Relentless Resources Announces Non-Brokered Private Placement Offering and Reserves Information Regarding Assets Being Purcha...

May 30 2014 - 1:56PM

Marketwired Canada

Relentless Resources Ltd. (TSX VENTURE:RRL) ("Relentless" or "the Company")

announced today that it intends to complete a non-brokered private placement for

up to $3.0 million dollars, made up of 4,166,666 flow through shares at

$0.24/share and 10,000,000 common shares at $0.20/share. The shares will be

subject to a four month hold period. A portion of the offering may be subscribed

for by officers and directors of the Company.

The proceeds of the common share portion of the offering would be used to

partially finance the previously announced $3 million purchase of oil and

natural gas assets, (the "Assets") which are held currently by its nominee,

1819113 Alberta Ltd. ("1819113" or the "Nominee"). Completion of the proposed

transactions are subject to a number of conditions including, without

limitation, approval of the TSX Venture Exchange ("TSXV") by August 31, 2014.

The Assets consist of approximately 127 boe/d of conventional producing

petroleum and natural gas properties in the Peace River Arch Area of Alberta for

$3.0 million dollars.

Some highlights of the proposed acquisition are as follows:

-- 127 boed of 64% natural gas production (6:1 conversion) from 12 gross

(7.4 net) producing wells, 2 gross (1.2 net) suspended wells and 1 gross

(0.23 net) abandoned well.

-- Production from the Doe Creek and Charlie Lake intervals with 2013

historical operating netbacks in excess of $30.00/boe.

-- A 2.08% Working Interest in the Saddle Hills Doe Creek Unit #1

-- Largely operated production and corresponding high Alberta Energy

Regulator Licensee Liability Rating.

-- Accretive purchase metrics of $24,000/boe and $9.38/boe for total proved

plus probable reserves.

-- Forecast 15% production decline with significant infill and horizontal

drilling upside.

A summary of the reserves and future net revenue for the Assets from a report

dated as of March 1, 2014 prepared by Sproule Associates Ltd., independent

qualified reserves evaluators, (the "Sproule Report") is presented below. The

Sproule Report was prepared in accordance with National Instrument 51-101 -

Standards of Disclosure for Oil and Gas Activities ("NI 51-101").

It should not be assumed that the estimates of the present value of future net

revenues presented in the following tables represent the fair market value of

the reserves. There can be no assurance that the forecast price and cost

assumptions contained in the Sproule Report will be consistent with actual

prices and costs and variances could be material.

Consolidation - Relentless Resources Ltd.

Evaluation of the P.&N.G. Reserves - As of date 2014-02-28

Net Present Value

Remaining Reserves before Taxes

------------------ -----------------

Gross' Company

------ -------

100% Gross Net 0% 5% 10% 15% 20%

----------------------------------------------

M$ M$ M$ M$ M$

Oil (Mbbl)

----------

Proved Developed Producing 1428.5 68.6 63.9 4828 4079 3531 3118 2798

Probable Developed Producing 312.5 19.2 17.5 1762 1232 904 691 546

----------------------------------------------

Total Proved + Probable 1741.0 87.8 81.4 6590 5311 4435 3809 3344

Sol'n Gas (MMcf)

Proved Developed Producing 671 430 404 0 0 0 0 0

Probable Developed Producing 213 153 144 0 0 0 0 0

----------------------------------------------

Total Proved + Probable 884 583 548 0 0 0 0 0

Non Assoc, Assoc Gas (MMcf)

Proved Developed Producing 868 411 366 2257 1574 1221 1012 874

Probable Developed Producing 257 124 111 870 380 223 156 120

----------------------------------------------

Total Proved + Probable 1124 535 478 3127 1953 1443 1167 994

NGLs (Mbbl)

Proved Developed Producing 63.4 34.4 21.9 0 0 0 0 0

Probable Developed Producing 19.7 11.1 7.0 0 0 0 0 0

----------------------------------------------

Total Proved + Probable 83.1 45.5 28.9 0 0 0 0 0

Grand Total (Mboe)

Proved Developed Producing 1748.3 243.1 214.2 7085 5652 4752 4130 3672

Probable Developed Producing 410.5 76.5 67.0 2632 1611 1126 846 666

----------------------------------------------

Total Proved + Probable 2158.8 319.6 281.2 9717 7264 5878 4976 4338

Solution gas revenue included in oil, NGL revenue included in gas.

