West Red Lake Gold Mines Ltd. (“West Red

Lake Gold” or “WRLG” or the “Company”) (TSXV: WRLG)

(OTCQB: WRLGF) is pleased to report drill results

from its 100% owned Madsen Mine located in the Red Lake Gold

District of Northwestern Ontario, Canada.

The drill results featured in this news release

are focused on the high-grade Austin Zone. The

Austin Zone currently contains an

Indicated mineral resource of 914,200 ounces (“oz”) grading

6.9 grams per tonne (“g/t”) gold (“Au”), with an

additional Inferred resource of 104,900 oz grading 6.5 g/t

Au.

The purpose of this drilling was definition

within priority areas of Austin to continue building an

inventory of high-confidence ounces to support the

restart of production at the Madsen mine, which is expected to

commence in H2 2025. The Company expects to complete a

pre-feasibility study in support of that restart goal in the coming

months.

AUSTIN ZONE HIGHLIGHTS:

- Hole

MM24D-12-4791-020 Intersected 4m @ 54.19

g/t Au, from 32m to 36m, Including 1m @ 215.61 g/t

Au, from 33m to 34m.

- Hole

MM24D-12-4791-026 Intersected 3.53m @

23.73 g/t Au, from 27.50m to 31.03m, Including 1m

@ 79.81 g/t Au, from 30.03m to 31.03m.

- Hole

MM24D-12-4791-023 Intersected 3m @ 24.49

g/t Au, from 32m to 35m, Including 1m @ 71.02 g/t

Au, from 33m to 34m; AND

- Hole

MM24D-12-4791-041 Intersected 6m @ 11.65

g/t Au, from 35m to 41m, Including 1m @ 10.86 g/t

Au, from 36m to 37m, Also including 1.05m @ 47.27

g/t Au, from 39.95m to 41.00m.

- Hole

MM24D-12-4791-035 Intersected 3.2m @ 15.84

g/t Au, from 38.8m to 42.0m, Including 2m @ 24.32

g/t Au, from 39.4m to 41.4m.

- Hole

MM24D-12-4791-002 Intersected 4.8m @ 9.95

g/t Au, from 26.2m to 31.0m, Including 0.87m @

10.47 g/t Au, from 26.20m to 27.07m, Also including

0.52m @ 43.08 g/t Au, from 29.82m to 30.34m.

- Hole

MM24D-12-4791-023 also Intersected 3.15m @

15.06 g/t Au, from 20.35m to 23.50m, Including

0.88m @ 22.62 g/t Au, from 21.12m to 22.00m, Also

including 0.98m @ 20.20 g/t Au, from 22.52m to

23.50m.

Shane Williams, President & CEO, stated,

“The deeper portions of the Austin Zone are continuing to return

very positive results as we advance the infill drilling programs

and increase our confidence in these areas of the mine. Due to

limited underground development, the two previous operators were

only able to access portions of the Madsen deposit down to around 9

level. We are very excited to continue accessing deeper portions of

the deposit which were historically mined during a period when gold

was only valued at $20-40 per ounce. This resulted in very

selective mining practices targeting just the core of the system

that left behind a lot of mineralization that would be considered

high grade by current standards. With gold prices now in excess of

US $2,500/oz we are taking full advantage of that remnant material

and see a lot of upside at depth in Madsen.”

Plan maps and section for the Austin drilling

outlined in this release are provided in Figures 1 through 10. To

see these drill holes in the context of a 3-dimensional model of

the Madsen project mineral resource, click here.

https://vrify.com/decks/16834?auth=fa5e3754-1ad2-440b-b5cc-fcfee08d8175

TABLE 1. Significant intercepts (>3 g/t Au) from

drilling at Austin Zone.

