Amended Annual Report (10-k/a)

May 01 2023 - 5:25PM

Edgar (US Regulatory)

0000793306true--12-31FY202200007933062022-01-012022-12-3100007933062023-03-3100007933062021-06-30iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 0-15905

BLUE DOLPHIN ENERGY COMPANY |

(Exact name of registrant as specified in its charter) |

Delaware | | 73-1268729 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

801 Travis Street, Suite 2100, Houston, Texas | | 77002 |

(Address of principal executive offices) | | (Zip Code) |

713-568-4725

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.01 per share |

(Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☐ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. Yes ☐ No ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of shares of common stock held by non-affiliates of the registrant was $2,919,215 as of June 30, 2022 (the last trading day of the registrant’s most recently completed second fiscal quarter) based on the number of shares of common stock held by non-affiliates and the last reported sale price of the registrant’s common stock on June 30, 2022.

Number of shares of common stock, par value $0.01 per share, outstanding at May 1, 2023: 14,921,968 |

Auditor Name | Auditor Location | PCAOB Number |

UHY, LLP | Sterling Heights, Michigan | 01195 |

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (the “Amendment”) amends the Annual Report on Form 10-K (the “2022 Form 10-K”) of Blue Dolphin Energy Company (“Blue Dolphin”) for the fiscal year ended December 31, 2022 (the “2022 Fiscal Year”), as filed with the Securities and Exchange Commission (the “SEC”) on April 3, 2023. We are filing this Amendment to amend Part III of the 2022 Form 10-K to include the information required by and not included in Part III of the 2022 Form 10-K because we do not intend to file our definitive proxy statement within 120 days of the end of the 2022 Fiscal Year.

In addition, this Amendment updates the Exhibit Index in Item 15 of Part IV of the 2022 Form 10-K to file as an exhibit a currently dated certification as required under Section 302 of the Sarbanes-Oxley Act of 2002. This certification is attached as Exhibit 31.1. Because no financial statements are contained within this Amendment, we are not filing a currently dated certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

Except as described above, no other changes have been made to the 2022 Form 10-K. The 2022 Form 10-K continues to speak as of the date of the 2022 Form 10-K, and we have not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the 2022 Form 10-K other than as expressly indicated in this Amendment.

Unless the context otherwise requires, references in this report to “Blue Dolphin,” “we,” “us,” “our,” or “ours” refer to Blue Dolphin Energy Company, one or more of its consolidated subsidiaries, or all of them taken as a whole.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

Directors

This table reflects: (i) each Director’s name, age, principal occupation, and directorships during the past five (5) years and (ii) their relevant knowledge and experience that led to their service on the Board:

Name, Age Principal Occupation and Directorships During Past 5 Years | Knowledge and Experience |

| |

Jonathan P. Carroll, 61 Blue Dolphin Energy Company Chairman of the Board (since 2014) Chief Executive Officer, President, Assistant Treasurer and Secretary (since 2012) Lazarus Energy Holdings, LLC (“LEH”) Manager (since 2006) and Majority Owner Together, LEH and Jonathan Carroll own approximately 83% of our outstanding Common Stock as of the Record Date. Mr. Carroll has served on Blue Dolphin’s Board since 2014. He is currently Chairman of the Board. He previously served on the Board of Trustees of the Salient Fund Group from 2004 to 2022, and served on the compliance, audit, and nominating committees of several of Salient’s private and public closed-end and mutual funds at various times within that period. Mr. Carroll also previously served on the Board of Directors of the General Partner of LRR Energy, L.P. (NYSE: LRE) from January 2014 until its merger with Vanguard Natural Resources, LLC in October 2015. | Mr. Carroll earned a Bachelor of Arts degree in Human Biology and a Bachelor of Arts degree in Economics from Stanford University, and he completed a Directed Reading in Economics at Oxford University. Based on his educational and professional experiences, Mr. Carroll possesses particular knowledge and experience in business management, finance and business development that strengthen the Board’s collective qualifications, skills, and experience. |

| |

Blue Dolphin Energy Company | | │Page 2 |

Name, Age Principal Occupation and Directorships During Past 5 Years | | Knowledge and Experience |

