SNAKES & LATTES INC. (OTC: FUNN) is Pleased to Report an Almost 200% Increase in Year Over Year FY22 Revenue at $6,064,896, up From $2,027,988 for FY21, With Gross Profits up From $1,369,514 to $4,223,022

September 27 2022 - 8:14AM

InvestorsHub NewsWire

TORONTO, ON, Canada -- September 27, 2022 -- InvestorsHub

NewsWire -- SNAKES & LATTES INC. (OTC:

FUNN) is pleased to report an almost 200% increase in year over

year FY22 revenue at $6,064,896, up from $2,027,988 for FY21, with

gross profits up from $1,369,514 to $4,223,022.

Cash on hand at the end of the fiscal year was $55,156 with

total assets of $4,083,773 over total liabilities of

$9,037,903.

Cost of goods sold remains in line with expectations, hovering

around 30% for the year.

Net Income was -$2,089,972 FY22 compared to -$3,564,440

FY21.

The total outstanding common share count of the company was

758,849,876 as of June 30th, 2022.

“Fiscal year 2022 was a challenging but transitional year. The

numerous operational efficiencies designed and implemented are

bearing fruit. We continuously look for ways to increase our KPI

metrics and see positive trends in customer receipt value and

operational cost reductions. Our revenues are trending

significantly positive and closing the gap between gross profit and

net income towards overall profitability. We are invigorated by

this trend and believe it possible FY23 is the year we achieve

aggregate profitability,” said Snakes & Lattes Inc. Founder,

Ben Castanie.

During the pandemic, a significant amount of liability was

incurred from government subsidy loans. Per accounting principles,

these must be listed as liabilities. As debt forgiveness is

processed, these come out of liabilities and move to income. While

a significant portion has already been completed, there is still

close to one half million remaining under liabilities that will be

moved to income once forgiveness is finalized.

The past fiscal year represents a positive shift for Snakes

& Lattes. The pandemic and resultant environment created

numerous hurdles for the company, a couple which are still being

navigated. Staffing and training remains a focal point for the

company. The company experienced temporary location closures and/or

operational restrictions in some locations during this fiscal year.

While we have recovered from these and are trending positive, this

fact had some impact on the overall annual numbers. However, as the

numbers show, a healthy increase in comparative year over year

revenues was still achieved. As we now have few restrictions and

full operations, we are positioned well for the upcoming busy

holiday season and the rest of FY23.

The pandemic also created a need for critical focus. This led to

a hard look at all the areas of the company and the projects it was

working on, and deprioritizing anything that did not directly

contribute to maximizing revenues/location profitability. The

current operational goal now being to open up profitable locations

across the United States. We will only expand in Canada if the

location is extremely attractive from all aspects. The US locations

are needed for data leading to a higher level of financial growth;

be it scale, bank and institutional level investment,

profitability, auditing and uplist.

Within this strategy; if we find a location is not performing up

to expectations despite operational improvements and we cannot see

a path forward to profitability, then we may elect to divest

ourselves of that location. This was the case for our Snakes &

Lattes location in Guelph. After a comprehensive review of its

operational metrics, costs, and revenues the company decided this

location would ultimately not achieve profitability without

significant financial and human resources. Even if such additional

resources were applied, the risk of continued loss was too great.

The location was closed on September 12th, 2022. On the opposite

end of the spectrum, Tempe Snakes & Lattes continues to be the

largest revenue generator and is trending well. This location

remains the flagship for the United States locations and a model

for operations. During Q4 of FY22, we also began to recognize

revenue in our Provo, UT Snakes & Lattes location.

While the company continues to work on promising initiatives,

implementation of many has seen a delay while we apply resources to

work through staffing and training. We will report on initiative

implementation as solid news becomes available. Until then, the

sole focus is on optimizing current locations and US location

expansion. As previously mentioned we currently have a signed loan

agreement for specific locations to be funded. Currently, two

locations are undergoing due diligence. Profitability is still a

necessity and is a continued process until the goal is

achieved.

As always, a big thank you to all our supporters and loyal

customers, we continue to serve in honor to create the best

possible experience for our patrons. The future of Snake and Lattes

is very bright as we continue to focus on operational improvements

and add on new locations; building our brand. Creating memorable

quality human interactive experiences keeps us going, and at all

times we keep the mission of ‘Snakes and Lattes locations coast in

coast’ at the forefront of our strategy.

See you at Snakes & Lattes!

About Snakes & Lattes Inc.

Snakes & Lattes Inc. currently operates 7 tabletop gaming

bars and cafes: 3 located in Toronto, Ontario, Canada, 1 in Tempe,

Arizona, 1 in Tucson, Arizona, 1 in Provo, Utah, and 1 in Chicago,

Illinois. The company is in the process of expanding throughout

North America. Snakes & Lattes Inc. was the first board game

bar and cafe in North America, and is believed to be the largest in

the world. Our board game cafes have the largest circulating public

library of board games in North America for customers to choose

from.

For more information on Snakes & Lattes Inc., please visit

the website at www.snakesandlattes.com.

For further updates from Snakes & Lattes inc. please follow

us on Twitter @SnakesLattesInc

Safe Harbor Statement

This news release contains statements that involve expectations,

plans or intentions (such as those relating to future business or

financial results, new features or services, or management

strategies) and other factors discussed from time to time in the

Company's OTC Market or Securities and Exchange Commission filings.

These statements are forward-looking and are subject to risks and

uncertainties, so actual results may vary materially. You can

identify these forward-looking statements by words such as "may,"

"should,", "will", "expect," "anticipate," "believe," "estimate,"

"confident," "intend," "plan" and other similar expressions. Our

actual results, such as the Company's ability to finance, complete

and consolidate acquisition of IP, assets and operating companies,

could differ materially from those anticipated in these

forward-looking statements as a result of certain factors not

within the control of the company such as a result of various

factors, including future economic, competitive, regulatory, and

market conditions. The company cautions readers not to place undue

reliance on any such forward-looking statements, which speak only

as of the date made. The company disclaims any obligation

subsequently to revise any forward-looking statements to reflect

events or circumstances after the date of such statements or to

reflect the occurrence of anticipated or unanticipated events.

Contact:

Ben Castanie

Snakes & Lattes Inc.

Telephone: (416) 500-2911

Email: ben@snakesandlattes.com

Amfil Technologies (PK) (USOTC:FUNN)

Historical Stock Chart

From Dec 2024 to Jan 2025

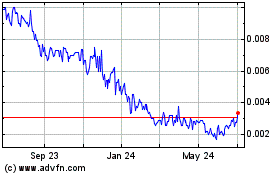

Amfil Technologies (PK) (USOTC:FUNN)

Historical Stock Chart

From Jan 2024 to Jan 2025