UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. ________)*

DynaResource,

Inc.

(Name

of Issuer)

Common

Shares

(Title

of Class of Securities)

268073

10 3

(CUSIP

Number)

K.W.

(“K.D.”) DIEPHOLZ

(Name,

Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

July

18, 2008

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. [

]

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section

18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

| |

|

|

|

|

| 1. |

|

NAMES

OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

KOY W. (“K.D.”) DIEPHOLZ |

|

|

| 2. |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) [ ]

(b) [ ] |

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS (see instructions)

PF and OO |

|

|

| 5. |

|

CHECK BOX

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ] |

|

|

| 6. |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

UNITED STATES OF AMERICA |

|

|

| |

|

|

|

|

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE

VOTING POWER

1,775,100 |

| |

8. |

|

SHARED

VOTING POWER

0 |

| |

9. |

|

SOLE

DISPOSITIVE POWER

1,775,100 |

| |

10. |

|

SHARED

DISPOSITIVE POWER

0 |

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,775,100 |

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) ¨ |

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11.6% |

| 14. |

|

TYPE OF REPORTING PERSON (see instructions)

IN |

| |

|

Item 1. Security

and Issuer.

Item 2. Identity

and Background.

Item 3. Source

or Amount of Funds or Other Consideration.

Item 4. Purpose

of Transaction.

Item 5. Interest

in Securities of the Issuer.

Item 6. Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Item 7. Material

to Be Filed as Exhibits.

This

Schedule 13D (this “Statement”) is filed by Koy W. (“K.D.”) Diepholz, individually.

Item

1. Security and Issuer

This

Statement relates to the Common Stock, par value $0.01 per share (“Common Stock”) of DynaResource, Inc., a Delaware

corporation (the “Issuer”). The address of the principal executive office of the Issuer is 222

W. Las Colinas Blvd., Suite 744 East Tower, Irving, Texas, 75039.

Item

2. Identity and Background

(a)

The following information is provided as to Mr. Diepholz.

(b)

The address of the principal office of Mr. Diepholz is 222 W. Las Colinas Blvd., Suite 744 East Tower, Irving, Texas, 75039.

(c)

Mr. Diepholz is the Chief Executive Officer and a member of the Board of Directors of the Issuer. The primary business of the

Issuer is the ownership and operation of mining operations. The address of the principal office of Issuer is 222 W. Las Colinas

Blvd., Suite 744 East Tower, Irving, Texas, 75039.

(d)

& (e) During the last five years, Mr. Diepholz has not (i) been convicted in a criminal proceeding (excluding traffic violations

or similar misdemeanors) or (ii) been party to a civil proceeding of a judicial or administrative body of competent jurisdiction

and as a result of such proceeding were or are subject to a judgment, decree or final order enjoining future violations of, or

prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such

laws.

(f)

Mr. Diepholz is a citizen of the United States.

Item

3. Source and Amount of Funds or Other Consideration.

The

registration of a class of equity securities (the Common Stock) of the Issuer under section 12 of the Securities Exchange Act

of 1934 became effective on July 18, 2008. Accordingly, this Statement reflects Mr.

Diepholz’s ownership as of such date, and through the date of filing of this Statement.

On July 18, 2008, Mr. Diepholz owned 1,419,415 shares of the Issuer’s Common Stock, representing in excess of 5% of the

outstanding shares. The following table details the acquisitions comprising such 1,419,415 shares:

| Date

of Purchase |

Shares

Purchased |

Source

of Funds |

Amount

of Funds or other Consideration |

| 4/11/1996 |

350,000 |

Not

applicable |

Services |

| 11/21/1996 |

418,632 |

Not

applicable |

Services |

| 12/07/2000 |

18,989 |

Debt

retirement |

$23,926 |

| 12/07/2000 |

87,500 |

Personal

Funds |

$70,875 |

| 12/29/2000 |

204,813 |

Not

applicable |

Services |

| 12/30/2004 |

250,000 |

Not

applicable |

Services |

| 12/29/2006 |

89,981 |

Not

applicable |

Services |

During

the calendar year ended 12/31/2011, Mr. Diepholz acquired 20,000 shares of the Issuer’s Common Stock in a series of transactions

for aggregate consideration of $84,425, all of which consideration was personal funds.