|

Hole ID |

|

Target |

From (m) |

To (m) |

Length (m)* |

Au (g/t) |

|

MM24D-12-4791-001 |

|

Austin |

No Assays > 3 g/t Au |

|

MM24D-12-4791-002 |

|

Austin |

26.20 |

31.00 |

4.80 |

9.95 |

|

Incl. |

|

26.20 |

27.07 |

0.87 |

10.47 |

|

Also Incl. |

|

29.82 |

30.34 |

0.52 |

43.08 |

|

AND |

|

Austin |

37.50 |

40.00 |

2.50 |

3.65 |

|

MM24D-12-4791-003 |

|

Austin |

24.34 |

29.50 |

5.16 |

5.65 |

|

Incl. |

|

28.00 |

28.83 |

0.83 |

17.54 |

|

AND |

|

Austin |

35.18 |

38.00 |

2.82 |

4.73 |

|

MM24D-12-4791-004 |

|

Austin |

22.29 |

23.29 |

1.00 |

4.43 |

|

AND |

|

Austin |

24.93 |

25.71 |

0.78 |

3.41 |

|

AND |

|

Austin |

26.50 |

27.50 |

1.00 |

4.82 |

|

MM24D-12-4791-005 |

|

Austin |

26.00 |

30.00 |

4.00 |

4.45 |

|

AND |

|

Austin |

33.00 |

34.00 |

1.00 |

3.06 |

|

AND |

|

Austin |

38.19 |

39.19 |

1.00 |

10.70 |

|

MM24D-12-4791-006 |

|

Austin |

23.58 |

24.10 |

0.52 |

3.28 |

|

AND |

|

Austin |

26.10 |

26.63 |

0.53 |

9.66 |

|

AND |

|

Austin |

30.64 |

31.50 |

0.86 |

4.56 |

|

MM24D-12-4791-007 |

|

Austin |

27.70 |

28.50 |

0.80 |

5.37 |

|

MM24D-12-4791-008 |

|

Austin |

43.07 |

46.00 |

2.93 |

8.44 |

|

Incl. |

|

44.00 |

45.00 |

1.00 |

18.13 |

|

AND |

|

Austin |

51.00 |

51.80 |

0.80 |

6.74 |

|

MM24D-12-4791-009 |

|

Austin |

20.58 |

22.06 |

1.48 |

3.98 |

|

AND |

|

Austin |

25.00 |

28.65 |

3.65 |

5.74 |

|

Incl. |

|

27.25 |

28.00 |

0.75 |

20.02 |

|

MM24D-12-4791-010 |

|

Austin |

No Assays > 3 g/t Au |

|

MM24D-12-4791-011 |

|

Austin |

No Assays > 3 g/t Au |

|

MM24D-12-4791-012 |

|

Austin |

23.82 |

24.50 |

0.68 |

5.48 |

|

MM24D-12-4791-013 |

|

Austin |

44.55 |

46.50 |

1.95 |

4.91 |

|

MM24D-12-4791-014 |

|

Austin |

No Assays > 3 g/t Au |

|

MM24D-12-4791-015 |

|

Austin |

20.68 |

22.00 |

1.32 |

3.72 |

|

MM24D-12-4791-016 |

|

Austin |

No Assays > 3 g/t Au |

|

MM24D-12-4791-017 |

|

Austin |

18.45 |

22.00 |

3.55 |

5.83 |

|

MM24D-12-4791-018 |

|

Austin |

23.10 |

29.00 |

5.90 |

3.62 |

|

MM24D-12-4791-019 |

|

Austin |

21.82 |

24.00 |

2.18 |

9.15 |

|

Incl. |

|

21.82 |

23.00 |

1.18 |

15.80 |

|

MM24D-12-4791-020 |

|

Austin |

20.00 |

22.92 |

2.92 |

7.70 |

|

Incl. |

|

21.46 |

21.96 |

0.50 |

40.74 |

|

AND |

|

Austin |

32.00 |

36.00 |

4.00 |

54.19 |

|

Incl. |

|

33.00 |

34.00 |

1.00 |

215.61 |

|

MM24D-12-4791-021 |

|

Austin |

30.00 |

33.22 |

3.22 |

7.92 |

|

Incl. |

|

Austin |

30.00 |

30.50 |

0.50 |

21.38 |

|

AND |

|

Austin |

35.00 |

37.50 |

2.50 |

3.47 |

|

MM24D-12-4791-022 |

|

Austin |

26.00 |

28.70 |

2.70 |

5.13 |

|

Incl. |

|

27.43 |

28.00 |

0.57 |

15.04 |

|

MM24D-12-4791-023 |

