Trump's Dollar Comments Send Asia-Pacific Stocks Lower

April 12 2017 - 11:28PM

Dow Jones News

By Kenan Machado

President Donald Trump's comments on the U.S. dollar sent the

currency lower against its Asian counterparts, prompting a selloff

in key regional equity markets early Thursday.

Australia's S&P/ASX 200 was down 0.8% with index

heavyweights, some of which report in U.S. dollars, dragging the

benchmark lower.

Among mining exporters, Fortescue Metals slumped as much as

8.1%, while Rio Tinto lost 4.4%. BHP Billiton fell 4%. The

Australian dollar was last up 0.6% against its U.S.

counterpart.

In Japan, the Nikkei Stock Average was down 1.1% after earlier

reaching its lowest level since December, as the yen hit fresh

five-month highs against the U.S. dollar.

The WSJ Dollar Index, which measures the dollar against 16

currencies, fell 0.5% during U.S. trading and was off another 0.1%

in Asia.

The dollar began its slide overnight after Mr. Trump told The

Wall Street Journal that the currency "is getting too strong" and

he would prefer the Federal Reserve to keep interest rates low.

"It's very, very hard to compete when you have a strong dollar and

other countries are devaluing their currency," he said.

Mr. Trump also said he changed his mind on calling China a

currency manipulator because he doesn't want to jeopardize talks

with Beijing over confronting the North Korean threat.

"As soon as his comments hit the wires, including his comments

favoring a low-interest rate and that China is not a currency

manipulator, the U.S. dollar came under heavy pressure," said Greg

McKenna, chief market strategist at AxiTrader.

Early Thursday, China's central bank set the yuan 0.4% stronger

against the dollar, the biggest one-day increase since Jan. 18. The

dollar was last down 0.2% against the yuan in onshore trading.

But analysts say that the interest rate differential between the

U.S. and other countries could support the dollar. On Thursday,

central banks in South Korea and Singapore both kept policy

unchanged.

Meanwhile, overnight selling in U.S. banking shares extended

into Asia. Citigroup, J.P. Morgan Chase and Wells Fargo will report

first-quarter earnings Thursday. Australia's Macquarie Group fell

0.9% while Australia and New Zealand Banking Group lost 0.6%.

Japan's Shinsei Bank was off 1.6% and Mitsubishi UFJ Financial fell

1.4%.

The rising uncertainty pushed up demand for gold, with prices

hitting another five-month high Thursday. A weaker dollar makes

gold cheaper to buy.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

April 12, 2017 23:13 ET (03:13 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

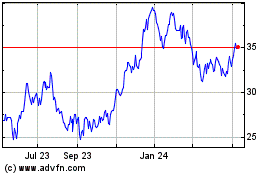

Fortescue Metal (QX) (USOTC:FSUGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

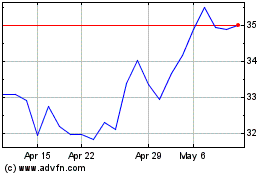

Fortescue Metal (QX) (USOTC:FSUGY)

Historical Stock Chart

From Dec 2023 to Dec 2024