UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934 (Amendment No. )

| Filed

by Registrant |

☒ |

|

| |

|

|

| Filed

by Party other than Registrant |

☐ |

|

| |

|

|

| Check

the appropriate box: |

|

|

| ☒ |

Preliminary

Proxy Statement |

☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

|

| ☐ |

Definitive

Proxy Statement |

☐ |

Definitive

Additional Materials |

| |

|

|

| ☐ |

Soliciting

Materials Pursuant to §240.14a-12 |

|

|

ADHERA

THERAPEUTICS, INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

|

| |

(1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

$_____

per share as determined under Rule 0-11 under the Exchange Act. |

| |

|

|

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

(5) |

Total

fee paid: |

| |

|

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

|

| |

(1) |

Amount

previously paid: |

| |

|

|

| |

(2) |

Form,

Schedule or Registration Statement No.: |

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

|

| |

(4) |

Date

Filed: |

PRELIMINARY

PROXY STATEMENT

Adhera

Therapeutics, Inc.

8000

Innovation Parkway

Baton

Rouge, LA 70820

(919)

518-3748

NOTICE

OF 2022 ANNUAL MEETING OF STOCKHOLDERS

TO

BE HELD ON AUGUST 18, 2022

To

the Stockholders of Adhera Therapeutics, Inc.:

We

are pleased to invite you to attend our 2022 Annual Meeting of Stockholders (the “Annual Meeting”), which will be held at

10:00 am, Eastern Time on August 18, 2022. The Annual Meeting is being held to:

1.

Elect four directors for a one-year term expiring at the next annual meeting of stockholders;

2.

Ratify the selection of Salberg & Company, P.A. as the Company’s independent registered

public accounting firm for the year ending December 31, 2022;

3.

Approve amendment(s) to our Certificate of Incorporation to effect one or more reverse stock splits of our

issued and outstanding shares of common stock, par value $0.006 per share, at a ratio to be determined in the discretion of

our Board of Directors within a range of one-for-two through one-for-200, provided that in no event shall such amendments

collectively exceed a reverse stock split ratio of one-for-200 (individually or collectively, as applicable, the “Reverse

Split”);

4.

Approve an adjournment of the Annual Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies

if there are not sufficient votes at the time of the Annual Meeting to approve any of the proposals presented for a vote at the Annual

Meeting; and

5.

Transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

Our

Board of Directors has fixed the close of business on June 24, 2022 as the record date for a determination of the stockholders

entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof.

Important

Notice Regarding the Availability of Proxy Materials for the Annual Meeting

to

Be Held on August 18, 2022:

The

Notice, Proxy Statement and 2021 Annual Report on Form 10-K, as amended, are available at www.proxyvote.com.

This

year, our Annual Meeting will be accessible through the Internet. You can attend our Annual Meeting by visiting www.virtualshareholdermeeting.com/ATRX2022.

The Annual Meeting will be conducted via live webcast. To be admitted to the Annual Meeting, you must enter the control number found

on your proxy card, voting instruction form or Notice you previously received. We have adopted a virtual format for our Annual Meeting

in lieu of an in person meeting. Additionally, we believe that a virtual meeting allows us to make participation accessible for stockholders

from any geographic location with Internet connectivity.

Whether

or not you expect to participate in the Annual Meeting, we urge you to vote your shares at your earliest convenience. This will ensure

the presence of a quorum at the meeting. Promptly voting your shares via the Internet, by phone or by signing, dating, and returning

the enclosed proxy card will save us the expenses and extra work of additional solicitation. An addressed envelope for which no postage

is required if mailed in the United States is enclosed if you wish to vote by mail. Submitting your proxy now will not prevent you from

voting your shares at the meeting if you desire to do so, as your proxy is revocable at your option. Your vote is important, so please

act today.

| |

By

the Order of the Board of Directors: |

| |

|

| |

/s/

Andrew Kucharchuk |

| |

Andrew

Kucharchuk |

| |

Chief

Executive Officer |

_________,

2022

PRELIMINARY

PROXY STATEMENT

Table

of Contents

PRELIMINARY

PROXY STATEMENT

Adhera

Therapeutics, Inc.

8000

Innovation Parkway

Baton

Rouge, LA 70820

(919)

518-3748

2022

ANNUAL MEETING OF STOCKHOLDERS

PROXY

STATEMENT

This

Proxy Statement is being made available to the holders of shares of the voting stock of Adhera Therapeutics, Inc., a Delaware corporation

(“Adhera” or the “Company”) in connection with the solicitation of proxies by our Board of Directors (the “Board”)

for use at the 2022 Annual Meeting of Stockholders of Adhera (the “Annual Meeting”) to be held at 10:00 am, Eastern Time

on August 18, 2022. The Annual Meeting will be a virtual meeting via live webcast over the Internet. You will be able to attend

the Annual Meeting, vote your shares and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/ATRX2022.

The proxy materials are first being mailed to our stockholders on or about June 27, 2022.

Who

is entitled to vote?

Our

Board has fixed the close of business on June 24, 2022 as the record date for a determination of the stockholders entitled to

notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. On the record date, there were 62,835,407 shares

of common stock, par value $0.006 per share, issued, outstanding and entitled to vote. This amount gives effect to recent

conversions of our former Series E Convertible Preferred Stock and Series F Convertible Preferred Stock (the “Series F”)

into a total of 48,902,167 shares of common stock, which assumes no former holders of such series of preferred stock beneficially

own shares of common stock in street name which would cause a holder to be the beneficial owner of over 4.99% of our outstanding

common stock after giving effect to the conversions. If that occurs as to any such holders, the number of shares of common stock

outstanding and entitled to vote will be reduced accordingly. Additionally, the number does not include 3,559,997 shares of common

stock underlying shares of Series F which were not issued because of the 4.99% beneficial ownership limitation applicable to two

holders of the Series F, and as a result 356 shares of Series F remain outstanding. Each share of Adhera common stock represents

one vote that may be voted on each matter that may come before the Annual Meeting.

As of the record date, Adhera had issued and outstanding

140 shares preferred stock that is entitled to vote, as follows: 100 shares of Series C Convertible Preferred Stock, (“Series

C”) and 40 shares of Series D Convertible Preferred Stock, (“Series D”, and together with the Series C, the

“Preferred Stock”). The holders of Preferred Stock are entitled to vote on all matters submitted to stockholders of the Company

and are entitled to the number of votes for each share of Preferred Stock owned as of the record date equal to the number of shares

of Common Stock into which such shares of Preferred Stock are convertible into at such time, subject to the limitation on the beneficial

ownership set forth in the Certificates of Designation of Preferred Stock of 4.99% or 9.99%, to the extent the 4.99% limitation has been

waived by the holder.

What

is the difference between holding shares as a record holder and as a beneficial owner?

If

your shares are registered in your name with American Stock Transfer & Trust Company, our transfer agent, you are the “record

holder” of those shares. If you are a record holder, this Proxy Statement has been provided directly to you by Adhera.

If

your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner”

of those shares held in “street name.” If your shares are held in street name, these materials have been forwarded to you

by that organization. As the beneficial owner, you have the right to instruct this organization on how to vote your shares.

Who

may attend the meeting and how do I attend?

Record

holders and beneficial owners may attend the Annual Meeting. This year the Annual Meeting will be held entirely online via live webcast.