During

the calendar year ended 12/31/2012, Mr. Diepholz acquired 18,600 shares of the Issuer’s Common Stock in a series of transactions

for aggregate consideration of $72,892, all of which consideration was personal funds.

During

the calendar year ended 12/31/2013, Mr. Diepholz acquired 25,297 shares of the Issuer’s Common Stock in a series of transactions

for aggregate consideration of $72,884, all of which consideration was personal funds.

During

the calendar year ended 12/31/2014, Mr. Diepholz acquired 168,247 shares of the Issuer’s Common Stock in a series of transactions

for aggregate consideration of $426,184, all of which consideration was personal funds.

During

the period January 1, 2015 through April 15, 2015, Mr. Diepholz acquired 123,041 shares of the Issuer’s Common Stock in

a series of transactions for aggregate consideration of $54,860 all which consideration was personal funds. Such transactions

include the following transaction effected during the 60 days prior to the filing of this Statement:

| Date

of Purchase |

Shares

Purchased |

Source

of Funds |

Amount

of Funds or other Consideration |

| 4/13/2015 |

100,000 |

Not

Applicable |

Services |

Item

4. Purpose of Transaction.

Mr. Diepholz

acquired shares of Common Stock of the Issuer for investment purposes. Mr. Diepholz intends to review his investment in the Issuer

on a continuing basis and may, at any time, consistent with his obligations under the federal securities laws, determine to increase

or decrease his ownership of securities of the Issuer through purchases or sales in the open market or in privately-negotiated

transactions, including estate planning transactions. The review of his holdings in the Issuer’s Common Stock will depend

on various factors, including the Issuer’s business prospects, other developments concerning the Issuer, general economic

conditions, financial and stock market conditions, considerations arising from tax and estate planning matters, his need for and

availability of capital, and any other facts and circumstances which may become known to him regarding his investment in the Issuer.

Other than the foregoing, at the time of filing this Statement, Mr. Diepholz has no plans to purchase additional securities of

the Issuer in the open market in the immediate future. However, Mr. Diepholz may engage in privately-negotiated or open market

transactions in the future for his own account, and hereby reserves the right to reevaluate his investment in the Issuer and to

purchase additional securities in the open market or otherwise.

Except

as may occur in the ordinary course of business of the Issuer, Mr. Diepholz does not have any present plans or proposals which

relate to or would result in (i) an extraordinary corporate transaction, such as a merger, reorganization, or liquidation,

involving the Issuer or any of its subsidiaries, (ii) a sale or transfer of a material amount of assets of the Issuer or

any of its subsidiaries, (iii) any change in the board of directors or executive management of the Issuer or any of its subsidiaries,

(iv) any material change in the present capitalization or dividend policy of the Issuer, (v) any other material change

in the Issuer’s business or corporate structure, (vi) changes in the Issuer’s charter or bylaws or other actions

which may impede the acquisition of control of the Issuer by any person, (vii) a series of securities of the Issuer being

delisted from a national securities exchange or no longer being quoted in an inter-dealer quotation system of a registered national

securities association, (viii) a series of equity securities of the Issuer becoming eligible for termination of registration

pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934, or (ix) any action similar to any of those described

above. However, Mr. Diepholz, in his capacity as Chief Executive Officer and member of the Board of Directors of the Issuer,

may, from time to time, become aware of, initiate and/or be involved in discussions which relate to the transactions described

in this Item 4 and thus retains his right to modify his plans with respect to the transactions described in this Item 4

to acquire or dispose of securities of the Issuer and to formulate plans and proposals which could result in the occurrence of

any such events, subject to applicable laws and regulations.

Item

5. Interest in Securities of the Issuer.

(a)

As of the date of filing of this Statement, Mr. Diepholz beneficially owns 1,775,100 shares of the Issuer’s Common Stock,

representing approximately 11.6% of the Issuer’s Common Stock outstanding as of May 6, 2015.

(b)

As of the date of filing of this Statement, Mr. Diepholz has sole power to vote and sole dispositive power over 1,775,100 shares

of the Issuer’s Common Stock.