|

Austin |

20.35 |

23.50 |

3.15 |

15.06 |

|

Incl. |

|

21.12 |

22.00 |

0.88 |

22.62 |

|

Also Incl. |

|

22.52 |

23.50 |

0.98 |

20.20 |

|

AND |

|

Austin |

32.00 |

35.00 |

3.00 |

24.49 |

|

Incl. |

|

33.00 |

34.00 |

1.00 |

71.02 |

|

MM24D-12-4791-024 |

|

Austin |

48.80 |

51.00 |

2.20 |

8.01 |

|

Incl. |

|

49.77 |

50.50 |

0.73 |

20.54 |

|

MM24D-12-4791-025 |

|

Austin |

41.75 |

45.25 |

3.50 |

8.70 |

|

Incl. |

|

43.25 |

44.25 |

1.00 |

18.82 |

|

AND |

|

Austin |

48.00 |

49.00 |

1.00 |

3.02 |

|

MM24D-12-4791-026 |

|

Austin |

27.50 |

31.03 |

3.53 |

23.73 |

|

Incl. |

|

30.03 |

31.03 |

1.00 |

79.81 |

|

MM24D-12-4791-027 |

|

Austin |

30.50 |

36.30 |

5.80 |

5.51 |

|

Incl. |

|

34.30 |

35.30 |

1.00 |

15.58 |

|

MM24D-12-4791-028 |

|

Austin |

36.72 |

41.98 |

5.26 |

5.76 |

|

Incl. |

|

40.45 |

41.98 |

1.53 |

10.87 |

|

AND |

|

Austin |

45.00 |

48.00 |

3.00 |

4.30 |

|

MM24D-12-4791-029 |

|

Austin |

28.00 |

30.75 |

2.75 |

7.81 |

|

Incl. |

|

29.00 |

30.00 |

1.00 |

14.39 |

|

AND |

|

Austin |

33.00 |

34.30 |

1.30 |

6.90 |

|

MM24D-12-4791-030 |

|

Austin |

No Assays > 3 g/t Au |

|

MM24D-12-4791-031 |

|

Austin |

30.18 |

34.04 |

3.86 |

3.99 |

|

MM24D-12-4791-032 |

|

Austin |

41.95 |

44.00 |

2.05 |

3.99 |

|

MM24D-12-4791-033 |

|

Austin |

33.65 |

34.30 |

0.65 |

12.67 |

|

MM24D-12-4791-034 |

|

Austin |

32.00 |

33.04 |

1.04 |

4.24 |

|

AND |

|

Austin |

35.60 |

38.00 |

2.40 |

11.36 |

|

Incl. |

|

35.60 |

36.31 |

0.71 |

37.75 |

|

MM24D-12-4791-035 |

|

Austin |

38.80 |

42.00 |

3.20 |

15.84 |

|

Incl. |

|

39.40 |

41.40 |

2.00 |

24.32 |

|

AND |

|

Austin |

44.00 |

46.00 |

2.00 |

3.54 |

|

MM24D-12-4791-036 |

|

Austin |

27.00 |

34.00 |

7.00 |

3.76 |

|

MM24D-12-4791-037 |

|

Austin |

30.00 |

33.47 |

3.47 |

3.82 |

|

MM24D-12-4791-038 |

|

Austin |

36.60 |

38.00 |

1.40 |

5.90 |

|

MM24D-12-4791-039 |

|

Austin |

37.15 |

40.75 |

3.60 |

4.68 |

|

MM24D-12-4791-040 |

|

Austin |

36.30 |

38.50 |

2.20 |

5.89 |

|

Incl. |

|

36.30 |

37.00 |

0.70 |

14.55 |

|

AND |

|

Austin |

44.70 |

45.20 |

0.50 |

3.58 |

|

MM24D-12-4791-041 |

|

Austin |

35.00 |

41.00 |

6.00 |

11.65 |

|

Incl. |

|

36.00 |

37.00 |

1.00 |

10.86 |

|

Also Incl. |

|

39.95 |

41.00 |

1.05 |

47.27 |

|

|

|

|

|

|

|

|

*The “From-To” intervals in Table 1 are denoting

overall downhole length of the intercept. True thickness has not

been calculated for these intercepts but is expected to be ≥ 70% of

downhole thickness based on intercept angles observed in the drill

core. Internal dilution for composite intervals does not exceed 1m

for samples grading <0.1 g/t Au.