Set

forth below is a summary of the information you need to attend the virtual Annual Meeting:

| |

● |

Visit

www.virtualshareholdermeeting.com/ATRX2022 to access the live webcast; |

| |

|

|

| |

● |

Stockholders

can vote electronically and submit questions online while attending the Annual Meeting; To be admitted to the Annual Meeting, you

must enter the control number found on your proxy card, voting instruction Notice you previously received; |

| |

|

|

| |

● |

Instructions

on how to attend and participate in the virtual Annual Meeting, including how to demonstrate proof of stock ownership, are also available

at www.virtualshareholdermeeting.com/ATRX2022. |

Stockholders

may vote electronically and submit questions online while attending the virtual Annual Meeting.

How

do I vote?

If

you are a stockholder of record, you may vote:

| |

1. |

By

Internet. The website address for Internet voting is on your Notice. |

| |

|

|

| |

2. |

By

phone. Call 1 (800) 690-6903 and follow the instructions on your Notice. |

| |

|

|

| |

3. |

By

mail. Mark, date, sign and mail promptly the enclosed proxy card (a postage-paid envelope is provided for mailing in the United

States). |

| |

|

|

| |

4. |

In

person: Visit www.virtualshareholdermeeting.com/ATRX2022 to vote at the virtual Annual Meeting. |

If

you vote by Internet or phone, please DO NOT mail your proxy card.

If

your shares are held in street name, you may vote:

| |

1. |

By

Internet. The website address for Internet voting is on your voting instruction form provided by your bank, broker, or similar

organization. |

| |

|

|

| |

2. |

By

mail. Mark, date, sign and mail promptly the enclosed voting instruction form provided by your bank or broker. |

| |

|

|

| |

3. |

In

person: Visit www.virtualshareholdermeeting.com/ATRX2022 to vote at the virtual Annual Meeting. |

If

you are a beneficial owner, you must follow the voting procedures of your nominee included with your proxy materials. If your shares

are held by a nominee and you intend to vote at the Annual Meeting, please be ready to demonstrate proof of your beneficial ownership

as of the record date (such as your most recent account statement as of the record date, a copy of the voting instruction form provided

by your broker, bank, trustee or nominee, or other similar evidence of ownership) and a legal proxy from your nominee authorizing you

to vote your shares.

What

constitutes a Quorum?

To

carry on the business of the Annual Meeting, we must have a quorum. A quorum is present when the holders of shares of voting stock representing

a majority of the voting power of the outstanding shares of voting stock issued, outstanding and entitled to vote at a meeting of stockholders

are represented in person or by proxy at such meeting. Shares owned by Adhera are not considered outstanding or considered to be present

at the Annual Meeting. Broker non-votes (because there are routine matters presented at this Annual Meeting) and abstentions are counted

as present for the purpose of determining the existence of a quorum.

What

happens if Adhera is unable to obtain a Quorum?

If

a quorum is not present to transact business at the Annual Meeting or if we do not receive sufficient votes in favor of the proposals

by the date of the Annual Meeting, the person named as proxy may propose one or more adjournments of the Annual Meeting to permit solicitation

of proxies.

What

if I sign and return my proxy without making any selections?

If

you are the stockholder of record, and you sign and return a proxy card without giving specific voting instructions, then your shares

will be voted “FOR” Proposals 1, 2, 3, and 4. If other matters properly come before the Annual Meeting, the proxy holder

will have the authority to vote your shares at his discretion.

How

Many Votes are Needed for Each Proposal to Pass?

| Proposals |

|

Vote

Required |

| |

|

|

|

| 1. |

Election

of directors; |

|

Plurality

|

| 2. |

Ratification

of the selection of our independent registered public accounting firm |

|

Majority

of the voting power present and entitled to vote on the matter |

| 3. |

Approval

of amendment(s) to the Certificate of Incorporation to Effect the Reverse Split |

|

Majority

of outstanding voting power entitled to vote on the matter |

| 4. |

Adjournment

of the Annual Meeting |

|

Majority

of the voting power present and entitled to vote on the matter |

Election

of Directors. In order to be elected to the Board, each nominee must receive a plurality of the votes cast. This means that the four

director nominees who receive the highest number of votes “FOR” their election are elected.

Ratification

of the Independent Registered Public Accounting Firm. The affirmative vote of a majority of the voting power present at the Annual

Meeting in person or represented by proxy and entitled to vote on the matter is required for the ratification of the selection of the

independent registered public accounting firm.

Approval

of Amendment(s) to the Certificate of Incorporation to Effect the Reverse Split. The affirmative vote of a majority

of outstanding voting power entitled to vote on the matter is required to approve the amendment(s) to the Certificate of Incorporation

to effect the Reverse Split.

Adjournment

of the Annual Meeting. The affirmative vote of a majority of the voting power present at the Annual Meeting in person or represented

by proxy and entitled to vote on the matter is required to approve the adjournment of the Annual Meeting to a later date or time, if

necessary, to permit further solicitation and vote of proxies if there are not sufficient votes at the time of the Annual Meeting to

approve any of the proposals presented for a vote at the Annual Meeting.

What

are the Voting Procedures?

In

voting by proxy with regard to the election of directors, you may vote in favor of all nominees, withhold your votes as to all nominees,

or withhold your votes as to specific nominees. On Proposals 2, 3, and 4 you may vote in favor of or against the proposal, or you may

abstain from voting on the proposal. You should specify your respective choices on the proxy card or your voting instruction form.

How

are abstentions treated?

| Proposals |

|

Effect

of Abstentions on the Proposal |

| |

|

|

|

| 1. |

Election

of directors |

|

Not

applicable |

| 2. |

Ratification

of the selection of our independent registered public accounting firm |

|

Against |

| 3. |

Approval

of amendment(s) to the Certificate of Incorporation to effect the Reverse Split |

|

Against |

| 4. |

Adjournment

of the Annual Meeting |

|

Against |

Abstentions

will have the same effect as a vote “AGAINST” Proposals 2, 3, and 4. Withheld votes will not have any effect on Proposal

1.

What

if I am a beneficial owner and I do not give the nominee voting instructions?

If

your shares are held in street name, you must instruct the organization that holds your shares how to vote. Such organization is bound

by the rules of the New York Stock Exchange, or NYSE, regarding whether or not it can exercise discretionary voting power for any particular

proposal in the absence of voting instructions from you. Brokers have the authority to vote shares for which their customers do not provide

voting instructions on certain “routine” matters. A broker non-vote occurs when a nominee who holds shares for another does

not vote on a particular matter because the nominee does not have discretionary voting authority for that item and has not received instructions

from the owner of the shares or when a broker for its own internal reasons elects not to vote uninstructed shares. Broker non-votes are

included in the calculation of the number of votes deemed present at the meeting for purposes of determining the presence of a quorum.

