Pulse Oil Corp. (the “Company” or “

Pulse”) (TSXV:

PUL) announced that it is offering rights (the “

Rights

Offering”) to holders of its common shares

(“

Common Shares”) of record at the close of

business on December 15, 2023 (the “

Record Date”).

Pursuant to the Rights Offering, each holder of Common Shares (a

“

Shareholder”) will receive one-fifth of a

transferable right for each Common Share held of Pulse as of the

Record Date. Each whole right (a “

Right”) will

entitle the holder thereof to subscribe for one (1) Common Share at

a price of $0.04 per Common Share (the “

Basic Subscription

Privilege”) until 2:00 p.m. (Pacific time) (the

“

Expiry Time”) on January 12, 2024. If the Rights

are fully exercised, the Rights Offering will raise gross proceeds

of $4,156,000.

The Rights will be offered to Shareholders resident in each

province and territory of Canada (the “Eligible

Jurisdictions”) and Shareholders who have satisfied the

requirements of Pulse for those resident outside of the Eligible

Jurisdictions. Accordingly, and subject to the detailed provisions

of the right offering circular dated December 7, 2023 (the

“Circular”), Rights certificates (“Rights

Certificates”) will not be mailed to Shareholders resident

outside of the Eligible Jurisdictions, unless such Shareholders

are able to establish to the satisfaction of Pulse, on or before

December 29, 2023, that they are eligible to participate in the

Rights Offering. Shareholders who fully exercise their Rights will

be entitled to subscribe pro rata for Common Shares not otherwise

subscribed for by other holders of Rights prior to the expiry time,

if any, pursuant to the Basic Subscription Privilege.

Neither the Rights being offered or the Common Shares issuable

upon exercise of the Rights have been or will be registered under

the United States Securities Act of 1933, as amended, and

may not be exercised, offered or sold, as applicable, in the

United States absent registration or an applicable exemption

from the registration requirements. This news release shall not

constitute an offer to sell or the solicitation of an offer to buy

the securities of Pulse. There shall be no offer or sale of these

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful prior to the registration or qualification

of such securities under the laws of any such jurisdiction.

Standby Commitment Agreement

In connection with the Rights Offering, Pulse has entered into

standby commitment agreements (the "Standby Commitment

Agreements") with CDN Trustee Limited TR CDN Trust

and Andrew Ritchie TR AJ Trust No 2 (the "Standby

Purchasers"), insiders of Pulse currently owning 13.28%

and 15.40%, respectively, of Pulse’s Common Shares. The Standby

Purchasers have agreed, subject to certain terms and conditions, to

exercise their Basic Subscription Privilege in respect of any

Rights it holds, and, in addition thereto, acquire any additional

Common Shares available as a result of any unexercised Rights under

the Rights Offering (the "Standby Commitments"),

such that Pulse will, subject to the terms of the Standby

Commitment Agreement, be guaranteed to issue 98,000,000 Common

Shares in connection with the Rights Offering for aggregate gross

proceeds of $3,920,000. The Standby Commitment is being

guaranteed by CDN Trustee Limited TR CDN Trust in the amount of

$2,180,000 and Andrew Ritchie TR AJ Trust No 2 in the amount of

$1,740,000 and has been approved by the independent directors of

the Company. As consideration for the Standby Commitment, the

Company has agreed to issue non-transferable bonus warrants (the

“Standby Commitment Warrants”) to the Standby

Purchasers (being 25% of the amount of the Standby Commitment

exceeding the Basic Subscription Privilege). Each Standby

Commitment Warrant will be exercisable for sixty (60) months from

the date of issuance into one Common Share at a price of $0.05 per

share. CDN Trustee Limited TR CDN Trust and Andrew Ritchie TR AJ

Trust No 2 have undertaken not to exercise their Standby Commitment

Warrants if to do so would result in its beneficial shareholdings

of Pulse exceeding 20% unless Pulse disinterested shareholder

approval to the same has been obtained.

