Osisko Metals Incorporated (the “

Company” or

“

Osisko Metals”) (TSX-V: OM; OTCQX: OMZNF;

FRANKFURT: 0B51) is pleased to announce the 2024 Mineral Resource

Estimate Update (“

2024 MRE”) for the Pine Point

Project (“Pine Point” or “the Project”), located near Hay River, in

the Northwest Territories of Canada. The 2024 MRE was prepared by

BBA Inc. (“BBA”) and PLR Resources Inc. and will form the resource

base for a Feasibility Study (“FS”) that is planned to officially

start in Q3 2024. Cut-off grades are based on estimated long-term

metal prices, mining costs, metal recoveries, concentrate

transport, and smelter costs. The definition drill program

supporting the 2024 MRE was executed between 2018 and 2024.

Highlights:

-

Indicated Mineral Resources of 49.5Mt grading 4.22% zinc

and 1.49% lead (5.52% Zinc Equivalent (“ZnEq”)) containing

approximately 4.6 billion pounds of zinc and 1.6 billion pounds of

lead in situ (undiluted).

-

Inferred Mineral Resources of 8.3Mt grading 4.18% zinc and

1.69% lead (5.64% Zinc Equivalent (“ZnEq”)) containing

approximately 0.7 billion pounds of zinc and 0.3 billion pounds of

lead in situ (undiluted).

-

Compared to the previous MRE, the conversion of Inferred

Mineral Resources (see press release dated July

13, 2022) increased the tonnage of the current

Indicated Mineral Resources by 214% with an associated decrease in

the quantity of Inferred Mineral Resources.

- Mineral

Resources reported for the 2024 MRE used variable cut-off grades

between 1.41% and 1.51% ZnEq for open pit resources and between

4.10% and 4.40% ZnEq for underground resources.

- The

project's East Mill, Central, and North Zones now contain

approximately 36.2Mt of Indicated Mineral Resources grading 5.22%

ZnEq, or 3.2 billion pounds of zinc and 1.1 billion pounds of lead

in situ.

- New metallurgical test work

is in progress. Previous metallurgical test work described in the

2022 PEA (see press release August 29,

2022) highlighted Pine Point as a potential

producer of among the cleanest, high-grade zinc and lead

concentrates globally. This adds value to the project as any and

probably most smelter clients would want some Pine Point

concentrate for blending purposes.

A Technical Report supporting this 2024 MRE will

be filed within 45 days.

Robert Wares, CEO and Chairman of the Board,

commented, “We are very happy to have met a critical milestone with

this MRE that successfully converted the majority of the mineral

resources to the Indicated category. With our partner Appian

Capital Advisory LLP, we can now rapidly advance Pine Point to the

Feasibility Stage following finalization of trade-off studies.”

Jeff Hussey, CEO of Pine Point Mining Limited,

stated, “This represents the culmination of a multi-year definition

drill program that raised the confidence level in the mineral

resource base for the Feasibility Study. We will also continue

exploring for new deposits and should significant discoveries be

made this summer; they will be rapidly incorporated into the final

inventory.”

The project has significant supporting

infrastructure, including access by paved roads, a railhead in Hay

River, and an on-site hydroelectric substation. Additionally, the

project benefits from one hundred kilometres of pre-existing mine

haul roads from the original mining operations. These provide

access to most of the deposits in the 2024 MRE. The future

concentrator and camp location will be adjacent to the original

concentrator area.

The 2024 MRE is divided into five geographic

zones, each composed of one or more individual deposits (see Map 1

and Table 1).

Table 1: 2024 Mineral Resource Estimate

for Pine Point

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Indicated |

|

Inferred |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Method |

Zone |

Cut-off Grade |

|

Tonnage |

ZnEq |

|

Pb |

Zn |

|

Tonnage |

ZnEq |

|

Pb |

Zn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(ZnEq %) |

|

(kt) |

(%) |

|

(%) |

(%) |

|

(kt) |

(%) |

|

(%) |

(%) |

|

Pit Constrained Mineral Resources |

Central |

1.41 |

|

7,400 |

6.21 |

|

1.50 |

4.91 |

|

498 |

4.50 |

|

0.75 |

3.84 |

|

East Mill |

1.41 |

|

10,047 |

4.69 |

|

1.11 |

3.72 |

|

1,051 |

3.54 |

|

0.73 |

2.90 |

|

North |

1.41 - 1.44 |

|

18,763 |

5.10 |

|

1.47 |

3.82 |

|

680 |

4.08 |

|

0.65 |

3.52 |

|

N204 |

1.51 |

|

8,923 |

4.05 |

|

0.90 |

3.27 |

|

3,027 |

4.20 |

|

0.92 |

3.40 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Underground Mineral Resources |