TABLE 2: Drill collar summary for holes reported in this

News Release.

|

Hole ID |

Target |

Easting |

Northing |

Elev (m) |

Length (m) |

Azimuth |

Dip |

|

MM24D-12-4791-001 |

Austin |

435847 |

5646644 |

-147 |

50.6 |

86 |

-25 |

|

MM24D-12-4791-002 |

Austin |

435847 |

5646645 |

-145 |

83.0 |

64 |

27 |

|

MM24D-12-4791-003 |

Austin |

435847 |

5646645 |

-144 |

88.8 |

66 |

35 |

|

MM24D-12-4791-004 |

Austin |

435847 |

5646645 |

-145 |

81.0 |

73 |

30 |

|

MM24D-12-4791-005 |

Austin |

435847 |

5646645 |

-144 |

95.1 |

76 |

40 |

|

MM24D-12-4791-006 |

Austin |

435848 |

5646644 |

-146 |

75.2 |

83 |

10 |

|

MM24D-12-4791-007 |

Austin |

435847 |

5646643 |

-146 |

111.0 |

93 |

10 |

|

MM24D-12-4791-008 |

Austin |

435847 |

5646643 |

-147 |

100.3 |

96 |

-32 |

|

MM24D-12-4791-009 |

Austin |

435847 |

5646643 |

-144 |

105.0 |

98 |

32 |

|

MM24D-12-4791-010 |

Austin |

435847 |

5646643 |

-146 |

102.3 |

103 |

10 |

|

MM24D-12-4791-011 |

Austin |

435847 |

5646643 |

-145 |

111.0 |

104 |

22 |

|

MM24D-12-4791-012 |

Austin |

435847 |

5646643 |

-144 |

81.0 |

105 |

42 |

|

MM24D-12-4791-013 |

Austin |

435847 |

5646643 |

-147 |

90.0 |

105 |

-32 |

|

MM24D-12-4791-014 |

Austin |

435846 |

5646643 |

-147 |

75.0 |

113 |

-32 |

|

MM24D-12-4791-015 |

Austin |

435846 |

5646643 |

-145 |

57.0 |

117 |

20 |

|

MM24D-12-4791-016 |

Austin |

435846 |

5646643 |

-144 |

66.0 |

120 |

40 |

|

MM24D-12-4791-017 |

Austin |

435846 |

5646642 |

-145 |

60.0 |

125 |

29 |

|

MM24D-12-4791-018 |

Austin |

435846 |

5646642 |

-146 |

90.0 |

127 |

8 |

|

MM24D-12-4791-019 |

Austin |

435846 |

5646642 |

-145 |

63.0 |

130 |

19 |

|

MM24D-12-4791-020 |

Austin |

435846 |

5646642 |

-144 |

72.0 |

132 |

37 |

|

MM24D-12-4791-021 |

Austin |

435846 |

5646642 |

-146 |

78.0 |

136 |

-7 |

|

MM24D-12-4791-022 |

Austin |

435846 |

5646642 |

-146 |

84.0 |

137 |

7 |

|

MM24D-12-4791-023 |

Austin |

435846 |

5646642 |

-145 |

66.0 |

137 |

27 |

|

MM24D-12-4791-024 |

Austin |

435845 |

5646642 |

-147 |

72.0 |

140 |

-28 |

|

MM24D-12-4791-025 |

Austin |

435845 |

5646641 |

-147 |

66.0 |

139 |

-22 |

|

MM24D-12-4791-026 |

Austin |

435845 |

5646641 |

-145 |

63.0 |

141 |

17 |

|

MM24D-12-4791-027 |

Austin |

435845 |

5646641 |

-146 |

75.0 |

144 |

-5 |

|

MM24D-12-4791-028 |

Austin |

435845 |

5646641 |

-147 |

66.0 |

144 |

-13 |

|

MM24D-12-4791-029 |

Austin |

435845 |

5646641 |

-146 |

63.0 |

146 |

8 |

|

MM24D-12-4791-030 |

Austin |

435845 |

5646641 |

-145 |

75.0 |

148 |

25 |

|

MM24D-12-4791-031 |

Austin |

435845 |

5646641 |

-146 |

75.0 |

149 |

1 |

|

MM24D-12-4791-032 |

Austin |

435845 |

5646641 |

-147 |

85.0 |

150 |

-15 |

|

MM24D-12-4791-033 |

Austin |

435844 |

5646641 |

-145 |

72.0 |

151 |

16 |

|

MM24D-12-4791-034 |

Austin |

435844 |

5646641 |

-146 |

66.0 |

153 |

8 |

|

MM24D-12-4791-035 |

Austin |

435844 |

5646641 |

-146 |

69.0 |

154 |

-6 |

|

MM24D-12-4791-036 |

Austin |

435844 |

5646641 |

-145 |

63.0 |

155 |

32 |

|

MM24D-12-4791-037 |

Austin |

435844 |

5646641 |

-145 |

72.0 |

158 |

23 |

|

MM24D-12-4791-038 |

Austin |

435844 |

5646641 |

-146 |

85.0 |

159 |

5 |

|

MM24D-12-4791-039 |

Austin |

435844 |

5646640 |

-145 |

63.0 |

166 |

14 |

|

MM24D-12-4791-040 |

Austin |

435844 |

5646640 |

-145 |

75.0 |

170 |

19 |

|

MM24D-12-4791-041 |

Austin |

435844 |

5646641 |

-145 |

63.0 |

170 |

26 |

|

|

|

|

|

|

|

|

|

DISCUSSION

The Austin zone is accessed through the Madsen

Mine West Portal. Like the other mineralized domains that comprise

the Madsen Mine, the Austin structures are hosted within broad,

kilometer-scale planar alteration and deformation corridors that

have been repeatedly reactivated during gold mineralization and