Each of the Standby Purchasers and Standby Guarantors is a

“related party” of Pulse under Multilateral Instrument 61-101

– Protection of Minority Security Holders in Special

Transactions (“MI 61-101”) because CDN

Trustee Limited TR CDN Trust and Andrew Ritchie TR AJ Trust No 2

each exercise control and direction over more than 10% of the

issued and outstanding Common Shares. The Rights Offering is

not subject to the related party rules under MI 61-101 based on a

prescribed exception related to rights offerings. With respect to

the issuance of the Standby Commitment Warrants to the Standby

Purchasers, Pulse is relying on exemptions from the formal

valuation and minority approval requirements of MI 61-101 pursuant

to sections 5.5(b) and 5.7(1)(a) thereof on the basis that Common

Shares are listed only on the TSX Venture Exchange and, at the time

the time the Standby Commitment Agreements were entered into,

neither the fair market value of the Standby Commitment Warrants,

nor the fair market value of the consideration for Standby

Commitment Warrants exceeded 25% of Pulse’s market capitalization,

respectively.

Early Warning Disclosure

CDN Trustee Limited TR CDN Trust and Andrew Ritchie TR AJ Trust

No 2 are providing the following additional information pursuant to

the early warning requirements of applicable Canadian securities

laws:

CDN Trustee Limited TR CDN Trust:

Prior to the entering into of the Standby Commitment Agreements,

CDN Trustee Limited TR CDN Trust beneficially owned an aggregate of

69,000,000 Common Shares, representing approximately 13.28% of the

issued and outstanding Common Shares. Patrick Harrison, a

director of Pulse, is a director of the corporate trustee of CDN

Trustee Limited TR CDN Trust. Assuming none of the holders of

Rights (other than the Standby Purchasers) take up their Basic

Subscription Privilege and the Standby Purchasers provide their

respective Standby Commitment in full, CDN Trustee Limited TR CDN

Trust would acquire an aggregate of 54,500,000 Common Shares, in

connection with the Rights Offering and 10,175,000 Standby

Commitment Warrants in connection with the Standby Commitment.

Following closing of the Rights Offering, CDN Trustee Limited TR

CDN Trust would beneficially own an aggregate of 123,500,000 Common

Shares, which would represent approximately 19.9982% of the

issued and outstanding Common Shares. In addition, if CDN Trustee

Limited TR CDN Trust exercises it’s Standby Commitment Warrants and

all other Common Share purchase rights, options and other rights to

acquire Common Shares held by it, it would own 133,675,000 Common

Shares or approximately 21.29%.

The Common Shares are being acquired for investment purposes.

CDN Trustee Limited TR CDN Trust may from time to time acquire

additional securities, dispose of some or all of the existing or

additional securities, or may continue to hold the securities of

Pulse.

Andrew Ritchie TR AJ Trust No 2:

Prior to the entering into of the Standby Commitment Agreements,

Andrew Ritchie TR AJ Trust No 2 beneficially owned an aggregate of

80,000,000 Common Shares, representing approximately 15.40% of the

issued and outstanding Common Shares. Assuming none of the holders

of Rights (other than the Standy Purchasers) take up their Basic

Subscription Privilege and the Standby Purchasers provide their

Standby Commitment in full, Andrew Ritchie TR AJ Trust No 2 would

acquire an aggregate of 43,500,000 Common Shares, in connection

with the Rights Offering and 6,875,000 Standby Commitment Warrants

in connection with the Standby Commitment. Following closing of the

Rights Offering, Andrew Ritchie TR AJ Trust No 2 would beneficially

own an aggregate of 123,500,000 Common Shares, which would

represent approximately 19.9982% of the issued and outstanding

Common Shares. In addition, if Andrew Ritchie TR AJ Trust No 2

exercises it’s Standby Commitment Warrants and all other Common

Share purchase rights, options and other rights to acquire Common

Shares held by it, it would own 130,375,000 Common Shares or

approximately 20.88%.

