Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

February 28 2020 - 6:35AM

Edgar (US Regulatory)

Free Writing Prospectus

Filed pursuant to Rule 433

Supplementing the

Preliminary Prospectus Supplement, dated February 26, 2020

Registration No. 333-236647

$350,000,000

3.375% Fixed to Floating Rate Subordinated Notes due 2030

Term Sheet

|

Issuer:

|

First Citizens BancShares, Inc. (the “Company”)

|

|

|

|

|

Security:

|

3.375% Fixed to Floating Rate Subordinated Notes due 2030 (the “Notes”)

|

|

|

|

|

Aggregate Principal Amount:

|

$350,000,000

|

|

|

|

|

Ratings:

|

Baa1 by Moody’s

A rating is not a recommendation to buy, sell or hold securities. Ratings may be subject to revision or withdrawal at any time by the assigning rating organization. Each rating should be evaluated independently of any other rating.

|

|

|

|

|

Trade Date:

|

February 27, 2020

|

|

|

|

|

Settlement Date:

|

March 4, 2020 (T + 4)

|

|

|

|

|

Final Maturity Date (if not previously redeemed):

|

March 15, 2030

|

|

|

|

|

Coupon:

|

From and including the Settlement Date, to but excluding, March 15, 2025 or the date of earlier redemption (the “fixed rate period”) 3.375% per annum, payable semi-annually in arrears. From and including March 15, 2025 to, but excluding, the

Maturity Date or the date of earlier redemption (the “floating rate period”), a floating per annum rate equal to a Benchmark rate, (which is expected to be the Three-Month Term SOFR) (each as defined in the prospectus supplement under

“Description of the Notes — Interest”), plus 246.5 basis points for each quarterly interest period during the floating rate period, payable quarterly in arrears; provided, however, that if the Benchmark rate is less than zero, the Benchmark

rate shall be deemed to be zero.

|

|

|

|

|

Interest Payment Dates:

|

Interest on the Notes will be payable on March 15 and September 15 of each year through, but not including, March 15, 2025, and quarterly thereafter on March 15, June 15, September 15, and December 15 of each year to, but not including, the

maturity date or earlier redemption date. The first interest payment will be made on September 15, 2020.

|

|

|

|

|

Record Dates:

|

The 15th calendar day immediately preceding the applicable interest payment date

|

|

|

|

|

Day Count Convention:

|

30/360 to but excluding March 15, 2025, and, thereafter, a 360-day year and the number of days actually elapsed.

|

|

Optional Redemption:

|

The Company may, at its option, beginning with the interest payment date of March 15, 2025 and on any interest payment date thereafter, redeem the Notes, in whole or in part, from time to time, subject to obtaining the prior approval of the

Federal Reserve to the extent such approval is then required under the capital adequacy rules of the Federal Reserve, at a redemption price equal to 100% of the principal amount of the Notes being redeemed plus accrued and unpaid interest to

but excluding the date of redemption.

|

|

|

|

|

Special Redemption:

|

The Company may redeem the Notes, in whole but not in part, at any time, including prior to March 15, 2025, subject to obtaining the prior approval of the Federal Reserve to the extent such approval is then required under the capital

adequacy rules of the Federal Reserve, if (i) a change or prospective change in law occurs that could prevent us from deducting interest payable on the Notes for U.S. federal income tax purposes, (ii) a subsequent event occurs that could

preclude the Notes from being recognized as Tier 2 Capital for regulatory capital purposes, or (iii) we are required to register as an investment company under the Investment Company Act of 1940, as amended, in each case, at a redemption price

equal to 100% of the principal amount of the Notes plus any accrued and unpaid interest to but excluding the redemption date.

|

|

|

|

|

Denominations:

|

$1,000 minimum denominations and $1,000 integral multiples thereof.

|

|

|

|

|

Use of Proceeds:

|

The Company intends to use the net proceeds from this offering for general corporate purposes.

