- Current report filing (8-K)

August 05 2009 - 4:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): July 30, 2009

BEYOND

COMMERCE, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-52490

|

|

98-0512515

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer Identification No.)

|

9029

South Pecos

Suite

2800

Henderson,

Nevada 89074

(Address

of principal executive offices, including zip code)

(702)

463-7000

(Registrant’s

telephone number, including area code)

Copies

to:

Gregory

Sichenzia, Esq.

Darrin M.

Ocasio, Esq.

Sichenzia

Ross Friedman Ference LLP

61

Broadway, 32

nd

Floor

New York,

New York 10006

Phone:

(212) 930-9700

Fax:

(212) 930-9725

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

o

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

o

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

o

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

o

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

|

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance

Sheet Arrangement of a Registrant

|

The

Company and St. George Investments, LLC, entered into an agreement dated July

30, 2009 (the “Agreement”) pursuant to which the Company will satisfy the entire

outstanding balance of $420,593.40 on its Series 2009 Secured Convertible

Original Issue Discount Note, due June 15, 2010, issued to St. George (the

“Note”). Pursuant to the Agreement, the Company will make the

following payments (the “Scheduled Payments”) on the Note: (i)

$100,000 paid on July 30, 2009, (ii) $50,000 shall be paid by August 6, 2009,

(iii) 50,000 shall be paid by August 13, 2009, (iv) $50,000 shall be paid by

August 20, 2009, (v) $50,000 shall be paid by August 27, 2009, (vi) $50,000

shall be paid on or before September 3, 2009, (vii) $50,000 shall be

paid on or before September 10, 2009 and (viii) $20,995.40 shall be paid on or

before September 17, 2009. Provided the Scheduled Payments have

been made in accordance with the Agreement, the Note shall be deemed paid in

full and St. George shall return 3,015,424 shares of the Company’s common stock

which had been pledged as security for repayment of the Note, and will not hold

any other shares pledged in connection with the Note.

A copy of

the Amendment is filed as an exhibit to this Current Report on Form 8-K.

The summary of the Agreement set forth above is qualified by reference to

such exhibit.

|

Item

9.01

|

Financial

Statements and Exhibits

|

|

(a)

|

Financial

statements.

|

Not

applicable.

|

(b)

|

Pro

forma financial information.

|

Not

applicable.

(c)

Shell Company Transactions.

Not

Applicable

(d)

Exhibits

|

Exhibit

Number

|

|

Description

|

|

10.1

|

|

Agreement

between Beyond Commerce, Inc. and St. George Investments, LLC, dated July

30,

2009.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

Beyond

Commerce, Inc.

|

|

|

|

|

|

|

By:

|

/s/

Mark

V. Noffke

|

|

|

|

Mark

V. Noffke

|

|

|

|

Chief

Financial Officer

|

Date:

August 4, 2009

Exhibit

Index

|

Exhibit

Number

|

|

Description

|

|

10.1

|

|

Agreement

between Beyond Commerce, Inc. and St. George Investments, LLC, dated July

30, 2009.

|

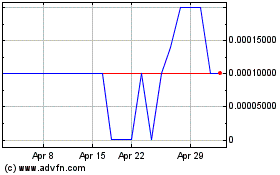

Beyond Commerce (PK) (USOTC:BYOC)

Historical Stock Chart

From Jun 2024 to Jul 2024

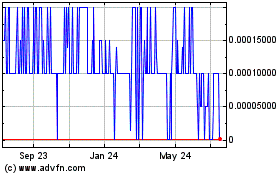

Beyond Commerce (PK) (USOTC:BYOC)

Historical Stock Chart

From Jul 2023 to Jul 2024