Current Report Filing (8-k)

August 07 2019 - 4:46PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date

of Report (Date of Earliest Event Reported):

|

August

5, 2019

|

Adhera

Therapeutics, Inc.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

|

000-13789

|

|

11-2658569

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(I.R.S.

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

No.)

|

|

4721

Emperor Boulevard, Suite 350

Durham,

North Carolina

|

|

27703

|

|

(Address of principal executive offices)

|

|

(Zip

Code)

|

|

Registrant’s

telephone number, including area code:

|

919-578-5901

|

N/A

Former name or former address, if changed since last report

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

[ ]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01. Entry into a Material Definitive Agreement.

On

August 5, 2019, Adhera Therapeutics, Inc. (the “Company”) conducted the final closing (the “Final Closing”)

of the private placement (the “Private Placement”) of secured promissory notes of the Company (each a “Note”

and collectively the “Notes”).

In

connection with the Final Closing, the Company entered into Subscription Agreements (each a “Subscription Agreement”

and collectively the “Subscription Agreements”) with certain accredited investors pursuant to which the Company issued

Notes in the aggregate principal amount of $1,722,500. In aggregate, the Company issued Notes in the aggregate principal amount

of approximately $5.7 million in connection with the Private Placement.

The

obligations of the Company under the Notes are secured by a first lien and security interest in all of the assets of the Company

and certain of its wholly-owned subsidiaries pursuant to the terms and conditions of a Security Agreement dated June 29, 2019

by the Company and such wholly-owned subsidiaries in favor of the holders of the Notes (the “Security Agreement”).

The

Company intends to use the proceeds from the sale of the Notes for the commercialization of the Company’s approved product

for the treatment of hypertension, funding working capital, capital expenditure needs and other general corporate requirements.

The

Private Placement was conducted pursuant to exemptions from the registration requirements of the Securities Act of 1933, as amended,

afforded by Section 4(a)(2) and Rule 506(b) of Regulation D promulgated thereunder.

The

terms and conditions of the Notes were summarized in the Current Report on Form 8-K that the Company filed with the Securities

and Exchange Commission on July 3, 2019 in connection with the initial closing of the Private Placement (the “Prior 8-K”).

Maxim

Merchant Capital, a division of Maxim Group LLC, acted as placement agent in connection with the Private Placement. In connection

with the Private Placement, the Company paid to the placement aggregate cash fees in the amount of approximately $0.57 million.

The

foregoing summaries of the material terms of the form of Note, the form of Subscription Agreement and the Security Agreement are

not complete and are qualified in their entirety by reference to the full text thereof, copies of which are filed herewith as

Exhibits 4.1, 10.1 and 10.2, respectively, and incorporated by reference herein.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth in “Item 1.01. Entry into a Material Definitive Agreement” relating to the issuance of the Notes,

and the material terms and conditions thereof, is incorporated by reference herein in its entirety.

Item

9.01. Financial Statements and Exhibits.

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

4.1

|

|

Form of Secured Promissory Note (filed as Exhibit 4.1 to the Prior 8-K and incorporated herein by reference).

|

|

|

|

|

|

10.1

|

|

Security Agreement, dated as of June 28, 2019, among Adhera Therapeutics, Inc., IThenaPharma, Inc., Cequent Pharmaceuticals, Inc., MDRNA Research, Inc., the purchasers of secured promissory notes identified on the signature pages thereto, and Jeff S. Phillips as agent (filed as Exhibit 10.1 to the Prior 8-K and incorporated herein by reference).

|

|

|

|

|

|

10.2

|

|

Form of Subscription Agreement.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed

on its behalf by the undersigned hereunto duly authorized.

|

|

ADHERA

THERAPEUTICS, INC.

|

|

|

|

|

|

August

7, 2019

|

By:

|

/s/

Nancy R. Phelan

|

|

|

Name:

|

Nancy

R. Phelan

|

|

|

Title:

|

Chief

Executive Officer

|

EXHIBIT

INDEX

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

4.1

|

|

Form of Secured Promissory Note (filed as Exhibit 4.1 to the Prior 8-K and incorporated herein by reference).

|

|

|

|

|

|

10.1

|

|

Security Agreement, dated as of June 28, 2019, among Adhera Therapeutics, Inc., IThenaPharma, Inc., Cequent Pharmaceuticals, Inc., MDRNA Research, Inc., the purchasers of secured promissory notes identified on the signature pages thereto, and Jeff S. Phillips as agent (filed as Exhibit 10.1 to the Prior 8-K and incorporated herein by reference).

|

|

|

|

|

|

10.2

|

|

Form of Subscription Agreement.

|

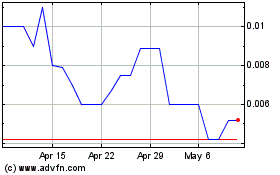

Adhera Therapeutics (CE) (USOTC:ATRX)

Historical Stock Chart

From Nov 2024 to Dec 2024

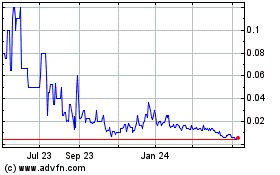

Adhera Therapeutics (CE) (USOTC:ATRX)

Historical Stock Chart

From Dec 2023 to Dec 2024