The

table below sets forth, for each proposal, whether a nominee organization can exercise discretion and vote your shares absent your instructions

and if not, the impact of such broker non-vote on the approval of the proposal.

| Proposal |

|

Broker

Discretionary

Vote

Allowed |

|

Impact

of

Broker

Non-

Vote* |

| |

|

|

|

|

|

| 1. |

Election

of directors |

|

No |

|

None |

| 2. |

Ratification

of the selection of our independent registered public accounting firm |

|

Yes |

|

N/A |

| 3. |

Approval

of amendment(s) to the Certificate of Incorporation to effect the Reverse Split |

|

Yes |

|

N/A |

| 4. |

Adjournment

of the Annual Meeting |

|

Yes |

|

N/A |

*If

you do not provide voting instructions, your shares will not be voted on any non-routine proposal. Proposals 2, 3, and 4 are considered

“routine” proposals, while Proposal 1 is considered a “non-routine” proposal. As a result, if you do not provide

voting instructions to your nominee organization, your shares will not be voted on Proposal 1. Broker non-votes do not count as a vote

“FOR” or “AGAINST” Proposal 1, and accordingly will have no impact on the outcome of that Proposal. For Proposals

2, 3, and 4, while broker discretionary voting in favor of management’s proposals is permitted under NYSE Rules, an increasing

number of brokers and similar organizations which hold shares in street name have elected to either refrain from discretionary voting

or engage in a form of proportionate voting such as voting shares in a manner consistent with all other votes cast at the meeting. As

a result, while broker discretionary voting could result in a vote “FOR” Proposals 2, 3, and 4 for some or all instances

in which a beneficial stockholder declines to provide instructions for voting his, her or its shares, we cannot predict what the ultimate

outcome will be as it depends on the organization which has custody of the shares in each such case.

Is

My Proxy Revocable?

If

you are a stockholder of record, you may revoke your proxy and reclaim your right to vote up to and including the day of the Annual Meeting

by giving written notice of revocation to the Corporate Secretary of Adhera bearing a later date than your proxy, by executing and delivering

to the Corporate Secretary of Adhera a proxy card dated after the date of your proxy, or by voting in person at the Annual Meeting. All

written notices of revocation and other communications with respect to revocations of proxies should be addressed to: Adhera Therapeutics,

Inc., 8000 Innovation Parkway, Baton Rouge, LA 70820.

If

your shares are held in street name, you may change your vote by following your nominee’s procedures for revoking your proxy or

changing your vote.

Who

is Paying for the Expenses Involved in Preparing and Mailing this Proxy Statement?

All

of the expenses involved in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be paid

by Adhera. In addition to the solicitation by mail, proxies may be solicited by our officers and regular employees by telephone or in

person. Such persons will receive no compensation for their services other than their regular salaries. Arrangements will also be made

with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of the

shares held of record by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred by them in so

doing.

What

Happens if Additional Matters are Presented at the Annual Meeting?

Other

than the items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting.

If you submit a signed proxy card, the person named as proxy holder, Mr. Andrew Kucharchuk, will have the discretion to vote your shares

on any additional matters properly presented for a vote at the Annual Meeting. If for any reason any of our nominees is not available

as a candidate for director, the person named as proxy holder will vote your shares “FOR” such other candidate or candidates

as may be properly nominated by the Board.

What

is “householding” and how does it affect me?

Record

holders who have the same address and last name will receive only one copy of the printed proxy materials, unless we are notified that

one or more of these record holders wishes to continue receiving individual copies. This procedure will reduce our printing costs and

postage fees.

If

you are eligible for householding, but you and other record holders with whom you share an address, receive multiple copies of the proxy

materials, or if you hold Adhera stock in more than one account, and in either case you wish to receive only one copy of each of these

documents for your household, please contact our Corporate Secretary at: 8000 Innovation Parkway, Baton Rouge, LA 70820.

If

you participate in householding and wish to receive a separate copy of these proxy materials, or if you do not wish to continue to participate

in householding and prefer to receive separate copies of these documents in the future, please contact our Corporate Secretary as indicated

above. Beneficial owners can request information about householding from their brokers, banks or other holders of record.

Do

I Have Dissenters’ (Appraisal) Rights?

Appraisal

rights are not available to the Company’s stockholders with any of the proposals brought before the Annual Meeting.

Can

a Stockholder Present a Proposal To Be Considered At the 2023 Annual Meeting?

If

you wish to submit a proposal to be considered at the 2023 annual meeting of stockholders (the “Next Annual Meeting”), the

following is required:

| |

● |

For

a stockholder proposal to be considered for inclusion in Adhera’s Proxy Statement and proxy card for the Next Annual Meeting

pursuant to Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”) our Corporate Secretary must receive

the written proposal no later than February 27, 2023, which is 120 calendar days prior to the anniversary date Adhera’s Proxy

Statement was released to the stockholders in connection with the Annual Meeting. Such proposals also must comply with the Securities

and Exchange Commission (the “SEC”) regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in

company sponsored materials. |

| |

|

|

| |

● |

Our

Bylaws include advance notice provisions that require stockholders desiring to recommend or nominate individuals for election to

the Board or who wish to present a proposal at the Next Annual Meeting to do so in accordance with the terms of the advance notice

provisions. For a stockholder proposal or a nomination that is not intended to be included in Adhera’s Proxy Statement and

proxy card under Rule 14a-8, our Corporate Secretary must receive the written proposal not less than 75 days nor more than 120 days

prior to the anniversary date of this Annual Meeting; provided, however, that in the event the Next Annual Meeting

is scheduled to be held on a date more than 30 days before the anniversary date of this Annual Meeting or more than 60 days after

such anniversary date, a stockholder’s notice shall be timely if delivered to, or mailed to and received by, the Company not

later than the close of business on the later of (i) the 75th day prior to the scheduled date of the Next Annual Meeting, or (ii)

the 15th day following the day on which public announcement of the date of the Next Annual Meeting is first made by the Company.

If a stockholder fails to meet these deadlines and fails to satisfy the requirements of Rule 14a-8 under the Exchange Act, we may

exercise discretionary voting authority under proxies we solicit to vote on any such proposal as we determine appropriate. Your notice

must contain the specific information set forth in our Bylaws. |

A

nomination or other proposal will be disregarded if it does not comply with the above procedures. All proposals and nominations should

be sent to our Corporate Secretary at 8000 Innovation Parkway, Baton Rouge, LA 70820.

We

reserve the right to amend our Bylaws and any change will apply to the Next Annual Meeting unless otherwise specified in such

amendment.

Interest

of Officers and Directors in Matters to Be Acted Upon

Except

in the election of directors, none of the officers or directors have any interest in any of the matters to be acted upon at the Annual

Meeting.

Where

can I find voting results of the Annual Meeting?

We

will announce the results for the proposals voted upon at the Annual Meeting and publish voting results in a Current Report on Form 8-K

filed within four business days after the Annual Meeting.

The

Board Recommends that Stockholders Vote “FOR” Proposals 1, 2, 3, and 4.

PROPOSAL

1. ELECTION OF DIRECTORS

Pursuant

to the authority granted to our Board of Directors (the “Board”) under our Bylaws, the Board has fixed the number of directors

constituting the entire Board at four. The Board currently consists of four directors.

Our

Board has nominated the four individuals named below currently serving as directors of the Company to be elected as directors at the

Annual Meeting, each to hold office until the next annual meeting of stockholders and until his or her successor is duly elected and

qualified.

The

Board recommends a vote “For” the election of all of the director nominees.