| | |

Ryan A. Bailey, 47 Paradigm Institutional Investments Chief Investment Officer and Managing Partner (April 2023 to Present) Investment Office Resources Co-CIO and Partner (June 2022 to March 2023) Carbonado Partners Strategic Advisor (since June 2022 to Present) Managing Partner (September 2020 to June 2022) and Founder Pacenote Capital Managing Partner (2019 to 2020) and Co-founder Children’s Health System of Texas Head of Investments (2014 to 2019) Mr. Bailey was appointed to Blue Dolphin’s Board in November 2015. He is currently a member of the Audit and Compensation Committees. He also serves as an advisor and mentor to Texas Wall Street Women, a non-profit member organization; serves as Chairman of the Texas Alternative Investment Association; serves as member of the board of director, Stream Foundation, Bridgeway Capital Management, and Portfolios with Purpose. Mr. Bailey is also a member of the investment committees of Texas Employee Retirement System, American Heart Association, Dallas Police and Fire, and Dallas Parkland Hospital. | | Mr. Bailey earned a Bachelor of Arts in Economics from Yale University and completed a graduate course in tax planning from the Yale School of Management. He holds professional credentialing as a Chartered Financial Analyst (CFA), Financial Risk Manager (FRM), Chartered Alternative Investment Analyst (CAIA) and Chartered Market Technician (CMT). Based on his educational and professional experiences, Mr. Bailey possesses particular knowledge and experience in finance, financial analysis and modeling, investment management, risk assessment and strategic planning that strengthen the Board’s collective qualifications, skills, and experience. |

| | |

Amitav Misra, 45 HighRadius Corporation Vice President of Experiential Marketing and Partnerships (since December 2022) Vice President of Global Marketing, Mid-Market (July 2022 to December 2022) Vice President of Treasury Line of Business (December 2020 to July 2022) Vice President of Treasury Marketing (July 2020 to July 2022) Arundo Analytics, Inc. General Manager Americas (2018 to 2020) Vice President of Marketing (2017 to 2020) Mr. Misra has served on Blue Dolphin’s Board since 2014. He is currently a member of the Audit and Compensation Committees. Mr. Misra serves as an advisor to several energy, technology, and private investment companies. He is also a director of the Houston Center for Literacy, a non-profit organization. | | Mr. Misra earned a Bachelor of Arts in Economics from Stanford University and holds FINRA Series 79 and Series 63 licenses. Mr. Misra possesses particular knowledge and experience in economics, business development, private equity, and strategic planning that strengthen the Board’s collective qualifications, skills, and experience. |

| | |

Christopher T. Morris, 61 MPact Partners LLC President (2011 to Present) Bonaventure Realty Group Executive Vice President (2020 to 2022) Impact Partners LLC President (2017 to 2020) Mr. Morris has served on Blue Dolphin’s Board since 2012; he is currently Chairman of the Audit and Compensation Committees. | | Mr. Morris earned a Bachelor of Arts in Economics from Stanford University and a Masters in Business Administration from the Harvard Business School. Based on his educational and professional experiences, Mr. Morris possesses particular knowledge and experience in business management, finance, strategic planning, and business development that strengthen the Board’s collective qualifications, skills, and experience. |

| | |

Blue Dolphin Energy Company | | │Page3 |

Name, Age | | |

Principal Occupation and Directorships During Past 5 Years | | Knowledge and Experience |

| | |

Herbert N. Whitney, 82 Wildcat Consulting, LLC President (since 2006) and Founder Mr. Whitney has served on Blue Dolphin’s Board since 2012. He previously served on the Board of Directors of Blackwater Midstream Corporation, the Advisory Board of Sheetz, Inc., as Chairman of the Board of Directors of Colonial Pipeline Company, and as Chairman of the Executive Committee of the Association of Oil Pipelines. | | Mr. Whitney has more than 40 years of experience in pipeline operations, crude oil supply, product supply, distribution and trading, as well as marine operations and logistics having served as the President of CITGO Pipeline Company and in various general manager positions at CITGO Petroleum Corporation. He earned his Bachelor of Science in Civil Engineering from Kansas State University. Based on his educational and professional experiences, he possesses extensive knowledge in the supply and distribution of crude oil and petroleum products, which strengthens the Board’s collective qualifications, skills, and expertise. |

Executive Officers

Our sole executive officer is Jonathan Carroll, who serves as President and Chief Executive Officer.

