Branded PPE Company Is A Revenue Machine With $4M in Last 12 Mo. Sales

October 20 2020 - 8:00AM

InvestorsHub NewsWire

ADMQ Flies Under the Radar with

Branded PPE and Huge B2B E-Commerce Sales Growth

New Opportunity: ADM Endeavors Inc.

(OTC:ADMQ)

Investors looking for new opportunities in the equities markets

would do well to take note of ADM Endeavors Inc.

(OTC:ADMQ), a custom B2B and retail

goods player that has been capitalizing on recent accelerating

technology trends in the retail space to grow its presence in the

marketing and retail goods industry, with a strong E-Commerce

identity already in place.

COVID-19 has reshaped the world in so many ways. One of the most

prominent is the B2B small business economy. Everything in the

space is turning to virtual and automated functionality. At the

same time, brand-building is increasingly shifting toward product

merchandise, something that ADMQ has

anticipated in its core strategic objectives.

Shares of the stock have been advancing over the past two

months, rising over 250%, as the Company nails down a wider

exposure profile through expanded marketing reach, strong new

catalysts, and robust sales growth, with over $4 million in

trailing 12-month sales.

ADMQ has also become a key potential

player on the need for personal protection equipment in response to

the COVID-19 pandemic global health crisis as it offers

personalized face masks that allow individuals to meet local

regulations and protect themselves and their families while

expressing custom style with personalized graphics.

Key Points:

- ADMQ has pulled in over $4 million in

trailing twelve-month revenues from its product branding

operations

- ADMQ has witnessed over 20% in sequential

quarterly revenue growth over the past six months

- ADMQ has been consistently profitable

since its formation in 2010, with sales topping $3.8 million in FY

2019, leading to a net profit of over $270k

- ADMQ’s top executive has been amassing an

increasing ownership share over the company in the past 2 years,

suggesting those with the deepest knowledge of its operations and

opportunities are also its biggest capital supporters

- ADMQ is coming off an RSI trough under

40, pointing to a massively oversold stock now heading back the

other way.

- ADMQ is testing both the 200-day MA and

the 62% Fib retracement support levels, finding what appears to be

a strong supportive bid according to our technical analysis

Conclusion

B2B E-Commerce is at the front of the class right now,

especially if it plays into branded personal protection equipment

ahead of an anticipated second-wave breakout as we approach this

fall’s onset of the cold and flu season.

ADMQ has been racking up financial

performance for years, with strong and steady growth, including

over 20% on a sequential basis on the company’s most recent q/q

data. We draw extra comfort from the fact that the company’s top

leader is also apparently its biggest capital supporter, racking up

a controlling stake in preferred shares and nearly a third of the

company’s common stock over the past two years.

This is no fly-by-night company trying to grab some spotlight on

the COVID-19 headlines. This is a company pulling in millions in

sales with popular PPE product going out the door already.

Company Spotlight

Symbol: ADMQ

Company: ADM Endeavors Inc.

Company Website: admendeavors.com

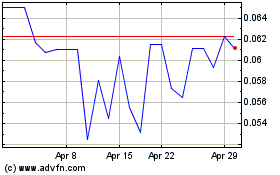

ADM Endeavors (QB) (USOTC:ADMQ)

Historical Stock Chart

From Aug 2024 to Sep 2024

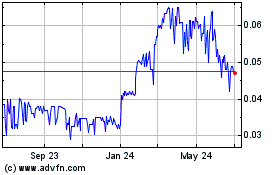

ADM Endeavors (QB) (USOTC:ADMQ)

Historical Stock Chart

From Sep 2023 to Sep 2024