(c)

Except as disclosed in Item 3, Mr. Diepholz has not effected any transaction involving shares of the Issuer’s Common

Stock during the past 60 days.

(d)

Not applicable.

(e)

Not applicable.

Item

6. Contracts, Arrangements, Undertakings or Relationships with Respect to Securities of the Issuer.

Mr.

Diepholz has executed a Voting and Support Agreement among a limited number of stockholders to

facilitate the amendment of the Issuer’s charter. The parties to the Voting and Support Agreement are named in the attached

exhibit.

Item

7. Material to be Filed as Exhibits.

The

Voting and Support Agreement referenced in Item 6 is attached to this Statement as an exhibit and is incorporated herein by reference.

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

| |

Dated: May 8, 2015 |

Koy W. (“K.D.”) Diepholz, Individually |

| |

|

|

| |

|

|

| |

|

/s/ Koy W. (“K.D.”) Diepholz |

| |

|

Koy W. (“K.D.”) Diepholz |

Exhibits.

Exhibit

Number

|

Description

|

| 1.1

* |

Voting

and Support Agreement among the stockholders listed, the Issuer, and Golden Post Rail, LLC |

*

Filed herewith

Exhibit

1.1

Execution

Version

VOTING

AND SUPPORT AGREEMENT

This

VOTING AND SUPPORT AGREEMENT, dated as of May 6, 2015 (this “Agreement”), is by and among the stockholders

listed on the signature pages hereto (collectively, the “Stockholders” and each individually, a “Stockholder”),

DynaResource, Inc., a Delaware corporation (the “Company”) and Golden Post Rail, LLC, a Texas limited

liability company (the “Purchaser”).

RECITALS

WHEREAS,

as of the date hereof, each Stockholder is the record and beneficial owner of the number of shares of the Company’s Common

Stock, par value $0.01 per share, set forth opposite such Stockholder’s name on the attached Schedule A and any other

shares acquired by such stockholders (the “Subject Shares”);

WHEREAS,

concurrently with the execution of this Agreement, the Purchaser and the Company are entering into (i) a Securities Purchase

Agreement (the “SPA”), pursuant to which Purchaser will acquire 1,600,000 shares of Series C Senior

Convertible Preferred Stock of the Company and a Common Stock Purchase Warrant to purchase 2,000,000 shares of the Company’s

Common Stock (the “Securities”) subject to the terms and conditions of the SPA and (ii) a Promissory

Note (the “Note”) pursuant to which Purchaser will lend $500,000 to the Company subject to the terms

and conditions of the Note; and

WHEREAS,

the Purchaser has required that the Company and the Stockholders enter into this Agreement as a condition to its willingness to

enter into this Agreement, and the Company and the Stockholders desire to enter into this Agreement to induce the Purchaser to

purchase the Securities under the SPA and lend $500,000 under the Note;

NOW,

THEREFORE, in consideration of the foregoing and the mutual covenants and agreements contained herein, and intending to be legally

bound hereby, the parties hereby agree, severally and not jointly, as follows:

1. Voting

of Shares. From the period commencing with the execution and delivery of this Agreement and continuing through the Expiration

Date (defined below), at every meeting of the stockholders of the Company called with respect to any of the following, and at

every adjournment or postponement thereof, and on every action or approval by written consent of the stockholders of the Company

with respect to any of the following, each Stockholder shall vote or cause to be voted the Subject Shares that such Stockholder

is entitled to vote in favor of the two (2) amendments to the certificate of incorporation of the Company described in more detail

on Schedule B;

2. Transfer

of Shares. Each Stockholder covenants and agrees that during the period from the date of this Agreement through the Expiration

Date, such Stockholder will not, directly or indirectly, (i) transfer, assign, sell, or otherwise dispose of (“Transfer”),

or cause to be Transferred, any of the Subject Shares, (ii) deposit any of the Subject Shares into a voting trust or

enter into a voting agreement or arrangement with respect to the Subject Shares or grant any proxy or power of attorney with respect

thereto that is inconsistent with this Agreement, (iii) enter into any contract, option or other arrangement with respect

to the Transfer of any Shares, or (iv) take any other action that would materially restrict, limit or interfere with the

performance of such Stockholder’s obligations hereunder.