Audit Committee

The Audit Committee consists of Messrs. Morris, Bailey, and Misra, with Mr. Morris serving as Chairman. During 2022, the Audit Committee met four (4) times. The Board has affirmatively determined that all members of the Audit Committee are independent under OTCQX and SEC rules and that each of Messrs. Morris and Bailey qualifies as an Audit Committee Financial Expert. The Audit Committee’s duties include overseeing financial reporting and internal control functions. The Audit Committee’s written charter is available on our corporate website (http://www.blue-dolphin-energy.com).

Code of Ethics and Code of Conduct

In compliance with the Sarbanes-Oxley Act of 2002, the Board adopted a code of ethics policy and a code of conduct policy. The Audit Committee established procedures to enable anyone who has a concern about our conduct, policies, accounting, internal control over financial reporting, and/or auditing matters to communicate that concern directly to the Chairman of the Audit Committee. Our code of ethics and code of conduct policies are available on our website (http://www.blue-dolphin-energy.com). Any amendments or waivers to provisions of our code of ethics or code of conduct will be disclosed on Form 8-K as filed with the SEC and/or posted on our website.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers, and stockholders who own more than ten percent (10%) of the Common Stock, to file reports of stock ownership and changes in ownership with the SEC and to furnish us with copies of all such reports as filed. Based solely on a review of the copies of the Section 16(a) reports furnished to us, we are unaware of any late filings made during 2022.

ITEM 11. EXECUTIVE COMPENSATION

Executive Compensation Policy and Procedures

Lazarus Energy Holdings, LLC (“LEH”) operates and manages all Blue Dolphin assets pursuant to an Amended and Restated Operating Agreement dated April 1, 2020 (the “Amended and Restated Operating Agreement) between LEH and Blue Dolphin, Lazarus Energy, LLC (“LE”), Lazarus Refining & Marketing, LLC (“LRM”), Nixon Product Storage, LLC (“NPS”), Blue Dolphin Pipe Line Company (“BDPL”), Blue Dolphin Petroleum Company (“BDPC”), and Blue Dolphin Services Co. (“BDSC”). Services under the Amended and Restated Operating Agreement include personnel serving in a variety of capacities, including, but not limited to corporate executives. All personnel work for and are paid by LEH.

Blue Dolphin Energy Company | | │Page 4 |

Compensation for Named Executives

Jonathan Carroll is our only executive officer. As noted above under “Executive Compensation Policy and Procedures,” Mr. Carroll’s remuneration is provided by LEH under the Amended and Restated Operating Agreement.We do not provide any of his remuneration, but rather pay a management fee to LEH under the Amended and Restated Operating Agreement. During the fiscal year ended December 31, 2022, we paid $0.7 million to LEH under this agreement. Also, as disclosed under “Related Party Transactions – Affiliate Agreements,” Mr. Carroll receives certain fees under various other affiliate agreements.

Summary Compensation Table

Name and Principal Position | | Year | | | Salary | | | Total |

| | | | (in thousands) |

| | | | | | | | |

Jonathan P. Carroll | | 2022 | | $ | - | | $ | - |

Chief Executive Officer and President | | 2021 | | | - | | | - |

(Principal Executive Officer, Principal | | | | | | | | |

Financial Officer, and Principal | | | | | | | | |

Accounting Officer) | | | | | | | | |

Compensation Risk Assessment

LEH’s approach to compensation practices and policies applicable for non-executive personnel throughout our organization is consistent with the base pay market median for each position. LEH believes its practices and policies in this regard are not reasonably likely to have a material adverse effect on us.

Outstanding Equity Awards

None.