The Common Shares are being acquired for investment purposes.

Andrew Ritchie TR AJ Trust No 2 may from time to time acquire

additional securities, dispose of some or all of the existing or

additional securities, or may continue to hold the securities of

Pulse.

Pulse understands that certain directors and officers of Pulse

who own Common Shares may intend to exercise their rights to

purchase Common Shares under the Rights Offering.

Operational Update:

The net proceeds from the Rights Offering will primarily be used

on the first of two 100% owned Bigoray Nisku Pinnacle Reefs by

funding growth opportunities within Pulse’s Bigoray Enhanced Oil

Recovery (Bigoray EOR) project that Pulse believes will result in

significant production, cashflow and oil reserve growth for many

years.

Pulse has recently completed an extensive technical analysis and

update of its EOR program that consisted of retaining an

experienced and independent reservoir engineer to update Pulse’s

EOR reservoir modelling on the Nisku D and E pinnacle reefs that

was initially completed by Schlumberger International in 2018.

During this recent technical analysis, Pulse was excited to

learn that within the Nisku D pool there is an additional

opportunity to increase the efficiency of the EOR by accessing

incremental oil and gas production. The updated reservoir modelling

indicated that a part of the Nisku D reef was not swept efficiently

by the water flood that was completed prior to Pulse acquiring the

Bigoray project. Pulse intends to continue the solvent flood

currently underway while also adding a water flooding project to be

conducted over the next 12 to 18 months, and then adding a second

solvent injection well after the water flood is complete to work in

combination with Pulse’s current solvent injection well in the D

pool.

Reservoir Engineering has also concluded that there is potential

for strong incremental production growth and stable production over

the first five years of production and then declining over the next

twenty years.

In addition, the EOR modeling update offered other opportunities

for Pulse to enhance production growth and ultimate recovery of oil

and gas within the Bigoray EOR project.

Specifically, the proceeds of this Offering will allow Pulse to

do the following:

- Workover and

stimulate one Bigoray well located in the Nisku E pool in order to

place the well on production.

- Drill and complete

one new vertical well within the Bigoray Nisku D pool to grow

Pulse’s oil and gas production immediately, while also adding an

EOR production well in an ideal location within the Nisku D pool,

expediting production growth from Pulse’s existing EOR

program.

- Fund continued

solvent injection into the Nisku D pool.

Pulse believes that the resultant cashflow from the above

operations will allow Pulse to expand the EOR operational plan as

follows:

- Drill a new

horizontal well near the newly water flooded section and completing

the well with sliding sleeve technology that will allow for

expedited production growth during the EOR program.

- Drill a new vertical

production well ideally located within the Nisku D pool, to

maximize production rates and increase maximize ultimate oil

recovery within the pool.

- Convert a third well

in the Nisku D pool to a solvent injection well in order to enhance

solvent injection.

The Rights Offering is subject to regulatory approval, including

the final approval of the TSX Venture Exchange (the

“TSXV”).

Complete details of the Rights Offering are set out in the

Circular and the rights offering notice (the

“Notice”), which are filed under Pulse’s profile

at www.sedarplus.ca. Registered Shareholders

who wish to exercise their Rights must complete and forward the

Rights Certificate, together with applicable funds, to

Computershare Investor Services Inc., the depositary for the

Rights Offering, on or before the Expiry Time of the Rights

Offering. Shareholders who own their Common Shares through an

intermediary, such as a bank, trust company, securities dealer or

broker, will receive materials and instructions from their

intermediary.

Pulse CEO, Garth Johnson commented, “The work our team has done

has created a lot of excitement for Pulse’s future. We have a

technically supported, well thought out operational plan to enhance

near term production while also expediting our Bigoray EOR project.