3. Further

Assurances. From time to time and without additional consideration, each Stockholder shall execute and deliver, or cause to

be executed and delivered, such additional instruments, and shall take such further actions, as the Company may reasonably request

for the purpose of carrying out and furthering the intent of this Agreement.

4. Representations

and Warranties of each Stockholder. Each Stockholder on its own behalf hereby represents and warrants to the Company and the

Purchaser, severally and not jointly, with respect to such Stockholder and such Stockholder’s ownership of the Subject Shares

as follows:

(a) Authority.

Such Stockholder has all requisite power and authority to enter into this Agreement and to consummate the transactions contemplated

hereby. This Agreement has been duly authorized, executed and delivered by such Stockholder and constitutes a valid and binding

obligation of such Stockholder enforceable in accordance with its terms, except as enforcement may be limited by applicable bankruptcy,

insolvency, reorganization, moratorium or similar laws affecting creditors’ rights generally and by general principles of

equity (regardless of whether considered in a proceeding in equity or at law). If such Stockholder is a trust, no consent of any

beneficiary is required for the execution and delivery of this Agreement or the consummation of the transactions contemplated

hereby. Other than as any filings by Stockholder with the Securities and Exchange Commission, the execution, delivery and performance

by such Stockholder of this Agreement does not require any consent, approval, authorization or permit of, action by, filing with

or notification to any governmental entity.

(b) No

Conflicts. Neither the execution and delivery of this Agreement, nor the consummation of the transactions contemplated hereby,

nor compliance with the terms hereof, will violate, conflict with or result in a breach of, or constitute a default under any

provision of, any agreement applicable to such Stockholder or to such Stockholder’s property or assets.

(c) The

Subject Shares. Such Stockholder is the record and beneficial owner of and has good and marketable title to, the Subject Shares

set forth opposite such Stockholder’s name on Schedule A hereto. Such Stockholder has, or will have at

the time of the applicable stockholder meeting, the sole right to vote or direct the vote of, or to dispose of or direct the disposition

of, such Subject Shares, and none of the Subject Shares is subject to any agreement, arrangement or restriction with respect to

the voting of such Subject Shares that would prevent or delay a Stockholder’s ability to perform its obligations hereunder.

There are no agreements or arrangements of any kind, obligating such Stockholder to Transfer, or cause to be Transferred, any

of the Subject Shares set forth opposite such Stockholder’s name on Schedule A and no person, including

but not limited to any natural person, firm, individual, partnership, joint venture, business trust, trust, association, corporation,

company, limited liability company, unincorporated entity or governmental authority, has any contractual or other right or obligation

to purchase or otherwise acquire any of such Subject Shares.

(d) Reliance

by the Company. Such Stockholder understands and acknowledges that the Company is entering into the SPA in reliance upon such

Stockholder’s execution and delivery of this Agreement.

5. Representations

and Warranties of the Company. The Company represents and warrants to the Stockholders and the Purchaser that the Company

is a corporation duly incorporated, validly existing and in good standing under the laws of the State of Delaware and has full

corporate power and authority to execute and deliver this Agreement and to consummate the transactions contemplated hereby. The

execution and delivery of this Agreement, the SPA and the Note by the Company and the consummation of the transactions contemplated

hereby and thereby have been duly and validly authorized by the Company’s Board of Directors, and no other corporate proceedings

on the part of the Company are necessary to authorize the execution, delivery and performance of this Agreement, the SPA and the

Note by the Company and the consummation of the transactions contemplated hereby and thereby. The Company has duly and validly

executed this Agreement, and this Agreement constitutes a legal, valid and binding obligation of the Company enforceable against

the Company in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization

or other similar Laws affecting creditors’ rights generally and by general equitable principles (regardless of whether enforceability

is considered in a proceeding in equity or at law).

6. Stockholder

Capacity. Each Stockholder is entering into this Agreement solely in such Stockholder’s capacity as the record holder

and beneficial owner of Subject Shares.