----------------------------------------------------------------------------

Table S-2

Summary of Selected Canadian Price Forecasts(1) (Effective February 28,

2014)

----------------------------------------------------------------------------

Edmonton

Par Western

Price 40 Canada Alberta Edmonton

degrees Select AECO-C Pentanes Edmonton Edmonton

API 20.5 API Spot Plus Butane Propane

($Cdn/ ($Cdn/ ($Cdn/ ($Cdn/ ($Cdn/ ($Cdn/

Year bbl) bbl) MMBTU) bbl) bbl) bbl)

----------------------------------------------------------------------------

Historical

2009 66.20 58.66 4.19 68.13 49.34 38.39

2010 77.80 67.21 4.16 84.21 57.99 44.45

2011 95.16 77.09 3.72 104.12 70.93 50.17

2012 86.57 73.08 2.43 100.76 64.48 47.40

2013 93.27 73.78 3.13 104.86 69.88 38.35

Forecast

2014 97.52 81.92 4.78 108.96 72.69 57.84

2015 92.62 77.80 4.30 103.48 69.03 45.77

2016 91.70 77.03 4.19 102.45 68.35 45.32

2017 102.08 85.74 5.02 114.04 76.08 50.45

2018 106.14 89.15 5.22 118.58 79.11 52.46

2019 107.73 90.49 5.30 120.36 80.29 53.24

2020 109.34 91.85 5.39 122.16 81.50 54.04

2021 110.98 93.23 5.47 124.00 82.72 54.85

2022 112.65 94.63 5.56 125.86 83.96 55.67

2023 114.34 96.04 5.65 127.74 85.22 56.51

2024 116.05 97.49 5.74 129.66 86.50 57.36

----------------------------------------------------------------------------

Notes:

1. This summary table identifies benchmark pricing schedules that might

apply to a reporting issuer.

2. Product sale prices will reflect these reference prices with further

adjustments for quality and transportation to point of sale.

3. Forecast prices are escalated after 2024 at the rate of 1.5% per year.

About Relentless Resources Ltd.

Relentless is a Calgary based emerging oil and natural gas company, engaged in

the exploration, development, acquisition and production of natural gas and

light gravity crude oil reserves in Alberta and Saskatchewan. Relentless's

common shares trade on the TSX Venture Exchange under the symbol RRL.

Relentless's primary corporate objective is to achieve non-dilutive growth and

enhance shareholder value through internal prospect development, strategic

production acquisitions and prudent financial management.

Forward-Looking Statements: All statements, other than statements of historical

fact, set forth in this news release, including without limitation, assumptions

and statements regarding the volumes and estimated value of the Company's proved

and probable reserves, future production rates, exploration and development

results, financial results, and future plans, operations and objectives of the

Company are forward-looking statements that involve substantial known and

unknown risks and uncertainties. Some of these risks and uncertainties are

beyond management's control, including but not limited to, the impact of general

economic conditions, industry conditions, fluctuation of commodity prices,

fluctuation of foreign exchange rates, environmental risks, industry

competition, availability of qualified personnel and management, availability of

materials, equipment and third party services, stock market volatility, timely

and cost effective access to sufficient capital from internal and external

sources. The reader is cautioned that assumptions used in the preparation of

such information, although considered reasonable by the Company at the time of

preparation, may prove to be incorrect. There can be no assurance that such

statements will prove to be accurate and actual results and future events could

differ materially from those anticipated in such statements.

These assumptions and statements necessarily involve known and unknown risks and

uncertainties inherent in the oil and gas industry such as geological,

technical, drilling and processing problems and other risks and uncertainties,

as well as the business risks discussed in Management's Discussion and Analysis

of the Company under the heading "Business Risks". The Company does not

undertake any obligation, except as required by applicable securities

legislation, to update publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events or otherwise.

Barrels of oil equivalent (boe) is calculated using the conversion factor of 6

mcf (thousand cubic feet) of natural gas being equivalent to one barrel of oil.

Boes may be misleading, particularly if used in isolation. A boe conversion

ratio of 6 mcf:1 bbl (barrel) is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not represent a value

equivalency at the wellhead. Given that the value ratio based on the current

price of crude oil as compared to natural gas is significantly different from

the energy equivalency of 6:1, utilizing a conversion on a 6:1 basis may be

misleading as an indication of value.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Relentless Resources Ltd.

Dan Wilson

CEO

(403) 532-4466 ext. 227 or Mobile: (403) 874-9862

(403) 303-2503 (FAX)

Relentless Resources Ltd.

Ron Peshke

President

(403) 532-4466 ext. 223 or Mobile: (403) 852-3403

(403) 303-2503 (FAX)

info@relentless-resources.com

www.relentless-resources.com

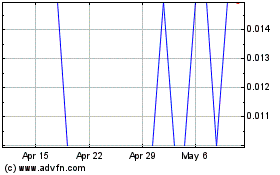

Resolute Resources (TSXV:RRL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Resolute Resources (TSXV:RRL)

Historical Stock Chart

From Dec 2023 to Dec 2024