NOMINEES

FOR DIRECTOR

The

following table sets forth information provided by the nominees as of the record date. All of the nominees are currently serving as directors

of Adhera. All of the nominees have consented to serve if elected by our stockholders. There are no family relationships among our directors

and executive officers.

| Name |

|

Age |

|

Position |

| Trond

Waerness |

|

54 |

|

Chairman

of the Board |

| Andrew

Kucharchuk |

|

41 |

|

Vice

Chairman of the Board |

| Charles

Rice |

|

56 |

|

Director |

| Zahed

Subhan |

|

64 |

|

Director |

Director

Nominees Biographies

Trond

K. Waerness – Mr. Waerness has served as a director of the Company since April

2021. Since 2016, Mr. Waerness has either founded or co-founded three pharmaceutical services

companies including Atna Consulting Services where he has served as President since June

2017.

We

believe that Mr. Waerness’ experience in various roles of pharmaceutical commercialization makes him a valuable asset to our Board.

Andrew

Kucharchuk – Mr. Kucharchuk has served on our Board and as Chief Executive Officer since July 7, 2020. He has

also served on the Board of Directors of Theralink Technologies, Inc. (“Theralink”) since 2020 after previously serving in

such role from September 2015 to March 2017. Previously, he served as President and Chief Financial Officer of Theralink from February

2016 until June 2020, and as Chief Executive Officer of Theralink from November 2019 until June 2020. Mr. Kucharchuk has also served

as Acting Chief Financial Officer of Theralink from June 2020 to September 2020.

We

believe that Mr. Kucharchuk’s prior executive experience in the pharmaceutical industry, as well as his financial background, make

him a valuable asset to our Board.

Charles

L. Rice – Mr. Rice has served as a director since July 10, 2020. He also served as a member of the Board of Directors of Theralink

from November 2015 until June 2020. He is also the President of Entergy New Orleans, Inc. (“Entergy”), an electric and gas

utility company, where he has served since 2010.

We

believe that Mr. Rice’s prior management and governance experience makes him a valuable asset to our Board.

Zahed

Subhan – Mr. Subhan has served as a director of the Company since November 2021. He was appointed as the Company’s

Chief Scientific Officer on June 17, 2022. He has served as the Chief Executive Officer and director of Aestas Pharma Inc. since

2015. Mr. Subhan has also been a director of Eppin Pharma Inc. (“Eppin”) since 2013, and the Chief Executive Officer of Eppin

from 2013 to 2018.

We

believe that Mr. Subhan’s extensive experience in the pharmaceutical and biotechnology industries makes him a valuable asset to

our Board.

EXECUTIVE

OFFICERS

| Name |

|

Age |

|

Position |

| Andrew

Kucharchuk |

|

41 |

|

Chief

Executive Officer |

| Zahed Subhan |

|

64 |

|

Chief Scientific Officer |

See

“Director Biographies” above for each executive officer’s biographical information.

CORPORATE

GOVERNANCE

Board

Meetings

Our

Board held a total of seven meetings during 2021. We have no formal policy regarding attendance by directors or officers at our

stockholders’ meetings. All of the directors attended over 75% of the applicable Board meetings held in 2021.

Director

Independence

The

Board utilizes the Nasdaq Stock Market’s (“Nasdaq”) standards for determining the independence of its members. In applying

these standards, the Board considers commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships,

among others, in assessing the independence of directors, and must disclose any basis for determining that a relationship is not material.

The Board has determined that with the exception of Messrs. Kucharchuk and Subhan, each of our directors is independent

directors within the meaning of the Nasdaq independence standards. In making this independence determination, the Board did not exclude

from consideration as immaterial any relationship potentially compromising the independence of any of the above directors.

Audit

Committee

Due

to our financial and operational condition, and the size of our Board, we do not have any separate committees of the Board, and the entire

Board functions as the Audit Committee. See “Audit Committee Report.”

The

Board has determined that the Company does not have an Audit Committee Financial Expert, as that term is defined in Item 407(d) of Regulation

S-K, due to its lack of a separate Audit Committee, small size and limited resources.

Board

Diversity

While

we do not have a formal policy on diversity, our Board, as part of its review of potential director candidates, considers each candidate’s

character, judgment, skill set, background, reputation, type and length of business experience, personal attributes, and a particular

candidate’s contribution to that mix. While no particular criteria are assigned specific weights, the Board believes that the backgrounds

and qualifications of our directors, as a group, should provide a composite mix of experience, knowledge, backgrounds and abilities that

will allow our Board to be effective, collegial and responsive to the nature of our business and our needs, and satisfy the requirements

of applicable the rules and regulations, including the rules and regulations of the SEC.

Board

Leadership Structure

While our Board has no fixed policy with respect

to combining or separating the offices of Chairman of the Board and Chief Executive Officer, those positions are presently held

by separate individuals. We believe that this Board leadership structure is the most appropriate for the Company at this time

because it allows for sufficient Board oversight of the business and supervision of our Chief Executive Officer, while still providing

sufficient autonomy to our management team to oversee day-to-day operations of the Company. Further, the current separation of the roles

allows the Chief Executive Officer to focus his time and energy on operating and managing the Company while also enabling our Company

to benefit from leveraging the experience and perspectives of the Chairman against that of the Company’s senior management.

Board

Assessment of Risk

The

Board is actively involved in the oversight of risks that could affect Adhera. This oversight is conducted primarily through the Board

for general oversight of risks. The Board considers and reviews with management the adequacy of our internal controls, including the

processes for identifying significant risks and exposures, and elicits recommendations for the improvements of such procedures where

desirable. The Board is involved in oversight and administration of risk and risk management practices. Members of our management have

day-to-day responsibility for risk management and establishing risk management practices, and members of management are expected to report

matters relating specifically to the Board directly thereto. Our management has an open line of communication to the Board and have the

discretion to raise issues from time-to-time in any manner they deem appropriate, and management’s reporting on issues relating

to risk management typically occurs through direct communication with directors or committee members as matters requiring attention arise.

Our sole executive officer is a member of the Board.

The

Board actively interfaces with management on seeking solutions to any perceived risk.

Code

of Ethics

We

have adopted a Code of Business Conduct and Ethics that applies to all of our employees, including our executive officers, and to members

of our Board. Our Code of Business Conduct and Ethics is filed as Exhibit 10.18 to the Amendment to our Annual Report on Form 10-K for

the year ended December 31, 2021 filed on April 29, 2022. Printed copies are available upon request without charge by contacting us at

our corporate headquarters at 8000 Innovation Parkway, Baton Rouge, LA 70820 Attention: Corporate Secretary. Any amendment to or waiver

of the Code of Business Conduct and Ethics will be disclosed on our website promptly following the date of such amendment or waiver.

Hedging

Under

the Company’s Insider Trading Policy, all officers, directors and certain identified employees are prohibited from engaging in

hedging transactions.

Stockholder

Communications

Although

we do not have a formal policy regarding communications with our Board, stockholders may communicate with the Board by writing to the

Corporate Secretary of Adhera Therapeutics, Inc. at 8000 Innovation Parkway, Baton Rouge, LA 70820, or by email at: akucharchuk@adherathera.com.

Stockholders who would like their submission directed to a member of the Board may so specify, and the communication will be forwarded,

as appropriate.