7. Termination.

This Agreement shall automatically terminate without further action upon the earlier to occur (the “Expiration Date”)

of (i) the day after the date on which the stockholders meeting to consider and vote upon the amendments to the certificate of

incorporation of the Company described in more detail on Schedule B is finally adjourned, and (ii) August 4, 2015.

8. Specific

Performance. Each Stockholder acknowledges and agrees that (a) the covenants, obligations and agreements contained in this

Agreement relate to special, unique and extraordinary matters, (b) the Company is relying on such covenants in connection with

entering into the SPA and the Note and Purchaser is relying on such covenants in connection with entering into the SPA and lending

the Company $500,000 subject to the terms and conditions of the Note and (c) a violation of any of the terms of such covenants,

obligations or agreements will cause the Company and Purchaser irreparable injury for which adequate remedies are not available

at law and for which monetary damages are not readily ascertainable. Therefore, each Stockholder agrees that the Company and Purchaser

shall be entitled to an injunction, restraining order or such other equitable relief (without the requirement to post bond) as

a court of competent jurisdiction may deem necessary or appropriate to restrain such Stockholder from committing any violation

of such covenants, obligations or agreements. These injunctive remedies are cumulative.

9. Governing

Law; Jurisdiction. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware,

without giving effect to any choice or conflict of law provision or rule that would cause the application of the laws of any jurisdiction

other than the State of Delaware. In addition, each of the parties hereto irrevocably agrees that any legal action or proceeding

with respect to this Agreement and the rights and obligations arising hereunder, shall be brought and determined exclusively in

the Delaware Court of Chancery and any state appellate court therefrom within the State of Delaware.

10. Amendment,

Waivers, etc. Neither this Agreement nor any term hereof may be amended or otherwise modified other than by an instrument

in writing signed by the Company and each of the Stockholders. No provision of this Agreement may be waived, discharged or terminated

other than by an instrument in writing signed by the party against whom the enforcement of such waiver, discharge or termination

is sought.

11. Entire

Agreement. This Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and

supersedes all prior agreements and understandings between the parties with respect thereto. No addition to or modification of

any provision of this Agreement shall be binding upon either party unless made in writing and signed by both parties.

12. Assignment. Neither

party to this Agreement may assign its rights or delegate its obligations hereunder without the prior written consent of the other

party. Any such attempted assignment shall be null and void ab initio.

13. Section Headings. The

headings contained in this Agreement are for reference purposes only and will not affect in any way the meaning or interpretation

of this Agreement.

14. Forbearance;

Waiver. Forbearance or failure to pursue any legal or equitable remedy or right available to a party upon default

under, or upon a breach of, this Agreement shall not constitute waiver of such right, nor shall any such forbearance, failure

or actual waiver imply or constitute waiver of a subsequent default or breach.

15. Legal Fees and Expenses. The

prevailing party in any legal proceeding based upon this Agreement shall be entitled to reasonable attorney’s fees and court

costs, in addition to any other recoveries allowed by law.

16. Time

of Essence. With regard to all dates and time periods set forth or referred to in this Agreement, time is of the essence.

17. Counterparts.

This Agreement may be executed in any number of counterparts, each such counterpart being deemed to be an original instrument,

and all such counterparts shall together constitute the same agreement.

[Remainder

of page intentionally left blank]

IN

WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

| |

DYNARESOURCE, INC. |

|

| |

|

|

| |

|

|

| |

By: _____________________________ |

|

| |

Name: K.W. (“K.D.”) Diepholz |

|

| |

Title: Chairman & CEO |

|

| |

|

|

| |

|

|

| |

|

|

| |

GOLDEN POST RAIL, LLC |

|

| |

|

|

| |

|

|

| |

By: _____________________________ |

|

| |

Name: ________________________ |

|

| |

Title: Manager, President, Secretary and |

|

| |

Treasurer |

|

IN

WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

K.W.

(“K.D.”) Diepholz

________________________________

Name:

K.W. (“K.D.”) Diepholz, individually

Charles

Smith

________________________________

Name:

Charles Smith, individually

Dale

Langenderfer

________________________________

Name:

Dale Langenderfer, individually

Dr.

Ralph Whalen

_______________________________

Name:

Ralph Whalen, individually

Roy

Shannon

_______________________________

Name:

Roy Shannon, individually

Dr.