|

|

|

|

|

Price to Public:

|

100.00%

|

|

|

|

|

Underwriters’ Discount:

|

0.875% of principal amount

|

|

|

|

|

Proceeds to Issuer (after underwriters’ discount, but before expenses):

|

$346,937,500

|

|

Ranking:

|

The Notes will be unsecured, subordinated obligations of the Company and:

|

|

•

|

will rank junior in right of payment and upon the Company’s liquidation to any of the Company’s existing and all future Senior Debt (as defined in the indenture pursuant to which the Notes

will be issued and described under “Description of the Notes” in the preliminary prospectus supplement);

|

|

•

|

will rank equal in right of payment and upon our liquidation with any of the Company’s existing and all of its future indebtedness the terms of which provide that such indebtedness ranks

equally with the Notes;

|

|

•

|

will rank senior in right of payment and upon the Company’s liquidation to (i) its existing junior subordinated debentures and (ii) any of its future indebtedness the terms of which provide

that such indebtedness ranks junior in right of payment to note indebtedness such as the Notes; and

|

|

•

|

will be effectively subordinated to the Company’s future secured indebtedness to the extent of the value of the collateral securing such indebtedness, and structurally subordinated to the

existing and future indebtedness of the Company’s subsidiaries, including without limitation depositors of First-Citizens Bank & Trust Company (“First Citizens Bank”), liabilities to general creditors and liabilities arising in the ordinary

course of business or otherwise.

|

|

|

As of December 31, 2019, on a consolidated basis, the Company’s liabilities totaled approximately $36.24 billion, which includes approximately $34.43 billion of deposit liabilities, $572.19 million of Federal

Home Loan Bank borrowings, $163.41 million of junior subordinated debentures issued or assumed by the Company and First Citizens Bank, $591.27 million of other borrowings and $480.21 million of other liabilities. Except for the approximately

$105.68 million of junior subordinated debentures issued or assumed by the Company (which rank junior in right of payment and upon liquidation to the Notes), all of these liabilities are contractually or structurally senior to the Notes. The

Indenture does not limit the amount of additional indebtedness the Company or its subsidiaries may incur.

|

|

|

|

|

CUSIP/ISIN:

|

31946M AA1 / US31946MAA18

|

|

|

|

|

Book-Running Manager:

|

Piper Sandler & Co.

|

We expect that delivery of the Subordinated Notes will be made against payment for the Subordinated Notes on or about Settlement Date indicated above, which will be the fourth business day following

the trade date of February 27, 2019 (this settlement cycle being referred to as “T+4”). Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally will be required to settle in two business days,

unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Subordinated Notes on any date prior to the fourth business day preceding the Settlement Date will be required, by virtue of the fact that the

notes will initially settle in four business days (T+4), to specify alternative settlement arrangements to prevent a failed settlement and should consult their own investment advisor.

This Pricing Term Sheet is qualified in its entirety by reference to the Preliminary Prospectus Supplement. The information in this Pricing Term Sheet supplements the Preliminary Prospectus Supplement

and supersedes the information in the Preliminary Prospectus Supplement to the extent it is inconsistent with the information in the Preliminary Prospectus Supplement. Other information (including other financial information) presented in the

Preliminary Prospectus Supplement is deemed to have changed to the extent affected by the information contained herein. Capitalized terms used in this Pricing Term Sheet but not defined have the meanings given them in the Preliminary Prospectus

Supplement. The Issuer has filed a registration statement (including a prospectus) and a preliminary prospectus supplement with the Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest, you

should read the prospectus in that registration statement, the preliminary prospectus supplement and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get these documents for

free by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offerings will arrange to send you the prospectus and the related preliminary prospectus supplement if you

request it by calling Piper Sandler & Co. toll-free at (866) 805-4128 or emailing fsgsyndicate@psc.com.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF

THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

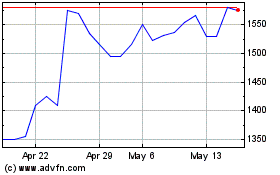

First Citizen Bancshares (PK) (USOTC:FCNCB)

Historical Stock Chart

From Jun 2024 to Jul 2024

First Citizen Bancshares (PK) (USOTC:FCNCB)

Historical Stock Chart

From Jul 2023 to Jul 2024