Amended Current Report Filing (8-k/a)

September 22 2021 - 6:04AM

Edgar (US Regulatory)

0001431074

true

0001431074

2021-07-01

2021-07-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Current Report Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 1, 2021

BERGIO INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

Wyoming

|

|

333-150029

|

|

27-1338257

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification Number)

|

12 Daniel Road

East Fairfield, NJ 07004

(Address of principal executive offices) (Zip Code)

(973) 227-3230

Registrant’s telephone number, including

area code:

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communication pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 40.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

EXPLANATORY NOTE

This Current Report on Form 8-K/A is being filed

by Bergio International, Inc., a Wyoming corporation (the “Company” or “BRGO”) in connection with the completion

of the acquisition of the assets and operations of the business of Gear Bubble, Inc., a Nevada corporation, as first detailed in the Company’s

Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on July 12, 2021. As indicated

in the Merger Agreement detailed therein, the completion of the Acquisition required audited financial statements of Gear Bubble. The

purpose of this Amendment to the Current Report filed on July 12, 2021 is to provide the audited financial statements and pro forma financial

information required by Items 9.01(a) and (b) of Form 8-K, which were not previously filed with the Original 8-K as permitted by the rules

of the SEC.

FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K may contain certain

forward-looking statements regarding our prospective performance and strategies within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements, which are based on

certain assumptions and describe future plans, strategies, and expectations of our company, are generally identified by use of words “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “plan,” “project,”

“seek,” “strive,” “try,” or future or conditional verbs such as “could,” “may,”

“should,” “will,” “would,” or similar expressions. Our ability to predict results or the actual effects

of our plans or strategies is inherently uncertain. Accordingly, actual results may differ materially from anticipated results. Some of

the factors that could cause our actual results to differ from our expectations or beliefs include, without limitation, the risks discussed

from time to time in our filings with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this release. Except as required by applicable law or regulation, we undertake

no obligation to update these forward-looking statements to reflect events or circumstances that occur after the date on which such statements

were made.

ITEM 2.01 - COMPLETION OF ACQUISITION OR DISPOSITION

OF ASSETS

On July 1, 2021, Bergio International, Inc. (the

“Company” or “BRGO”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Gear

Bubble, Inc., a Nevada corporation, (“Gear Bubble”), pursuant to which the shareholders of Gear Bubble (the “Selling

Shareholders”) agreed to sell 100% of the issued and outstanding shares of Gear Bubble to a recently formed wholly-owned subsidiary

of the Company known as Gear Bubble Tech, Inc., a Wyoming corporation (the “Merger Sub”) in exchange for $3,162,000.00

(the “Cash Purchase Price”), which shall be paid as follows: a) $2,000,000.00 (which was paid in cash at Closing), b) $1,162,000.00

to be paid in 15 equal installments, and c) 49,000 of the 100,000 authorized shares of the Merger Sub, such that upon the Closing, 51%

of the Merger Sub shall be owned by BRGO, and 49% of the Merger Sub shall be owned by the Gear Bubble Shareholders.

The terms and conditions of the Merger Agreement,

under Section “Seller Audits” required the completion of an audit of the Gear Bubble business for the fiscal years ending

on December 31, 2018, 2019 and 2020. The Company waived the requirement to audit Gear Bubble’s financial statements for 2018.

The foregoing description of the Merger Agreement

is qualified by the terms of the full text of the Merger Agreement previously filed as Exhibit 10.1 to the Company’s Current Report

on Form 8-K filed on July 12, 2021, and the terms thereof are incorporated herein by reference.

ITEM 9.01 - FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits. The following exhibits are filed

with this report:

|

*

|

Previously filed as Exhibit 10.1 to the Company’s Current

Report on Form 8-K dated July 12, 2021

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

BERGIO INTERNATIONAL, INC.

|

|

|

|

|

|

Date: September 21, 2021

|

By:

|

/s/ Berge Abajian

|

|

|

|

Name:

|

Berge Abajian

|

|

|

|

Title:

|

Chief Executive Officer

|

4

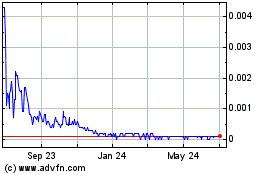

Bergio (PK) (USOTC:BRGO)

Historical Stock Chart

From Nov 2024 to Dec 2024

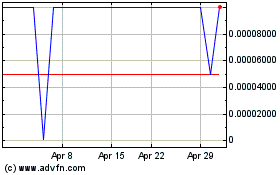

Bergio (PK) (USOTC:BRGO)

Historical Stock Chart

From Dec 2023 to Dec 2024