Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

January 16 2025 - 10:26AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

January 16, 2025

Commission File Number: 001-38159

BRITISH AMERICAN TOBACCO P.L.C.

(Translation of registrant’s name into English)

Globe House

4 Temple Place

London WC2R 2PG

United Kingdom

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

This report includes materials as exhibits that have been published and made available by British American Tobacco p.l.c. as of January 16, 2025.

EXHIBIT INDEX

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| |

British American Tobacco p.l.c.

|

|

| |

|

|

|

| |

|

|

|

|

|

By:

|

/s/ Nancy Jiang

|

|

| |

|

Name:

|

Nancy Jiang |

|

| |

|

Title:

|

Senior Assistant Company Secretary

|

|

| |

|

|

|

Date: January 16, 2025

Exhibit 1

British American Tobacco p.l.c.

TR-1: Notification of major holdings

|

1a. Identity of the issuer or the underlying issuer of existing shares to which voting rights are attachedii:

|

British American Tobacco p.l.c.

|

|

1b. Please indicate if the issuer is a non-UK issuer (please mark with an “X”

if appropriate)

|

|

Non-UK issuer

|

|

|

2. Reason for the notification (please mark the appropriate box or boxes with an “X”)

|

|

An acquisition or disposal of voting rights

|

X

|

|

An acquisition or disposal of financial instruments

|

|

|

An event changing the breakdown of voting rights

|

|

|

Other (please specify)iii:

|

|

|

3. Details of person subject to the notification obligationiv

|

|

Name

|

The Capital Group Companies, Inc.

|

|

City and country of registered office (if applicable)

|

Los Angeles, USA

|

|

4. Full name of shareholder(s) (if different from 3)v

|

|

Name

|

|

|

City and country of registered office (if applicable)

|

|

|

Name

|

|

|

City and country of registered office (if applicable)

|

|

|

Name

|

|

|

City and country of registered office (if applicable)

|

|

|

Name

|

|

|

City and country of registered office (if applicable)

|

|

|

Name

|

|

|

City and country of registered office (if applicable)

|

|

|

5. Date on which the threshold was crossed or reachedvi:

|

14/01/2025

|

|

6. Date on which issuer notified (DD/MM/YYYY):

|

15/01/2025

|

|

7. Total positions of person(s) subject to the notification obligation

|

| |

% of voting rights

attached to shares

(total of 8. A)

|

% of voting rights

through financial

instruments

(total of 8.B 1 + 8.B 2)

|

Total of both in %

(8.A + 8.B)

|

Total number of

voting rights of

issuervii

|

|

Resulting situation on the date on which threshold was crossed or reached

|

15.075429

|

0.000000

|

15.075429

|

332948937

|

|

Position of previous notification (if applicable)

|

14.040509

|

0.000000

|

14.040509

|

|

|

8. Notified details of the resulting situation on the date on which the threshold was crossed or reachedviii

|

|

A: Voting rights attached to shares

|

|

Class/type of shares

ISIN code

(if possible)

|

Number of voting rightsix

|

% of voting rights

|

|

Direct

(Art 9 of Directive 2004/109/EC)

(DTR5.1)

|

Indirect

(Art 10 of Directive 2004/109/EC)

(DTR5.2.1)

|

Direct

(Art 9 of Directive 2004/109/EC)

(DTR5.1)

|

Indirect

(Art 10 of Directive 2004/109/EC)

(DTR5.2.1)

|

|

GB0002875804 Common Stock

|

|

277826508

|

|

12.579568

|

|

US1104481072 Depository Receipt

|

|

55122429

|

|

2.495861

|

|

SUBTOTAL 8. A

|

332948937

|

15.075429%

|

|

B 1: Financial Instruments according to Art. 13(1)(a) of Directive 2004/109/EC (DTR5.3.1.1 (a))

|

|

Type of financial instrument

|

Expiration

datex

|

Exercise/Conversion Periodxi

|

Number of voting rights

that may be acquired

if the instrument is

exercised/converted.