Delinquent

Section 16(a) Reports

Section

16(a) of the Exchange Act requires our directors, executive officers, and persons who beneficially own more than 10% of our common stock

to file initial reports of ownership and changes in ownership of our common stock and other equity securities with the SEC. These individuals

are required by the regulations of the SEC to furnish us with copies of all Section 16(a) forms they file. Based solely on a review of

the copies of the forms furnished to us, and written representations from reporting persons, we believe that all filing requirements

applicable to our officers, directors and 10% beneficial owners were complied with during the year ended December 31, 2021, except the

Form 3 for Zahed Subhan, director, the Form 3 for Charles Rice, director, and the Form 3 for Trond Waerness, director, which were not

timely filed. None of our directors are owners of our common stock or other equity securities.

Involvement

in Certain Legal Proceedings

From

time-to-time, we may become a party to litigation and subject to claims incident to the ordinary course of our business. Although the

results of such litigation and claims in the ordinary course of business cannot be predicted with certainty, we believe that due to our

lack of capital any litigation will have a material adverse effect on our business, results of operations or financial condition. In

addition, litigation can have an adverse impact on us because of defense costs, diversion of management resources and other factors.

CERTAIN

RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Approval

for Related Party Transactions

It

is our practice and policy to comply with all applicable laws, rules and regulations regarding related-person transactions. Our Code

of Business Conduct and Ethics requires that all employees, including officers and directors, disclose to the Chief Executive Officer

the nature of any company business that is conducted with any related party of such employee, officer or director (including any immediate

family member of such employee, officer or director, and any entity owned or controlled by such persons). If the transaction involves

an officer or director of our Company, the Chief Executive Officer must bring the transaction to the attention of the Board, which must

review and approve the transaction in writing in advance. In reviewing such transactions the Board considers the relevant available facts

and circumstances.

Related

Party Transactions

Since

January 1, 2020, other than as disclosed below, there have been no transactions in which the Company was a participant and in

which any director or executive officer of the Company, any known 5% or greater stockholder of the Company or any immediate family member

of any of the foregoing persons, had a direct or indirect material interest as defined in Item 404(a) of Regulation S-K. As permitted

by the SEC rules, discussion of employment relationships or transactions involving the Company’s executive officers and directors,

and compensation solely resulting from such employment relationships or transactions, or service as a director of the Company, as the

case may be, has been omitted to the extent disclosed in the Executive Compensation or the Director Compensation sections of this Proxy

Statement, as applicable.

Licensing

Agreement – MLR 1023

On

August 24, 2021, the Company as licensee entered into an exclusive license agreement with Melior Pharmaceuticals I, Inc. (“Melior”)

for the development, commercialization and exclusive license of Melior’s MLR-1023(the “Melior Agreement”). MLR-1023

is being developed as a novel therapeutic for Type 1 diabetes. Under the Melior Agreement, the Company was granted an exclusive license

to use the Melior patents and know-how related to MLR-1023 to develop products in consideration for cash payments up to approximately

$21.8 million upon meeting certain performance milestones, as well as a tiered royalty of 8-12% of gross sales. Under

the original terms of the Melior Agreement, if the Company failed to raise $4 million within 120 days of the effective date then

the license would immediately terminate unless, by 120 days Adhera was in the process of completing transactions to complete the fundraising

then an additional 30 days would be provided to allow for the completion of the raise. On October 20, 2021, the Company expanded the

Melior Agreement to include two additional clinical indications for Non-Alcoholic Steatohepatitis (NASH) and pulmonary inflammation.

On November 17, 2021, Melior extended the Company’s timeline under the Melior Agreement from 120 days to 180 days from the

effective of the Melior Agreement for the Company to raise $4 million unless, by 180 days Adhera is in the process of completing transactions

to complete the fundraising then an additional 30 days shall be provided to allow for the completion of required fundraising. On February

16, 2022, an addendum to the Melior Agreement dated August 4, 2021, was executed by the Company and Melior, extending the requirement

by the Company to raise $4 million to June 16, 2022. As of the date of the mailing of this Proxy Statement, no performance milestones

had been met under the Melior Agreement. Zahed Subhan, a director of the Company since November 2021, is Chief Scientific Officer of

Melior and a developer of MLR-1023. On June 17, 2022 with the appointment of Mr. Zubhan as Chief Scientific Officer of the Company, the

President of Melior sent a promising email that they would agree to another extension with fair milestones.

Chief Scientific Officer Employment Agreement

Pursuant to the amendment to the Melior Agreement

described above, the Company was required to hire a Chief Scientific Officer by June 16, 2022. On June 17, 2022, the Board approved and

authorized the Company’s hiring of Zahed Subhan, a director of the Company, as the Company’s Chief Scientific Officer. In

connection with his appointment, the Company entered into an Employment Agreement with Mr. Subhan under which Mr. Subhan is entitled

to a base salary of $300,000 and will also be eligible to receive an annual incentive bonus if certain performance milestones and criteria

mutually agreed by Mr. Subhan and the Board are met. The Employment Agreement provides that Mr. Subhan’s employment is at will,

but if his employment is terminated without cause by the Company or for good reason by Mr. Subhan, Mr. Subhan will be entitled to severance

payments as follows: (a) if the termination is within the first six months of his employment, an amount equal to three-fourths of his

annual base salary, or nine months’ severance, and (b) if such termination is after the first six months of his employment, an

amount equal to his annual base salary, or twelve months’ severance; plus the continuation of certain benefits for the applicable

severance period. The term “cause” is defined as gross negligence, willful misconduct or embezzlement in the course of Mr.

Subhan’s employment or service, and the phrase “good reason” is defined as (a) a material reduction or diminution in

position, duties or responsibilities, (b) a material reduction in base salary or benefits, (c) the failure of any successor entity to

assume and honor the material terms and conditions of the Employment Agreement, or (d) the Company violates a material term or condition

of the Employment Agreement.

Security

Ownership of Certain Beneficial Owners and Management

The

following table sets forth certain information regarding the ownership of our common stock as of the record date beneficially

owned by: (i) each current director of our Company; (ii) our sole executive officer (named executive officer); (iii) all current executive

officers and directors of our Company as a group; and (iv) all those known by us to be beneficial owners of more than 5% of our common

stock.

To

our knowledge, except as indicated in the footnotes to the following table, and subject to state community property laws where applicable,

all beneficial owners named in the following table have sole voting and investment power with respect to all shares shown as beneficially

owned by them. Unless otherwise indicated, the business address of each person in the table below is c/o Adhera Therapeutics, Inc., 8000

Innovation Parkway, Baton Rouge, LA 70820.

| Beneficial Owner | |

Amount of Common Stock Beneficially Owned and Nature of Beneficial Owner (1) | | |

Percent of

Class (1) | |

| Officers and Directors: | |

| | | |

| | |

| Andrew Kucharchuk | |

| - | | |

| 0 | % |

| Charles Rice | |

| - | | |

| 0 | % |

| Trond Waerness | |

| - | | |

| 0 | % |

| Zahed Subhan | |

| - | | |

| 0 | % |

| | |

| | | |

| | |

| 5% Stockholders: | |

| | | |

| | |

| Vuong Trieu, Ph.D. | |

| 11,794,646 | (2) | |

| 17.69 | % |

| Autotelic Inc. | |

| 5,642,226 | (3) | |

| 8.61 | % |

*

Less than 1%.

| (1)

|

Applicable

percentages are based on 62,835,407 shares of common stock outstanding as of the record date, including shares not

yet issued which are issuable pursuant to conversions of the Company’s former Series E Convertible Preferred Stock and the

Series F, and excluding securities held by or for the account of the Company. This amount gives effect to recent conversions

of our former Series E Convertible Preferred Stock and the Series F into a total of 48,902,167 shares of common stock, which assumes

no former holders of such series of preferred stock beneficially own shares of common stock in street name which would cause a holder

to be the beneficial owner of over 4.99% of our outstanding common stock after giving effect to the conversions. If that occurs as

to any such holders, the number of shares of common stock outstanding will be reduced accordingly. Additionally, the number does

not include 3,559,997 shares of common stock underlying shares of Series F which were not issued because of the 4.99% beneficial

ownership limitation applicable to two holders of the Series F, and as a result 356 shares of Series F remain outstanding. Beneficial

ownership is determined under the rules of the SEC and generally includes voting or investment power with respect to securities.

