJECTIVE

The Fund seeks to provide long-term capital appreciation.

FUND FEES AND EXPENSES

The following table describes the fees and expenses that you may pay if you buy and hold Fund shares.

Shareholder Fees

(fees paid directly from your investment)

|

|

|

Class I

|

|

Maximum Sales Charge (Load) Imposed on Purchases (as a

percentage of offering price)

|

|

|

None

|

|

|

Maximum Deferred Sales Charge (Load) (as a percentage

of net asset value)

|

|

|

None

|

|

|

Maximum Sales Charge (Load) Imposed on Reinvested

Dividends and Other Distributions (as a percentage of

offering price)

|

|

|

None

|

|

|

Redemption Fee (as a percentage of amount redeemed, if

applicable)

|

|

|

None

|

|

|

|

Exchange Fee

|

|

|

None

|

|

|

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value

of your investment)

|

Management Fees

|

|

|

0.75

|

%

|

|

|

Distribution (12b-1) Fees

|

|

|

None

|

|

|

|

Other Expenses

|

|

|

0.43

|

%

|

|

|

Total Annual Fund Operating Expenses

|

|

|

1.18

|

%

|

|

|

Fee Waiver and Expense Reimbursement

1

|

|

|

0.24

|

%

|

|

Total Annual Fund Operating Expenses After Fee Waiver

and Expense Reimbursement

1

|

|

|

0.94

|

%

|

|

1

The Fund's investment adviser (the "Adviser") has contractually agreed to waive Management Fees and reimburse or pay certain operating expenses for the Fund to the extent the Fund's Total Annual Fund Operating Expenses exceed 0.94%, excluding certain expenses such as extraordinary expenses, acquired fund fees and expenses, taxes, brokerage commissions, dealer and underwriter spreads, commitment fees on leverage facilities, prime broker fees and expenses, interest expense and dividend expenses related to short sales. This contract continues through September 30, 2014, at which time the Adviser will determine whether to renew, revise or discontinue it. The Adviser can be reimbursed by the Fund for any contractual fee reductions or expense reimbursements if reimbursement to the Adviser (a) occurs within the three years following the year in which the Fund accrues a liability or recognizes a contingent liability with respect to such amounts paid, waived or reimbursed by the Adviser and (b) does not cause the Total Annual Fund Operating Expenses of a class to exceed the percentage limit that was in effect at the time the Adviser paid, waived or reimbursed the amount being repaid by the Fund.

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in Class I Shares of the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year, and that the Fund's operating expenses remain the same, except that the Fee Waiver and Expense Reimbursement is reflected only in the one year period below. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

|

Class I Shares

|

|

$

|

96

|

|

|

$

|

351

|

|

|

$

|

626

|

|

|

$

|

1,410

|

|

|

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 80% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund primarily invests in a diversified portfolio of domestic equity securities of large cap companies which includes common stock, American Depositary Receipts, preferred stock, warrants and rights. A large portion of the Fund will be invested in companies with a minimum market capitalization of $3 billion, but the Fund may invest in companies of any market capitalization.

Under normal circumstances, the Fund invests at least 80% of its net assets plus any borrowings for investment purposes in equity securities issued by large cap companies. The Fund will provide shareholders with at least 60 days' written notice before changing this 80% policy. The Fund may also invest in foreign stocks in keeping with the Fund's objective.

The Adviser employs a disciplined, rules-based, linear process focused on identifying companies that can produce earnings in

Summary Prospectus 1 of 4 PNC Large Cap Core Equity Fund

excess of market expectations. It begins with a multi-factor model based on stability of earnings, growth factors and value factors. Fundamental analysis then focuses on deriving proprietary earnings estimates, constructing a list of key merits and risks, and calculating high and low price targets which are used to determine reward/risk ratios. Candidate stocks with the ability to exceed consensus earnings estimates that also exhibit greater upside price potential than downside price risk are considered for further review. The stocks are then subject to extensive risk analysis within the context of the overall portfolio. Ongoing monitoring and a strict sell discipline are important aspects of the overall investment process. The Adviser utilizes a disciplined sell process and may choose to sell a holding, for example, when it does not satisfy specific quantitative criteria, if the Adviser's analysts project earnings below consensus estimates, if a security exceeds the Adviser's reasonable price target, or to take advantage of a better investment opportunity.

PRINCIPAL RISKS

Growth Investing Risk.

Growth stocks are generally more sensitive to market movements than other types of stocks primarily because their stock prices are based heavily on future expectations. If the Adviser's assessment of the prospects for a company's growth is wrong, or if the Adviser's judgment of how other investors will value the company's growth is wrong, then the price of the company's stock may fall or not approach the value that the Adviser has placed on it. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of the issuer's bonds and preferred stock generally take precedence over the claims of those who own common stock.

Issuer Risk.

The value of the Fund's investments may decline for a number of reasons directly related to the issuer, such as management performance, financial leverage and reduced demand for the issuer's goods or services, in addition to the historical and prospective earnings of the issuer and the value of its assets.

Management Risk.

The Fund is subject to management risk because it is actively managed. The Adviser will apply investment techniques and risk analysis in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired outcome. Additionally, legislative, regulatory or tax developments may affect the investment techniques available to the Adviser in managing the Fund and may also adversely affect the ability of the Fund to achieve its investment objective.

