Amended Statement of Beneficial Ownership (sc 13d/a)

February 04 2013 - 6:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 13D/A

Amendment No. 2

Final Amendment

Under the Securities Exchange Act of 1934

ECO-TEK GROUP, INC.

(Name of Issuer)

COMMON STOCK, PAR VALUE $0.001 PER SHARE

(Title of Class of Securities)

27887Y 106

(CUSIP Number)

Ira Morris

20 Rockport Crescent

Richmond Hill, Ontario

L4C 2L6

Telephone: 905-709-3410

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

January 22, 2012

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. [

]

The information required in the remainder of this cover page shall not be deemed to be filed for the purpose of Section 18 of the Securities Exchange Act of 1934 ("

Act

") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act.

|

|

|

|

|

| 1 |

|

Names of Reporting Persons.

|

|

|

|

I.R.S. Identification Nos. of above persons (entities only).

|

|

|

|

|

|

|

|

Ira Morris

|

|

|

|

|

| 2 |

|

Check the Appropriate Box if a Member of a Group

|

(a)[ ]

|

|

|

|

(b)[ ]

|

|

|

|

|

|

|

|

|

|

| 3 |

|

SEC Use Only

|

|

|

|

|

|

|

|

|

|

|

| 4 |

|

Source of Funds

|

|

|

|

IN

|

|

|

|

|

|

|

| 5 |

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

|

[ ]

|

|

|

|

|

|

|

|

|

|

| 6 |

|

Citizenship or Place of Organization

|

|

|

|

Canada

|

|

|

|

| 7 | Sole Voting Power

|

|

|

333,333 shares of the Company’s common stock

|

|

Number of

|

|

|

Shares Bene-

|

|

|

ficially

|

| 8 | Shared Voting Power

|

|

Owned by Each

|

0

|

|

Reporting

|

|

|

Person With

|

| 9 | Sole Dispositive Power

|

|

|

333,333 shares of the Company’s common stock

|

|

|

|

|

|

10 | Shared Dispositive Power

|

|

|

N/A

|

|

|

|

|

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

|

|

|

333,333 shares of the Company’s common stock

|

|

|

|

|

|

|

|

| 12 |

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

|

|

|

N/A

|

|

|

|

|

| 13 |

|

Percent of Class Represented by Amount in Row (11) (see Item 3 and Item 5)

|

|

|

Less than one percent

|

|

|

|

|

| 14 |

|

Type of Reporting Person

|

|

|

IN

|

This Amendment No. 2 Final Amendment (the “

Amendment

”) amends and supplements the Schedule 13D filed with the Securities and Exchange Commission (the “

Commission

”) on May 10, 2012 and the Amendment No. 1 to the Schedule 13D filed on July 17, 2012, by Ira Morris (collectively, the “

Schedule 13-D

”). Capitalized terms used but not otherwise defined in this Amendment have the meanings ascribed to such terms in the Schedule 13-D. Except as expressly amended and supplemented by this Amendment, the Schedule 13-D is not amended or supplemented in any respect.

Item 3. Source of Amount of Funds or Other Compensation

Effective January 22, 2013, Mr. Morris sold all 50,000,000 shares of the Company’s common stock which he held in a private transaction to four separate parties (including his adult son who purchased 25 million shares) for aggregate consideration of $8,400 or $0.000168 per share.

On January 29, 2013, Mr. Morris and the Company entered into a Debt Conversion Agreement, whereby Mr. Morris converted $10,000 which he had previously loaned the Company’s wholly-owned subsidiary, into 333,333 shares of the Company’s common stock ($0.03 per share).

Item 5. Interest in Securities of the Issuer

|

|

(a)

|

Mr. Morris beneficially owns 333,333 shares of the Company’s outstanding common stock, representing less than one percent of the Company’s outstanding common stock.

|

|

|

(b)

|

Mr. Morris holds the sole power to vote and direct the vote and the sole power to dispose and to direct the disposition of 333,333 shares of the Company’s common stock.

|

|

|

(c)

|

None other than as described in Item 3.

|

|

|

(d)

|

No other person has the right to receive or the power to direct the receipt of dividends from or the proceeds from the sale of 333,333 shares of the Company’s common stock.

|

|

|

(e)

|

Mr. Morris ceased to own more than 4.99% of the Company’s common stock on January 22, 2013.

|

Signature

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: February 1, 2013

|

By:

|

/s/ Ira Morris

|

|

|

Ira Morris

|

|

|

|

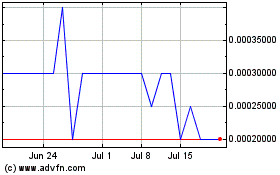

Eco Tek (PK) (USOTC:ETEK)

Historical Stock Chart

From Jun 2024 to Jul 2024

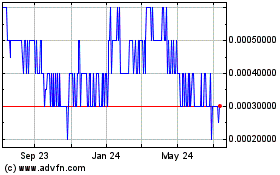

Eco Tek (PK) (USOTC:ETEK)

Historical Stock Chart

From Jul 2023 to Jul 2024