subsequent deformation and metamorphism.

At the deposit scale the Austin, South Austin,

North Austin, and McVeigh Zones are locally folded and structurally

dismembered by transposition and rotation into the penetrative S2

Foliation. In addition to this intense deformation overprint, the

mineralized veins and alteration have been subjected to the

relatively high temperatures of amphibolite facies metamorphism,

which led to extensive recrystallization and growth of the

skarn-like replacement mineral assemblage of

diopside-amphibole-quartz-biotite.

All significant gold mineralization on the mine

property is demonstrably early relative to the most significant,

penetrative deformation (D2) and metamorphic events. The North

Austin Zone displays ‘mine-style’ alteration and mineralization and

consists of multiple mineralized domains defined over a strike

length of 0.5km. Mineralization remains open at depth and along

strike to the northeast.

In drill core, or at underground face exposures,

gold-bearing zones at the Madsen Mine are best identified visually

by fine (sub-millimetre) grains of free gold within strong

alteration and veining. All high-grade intervals generally contain

visible gold on drill core exteriors, although numerous examples

exist of high-grade assays where visible gold was only identified

within the interior (cut surface) of the core samples. Apart from

the presence of free gold, pervasive silicification (locally

accompanied by discrete quartz veining) and quartz-carbonate or

diopside veining are the best indicators that a given interval is

within a high-grade zone along/within the mineralized

structure.

The current underground drilling program at the

Madsen Mine is focused on further definition of near-term mining

inventory, as well as growth of the current mineral resource.

Drilling has been focused on the more continuous and higher-grade

portions of the Austin, South Austin, North Austin and McVeigh

Zones. This will continue to be the strategy through 2024.

High resolution versions of all the figures contained in this

press release can be found at the following web address:

https://westredlakegold.com/september-10th-news-release-maps/

FIGURE 1. Madsen Mine long section showing location of

12-4791 Drill Bay in Austin Zone.[1]

[1] Mineral resources are estimated at a cut-off grade of 3.38

g/t Au and a gold price of US1,800/oz. Please refer to the

technical report entitled “Independent NI 43-101 Technical Report

and Updated Mineral Resource Estimate for the PureGold Mine,

Canada”, prepared by SRK Consulting (Canada) Inc. and dated June

16, 2023, and amended April 24, 2024. A full copy of the SRK report

is available on the Company’s website and on SEDAR+ at

www.sedarplus.ca.

FIGURE 2. Austin plan view drill section showing assay

highlights for Holes MM24D-12-4791-001 through

-041.[1]

[1] Mineral resources are estimated at a cut-off grade of 3.38

g/t Au and a gold price of US1,800/oz. Please refer to the

technical report entitled “Independent NI 43-101 Technical Report

and Updated Mineral Resource Estimate for the PureGold Mine,

Canada”, prepared by SRK Consulting (Canada) Inc. and dated June

16, 2023, and amended April 24, 2024. A full copy of the SRK report

is available on the Company’s website and on SEDAR+ at

www.sedarplus.ca.

FIGURE 3. Austin section view showing assay highlights

for Holes MM24D-12-4791-039 through

-041.[1]

[1] Mineral resources are estimated at a cut-off grade of 3.38

g/t Au and a gold price of US1,800/oz. Please refer to the

technical report entitled “Independent NI 43-101 Technical Report

and Updated Mineral Resource Estimate for the PureGold Mine,

Canada”, prepared by SRK Consulting (Canada) Inc. and dated June

16, 2023, and amended April 24, 2024. A full copy of the SRK report

is available on the Company’s website and on SEDAR+ at

www.sedarplus.ca.

