Purepoint Uranium Group Inc. (TSX VENTURE: PTU) is pleased to

provide the following overview of its current operations and

exploration plans for the coming year.

"As 2008 closed, the exploration industry's five year bull

market came to a hard stop, and Purepoint announced its decision to

dramatically reduce field work and conserve cash until signs of

improvement in the capital markets were apparent" said Chris

Frostad, President and CEO of Purepoint Uranium Group Inc. "Now, as

global economies begin to emerge from that severe recession,

Purepoint remains well positioned as a unique opportunity in

Canada's Athabasca Basin uranium region".

Corporate Highlights:

- Over a period of five years, during which the capital markets

were providing the lowest cost of capital the exploration industry

has seen in decades, Purepoint resolved to utilize its own capital

to advance its early stage projects while maintaining a 100%

ownership interest; deferring joint venture potential until higher

value could be empirically demonstrated. As a result of that

strategic decision Purepoint is now the only remaining public

exploration junior in the Basin actively advancing a portfolio of

100% owned, highly prospective uranium projects of proven

value;

- Purepoint continues to closely monitor exploration

developments in the Basin and has recently staked a new block of

promising properties within the Basin's primary mine trend;

- Joint venture discussions with more than a dozen Asian based

companies have recently resumed, companies which were forced to

suspend negotiations last year as global economies weakened;

- In anticipation of the pending Canada/India nuclear trade

agreement, new discussions with several large Indian companies have

recently commenced;

- Purepoint has now fully earned an initial 23% in its Smart

Lake joint venture with Cameco Corporation and can earn an

additional 27% by spending an additional $1.9 million by March 31,

2013;

- Purepoint has now fully earned an initial 20% in its Hook Lake

joint venture with Cameco Corporation and Areva Resources Canada

Ltd. and can earn an additional 30% by spending an additional $4.3

million by March 31, 2013;

- At the close of its last fiscal quarter (June 30, 2009) the

company held a working capital balance in excess of $2.8

million.

Exploration Highlights:

- The company will resume drilling activities in the upcoming

winter season, focusing its efforts on three high priority

projects, Red Willow, Smart Lake and Turnor Lake.

- Re-logging of drill core at Purepoint's Red Willow project has

provided a more detailed interpretation of the mineralized

structures within the Osprey Zone (assaying as high as 3.03%

U3O8);

- At Purepoint's Smart Lake joint venture with Cameco a

radioactive structure, originally intersected by SMT08-01, was

successfully traced for 50 metres during the last drill program,

returned assays up to 0.19% U3O8 over 0.1 m, and is associated with

the graphitic "Shearwater Conductor" that has been outlined for

over 1.4 kilometers;

- The most recent drill programs at the company's Turnor Lake

project continued to show that anomalous uranium mineralization is

spatially associated with the unconformity throughout the property.

As previously reported, last year's single drill hole into the

Serin Lake Zone intersected an interpreted uplifted block of

basement rocks, an important feature associated with many

high-grade uranium deposits in the Athabasca Basin.

- Purepoint was fortunate to have recently staked an additional

723 hectares in close proximity to its Henday Lake project. The

entire Henday Block now covers 1,752 hectares within the Athabasca

Basin's eastern uranium mine trend and is situated less than ten

kilometers from both Hathor's recently discovered Roughrider Zone

and Denison's Midwest uranium deposit.

Red Willow Project

Last year, a 37-hole diamond drill program totaling 7,160 metres

was completed on the Red Willow Property, a large property

containing more than 22 targets, each identified by multiple

indicia of Basin type deposits. This drill program successfully

followed up the 2007 Osprey Zone discovery, discovered two

additional radioactive structures within the Long Lake area, and

demonstrated the favourable prospectivity of the Radon Lake area

(see announcement dated June 11, 2008).

Drilling of the Osprey Zone intersected a structure averaging

0.58% U3O8 over 1.0 metre (RW-19) that included an interval

assaying 3.03% U3O8 over 0.1 metres. The RW-19 intercept is located

approximately 80 metres north from the Osprey zone discovery hole

RW-07, which returned 0.20% eU3O8 over 5.8 metres in 2007. Hole

RW-13 returned 0.27% U3O8 over 1.2 metres that represents a 20

metre step-out south of RW-07. The 2008 Osprey drilling results

indicate that significant uranium intercepts are related to a 40 -

50 metre wide pyritic/graphitic shear zone. The prospective shear

zone remains unexplored to depth and along most of its strike

length.

First pass drilling within the Long Lake area intersected a 1.6

metre radioactive structure in LL08-05 (including 269 ppm U over

0.5 m) and two narrow mineralized structures in LL08-07 (611 ppm U

and 237 ppm U over 0.1 and 0.2 m, respectively). Two of three

eastern electromagnetic conductors drill-tested in 2008 at Long

Lake are now known to reflect altered, graphitic rocks. These two

target areas represent 8.7 kilometers of prospective EM

conductors.

At Radon Lake, the VTEM conductor trending southwest from the

lake was explored systematically. Graphitic units were intersected

and anomalous uranium results were returned from RAD-08-01,

RAD-08-02, RAD-08-05, RAD-08-06 and RAD-08-09. Drill hole RAD08-09

provided the best uranium assay at Radon Lake returning 283 ppm U

over 1.1 metres between 106.1 and 107.2 metres. Favourable

alteration, including strong chlorite and hematization, was

intersected in most holes. Spring conditions prevented drill

testing the northern extension of the EM conductor.

The most recent drill program at Red Willow highlighted this

property's uranium potential by returning anomalous uranium

concentrations from all three areas drilled. Each of these areas

require further drilling to evaluate their potential while numerous

prospective geophysical targets have yet to be tested by diamond

drilling.