Director Compensation Policy and Procedures

Although Jonathan Carroll is a director of Blue Dolphin, his services as Chief Executive Officer are provided under the Amended and Restated Operating Agreement (see above under “Executive Compensation Policy and Procedures.”) Therefore, we do not have any directors that are also employed by Blue Dolphin. The Compensation Committee reviews and recommends to the Board for its approval all compensation for directors.

Compensation for Non-Employee Directors

For the fiscal year ended December 31, 2022, non-employee, independent directors received compensation in Common Stock and cash for their service on the Board in the amount of $40,000, as follow:

Fair Market Value | | Period Services Rendered | | Payment Method |

| | | | |

$10,000 | | January 1 – March 31 (First Quarter) | | Common stock |

$10,000 | | April 1 – June 30 (Second Quarter) | | Cash |

$10,000 | | July 1 – September 30 (Third Quarter) | | Common stock |

$10,000 | | October 1 – December 31 (Fourth Quarter) | | Cash |

For the first and third quarters, the number of shares of Common Stock issued was determined by the closing price of Blue Dolphin’s Common Stock on the last trading day in the respective quarterly period and such closing price was the cost basis for such issuance. The shares of Common Stock are subject to resale restrictions applicable to restricted securities and securities held by affiliates under federal securities laws.

Non-employee, independent directors also earned additional compensation for serving on the Audit Committee. The chairman of the Audit Committee earned an additional $2,500 in cash in each of the second and fourth quarters of the year, for a total of $5,000 annually. Members of the Audit Committee earned an additional $1,250 in cash in each of the second and fourth quarters of the year, for a total of $2,500 annually. Non-employee, independent directors serving on the Compensation Committee did not earn any additional compensation for their service as directors. Non-employee, independent directors were reimbursed for reasonable out-of-pocket expenses related to in-person meeting attendance.

Blue Dolphin Energy Company | | │Page 5 |

Accrued and Unpaid Non-Employee, Independent Director Compensation

| | Fiscal Year Ended December 31, 2022 | |

| | Cash | | | Common Stock(1)(2)(3) | | | | |

Name | | Paid | | | Unpaid | | | Paid | | | Unpaid | | | Total | |

| | | | | | | | | | | | | | | |

Christopher T. Morris | | $ | - | | | $ | 25,000 | | | $ | 20,000 | | | $ | - | | | $ | 45,000 | |

Ryan A. Bailey | | | - | | | | 22,500 | | | | 20,000 | | | | - | | | $ | 42,500 | |

Amitav Misra | | | - | | | | 22,500 | | | | 20,000 | | | | - | | | $ | 42,500 | |

| | | | | | | | | | | | | | | | | | | | |

| | $ | - | | | $ | 70,000 | | | $ | 60,000 | | | $ | - | | | $ | 130,000 | |

| | Fiscal Year Ended December 31, 2021 | |

| | Cash | | | Common Stock(1)(2)(4) | | | | |

Name | | Paid | | | Unpaid | | | Paid | | | Unpaid | | | Total | |

| | | | | | | | | | | | | | | |

Christopher T. Morris | | $ | - | | | $ | 25,000 | | | $ | - | | | $ | 20,000 | | | $ | 45,000 | |

Ryan A. Bailey | | | - | | | | 22,500 | | | | - | | | | 20,000 | | | $ | 42,500 | |

Amitav Misra | | | - | | | | 22,500 | | | | - | | | | 20,000 | | | $ | 42,500 | |

| | | | | | | | | | | | | | | | | | | | |

| | $ | - | | | $ | 70,000 | | | $ | - | | | $ | 60,000 | | | $ | 130,000 | |

(1) | On October 27, 2022, an aggregate of 24,591 restricted shares of Common Stock were issued to Messrs. Morris, Bailey, and Misra. No loss or gain was recorded related to the share issuance. The issuance represented payment for services rendered to the Board for the three-month period ended September 30, 2022. At September 30, 2022, the grant date market value cost basis was $1.22 per share. The cost basis for the period was determined by the closing price of Blue Dolphin’s common stock on the last trading day in the period in which services were rendered. |