FIGURE 4. Austin section view showing assay highlights

for Holes MM24D-12-4791-034 through

-038.[1]

[1] Mineral resources are estimated at a cut-off grade of 3.38

g/t Au and a gold price of US1,800/oz. Please refer to the

technical report entitled “Independent NI 43-101 Technical Report

and Updated Mineral Resource Estimate for the PureGold Mine,

Canada”, prepared by SRK Consulting (Canada) Inc. and dated June

16, 2023, and amended April 24, 2024. A full copy of the SRK report

is available on the Company’s website and on SEDAR+ at

www.sedarplus.ca.

FIGURE 5. Austin section view showing assay highlights

for Holes MM24D-12-4791-029 through

-033.[1]

[1] Mineral resources are estimated at a cut-off grade of 3.38

g/t Au and a gold price of US1,800/oz. Please refer to the

technical report entitled “Independent NI 43-101 Technical Report

and Updated Mineral Resource Estimate for the PureGold Mine,

Canada”, prepared by SRK Consulting (Canada) Inc. and dated June

16, 2023, and amended April 24, 2024. A full copy of the SRK report

is available on the Company’s website and on SEDAR+ at

www.sedarplus.ca.

FIGURE 6. Austin section view showing assay highlights

for Holes MM24D-12-4791-023 through

-028.[1]

[1] Mineral resources are estimated at a cut-off grade of 3.38

g/t Au and a gold price of US1,800/oz. Please refer to the

technical report entitled “Independent NI 43-101 Technical Report

and Updated Mineral Resource Estimate for the PureGold Mine,

Canada”, prepared by SRK Consulting (Canada) Inc. and dated June

16, 2023, and amended April 24, 2024. A full copy of the SRK report

is available on the Company’s website and on SEDAR+ at

www.sedarplus.ca.

FIGURE 7. Austin section view showing assay highlights

for Holes MM24D-12-4791-019 through

-022.[1]

[1] Mineral resources are estimated at a cut-off grade of 3.38

g/t Au and a gold price of US1,800/oz. Please refer to the

technical report entitled “Independent NI 43-101 Technical Report

and Updated Mineral Resource Estimate for the PureGold Mine,

Canada”, prepared by SRK Consulting (Canada) Inc. and dated June

16, 2023, and amended April 24, 2024. A full copy of the SRK report

is available on the Company’s website and on SEDAR+ at

www.sedarplus.ca.

FIGURE 8. Austin section view showing assay highlights

for Holes MM24D-12-4791-015 through

-018.[1]

[1] Mineral resources are estimated at a cut-off grade of 3.38

g/t Au and a gold price of US1,800/oz. Please refer to the

technical report entitled “Independent NI 43-101 Technical Report

and Updated Mineral Resource Estimate for the PureGold Mine,

Canada”, prepared by SRK Consulting (Canada) Inc. and dated June

16, 2023, and amended April 24, 2024. A full copy of the SRK report

is available on the Company’s website and on SEDAR+ at

www.sedarplus.ca.

FIGURE 9. Austin section view showing assay highlights

for Holes MM24D-12-4791-07 through -09 and -012 and

-013.[1] Holes -008 and -013

broke into historic stopes.

[1] Mineral resources are estimated at a cut-off grade of 3.38

g/t Au and a gold price of US1,800/oz. Please refer to the

technical report entitled “Independent NI 43-101 Technical Report

and Updated Mineral Resource Estimate for the PureGold Mine,

Canada”, prepared by SRK Consulting (Canada) Inc. and dated June

16, 2023, and amended April 24, 2024. A full copy of the SRK report

is available on the Company’s website and on SEDAR+ at

www.sedarplus.ca.

FIGURE 10. Austin section view showing assay highlights

for Holes MM24D-12-4791-002 through

-005.[1]

[1] Mineral resources are estimated at a cut-off grade of 3.38

g/t Au and a gold price of US1,800/oz. Please refer to the

technical report entitled “Independent NI 43-101 Technical Report

and Updated Mineral Resource Estimate for the PureGold Mine,

Canada”, prepared by SRK Consulting (Canada) Inc. and dated June

16, 2023, and amended April 24, 2024. A full copy of the SRK report

is available on the Company’s website and on SEDAR+ at

www.sedarplus.ca.

