Prospera Energy Inc. (TSX.V: PEI, OTC: GXRFF)

("

Prospera", “

PEI” or the

"

Corporation")

White Tundra Acquisition

Prospera Energy is pleased to announce a strategic acquisition

aimed at expanding its asset portfolio of low-decline base

production with significant production upside. The Corporation has

entered into an agreement to acquire 100% of the issued and

outstanding common shares of White Tundra Petroleum (“WTP”). WTP’s

assets produce 30° API medium oil and are located near Loyalist and

Hanna, Alberta. The acquisition strengthens PEI’s base production

and provides numerous high-impact reactivation opportunities. This

transaction is subject to TSXV acceptance.

As part of the transaction, 18,000,000 common

shares of PEI will be issued to WTP shareholders, contingent upon

WTP achieving 85 barrels of oil equivalent per day (boe/d) for

three consecutive days across its properties. This condition was

achieved based on production levels from February 27th to March

1st. A performance-based bonus of 7,312,500 additional shares will

be issued if production of 128 boe/d can be demonstrated for at

least seven consecutive days within six months from the acquisition

date. The Corporation is also assuming $695,000 in debt as part of

the transaction.

Prospera will assume operational oversight of

WTP on March 6th, 2025, and immediately deploy a $200,000 workover

and reactivation program to optimize production beyond 128 boe/d.

The bonus share consideration will be issued following the final

statement of adjustments and verification of sustained production

levels.

This transaction qualifies as a related party

transaction. Shubham Garg serves as Prospera’s Chairman of the

Board, the CEO of WTP, and is a shareholder of WTP. The Corporation

has relied on the exemptions from the valuation and minority

shareholder approval requirements of MI 61-101 contained in

sections 5.5(a) and 5.7(a) of MI 61-101 in respect of such insider

participation. In addition, the related party director has recused

himself from all board discussions including the acquisition’s deal

structure, valuation, and decisions in relation to this

transaction.

The Corporation has strengthened its corporate

governance policies, including full public disclosure of monthly

operational updates. These policies are now transparently available

on Prospera’s website which include the PEI board mandate, PEI

audit committee charter, PEI disclosure policy, ESTMA reports, and

PEI related parties policies. This highlights Prospera’s renewed

commitment to enhanced transparency, public disclosure, and

governance.

Operations Update:

Following the February operations update, PEI

production continues to increase, exiting February at 878 boe/d

(94% oil) which is up 10% from the previously reported February PEI

peak production. On March 3rd, Luseland production reached 130

boe/d (100% oil), the highest since December 2023, while Hearts

Hill achieved 208 boe/d (86% oil), marking the field’s highest

production since November 2019. These milestones reflect the

Corporation’s renewed strategic focus on high certainty, low-cost

workovers rather than development drilling programs. The

Corporation's two active service rigs are continuing to bring wells

online across its Luseland and Hearts Hill properties.

Convertible DebtProspera is

pleased to announce that it has reached a settlement agreement with

its convertible debt holders to address the upcoming maturity of

its $1,500,000 convertible debt, along with accrued interest of

$559,374.82 as of the note maturity date on March 26th, 2025.

Under the terms of the

agreement:

- The $1,500,000

principal will be refinanced through the issuance of a 12-month

promissory note bearing 12% interest, with monthly principal

repayments of $250,000 commencing six months after issuance.

Interest will be paid as a balloon payment at the end of the

term.

- $200,000 of

outstanding interest will be settled through a 12-month convertible

note at 12% interest, convertible into PEI common shares at $0.05

per share. Prospera retains the right to pay this note in cash by

providing thirty days notice, during which the holder retains the

right to convert.

- The remaining

$359,374.82 in accrued interest will be settled through a

shares-for-debt agreement at $0.04 per share, subject to TSXV

acceptance.

The convertible debt settlement reduces

Prospera’s total fully diluted share count by 30,000,000 common

shares, resulting in a net reduction of (17,015,630) shares to

Prospera’s fully diluted scenario after accounting for the shares

for debt and convertible debt transactions. PEI’s capitalization

table is available in its corporate deck at ProsperaEnergy.com.