Smart Lake Project

The Smart Lake property is situated in the southwestern portion

of the Athabasca Basin, approximately 60 km south of the former

Cluff Lake mine. Depth to the unconformity is shallow, at zero to

350 metres. Aeromagnetic and electromagnetic patterns at Smart Lake

reflect an extension of the unique patterns underlying the Shea

Creek deposits (max. grade of 58.3% U3O8 over 3.5 m) just 55 km

north of the property. Recent exploration by Purepoint and Cameco

has firmly established the presence and location of a number of

basement electromagnetic conductors never drill tested.

Previously reported drill hole SMT08-01 (see announcement dated

November 4, 2008) intersected a major structure between 222.5 and

276.5 m (true width estimated at 20 m) that displayed intense clay

alteration, silicification and hematization. The weak radioactive

structure was brecciated and healed with an overprinting of

alteration styles suggesting multiple episodes of alteration. Three

holes were drilled to follow-up the favourable SMT08-01 structure

and successfully intersected it 50 metres along strike. Drill hole

SMT08-05 intersected the radioactive fault between 150.1 and 154.2

m and returned up to 0.22% eU3O8 over 0.2 m. SMT08-06 returned

0.19% U3O8 over 0.1 m from a tension fracture associated with the

SMT08-05 radioactive fault.

The newly discovered radioactive structure at Smart Lake is

associated with graphite and the Shearwater conductor which will

aid ongoing exploration. The Shearwater conductor has been outlined

over 1.0 kilometer by a ground EM survey and over 1.4 kilometers by

an airborne EM survey.

Turnor Lake Project

Situated in the eastern side of the Athabasca Basin, the 100%

owned Turnor Lake Project includes five claims with a total area of

9,705 hectares. Depth to the unconformity is shallow at

approximately 180 metres.

The property covers known graphitic conductors that are

associated with uranium showings on adjoining properties, namely

Cameco's La Rocque showing (33.9% U3O8 over 5.5 m) to the west and

Areva's HLH-50 intercept (5.2% U3O8 over 0.38 m) located to the

south. The project lies in close proximity to several uranium

deposits including Midwest Lake, McClean Lake, Eagle Point, and

Collins Bay.

In light of the favourable results returned throughout the life

of this project, all conductors on the property continue to warrant

further diamond drill testing, specifically those conductors within

the Laysan and Serin target zones. Further drilling is required in

the area between drill holes TL-30 and TL-31 and in the vicinity of

TL-28, which returned results showing extensive clay alteration of

the sandstone. Follow-up holes to further test the areas of

anomalous halo mineralization are warranted including the vicinity

of TL-39. Drilling will also be conducted to determine the source

of the radon anomaly detected in the vicinity of drill holes TL-41

and -42.

Henday Block

Purepoint's 100% owned Henday Block is situate within ten

kilometers of both Hathor's recently discovered Roughrider Zone and

the Midwest uranium deposit owned by Denison Mines Corp., AREVA

Resources Canada Inc. and OURD.

The Henday Lake property falls within the Mudjatik-Wollaston

Tectonic Zone, a northeast trending structural zone along the

eastern margin of the Basin. Over 95% of known Canadian uranium

deposits, and all operating uranium mines in Canada, are located on

this trend. The Mudjatik-Wollaston Tectonic Zone is the NE trending

high strain tectonic zone marking the boundary between the Archean

gneisses and granitoids of the Mudjatik Domain to the west and

Archean gneisses, metasediments, and pegmatite intrusions of the

Wollaston domain to the east.

The Henday Block is 1,752 hectares in size, three times the size

of Hathor's nearby Midwest Northeast Project, which hosts their

Roughrider Zone. Only one historic drill hole is known to have been

drilled on Purepoint's Henday property. That hole, drilled by

Cogema Resources in 1998, encountered a steeply dipping, strongly

graphitic fault gouge at the bottom of the hole.

Annual Option Grant

Purepoint is also announcing today that the company has approved

the issuance of a total of 1,280,000 options to certain of its

Board of Directors, management and staff pursuant to its stock

option plan. The options are exercisable at a price of $0.14, are

subject to agreed vesting schedules and expire in five years.

Under Purepoint's stock option plan there are at present

7,330,803 common shares reserved for issuance, of which only

4,560,000 shares are subject to outstanding option grants.

About Purepoint

Purepoint Uranium Group Inc. is focused on the precision

exploration of more than 55 defined target areas on its eight 100%

owned projects in the Canadian Athabasca Basin, and its two Basin

projects joint ventured with Cameco Corporation and AREVA Resources

Canada Inc. Established in the Basin well before the resurgence in

uranium, Purepoint is actively advancing this large portfolio of

multiple drill targets in the world's richest uranium region.

Scott Frostad BSc, MASc, PGeo, Purepoint's Vice President,

Exploration, is the Qualified Person responsible for technical

content of this release.

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT

RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Contacts: Purepoint Uranium Group Inc. Chris Frostad President

and CEO (416) 603-8368 www.purepoint.ca

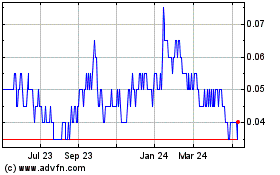

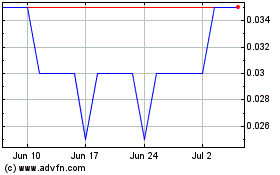

Purepoint Uranium (TSXV:PTU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Purepoint Uranium (TSXV:PTU)

Historical Stock Chart

From Jul 2023 to Jul 2024