A person is deemed to be the beneficial owner of securities that can be acquired by such person within 60 days after the date of

determination, whether upon the exercise of options, warrants or conversion of notes. Unless otherwise indicated in the footnotes

to this table, we believe that each of the stockholders named in the table has sole voting and investment power with respect to the

shares of common stock indicated as beneficially owned by them. |

| (2) |

Dr.

Trieu previously served as an executive officer and as a director of our Company. Includes 2,312,356 shares held by Autotelic LLC,

entity of which Dr. Trieu serves as an executive officer, 86,207 shares held by LipoMedics Inc., an entity of which Dr. Trieu serves

as Chairman of the Board and as an executive officer, and the shares of common stock held or beneficially owned by

Autotelic Inc., an entity of which Dr. Trieu serves as Chairman of the Board. Also includes warrants to purchase 1,135,425 shares

of common stock held by Dr. Trieu. Information based on a Schedule 13D/A filed with the SEC on April 27, 2018. |

| (3) |

Address

is 940 South Coast Drive, Suite 100, Costa Mesa, CA 92626. Represents 2,935,261 shares of common stock and warrants to purchase

2,706,965 shares of common stock which are subject to a 9.99% beneficial ownership limitation. Dr. Vuong Trieu is the Chief

Executive Officer of the entity. Information based on a Schedule 13D/A filed with the SEC on April 27, 2018. |

PROPOSAL

2. RATIFICATION OF THE SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our

Board has selected Salberg & Company, P.A. (“Salberg”) as our independent registered public accounting firm for the year

ending December 31, 2022 and our Board recommends that stockholders vote in favor of the ratification of such selection. Salberg has

been engaged as our independent registered public accounting firm since April 28, 2021.

The

selection of Adhera’s independent registered public accounting firm is not required to be submitted to a vote of the Company’s

stockholders. However, Adhera is submitting this matter to its stockholders for ratification as a matter of good corporate governance.

Even if the selection is ratified, the Board may, in its discretion, appoint a different independent registered public accounting firm

at any time during 2022 if they determine that such a change would be in the best interests of Adhera and its stockholders. If the selection

is not ratified, the Board will consider its options.

On

April 28, 2021, the Board approved the dismissal of Baker Tilly USA, LLP (“Baker Tilly”) as the Company’s independent

registered public accounting firm and approved the appointment of Salberg as its replacement beginning with the fiscal year ended December

31, 2021.

The

reports of Baker Tilly on the Company’s consolidated financial statements for the fiscal years ended December 31, 2020 and December

31, 2019 did not contain any adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope

or accounting principle, except that each report on the Company’s consolidated financial statements contained an explanatory paragraph

regarding the Company’s ability to continue as a going concern based on the Company’s accumulated deficit, negative cash

flows from operations, loss from operations and negative working capital for the fiscal years ended December 31, 2020 and as of December

31, 2019. During the fiscal years ended December 31, 2020 and December 31, 2019 and the subsequent interim period through April 28, 2021,

the effective date of Baker Tilly’s dismissal, there were (i) no disagreements (as that term is defined in Item 304(a)(1)(iv) of

Regulation S-K and the related instructions) between the Company and Baker Tilly on any matter of accounting principles or practices,

financial statement disclosure, or auditing scope or procedure, which, if not resolved to the satisfaction of Baker Tilly would have

caused Baker Tilly to make reference thereto in its reports on the consolidated financial statements of the Company for such years, and

(ii) no “reportable events” (as that term is defined in Item 304(a)(1)(v) of Regulation S-K).

Audit

Committee Report

Due

to our financial and operational condition, and the size of our Board, the entire Board functions as the Audit Committee, and oversees

our accounting practices, system of internal controls, audit processes and financial reporting processes. The Board is responsible for

selecting and retaining our independent auditor and approving the audit and non-audit services to be provided by the independent auditor.

Because we do not have a separate Audit Committee of the Board, we do not have an audit committee charter.

Our

management is responsible for preparing our financial statements and ensuring they are complete and accurate and prepared in accordance

with generally accepted accounting principles. The independent registered public accounting firm is responsible for performing an independent

audit of our consolidated financial statements and expressing an opinion on the conformity of those financial statements with generally

accepted accounting principles.

The

Board has:

| |

● |

reviewed

and discussed the audited financial statements with management; |

| |

|

|

| |

● |

discussed

with the independent registered public accounting firm matters required to be discussed by Statement on Auditing Standards No. 1301; |

| |

|

|

| |

● |

received

the written disclosures and the letter from the independent registered public accounting firm, as required by the applicable requirements

of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications

with the Board concerning independence, and has discussed its independence with Adhera; and |

| |

|

|

| |

● |

in

reliance on the review and discussions referred to above, the Board agreed that the audited financial statements be included in the

Annual Report on Form 10-K for the year ended December 31, 2021 for filing with the SEC. |

This

report is submitted by the Board.

Trond

K. Waerness, Chairman

Charles

L. Rice

Andrew Kucharchuk

Zahid

Subhan

The

above Audit Committee Report is not deemed to be “soliciting material,” is not “filed” with the SEC and is not

to be incorporated by reference in any filings that Adhera files with the SEC.

It

is not the duty of the Board to determine that Adhera’s financial statements and disclosures are complete and accurate and in accordance

with generally accepted accounting principles or to plan or conduct audits. Those are the responsibilities of management and Adhera’s

independent registered public accounting firm. In carrying out the foregoing responsibilities, the Board has relied on: (1) management’s

representations that such financial statements have been prepared with integrity and objectivity and in conformity with U.S. generally

accepted accounting principles; and (2) the report of Adhera’s independent registered public accounting firm with respect to such

financial statements.

Board’s

Pre-Approval Policies and Procedures

Our

Board reviews and approves audit and permissible non-audit services performed by our independent registered public accounting firm, as

well as the fees charged for such services. In its review of non-audit service and its appointment of our independent registered public

accounting firm, the Board considers and considered whether the provision of such services was compatible with maintaining independence.

All of the services provided and fees charged by our independent registered public accounting firm in 2021 and 2020 were approved by

the Board in accordance with its pre-approval policy.