|

% of voting rights

|

|

N/A

|

|

|

|

|

| |

|

SUBTOTAL 8. B 1

|

|

|

|

B 2: Financial Instruments with similar economic effect according to Art. 13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1 (b))

|

|

Type of financial instrument

|

Expiration

datex

|

Exercise/Conversion Period xi

|

Physical or

cash settlementxii

|

Number of

voting rights

|

% of voting rights

|

| |

|

|

|

|

|

| |

|

|

SUBTOTAL 8.B.2

|

|

|

| |

|

9. Information in relation to the person subject to the notification obligation (please mark the

applicable box with an “X”)

|

|

Person subject to the notification obligation is not controlled by any natural person or legal entity and does not control any other undertaking(s) holding directly or

indirectly an interest in the (underlying) issuerxiii

|

|

|

Full chain of controlled undertakings through which the voting rights and/or the financial instruments are

effectively held starting with the ultimate controlling natural person or legal entityxiv (please add additional rows as necessary)

|

X

|

|

Namexv

|

Name of controlled

undertaking

|

% of voting rights

if it equals or is

higher than the

notifiable threshold

|

% of voting rights

through financial

instruments if it

equals or is higher

than the

notifiable threshold

|

Total of both if

it equals or is

higher than the

notifiable threshold

|

|

The Capital Group Companies, Inc.

|

Capital Research and

Management Company

|

14.884669

|

|

14.884669%

|

|

The Capital Group Companies, Inc.

|

Capital International, Inc.

|

|

|

|

|

The Capital Group Companies, Inc.

|

Capital Group

Private Client Services, Inc.

|

|

|

|

|

The Capital Group Companies, Inc.

|

Capital International Sarl

|

|

|

|

|

The Capital Group Companies, Inc.

|

Capital International Limited

|

|

|

|

|

10. In case of proxy voting, please identify:

|

|

Name of the proxy holder

|

|

|

The number and % of voting rights held

|

|

|

The date until which the voting rights will be held

|

|

|

11. Additional informationxvi

|

|

The Capital Group Companies, Inc. (”CGC”) is the parent company of Capital Research and Management Company (”CRMC”) and Capital Bank & Trust Company (”CB&T”). CRMC is a

U.S.-based investment management company that serves as investment manager to the American Funds family of mutual funds, other pooled investment vehicles, as well as individual and institutional clients. CRMC and its investment manager

affiliates manage equity assets for various investment companies through three divisions, Capital Research Global Investors, Capital International Investors and Capital World Investors. CRMC is the parent company of Capital Group

International, Inc. (”CGII”), which in turn is the parent company of six investment management companies (”CGII management companies”): Capital International, Inc., Capital International Limited, Capital International Sàrl, Capital

International K.K., Capital Group Private Client Services Inc, and Capital Group Investment Management Private Limited. CGII management companies primarily serve as investment managers to institutional and high net worth clients. CB&T is

a U.S.-based registered investment adviser and an affiliated federally chartered bank.

Neither CGC nor any of its affiliates own shares of the Issuer for its own account. Rather, the shares reported on this Notification are owned by accounts under the

discretionary investment management of one or more of the investment management companies described above.

|

|

Place of completion

|

Los Angeles

|

|

Date of completion

|

15 January 2025

|

Name of duly authorised officer of issuer responsible for making notification:

Nancy Jiang

Senior Assistant Company Secretary

British American Tobacco p.l.c.

16 January 2025

Enquiries:

British American Tobacco Media Centre

+44 (0)20 7845 2888 (24 hours) │@BATPlc

Investor Relations

Victoria Buxton: +44 (0)20 7845 2012 | IR_team@bat.com

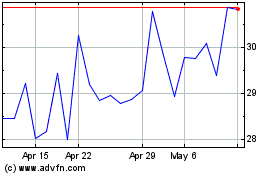

British American Tobacco (PK) (USOTC:BTAFF)

Historical Stock Chart

From Dec 2024 to Jan 2025

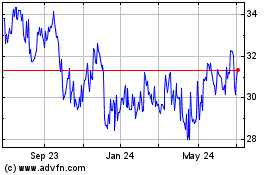

British American Tobacco (PK) (USOTC:BTAFF)

Historical Stock Chart

From Jan 2024 to Jan 2025