(2) | On May 12, 2022, an aggregate of 252,447 restricted shares of Common Stock were issued to Messrs. Morris, Bailey, and Misra. We recorded a loss of $11,272 related to the share issuance. The issuance represented catchup payments for services rendered to the Board for the three-month periods ended September 30, 2020, March 31, 2021, September 30, 2021, and March 31, 2022. At September 30, 2020, the grant date market value cost basis was $0.40 per share. At March 31, 2021, the grant date market value cost basis was $0.56 per share. At September 30, 2021, the grant date market value cost basis was $0.33 per share. At March 31, 2022, the grant date market value cost basis was $0.91 per share. The cost basis for each period was determined by the closing price of Blue Dolphin’s common stock on the last trading day in the period in which services were rendered. |

(3) | At December 31, 2022, Messrs. Morris, Bailey, Misra, and Whitney had total restricted awards of Common Stock outstanding of 212,400, 198,050, 204,141 and 9,683, respectively. |

(4) | At December 31, 2021, Messrs. Morris, Bailey, Misra, and Whitney had total restricted awards of Common Stock outstanding of 120,054, 105,704, 111,795 and 9,683, respectively. |

Pay Versus Performance

The following disclosure is required by Securities and Exchange Commission (“SEC”) rules but is not reflective of how we or the Compensation Committee determine executive compensation for our sole executive officer, Jonathan Carroll. As noted above under “Executive Compensation Policy and Procedures,” Mr. Carroll’s remuneration is provided by LEH under the Amended and Restated Operating Agreement. As a result, there is no applicable information to be provided pursuant to this table.

Year | | Summary Compensation Table Total for PEO | | | Compensation Actually Paid to PEO | | | Average Summary Compensation Table Total for Non-PEO NEOs | | | Average Compensation Actually Paid to non-PEO NEOs | | | Value of Initial Fixed $100 Investment Based on Total Shareholder Return | | | Net Income | |

| | (in thousands) | |

| | | | | | | | | | | | | | | | | | |

2022 | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

2021 | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

Equity Compensation Plan Information

None.

Blue Dolphin Energy Company | | │Page 6 |

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Security Ownership of Certain Beneficial Owners

This table shows information with respect to persons or groups known to us to be the beneficial owners of more than five percent (5%) of our Common Stock as of May 1, 2023. Unless otherwise indicated, each named party has sole voting and dispositive power with respect to such shares.

Title of Class | | Name of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | | Percent of Class(1) | |

| | | | | | | | |

Common Stock | | Lazarus Energy Holdings, LLC | | | 8,426,456 | | | | 56.5 | % |

| | 801 Travis Street, Suite 2100 | | | | | | | | |

| | Houston, Texas 77002 | | | | | | | | |

(1) Based upon 14,921,968 shares of Common Stock issued and outstanding as of May 1, 2023.

Security Ownership of Management

This table shows information as of May 1, 2023 with respect to: (i) directors, (ii) executive officers and (iii) directors and executive officers as a group beneficially owning our Common Stock. Unless otherwise indicated, each of the following persons has sole voting and dispositive power with respect to such shares.

Title of Class | | Name of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | | Percent of Class(1) | |

| | | | | | | | |

Common Stock | | Jonathan P. Carroll(2) | | | 12,357,754 | | | | 82.8 | % |

Common Stock | | Christopher T. Morris / Mpact Partners, LLC | | | 212,400 | | | * | |

Common Stock | | Amitav Misra | | | 204,141 | | | * | |

Common Stock | | Ryan A. Bailey | | | 198,050 | | | * | |

Common Stock | | Herbert N. Whitney | | | 9,683 | | | | --- | |

| | | | | | | | | | |

Directors/Nominees and Executive Officers as a Group (5 Persons) | | | | 12,982,028 | | | | 87.0 | % |

(1) | Based upon 14,921,968 shares of Common Stock issued and outstanding and 0 shares of Common Stock issuable upon exercise of stock options, each as of May 1, 2023. |

| |

(2) | Includes 8,426,456 shares issued to LEH. Mr. Carroll and his affiliates have an approximate 80% ownership interest in LEH. |

| |

* | Less than 1%. |

Remainder of Page Intentionally Left Blank

Blue Dolphin Energy Company | | │Page 7 |

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Related-Party Transactions

Affiliate Agreements

Blue Dolphin and certain of its subsidiaries are parties to several agreements with LEH and its affiliates (the “Affiliates”). With regard to guaranty fee agreements, Jonathan Carroll was required to personally guarantee repayment of borrowed funds and accrued interest under certain secured loan agreements. Management believes that these related-party agreements are arm’s-length transactions.