QUALITY ASSURANCE/QUALITY

CONTROL

Drilling completed underground at the Madsen

Mine consists of BQ-sized diamond drill core for definition drill

programs and oriented NQ-sized diamond drill core for exploration

focused drilling. All drill holes are systematically logged,

photographed, and sampled by a trained geologist at the Madsen Mine

core processing facility. Minimum allowable sample length is 0.5m.

Maximum allowable sample length is 1.5m. Control samples (certified

standards and uncertified blanks), along duplicates, are inserted

at a target 5% insertion rate. Results are assessed for accuracy,

precision, and contamination on an ongoing basis. The BQ-sized

drill core is whole core sampled. The NQ-sized drill core is then

cut lengthwise utilizing a diamond blade core saw along a line

pre-selected by the geologist. To reduce sampling bias, the same

side of drill core is sampled consistently utilizing the

orientation line as reference. For those samples containing visible

gold (“VG”), a trained geologist supervises the cutting/bagging of

those samples, and ensures the core saw blade is ‘cleaned’ with a

dressing stone following the VG sample interval. Bagged samples are

then sealed with zip ties and transported by Madsen Mine personnel

directly to SGS Natural Resource’s Facility in Red Lake, Ontario

for assay.

Samples are then prepped by SGS, which consists

of drying at 105°C and crushing to 75% passing 2mm. A riffle

splitter is then utilized to produce a 500g course reject for

archive. The remainder of the sample is then pulverized to 85%

passing 75 microns from which 50g is analyzed by fire assay and an

atomic absorption spectroscopy (AAS) finish (SGS Code GO-FAA50V10).

Samples returning gold values > 100 g/t Au are reanalyzed by

fire assay with a gravimetric finish on a 50g sample (SGS Code

GO_FAG50V). Samples with visible gold are also analyzed via

metallic screen analysis (SGS code: GO_FAS50M). For multi-element

analysis, samples are sent to SGS’s facility in Burnaby, British

Columbia and analyzed via four-acid digest with an atomic emission

spectroscopy (ICP-AES) finish for 33-element analysis on 0.25g

sample pulps (SGS code: GE_ICP40Q12). SGS Natural Resources

analytical laboratories operates under a Quality Management System

that complies with ISO/IEC 17025.

The Madsen Mine deposit presently hosts a

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”) Indicated resource of 1.65 million ounces

(“Moz”) of gold grading 7.4 g/t Au and an Inferred resource of 0.37

Moz of gold grading 6.3 g/t Au. Mineral resources are estimated at

a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz.

Mineral resources that are not mineral reserves do not have

demonstrated economic viability. Please refer to the technical

report entitled “Independent NI 43-101 Technical Report and Updated

Mineral Resource Estimate for the PureGold Mine, Canada”, prepared

by SRK Consulting (Canada) Inc. and dated June 16, 2023, and

amended April 24, 2024 (the “Madsen Report”). The

Madsen Resource Estimate has an effective date of December 31, 2021

and excludes depletion of mining activity during the period from

January 1, 2022 to the mine closure on October 24, 2022 as it has

been deemed immaterial and not relevant for the purpose of the

Madsen Report. A full copy of the Madsen Report is available on the

Company’s website and on SEDAR+ at www.sedarplus.ca.

The technical information presented in this news

release has been reviewed and approved by Will Robinson, P.Geo.,

Vice President of Exploration for West Red Lake Gold and the

Qualified Person for exploration at the West Red Lake Project, as

defined by NI 43-101 “Standards of Disclosure for Mineral

Projects”.

ABOUT WEST RED LAKE GOLD MINES

West Red Lake Gold Mines Ltd. is a mineral

exploration company that is publicly traded and focused on

advancing and developing its flagship Madsen Gold Mine and the

associated 47 km2 highly prospective land package in the Red Lake

district of Ontario. The highly productive Red Lake Gold District

of Northwest Ontario, Canada has yielded over 30 million ounces of

gold from high-grade zones and hosts some of the world’s richest

gold deposits. WRLG also holds the wholly owned Rowan Property in

Red Lake, with an expansive property position covering 31 km2

including three past producing gold mines - Rowan, Mount Jamie, and

Red Summit.

