Relentless Resources Announces Agreement to Purchase Alberta Oil and Gas Assets

May 23 2014 - 5:47PM

Marketwired

Relentless Resources Announces Agreement to Purchase Alberta Oil

and Gas Assets

CALGARY, ALBERTA--(Marketwired - May 23, 2014) - Relentless

Resources Ltd. (TSX-VENTURE:RRL) ("Relentless" or "the Company")

announced today that its nominee, 1819113 Alberta Ltd. ("1819113"

or "the Nominee" ) has completed a purchase of approximately 127

boe/d of conventional producing P&NG assets from a private

company for $3 million in cash, subject to industry standard

closing adjustments. 1819113 is wholly owned by certain directors

and officers of Relentless.

The Nominee funded the purchase with bank financing and loans

from its directors and officers. The loans will be payable on

demand and bear interest at the annual rate of 3%.

Relentless has the exclusive right to acquire the assets from

Nominee or its common shares and loans payable for $3 million.

Completion of the proposed transaction by Relentless is subject

to a number of conditions including, without limitation, approval

of the TSX Venture Exchange ("TSXV") by August 31, 2014. Relentless

will either acquire the assets from the Nominee or amalgamate with

the Nominee upon receipt of TSXV approval. Requirements for TSX

Approval may include approval of the transactions at a shareholder

meeting of Relentless.

The assets to be acquired are located in the Peace River Arch

area of Alberta, and are comprised of production of approximately

64% natural gas and 36% light oil and natural gas liquids (based on

conversion ratio of 6 mcf = 1 bbl). For the year ended December 31,

2013 the assets produced 46 bbl/day of oil and NGL's and 486

mcf/day of natural gas (127 boe/day). The majority of the

production is operated with high working interests. The assets

include a total net land base of approximately 5,000 acres (8

sections), and significant oil and gas gathering and processing

infrastructure.

The insider loans could be a "related party transaction" to

Relentless under Multilateral Instrument 61-101 and TSX Venture

Policy 5.9 (the "Policies") due to the fact that the directors of

Nominee are also officers and / or directors of Relentless.

The Corporation has determined that there are exemptions

available from certain requirements of the Policies for the insider

loans:

Exemptions from formal Valuation Requirements - Issuer Not

Listed on Specified Markets; and Distribution of Securities for

Cash.

Exemptions from Minority Approval Requirements - Loan to Issuer,

No Equity or Voting Component.

Neither the Corporation, nor to the knowledge of the Corporation

after reasonable inquiry, the insiders, have knowledge of any

material information concerning the issuer or its securities, that

has not been generally disclosed.

About Relentless Resources Ltd.

Relentless is a Calgary based emerging oil and natural gas

company, engaged in the exploration, development, acquisition and

production of natural gas and light gravity crude oil reserves in

Alberta. Relentless's common shares trade on the TSX Venture

Exchange under the symbol RRL.

Relentless's primary corporate objective is to achieve

non-dilutive growth and enhance shareholder value through internal

prospect development, strategic production acquisitions and prudent

financial management.

Forward-Looking Statements: All statements, other than

statements of historical fact, set forth in this news release,

including without limitation, assumptions and statements regarding

the volumes and estimated value of the Company's proved and

probable reserves, future production rates, exploration and

development results, financial results, and future plans,

operations and objectives of the Company are forward-looking

statements that involve substantial known and unknown risks and

uncertainties. Some of these risks and uncertainties are beyond

management's control, including but not limited to, the impact of

general economic conditions, industry conditions, fluctuation of

commodity prices, fluctuation of foreign exchange rates,

environmental risks, industry competition, availability of

qualified personnel and management, availability of materials,

equipment and third party services, stock market volatility, timely

and cost effective access to sufficient capital from internal and

external sources. The reader is cautioned that assumptions used in

the preparation of such information, although considered reasonable

by the Company at the time of preparation, may prove to be

incorrect. There can be no assurance that such statements will

prove to be accurate and actual results and future events could

differ materially from those anticipated in such statements.

These assumptions and statements necessarily involve known and

unknown risks and uncertainties inherent in the oil and gas

industry such as geological, technical, drilling and processing

problems and other risks and uncertainties, as well as the business

risks discussed in Management's Discussion and Analysis of the

Company under the heading "Business Risks". The Company does not

undertake any obligation, except as required by applicable

securities legislation, to update publicly or to revise any of the

included forward-looking statements, whether as a result of new

information, future events or otherwise.

Barrels of oil equivalent (boe) is calculated using the

conversion factor of 6 mcf (thousand cubic feet) of natural gas

being equivalent to one barrel of oil. Boes may be misleading,

particularly if used in isolation. A boe conversion ratio of 6

mcf:1 bbl (barrel) is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead. Given that the value

ratio based on the current price of crude oil as compared to

natural gas is significantly different from the energy equivalency

of 6:1, utilizing a conversion on a 6:1 basis may be misleading as

an indication of value.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Relentless Resources Ltd.Dan WilsonCEO(403) 532 - 4466 ext. 227

/ Mobile: (403) 874 - 9862(403) 303 -

2503info@relentless-resources.comwww.relentless-resources.com

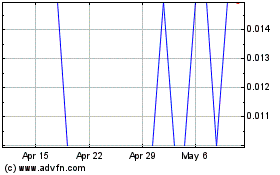

Resolute Resources (TSXV:RRL)

Historical Stock Chart

From Nov 2024 to Dec 2024

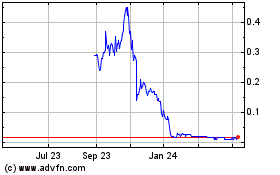

Resolute Resources (TSXV:RRL)

Historical Stock Chart

From Dec 2023 to Dec 2024