Maersk Expects Container Shipping Volumes to Fall Up to 25%

May 13 2020 - 1:21PM

Dow Jones News

By Costas Paris and Dominic Chopping

A.P. Moeller-Maersk A/S expects container volumes to fall up to

25% this quarter and plans to cancel dozens of sailings as the

Danish shipping giant copes with sliding demand in consumer and

industrial markets from the coronavirus pandemic lockdowns.

Maersk, which moves 17% of all containers world-wide, posted

better-than-expected first-quarter earnings on Wednesday as cost

cuts, lower fuel outlays and higher freight rates helped offset the

demand slump.

With the U.S. and European countries stepping carefully toward

reopening their economies, Chief Executive Soren Skou said he

expects no meaningful recovery until the end of the year, and added

that container volumes are expected to fall 20% to 25% in the

second quarter from a year ago.

"There is a massive impact on both Asia-to-Europe trades and

across the Pacific with the U.S. and Europe into lockdown," Mr.

Skou said. "Without a doubt it's going to be the steepest ever drop

in demand within a quarter."

The company suspended its financial outlook in March, and Mr.

Skou said business remains uncertain even if the lockdowns end and

a coronavirus vaccine is developed and distributed in the coming

months.

"It's one thing to reopen and another whether the consumer will

go out shopping," he said, adding that with millions out of work,

economic activity could be anemic for months.

Maersk and other container shipping lines have canceled hundreds

of sailings on major trade lanes and idled ships to cut costs and

maintain freight rates amid the declining demand.

Maersk said its average container freight rates were up 5.7% in

the first quarter from a year ago. The carrier canceled more than

90 sailings in the first quarter and expects another 140 to be

dropped in the second quarter.

"The aim is to provide capacity in line with demand. We save

costs with the fewer sailings and capacity utilization on the ships

that still sail is high," said Mr. Skou.

Maersk scrapped most of its full-year guidance in March amid the

Covid-19 impact on supply chains, but said Wednesday that it sees

2020 volume growth in its shipping unit in line or slightly lower

than the overall market.

Industry research group Alphaliner has projected that global

container trade will contract 7.3% this year from 2019 levels.

The company swung to a quarterly net profit of $197 million from

a loss of $659 million in the same period last year, beating

average expectations by analysts of $25 million in earnings,

according to FactSet. Earnings last year were weighed down by a

$552 million loss on discontinued operations.

Revenue rose 0.3% to $9.57 billion, while earnings before

interest, tax, depreciation and amortization of $1.52 billion beat

Maersk's own guidance of $1.4 billion.

Maersk Line, the company's shipping unit and main earner, made a

profit of $1.2 billion in the first quarter, up 25% from a year

ago.

Shipping executives expect the world's top 10 carriers to end

the year deeply in the red. Industry analysts have said that could

trigger some failures as carriers with strong cash holdings and

access to credit markets outlast weaker operators.

France's CMA CGM SA, the world's fourth-largest container line,

said Wednesday it had secured a EUR1.05 billion ($1.14 billion)

bank loan backed by the French government to help it weather an

expected 10% drop in its business.

It is the first time that a European government had guaranteed a

loan of that scale to a private shipping company. Under the terms,

the carrier must pay the loan back in a year but it get an

extension of up to five years.

Maersk is in a strong financial position with $9.2 billion in

cash reserves and access to revolving credit facilities, according

to Mr. Skou. Along with other liners it is benefiting from

substantially lower fuel prices.

Mr. Skou said he doesn't expect the world to emerge from the

pandemic-driven downturn with large changes in major trade patterns

even though some political leaders have called for "reshoring" of

manufacturing from Asia to domestic factories in Western

countries.

Production of medical supplies now produced in China will be

diversified, he said. "But masks and personal protection equipment

don't matter in terms of volumes in global trade and there is

nothing to suggest that the manufacturing of electronics, toys,

clothing, shoes, parts and others will not continue to be in Asia,"

Mr. Skou said.

Write to Costas Paris at costas.paris@wsj.com and Dominic

Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

May 13, 2020 13:06 ET (17:06 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

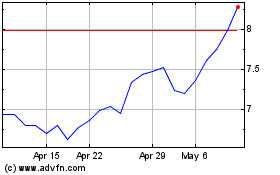

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Aug 2024 to Sep 2024

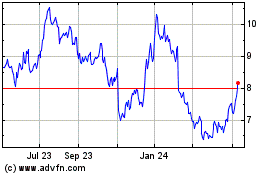

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Sep 2023 to Sep 2024