Jose Vargas Lugo

______________________________

Name:

Dr. Jose Vargas Lugo, individually

Carl

L. Jeter, Jr.

_____________________________

Name:

Carl L. Jeter, Jr., individually

Timothy

Boes

_____________________________

Name:

Timothy Boes, individually

Bob

Clemens Living Trust

_____________________________

Name:

Bob Clemens, Trustee

Ronald

Vail

_____________________________

Name:

Ronald Vail, individually

Schedule

A

Listing

of Stockholders and Shares Owned

| Name |

Shares

of Common Stock Owned |

K.W.

(“K.D.”) Diepholz |

1,775,100

|

Charles

Smith

|

146,250 |

Dale

Langenderfer |

505,447 |

Ralph

Whalen |

333,396 |

Roy

Shannon |

275,170 |

Dr.

Jose Vargas Lugo |

274,508 |

Carl

L. Jeter, Jr. |

159,761 |

Timothy

Boes |

240,000 |

Bob

Clemens Living Trust, Bob Clemens, Trustee |

155,088 |

Ronald

Vail |

195,001

|

| |

|

Total |

4,059,721 |

|

| |

|

|

|

|

| Total Outstanding Shares at May 6, 2015: |

|

15,295,663 |

|

|

| |

|

|

|

|

| Less: |

|

|

|

|

| Shares held by Mineras de DynaResource: |

|

(2,083,333) |

|

|

| (Shares held by a subsidiary are |

|

|

|

|

| not eligible to vote) |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| Total Shares Eligible to Vote: |

|

13,212,330 |

|

|

| |

|

|

|

|

| |

|

|

|

|

| Top 10 as a Percentage of Shares Eligible to Vote: |

|

30.73 % |

|

|

Schedule

B

Proposed

Charter Amendments

- Article

V will be amended and restated to read in its entirety as follows:

The

Board of Directors shall be divided into three classes of directors, Class I Directors, Class II Directors and Class III Directors,

all of whom shall be eligible for election at each annual meeting of the stockholders. The Board of Directors shall have the right

to fix the number of directors from time to time; provided that the number of Class I Directors shall at all times comprise a

majority of the directors and there shall always be at least one Class III Director. The Class I Directors shall be elected by

the vote of the holders of the issued and outstanding shares of Series A Preferred Stock voting together as a single class (and

to the extent that no shares of Series A Preferred Stock are issued and outstanding, then the Class I directors shall be elected

by the vote of the holders of the issued and outstanding shares of Common Stock voting together as a single class), the Class

II Directors shall be elected by the vote of the holders of the issued and outstanding shares of Common Stock voting together

as a single class, and the Class III Directors shall be elected by the vote of the holders of the issued and outstanding shares

of Series C Preferred Stock voting together as a single class (and to the extent that no shares of Series C Preferred Stock are

issued and outstanding, then the Class III directors shall be elected by the vote of the holders of the issued and outstanding

shares of Common Stock voting together as a single class).

- A

new Article XII will be added to read in its entirety as follows:

To

the fullest extent permitted by the General Corporation Law, a director of the Corporation shall not be liable to the Corporation

or its stockholders for monetary damages for breach of fiduciary duty as a director. Without limiting the effect of the preceding

sentence, if the General Corporation Law is hereafter amended to authorize the further elimination or limitation of the liabilities

of a director, then the liability of a director of the Corporation will be eliminated or limited to the fullest extent permitted

by the General Corporation Law, as so amended. This Article XII may only be amended with the vote of 95% of the outstanding equity

of the Corporation, voting on a fully-diluted and as-converted to Common Stock basis.

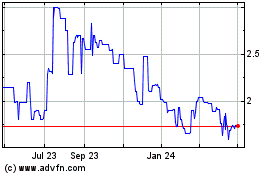

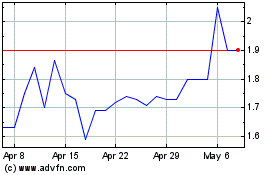

Dynaresource (QX) (USOTC:DYNR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Dynaresource (QX) (USOTC:DYNR)

Historical Stock Chart

From Jul 2023 to Jul 2024