Principal

Accounting Fees

As

of December 31, 2021, the Company owed Baker Tilly approximately $26,000 for audit fees incurred prior to the dismissal. The following

table sets forth the fees billed to the Company for professional services rendered by Salberg for the years ended December 31, 2021 and

2020:

| Services | |

2021($)* | | |

2020($)* | |

| Audit Fees (1) | |

$ | 65,000 | | |

$ | - | |

| Audit-Related fees (2) | |

| - | | |

| - | |

| Tax fees (3) | |

| - | | |

| - | |

| Total fees | |

$ | 65,000 | | |

$ | - | |

*Does

not include amounts billed to us by Baker Tilly, our former principal accountant, during the applicable period.

| (1) |

Audit

Fees – These consisted of the aggregate fees for professional services rendered in connection with (i) the audit of

our annual financial statements, (ii) the review of the financial statements included in our Quarterly Reports on Form 10-Q for the

quarters ended March 31, June 30 and September 30, 2021 and (iv) services provided in connection with statutory and regulatory filings

or engagements. |

| (2) |

Audit-Related

Fees – These consisted principally of the aggregate fees related to audits that are not included Audit Fees. |

| |

|

| (3) |

Tax

Fees – These consist of professional services rendered in connection with tax compliance, tax planning and federal and state

tax returns for the years ended December 31, 2021 and December 31, 2020. |

A

representative of Salberg is not expected to be present at the Annual Meeting.

The

Board recommends a vote “FOR” this Proposal 2.

PROPOSAL

3. APPROVAL OF AMENDMENT(S) TO THE CERTIFICATE OF INCORPORATION TO EFFECT THE REVERSE SPLIT

Our

Board has adopted and submitted for stockholder approval one or more amendments to our Certificate of Incorporation to effect

the Reverse Split of all outstanding shares of our common stock, at a ratio to be determined by the Board in the range of one-for-

two through one-for-200. At the Board’s discretion, the Company may affect multiple amendments to the Certificate of Incorporation

to effect multiple reverse stock splits, if it’s deemed in the Company’s best interest, however the ultimate effect of the

multiple reverse stock splits will not be in excess of a collective ratio of one-for-200. If approved, our Board will have the sole

discretion to determine the ratio(s) within the approved range at which the Reverse Split will be effected, subject to the

one-for-200 maximum aggregate ratio. Our Board believes that approval of a proposal granting this discretion to the Board, rather

than approval of an immediate and/or single reverse stock split at one specified ratio, will provide the Board with

maximum flexibility to react to current market conditions and other factors it deems appropriate and to therefore achieve the purposes

of the Reverse Split, and to act in the best interests of Adhera and our stockholders.

The

Reverse Split has been proposed for approval at the Annual Meeting to increase the Company’s authorized but unissued shares of

common stock in order to enable the Company to effect potential future issuances under outstanding derivative securities which are convertible

into or exercisable or exchangeable for, shares of the Company’s common stock. Under its Certificate of Incorporation, the Company

is currently authorized to issue up to 180,000,000 shares of common stock and 100,000 shares of Preferred Stock. As of the close of business

on the record date, there were 62,835,407 shares of Common Stock issued and outstanding and 496 shares of preferred stock

issued and outstanding which are convertible into a total of 3,676,664 shares of common stock. There are also 54,241,522

shares of common stock reserved for issuance pursuant to (i) outstanding stock options, (ii) outstanding warrants, and (iii) outstanding

convertible notes. This includes shares of common stock issuable upon exercise of 5.5 year warrants to purchase a total of 22,222,218

shares of common stock at an exercise price of $0.04 per share, which were issued by the Company together with a total of $2.2

million of secured promissory notes in an exempt offering which closed on May 11, 2022. These notes, which subject to prior repayment

mature in February 2023. Under the Securities Purchase Agreement for this recent financing, we are required to maintain a reserve of

88,888,872 shares, beginning on September 11, 2022 which is the four-month anniversary of the closing date.

Because

we are only authorized to issue 180,000,000 shares of common stock, and 62,835,407 shares are currently outstanding, the result

of the outstanding derivative securities and reserve requirements described above is that the Company’s capitalization, on a fully-diluted

basis (meaning giving effect to all outstanding securities convertible or exercisable into, or exchangeable for, common stock), is greater

than the number of shares that are authorized by our Certificate of Incorporation by 47,542,584 shares as of the record date.

The principal purpose of the Reverse Split, which will affect both outstanding common stock and outstanding derivative securities

proportionately, is to enable the Company to comply with its outstanding derivative securities and reserve requirements. If we are unable

to do so by effecting the Reverse Split, we will be in default under our outstanding convertible notes, which will result in an accelerated

due date and the application of increased default interest rates, and may also result in the note holders seeking to liquidate our assets

to satisfy those obligations, which in turn could force us to seek bankruptcy protection.

Given

the above outstanding securities and agreements to which the Company is subject, the Board believes it to be in the best interest of

the Company to increase the number of shares of common stock the Company is authorized to issue in order to enable the Company to comply

with its contractual obligations while also giving the Company greater flexibility in addressing its future general corporate needs,

including, but not limited to, the offer and sale of common stock in one or more registered public offerings, the grant of awards under

equity incentive plans, and issuance of shares of capital stock in strategic transactions or to raise capital. The Board believes that

additional authorized shares of capital stock which would result from the Reverse Split will also enable the Company to take timely

advantage of market conditions and favorable acquisition opportunities that may become available to the Company. Subject to reserve requirements

under outstanding derivative securities, the authorized but unissued shares of common stock will be issued at the direction of

the Board, without stockholder approval unless required by applicable law or regulation.

Finally,

the Reverse Split could assist the Company in meeting the initial listing requirements of a national securities exchange such as the

NYSE American or Nasdaq, which among other things require that the closing price of the Company’s common stock be above a specified

value. For example, the NYSE American requires a minimum bid price of $3.00 per share, and the Nasdaq Capital Market requires a minimum

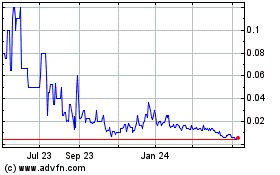

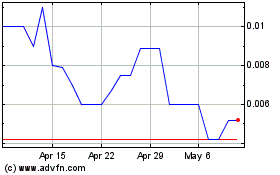

bid price of $4.00 per share for an initial listing. On May 23, 2022, The Company’s closing price on the OTCQB was $0.057 per share.

An effect of the Reverse Split will be to increase the closing price of the Company’s common stock as of the date it becomes effective,

although that increase may not be maintained. The Company intends to take steps towards this goal in the next several months in the hopes

of having its common stock listed on the NYSE American or another national securities exchange. If successful, such an uplisting would

enable the Company to more easily access the capital markets and raise funding necessary to meet its business objectives. However,

while allowing for multiple amendments to adjust the aggregate ratio used for the Reverse Split may increase the likelihood of achieving

the desired closing price to some extent in connection with a potential uplisting, no assurance can be given that, if approved, the

Reverse Split or other actions taken by the Company will be sufficient to achieve these goals. See the Risk Factors below for more information

of the risks and uncertainties inherent in the Reverse Split and the objectives we are seeking to achieve thereby.

To

effect the Reverse Split, our Board would authorize our management to file one or more Certificates of Amendment to our Certificate

of Incorporation with the Delaware Secretary of State. The number of issued and outstanding shares of our common stock (as well

as common stock underlying derivative securities such as options and warrants) would be reduced in accordance with the ratio(s)

selected by the Board for the Reverse Split, not exceed the aggregate ratio of one-for-200. The par value of our common stock

would remain unchanged, however the number of authorized and unissued shares of our common stock would increase as a result of the Reverse

Split. If approved by our stockholders, our Board may nonetheless elect not to implement the Reverse Split at its sole discretion. The

proposed form of amendment to our Certificate of Incorporation to implement the Reverse Split is attached to this Proxy Statement

as Annex A.