ON BEHALF OF WEST RED LAKE GOLD MINES

LTD.

“Shane Williams”

Shane WilliamsPresident & Chief Executive

Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Gwen PrestonTel: (604) 609-6132Email: investors@wrgold.com or

visit the Company’s website at https://www.westredlakegold.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

FORWARD-LOOKING INFORMATION

Certain statements contained in this news

release may constitute “forward-looking information” within the

meaning of applicable securities laws. Forward-looking information

generally can be identified by words such as “anticipate”,

“expect”, “estimate”, “forecast”, “planned”, and similar

expressions suggesting future outcomes or events. Forward-looking

information is based on current expectations of management;

however, it is subject to known and unknown risks, uncertainties

and other factors that may cause actual results to differ

materially from the forward-looking information in this news

release and include without limitation, statements relating to

plans for the potential restart of mining operations at the Madsen

Mine, the potential of the Madsen Mine; any untapped growth

potential in the Madsen deposit or Rowan deposit; timing of

pre-feasibility study and the Company’s future objectives and

plans. Readers are cautioned not to place undue reliance on

forward-looking information.

Forward-looking information involve numerous

risks and uncertainties and actual results might differ materially

from results suggested in any forward-looking information. These

risks and uncertainties include, among other things, market

volatility; the state of the financial markets for the Company’s

securities; fluctuations in commodity prices; timing and results of

the cleanup and recovery at the Madsen Mine; and changes in the

Company’s business plans. Forward-looking information is based on a

number of key expectations and assumptions, including without

limitation, that the Company will continue with its stated business

objectives and its ability to raise additional capital to proceed.

Although management of the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such forward-looking information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such forward-looking information. Accordingly,

readers should not place undue reliance on forward-looking

information. Readers are cautioned that reliance on such

information may not be appropriate for other purposes. Additional

information about risks and uncertainties is contained in the

Company’s management’s discussion and analysis for the year ended

November 30, 2023, and the Company’s annual information form for

the year ended November 30, 2023, copies of which are available on

SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein

is expressly qualified in its entirety by this cautionary

statement. Forward-looking information reflects management’s

current beliefs and is based on information currently available to

the Company. The forward-looking information is made as of the date

of this news release and the Company assumes no obligation to

update or revise such information to reflect new events or

circumstances, except as may be required by applicable law.

For more information on the Company, investors

should review the Company’s continuous disclosure filings that are

available on SEDAR+ at www.sedarplus.ca.

Photos accompanying this announcement are available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/1b4dd582-74c8-4d88-a201-1d0a212ad5c4https://www.globenewswire.com/NewsRoom/AttachmentNg/d6e06cff-73a1-434b-bd3f-15ecb76f54f3https://www.globenewswire.com/NewsRoom/AttachmentNg/58dc2983-1d51-4bc8-a201-a2c6283e1038https://www.globenewswire.com/NewsRoom/AttachmentNg/5d2a0b27-a5b6-49d5-9c59-facfaac9e382https://www.globenewswire.com/NewsRoom/AttachmentNg/aa4e2452-7263-4f86-a7e9-d9c7a5323df5https://www.globenewswire.com/NewsRoom/AttachmentNg/5646ce67-0903-49a1-b10d-370e6c6f8258https://www.globenewswire.com/NewsRoom/AttachmentNg/37f2ea87-c304-4107-b8f3-0c9480d4ae48https://www.globenewswire.com/NewsRoom/AttachmentNg/44dfaba2-c095-4507-abe0-7f9ef6071de9https://www.globenewswire.com/NewsRoom/AttachmentNg/e0ba2302-d35f-4dfb-973e-429191f5ae4chttps://www.globenewswire.com/NewsRoom/AttachmentNg/73de5394-4e14-44dc-bc0c-2d2fa61e50af

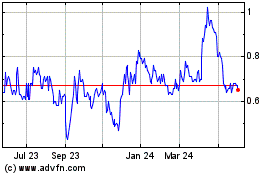

West Red Lake Gold Mines (TSXV:WRLG)

Historical Stock Chart

From Oct 2024 to Nov 2024

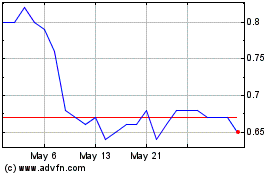

West Red Lake Gold Mines (TSXV:WRLG)

Historical Stock Chart

From Nov 2023 to Nov 2024