Market Risk.

Market risk is the risk that securities prices will fall over short or extended periods of time. Historically, the stock markets have moved in cycles, and the value of the Fund's securities may fluctuate from day to day. Individual companies may report poor results or be negatively affected by industry and/or economic trends and developments. The prices of securities issued by such companies may decline in response.

Value Investing Risk.

Value stocks can perform differently from the market as a whole and from other types of stocks. Value stocks also present the risk that their lower valuations fairly reflect their business prospects and that investors will not

agree that the stocks represent favorable investment opportunities, and they may fall out of favor with investors and underperform growth stocks during any given period. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of the issuer's bonds and preferred stock generally take precedence over the claims of those who own common stock.

All investments are subject to inherent risks, and an investment in the Fund is no exception. Your investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Accordingly, you may lose money by investing in the Fund.

PERFORMANCE INFORMATION

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the performance of the Fund's Class I Shares from year to year and by showing how the average annual returns of the Fund's Class I Shares compare with those of a broad measure of market performance. As with all mutual funds, the Fund's past performance (before and after taxes) does not predict the Fund's future performance. Updated information on the Fund's performance can be obtained by visiting http://pncfunds.com/Funds_Performance/Fund_Snapshot/

FundID_212/Overview.fs or by calling 1-800-622-FUND (3863).

Calendar Year Total Returns

|

Best Quarter

|

|

|

13.73

|

%

|

|

(06/30/03)

|

|

|

Worst Quarter

|

|

|

-25.68

|

%

|

|

(12/31/08)

|

|

The Fund's year-to-date total return for Class I Shares through June 30, 2013 was 9.13%.

AVERAGE ANNUAL TOTAL RETURNS

(For the periods ended December 31, 2012)

|

|

|

1 Year

|

|

5 Years

|

|

10 Years

|

|

|

Class I Shares

|

|

|

Returns Before Taxes

|

|

|

12.65

|

%

|

|

|

0.10

|

%

|

|

|

5.53

|

%

|

|

|

Returns After Taxes on Distributions

1

|

|

|

12.45

|

%

|

|

|

-0.09

|

%

|

|

|

5.06

|

%

|

|

Returns After Taxes on Distributions

and Sale of Fund Shares

1

|

|

|

8.48

|

%

|

|

|

0.04

|

%

|

|

|

4.75

|

%

|

|

S&P 500 Index (reflects no deduction

for fees, expenses or taxes)

|

|

|

16.00

|

%

|

|

|

1.66

|

%

|

|

|

7.10

|

%

|

|

1

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

Summary Prospectus 2 of 4 PNC Large Cap Core Equity Fund

MANAGEMENT OF THE FUND

Investment Adviser

PNC Capital Advisors, LLC is the investment adviser to the Fund.

Portfolio Managers

|

Name

|

|

Years as

Member

of Fund's

Portfolio

Management

Team

|

|

Title

|

|

|

Douglas J. Roman, CFA, CMT

|

|

|

4

|

|

|

Managing Director

|

|

|

Mark W. Batty, CFA

|

|

|

4

|

|

|

Senior Portfolio Manager

|

|

|

Ruairi G. O'Neill, CFA

|

|

|

4

|

|

|

Senior Portfolio Manager

|

|

IMPORTANT ADDITIONAL INFORMATION

Purchase and Sale of Fund Shares

You may purchase or redeem (sell) shares of the Funds by phone, mail, wire or online on each day that the New York Stock Exchange ("NYSE") is open. Shares cannot be purchased by wire transactions on days when banks are closed.

By Phone, Wire or through a Systematic Plan:

contact your financial intermediary or, if you hold your shares directly through the Funds, you should contact PNC Funds by phone at 1-800-622-FUND (3863).

By Mail:

write to PNC Funds c/o BNY Mellon Investment Servicing (US) Inc., P.O. Box 9795, Providence, Rhode Island 02940-9795.

By Internet:

www.pncfunds.com.

Minimum Initial Investments:

There is no minimum investment amount, except as described in the section of the prospectus entitled "Purchasing, Exchanging and Redeeming Fund Shares".

Minimum Subsequent Investments:

There is no minimum subsequent investment amount.

Tax Information

Each Fund's distributions generally will be taxed to you as ordinary income or capital gains. If you are invested in a Fund through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account, you will generally be taxed only upon your withdrawal of monies from the arrangement.

Payments to Broker Dealers and Other Financial Intermediaries

If you purchase a Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your individual financial professional to recommend the Fund over another investment. Ask your individual financial professional or visit your financial intermediary's website for more information.

Summary Prospectus 3 of 4 PNC Large Cap Core Equity Fund

PNC Funds

P.O. Box 9795

Providence, RI 02940-9795

Golden Star Resources (QB) (USOTC:GLNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

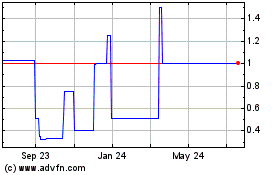

Golden Star Resources (QB) (USOTC:GLNS)

Historical Stock Chart

From Jul 2023 to Jul 2024