Agreement/Transaction | Parties | Effective Date | Key Terms |

Jet Fuel Sales Agreement | LEH LE | 04/01/2022 | 1-year term expiring earliest to occur of 03/31/2024 plus 30-day carryover or delivery of maximum jet fuel quantity; LEH is awarded jet fuel contracts under preferential pricing terms due to being HUBZone certified. |

Office Sub-Lease Agreement | LEH BDSC | 01/01/2018 | 68-month term expiring 08/31/2023; office lease Houston, Texas; includes 6-month rent abatement period; rent approximately $0.01 million per month. |

Amended and Restated Operating Agreement | LEH Blue Dolphin LE LRM NPS BDPL BDPC BDSC | 04/01/2020 | 1-year term; expires 04/01/2024 or notice by either party at any time of material breach or 90 days Board notice; LEH receives management fee of 5% of all consolidated operating costs, excluding crude costs, depreciation, amortization, and interest, of Blue Dolphin, LE, LRM, NPS, BDPL, BDPC and BDSC. |

LE Amended and Restated Guaranty Fee Agreement(1) | LE Jonathan Carroll | 04/01/2017 | Related to payoff of LE $25.0 million Veritex Community Bank (“Veritex”) loan (the “LE Term Loan Due 2034”); Jonathan Carroll receives fee equal to 2.00% per annum of outstanding principal balance owed under LE Term Loan Due 2034. |

LRM Amended and Restated Guaranty Fee Agreement(1) | LRM Jonathan Carroll | 04/01/2017 | Related to payoff of LRM $10.0 million Veritex loan (the “LRM Term Loan Due 2034”); Jonathan Carroll receives fee equal to 2.00% per annum of outstanding principal balance owed under LRM Term Loan Due 2034. |

| (1) | Effective January 1, 2023, the LE Amended and Restated Guaranty Fee Agreement and LRM Amended and Restated Guaranty Fee Agreement were modified; as modified, Jonathan Carroll shall receive a fee payable 100% in cash instead of 50% in stock and 50% in cash. |

Under the Office Sub-Lease Agreement, BDSC received sublease income from LEH totaling $0.03 million for both fiscal years ended December 31, 2022 and 2021. Under the Amended and Restated Operating Agreement, the LEH operating fee, related party was $0.7 million for the fiscal year ended December 31, 2022 compared to $0.5 million for the fiscal year ended December 31, 2021. The increase between the comparative periods coincided with increased cost of goods sold during the same periods.

Working Capital

We historically relied on Affiliates for funding during periods of working capital deficits. We reflect such borrowings in our consolidated balance sheets in accounts payable, related party, or long-term debt, related party. During the fiscal year ended December 31, 2022, continued liquidity improvement related to favorable market conditions enabled us to increasingly meet our needs through cash flow from operations.

Affiliate Long-Term Debt

Blue Dolphin and certain of its subsidiaries are parties to debt agreements with Affiliates. Related-party long-term debt as defined within this section includes:

■ | June LEH Note – June 2017 promissory note between Blue Dolphin and LEH; for Blue Dolphin working capital; reflects amounts owed to LEH under the Amended and Restated Operating Agreement; interest accrues at 8.00% compounded annually; no covenants; matured January 2019; currently in default for failing to pay past due obligations at maturity; pursuant to an Assignment Agreement between LEH, Ingleside Crude, LLC (“Ingleside”), and Lazarus Capital, LLC (“Lazarus Capital”) effective December 31, 2022, balances previously due under promissory notes between Ingleside and Lazarus Capital/Jonathan Carroll were added to the balance due under the June LEH Note. |