About Prospera Prospera Energy

Inc. is a publicly traded Canadian energy company specializing in

the exploration, development, and production of crude oil and

natural gas. Headquartered in Calgary, Alberta, Prospera is

dedicated to optimizing recovery from legacy fields using

environmentally safe and efficient reservoir development methods

and production practices. The company’s core properties are

strategically located in Saskatchewan and Alberta, including

Cuthbert, Luseland, Hearts Hill, and Brooks. Prospera Energy Inc.

is listed on the TSX Venture Exchange under the symbol PEI and the

U.S. OTC Market under GXRFF.

Prospera reports gross production at the first

point of sale, excluding gas used in operations and volumes from

partners in arrears, even if cash proceeds are received. Gross

production represents Prospera’s working interest before royalties,

while net production reflects its working interest after royalty

deductions. These definitions align with ASC 51-324 to ensure

consistency and transparency in reporting.

For Further Information:

Shawn Mehler, PR Email: investors@prosperaenergy.com

Chris Ludtke, CFOEmail: cludtke@prosperaenergy.com

Shubham Garg, Chairman of the BoardEmail:

sgarg@prosperaenergy.com

FORWARD-LOOKING STATEMENTSThis news release

contains forward-looking statements relating to the future

operations of the Corporation and other statements that are not

historical facts. Forward-looking statements are often identified

by terms such as “will,” “may,” “should,” “anticipate,” “expects”

and similar expressions. All statements other than statements of

historical fact included in this release, including, without

limitation, statements regarding future plans and objectives of the

Corporation, are forward-looking statements that involve risks and

uncertainties. There can be no assurance that such statements will

prove to be accurate and actual results and future events could

differ materially from those anticipated in such statements.

Although Prospera believes that the expectations and assumptions

on which the forward-looking statements are based are reasonable,

undue reliance should not be placed on the forward-looking

statements because Prospera can give no assurance that they will

prove to be correct. Since forward-looking statements address

future events and conditions, by their very nature they involve

inherent risks and uncertainties. Actual results could differ

materially from those currently anticipated due to a number of

factors and risks. These include, but are not limited to, risks

associated with the oil and gas industry in general (e.g.,

operational risks in development, exploration and production;

delays or changes in plans with respect to exploration or

development projects or capital expenditures; the uncertainty of

reserve estimates; the uncertainty of estimates and projections

relating to production, costs and expenses, and health, safety and

environmental risks), commodity price and exchange rate

fluctuations and uncertainties resulting from potential delays or

changes in plans with respect to exploration or development

projects or capital expenditures.

The reader is cautioned that assumptions used in the preparation

of any forward-looking information may prove to be incorrect.

Events or circumstances may cause actual results to differ

materially from those predicted, as a result of numerous known and

unknown risks, uncertainties, and other factors, many of which are

beyond the control of Prospera. As a result, Prospera cannot

guarantee that any forward-looking statement will materialize, and

the reader is cautioned not to place undue reliance on any forward-

looking information. Such information, although considered

reasonable by management at the time of preparation, may prove to

be incorrect and actual results may differ materially from those

anticipated. Forward-looking statements contained in this news

release are expressly qualified by this cautionary statement. The

forward-looking statements contained in this news release are made

as of the date of this news release, and Prospera does not

undertake any obligation to update publicly or to revise any of the

included forward-looking statements, whether as a result of new

information, future events or otherwise, except as expressly

required by Canadian securities law.

Neither TSXV nor its Regulation Services Provider (as that term

is defined in the policies of the TSXV) accepts responsibility for

the adequacy or accuracy of this release.

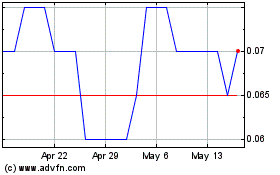

Prospera Energy (TSXV:PEI)

Historical Stock Chart

From Feb 2025 to Mar 2025

Prospera Energy (TSXV:PEI)

Historical Stock Chart

From Mar 2024 to Mar 2025