We will update all shareholders soon as specific operations get

underway. We thank all our shareholders for their continued support

and patience as we have worked through the initial challenges over

the past year during the start-up of our solvent injection process.

We are happy to have achieved consistent injection rates for the

last couple of months and we have a plan to increase those

injection rates soon.”

Pulse is a Canadian company incorporated under the Business

Corporations Act (Alberta) that is primarily focused on a 100%

Working Interest Enhanced Oil Project Located in West Central

Alberta, Canada. The project includes two established Nisku

pinnacle reef reservoirs that have been producing sweet light crude

oil for over 40 years. The Company plans to institute a proven

recovery methodology (NGL solvent injection) to further enhance the

ultimate oil recovery from these two proven pools. With under 10

million barrels of oil recovered to date, and representing

approximately 30% recovery factor from the pools, Pulse is moving

forward to execute the EOR project and unlock significant value for

shareholders. Pulse’s total reclamation liabilities are just $2.96

million which, when compared to many peers in the industry in

Western Canada, are very low.

Neither the TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

For further information contact:

Pulse Oil Corp.

Garth

JohnsonCEO604-306-4421garth@pulseoilcorp.com

Forward Looking Statements:

This news release contains “forward-looking information” within

the meaning of applicable Canadian securities legislation. All

statements, other than statements of historical fact, included

herein are forward-looking information. In particular, this news

release contains forward-looking information regarding: the Rights

Offering, including the expiry time of the Rights Offering, the

potential use of proceeds, forecasted operations and the results of

such operations. There can be no assurance that such

forward-looking information will prove to be accurate, and actual

results and future events could differ materially from those

anticipated in such forward-looking information. This

forward-looking information reflects Pulse’s current beliefs and

is based on information currently available to Pulse and on

assumptions Pulse believes are reasonable. These assumptions

include, but are not limited to: the underlying value of Pulse and

its Common Shares; market acceptance of the Rights Offering; TSX

Venture Exchange final approval of the Rights Offering; operational

timing and results; and the market acceptance of Pulse’s business

strategy. Forward-looking information is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

Pulse to be materially different from those expressed or implied

by such forward-looking information. Such risks and other factors

may include, but are not limited to: general business, economic,

competitive, political and social uncertainties; general capital

market conditions and market prices for securities; delay or

failure to receive board or regulatory approvals; the actual

results of future drilling and workover operations; production

growth anticipated from drilling operations, EOR operational

results, competition; changes in legislation, including

environmental legislation, affecting Pulse; the timing and

availability of external financing on acceptable terms; and loss

of key individuals. A description of additional risk factors that

may cause actual results to differ materially from forward-looking

information can be found in Pulse’s disclosure documents on the

SEDAR+ website at www.sedarplus.ca. Although Pulse has attempted

to identify important factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated or intended. Readers are cautioned

that the foregoing list of factors is not exhaustive. Readers are

further cautioned not to place undue reliance on forward-looking

information as there can be no assurance that the plans,

intentions or expectations upon which they are placed will occur.

Forward-looking information contained in this news release is

expressly qualified by this cautionary statement. The

forward-looking information contained in this news release

represents the expectations of Pulse as of the date of this news

release and, accordingly, is subject to change after such date.

However, Pulse expressly disclaims any intention or obligation to

update or revise any forward-looking information, whether as a

result of new information, future events or otherwise, except as

expressly required by applicable securities law.

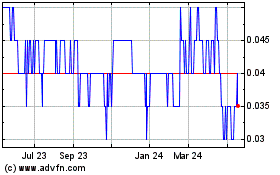

Pulse Oil (TSXV:PUL)

Historical Stock Chart

From Nov 2024 to Dec 2024

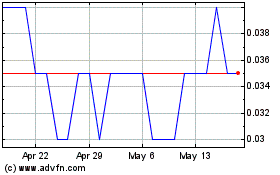

Pulse Oil (TSXV:PUL)

Historical Stock Chart

From Dec 2023 to Dec 2024