| |

■ | BDPL-LEH Loan Agreement – Loan Agreement dated August 15, 2016, between BDPL and LEH in the original principal amount of $4.0 million; interest accrues at 16.00% annually; guaranteed by certain BDPL property; contains representations and warranties, affirmative and negative covenants, and events of default that are usual and customary for a credit facility of this type; matured August 2018; currently in default for failing to pay past due obligations at maturity. |

| |

Loan Description | Parties | Maturity Date | Interest Rate | Loan Purpose |

June LEH Note (in default) | LEH Blue Dolphin | Jan 2019 | 8.00% | Blue Dolphin working capital; reflects amounts owed to LEH under the Amended and Restated Operating Agreement |

BDPL-LEH Loan Agreement (in default) | LEH BDPL | Aug 2018 | 16.00% | Original principal amount of $4.0 million; Blue Dolphin working capital |

Guarantees, Security, and Defaults

Loan Description | Guarantees | Security | Event(s) of Default |

June LEH Note (in default) | --- | --- | Failure to pay past due obligations at maturity (loan matured January 2019) |

BDPL-LEH Loan Agreement (in default) | --- | Certain BDPL property | Failure to pay past due obligations at maturity (loan matured August 2018) |

Blue Dolphin Energy Company | | │Page 8 |

Covenants

The BDPL-LEH Loan Agreement contains representations and warranties, affirmative and negative covenants, and events of default that we consider usual and customary for a credit facility of this type. There are no covenants associated with the June LEH Note.

Director Independence

The Board has affirmatively determined that each of Ryan A. Bailey, Amitav Misra, and Christopher T. Morris, each an outside director, is considered an “Independent Director” as such term is defined by OTCQX and SEC rules. Jonathan P. Carroll, our Chief Executive Officer and President, and Herbert N. Whitney, are not independent directors. Mr. Whitney serves as a consultant.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

This table shows fees paid to UHY during the periods indicated:

| | December 31, | |

| | 2022 | | | 2021 | |

| | | | |

Audit fees | | $ | 232,500 | | | $ | 175,000 | |

Audit-related fees | | | - | | | | - | |

Tax fees | | | - | | | | - | |

| | | | | | | | |

| | $ | 232,500 | | | $ | 175,000 | |

Amounts billed but unpaid during 2022 and 2021 totaled $55,000 and $107,500, respectively. Audit fees for 2022 and 2021 related to the audit of our consolidated financial statements and the review of our quarterly reports that are filed with the SEC. The Audit Committee must pre-approve all audit and non-audit services provided to us by our independent registered public accounting firm.

Blue Dolphin Energy Company | | │Page 9 |

PART IV

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

Exhibits and Financial Statement Schedules

Following is a list of documents filed as part of this report:

· | Exhibits as listed in the exhibit index of this report, which is incorporated herein by reference. |

Exhibits Index

Remainder of Page Intentionally Left Blank

Blue Dolphin Energy Company | | │Page 10 |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this Amendment to be signed on its behalf by the undersigned, thereunto duly authorized.

| BLUE DOLPHIN ENERGY COMPANY | |

| (Registrant) | |

| | | |

| | | |

May 1, 2023 | By: | /s/ JONATHAN P. CARROLL | |

| | Jonathan P. Carroll Chief Executive Officer, President, Assistant Treasurer and Secretary (Principal Executive Officer, Principal Financial Officer, and Principal Accounting Officer) | |

Blue Dolphin Energy Company | | │Page 11 |

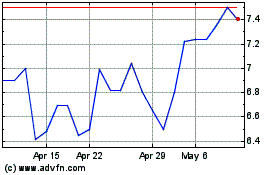

Blue Dolphin Energy (QX) (USOTC:BDCO)

Historical Stock Chart

From Apr 2024 to May 2024

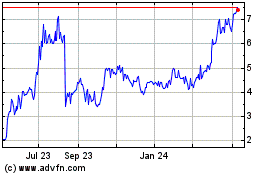

Blue Dolphin Energy (QX) (USOTC:BDCO)

Historical Stock Chart

From May 2023 to May 2024