For

more information on the risks inherent in the Reverse Split, see below under the heading “Certain Risks Associated with the Reverse

Split.” For additional information about the risks we and our investors face with respect to our common stock, business and other

matters, see “Item 1A. - Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, a copy

of which has been mailed with this Proxy Statement to our stockholders of record as of the record date.

Certain

Risks Associated with the Reverse Split

If

the Reverse Split does not result in a proportionate increase in the price of our common stock, we may be unable to meet the listing

requirements of a national securities exchange.

We

expect that if approved the Reverse Split will increase the market price of our common stock, which may help us with our listing application

to have our common stock listed on a national securities exchange such as The Nasdaq Stock Market or the NYSE American in the

future. However, the effect of the Reverse Split on the market price of our common stock cannot be predicted with certainty, and the

results of reverse stock splits by companies under similar circumstances have varied. It is possible that the market price of our common

stock following the Reverse Split will not increase sufficiently for us to meet the listing requirements of a national securities exchange

in the near term or at all, particularly given the maximum collective ratio of one-for-200 which cannot be exceeded even if the Board

decides to implement the Reverse Split through multiple amendments to our Certificate of Incorporation. If we are unable meet the

minimum bid price requirement or other requirements of a national securities exchange we may seek to apply for listing on in the future,

we may be unable to list our common stock on a national securities exchange. This could have a material adverse effect on our liquidity

and an investment in us, and impose additional hardships on investors seeking to sell our common stock.

The

Reverse Split may decrease the liquidity of our common stock.

The

liquidity of our common stock may be adversely affected by the Reverse Split given the reduced number of shares that will be outstanding

following the Reverse Split, especially if the market price of our common stock does not sufficiently increase as a result of the Reverse

Split. In addition, by reducing the number of shares held by each stockholder, the Reverse Split may create the potential

for such stockholders to experience an increase in the cost of selling their shares and greater difficulty effecting such sales.

The

increased market price of our common stock resulting from the Reverse Split may not attract new investors, including institutional investors,

and may not satisfy the investing guidelines of those investors, and consequently, the liquidity of our common stock may not improve.

Although

we believe that a higher market price may help generate greater or broader investor interest in our common stock, there can be no assurance

that the Reverse Split will result in a per-share price increase sufficient to attract new investors, including institutional investors.

Additionally, there can be no assurance that the market price of our common stock will satisfy the investing guidelines of those investors.

As a result, the trading liquidity of our common stock may not necessarily improve following the Reverse Split.

Principal

Effects of the Reverse Split

The

Reverse Split, if implemented, will have the following principal effects:

| |

● |

the

number of shares of our common stock held by individual stockholders will decrease based on the ultimate ratio used for the Reverse

Split; and |

| |

|

|

| |

● |

the

number of shares of common stock issuable upon exercise of outstanding stock options and warrants or conversion of outstanding convertible

securities (if any) and the exercise price of such outstanding options and warrants and the conversion price of such outstanding

convertible securities (if any), will be proportionately adjusted in accordance with their respective terms based on the ultimate

ratio at which the Reverse Split is effected. |

Shares

of common stock after the Reverse Split will be fully paid and non-assessable. The amendment(s) will not change any of the other

terms of our common stock. Following the Reverse Split, the shares of common stock will have the same voting rights and rights to dividends

and distributions and will be identical in all other respects to the shares of common stock prior to the Reverse Split. Following the

Reverse Split, we will continue to be subject to the reporting requirements of the Exchange Act.

Because

the authorized common stock will not be reduced at the same ratio as the Reverse Split ratio, the Reverse Split will have an overall

effect of increasing the authorized but unissued shares of common stock. These shares may be issued by our Board in its sole discretion.

See “Anti-Takeover Effects of the Reverse Split” below. Any future issuance will have the effect of diluting the percentage

of stock ownership and voting rights of the present holders of our common stock.

Fractional

Shares and Round Lots

No

fractional shares will be issued as the result of the Reverse Split. We will round up any fractional shares resulting from the Reverse

Split to the nearest whole share.

Further, if any holder of at least 100 shares of common stock immediately

prior to the Reverse Split would otherwise become the holder of less than 100 shares of common stock as a result of the Reverse Split,

such holder will instead become the holder of 100 shares of common stock as a result of the Reverse Split.

No

Going Private Transaction

Notwithstanding

the decrease in the number of outstanding shares of common stock following the proposed Reverse Split, our Board does not intend for

this transaction to be the first step in a “going private transaction” within the meaning of Rule 13e-3 under the Exchange

Act.

Procedure

for Implementing the Reverse Split

The

Reverse Split would become effective upon the filing with the Delaware Secretary of State of the final Certificate of Amendment

to Certificate of Incorporation as of the time of filing or such other time set forth in such Certificate of Amendment,

as determined by our Board based on its evaluation as to when such action will be the most advantageous to us and our stockholders. However,

if the Reverse Split is implemented using more than one amendment, any amendment filed with Delaware prior to the final amendment for

the Reverse Split will proportionately affect the outstanding common stock and derivative securities based on the ratio set forth in

such amendment at the time of its filing, unless otherwise specified therein. For example, if the Board initially approves a ratio of

one-for-80 and the Company files an amendment at that ratio, then unless otherwise specified in such amendment, that ratio will affect

the Company’s outstanding securities accordingly effective at the time of its filing with Delaware, and any subsequent amendment

at a higher ratio within the aggregate prescribed range will become effective at the time of such subsequent amendment’s filing

with Delaware unless otherwise specified in that amendment. The effective time of any such amendment filing with Delaware in connection

with the Reverse Split, as applicable, is referred to in this Proxy Statement as an “Effective Time.”

Additionally,

the Board reserves the right, notwithstanding stockholder approval and without further action by the stockholders, to elect not to proceed

with the Reverse Split if, at any time prior to the filing of the first Certificate of Amendment in connection with the Reverse

Split, the Board, in its sole discretion, determines that it is no longer in the best interest of the Company and the stockholders

to effect the Reverse Split. Beginning at any Effective Time, each certificate representing shares of common stock will be deemed

for all corporate purposes to evidence ownership of the number of whole shares into which the shares previously represented by the certificate

were combined pursuant to the Reverse Split.

After

any Effective Time, our common stock will have a new Committee on Uniform Securities Identification Procedures (“CUSIP”)

number, used to identify our equity securities. Stock certificates with the older CUSIP number will need to be exchanged for stock certificates

with the new CUSIP number by following the procedures described below.

Effect

on Beneficial Owners of Common Stock

Upon each Effective Time of a Certificate

of Amendment that the Company files in connection with the Reverse Split, we intend to treat shares held by stockholders through

a bank, broker, custodian or other nominee in the same manner as registered stockholders whose shares are registered in their names with

American Stock Transfer & Trust Company, the Company’s transfer agent (the “Transfer Agent”). Banks, brokers, custodians

or other nominees will be instructed to effect the Reverse Split for their beneficial holders holding our common stock in street name.

However, these banks, brokers, custodians or other nominees may have different procedures for processing the Reverse Split. Stockholders