Central |

4.40 |

|

121 |

6.66 |

|

0.81 |

5.95 |

|

63 |

5.62 |

|

1.44 |

4.37 |

|

West |

4.10 - 4.40 |

|

4,215 |

11.21 |

|

3.69 |

8.00 |

|

2,934 |

8.44 |

|

3.55 |

5.35 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Pit Constrained |

1.41 - 1.51 |

|

45,133 |

4.99 |

|

1.28 |

3.87 |

|

5,256 |

4.08 |

|

0.65 |

3.52 |

|

Total Underground |

4.10 - 4.40 |

|

4,336 |

11.08 |

|

3.61 |

7.94 |

|

2,997 |

8.38 |

|

3.51 |

5.33 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Combined |

|

|

49,469 |

5.52 |

|

1.49 |

4.22 |

|

8,253 |

5.64 |

|

1.69 |

4.18 |

| Notes: |

|

|

1) |

All tonnages are rounded to the nearest thousand tonnes. |

| |

2) |

ZnEq percentages are calculated

using metal prices, forecasted metal recoveries, concentrate

grades, transport costs, smelter payable metals and charges. |

| |

3) |

Pit-constrained cut-off grades

vary primarily due to variable transportation distances to the

presumed concentrator location. |

| The weighted average

strip ratio for all modelled pit-constrained mineralization is

5.8:1. |

| |

Compared to the 2022 Mineral Resource Estimate,

there is a decrease in overall tonnage, however grades remain

similar. The key factors include:

- Tighter

parameters guiding reasonable prospects for eventual economic

extraction driven by increased knowledge on project OPEX and mining

parameters.

- Open Pit:

Whittle optimization parameters as well as the increased cutoff

grade (+13%) and an increase in tonnage [+0.4%], due to the

conversion of the Underground Central zone that is now being

declared as Open Pit resources.

- Underground

(West): Tighter stope optimization parameters; decrease in tonnage

[-29%]

- Underground

(Central): Tighter stope optimization parameters and most of the

2022 underground material that is now tonnage declared inside pit

shells [-93%]

The in-pit MRE is constrained within pit shells

that were developed from a pit optimization analysis that was done

with Geovia Whittle 2022 software using the economic and operating

parameters presented below:

Table 2: Pit Optimization

Parameters

|

Parameter |

Unit |

Input |

|

Mine Site Costs |

|

|

|

Mining Cost – Overburden1 |

C$/t mined |

2.63 |

|

|

Mining Cost - Mineralized Material1 |

C$/t mined |

3.85 |

|

|

Mining Cost – Waste1 |

C$/t mined |

3.85 |

|

|

Transport Mineralized Material to Mill |

C$/t mined |

0.13 |

|

|

Processing Cost |

C$/t milled |

11.00 |

|

|

Power Cost2 |

C$/t milled |

5.00 |

|

|

Waste and Water Management Cost |

C$/t milled |

2.00 |

|

|

G&A Cost |

C$/t mined |

8.50 |

|

|

Recoveries |

|

|

|

Average Zinc |

% |

87 |

% |

|

Average Lead |

% |

93 |

% |

|

Zinc Concentrate Grade |

% |

60 |

% |

|

Lead Concentrate Grade |

% |

65 |

% |

|

Zinc Concentrate Costs |

|

|

|

Transport from mine to Smelter |

C$/wmt |

215.80 |

|

|

Smelter Cost |

C$/dmt |

266.50 |

|

|

Lead Concentrate Costs |

|

|

|

Transport from mine to Smelter |

C$/wmt |

261.30 |

|

|

Smelter Cost |

C$/dmt |

152.10 |

|

|

Metal Prices |

|

|

|

Zinc |

US$/lb |

1.30 |

|

|

Lead |

US$/lb |

1.00 |

|

|

Exchange Rate |

|

1.30 |

|

1 – Includes dewatering costs2 - Process plant

power cost is included in Power Cost

Table 3: Underground

Parameters

|

Parameter |

Unit |

Input |

|

Mine Site Costs |

|

|

|

Mining Cost – LHS1 |

C$/t mined |

54.22 |

|

|

Mining Cost - R&P1 |

C$/t mined |

59.99 |

|

|

Processing Cost |

C$/t milled |

11.00 |

|

|

Power Cost2 |

C$/t milled |

5.00 |

|

|

Waste and Water Management Cost |

C$/t milled |

2.00 |

|

|

G&A Cost |

C$/t mined |

8.50 |

|

|

Recoveries |

|

|

|

Average Zinc |

% |

87 |

% |

|

Average Lead |

% |

93 |

% |

|

Zinc Concentrate Grade |

% |

60 |

% |

|

Lead Concentrate Grade |

% |

65 |

% |

|

Zinc Concentrate Costs |

|

|

|

Transport from mine to Smelter |

C$/wmt |

215.80 |

|

|

Smelter Cost |

C$/dmt |

266.50 |

|

|

Lead Concentrate Costs |

|

|

|

Transport from mine to Smelter |

C$/wmt |

261.30 |

|

|

Smelter Cost |

C$/dmt |

152.10 |

|

|

Metal Prices |

|

|

|

Zinc |

US$/lb |

1.30 |

|

|

Lead |

US$/lb |

1.00 |

|

|

Exchange Rate |

|

1.30 |

|

1 – Includes dewatering costs.2 - Process plant

power cost is included in Power Cost

Open Pit and Underground

Mineralization

Prismatic-style deposits are defined by greater

than 10 metres of greater than 10% zinc + lead, with a distinct

vertical aspect of the deposit outline that crosscuts stratigraphy.

Vertical thicknesses of mineralization can exceed 70 metres, and

they have horizontal cross-sections of less than 200 by 200

metres.

Tabular-style deposits comprise sub-horizontal,

stratabound mineralization extending over a significant strike

length at varying lateral widths from 50 to 200 metres wide. The

strike extent can be in the order of kilometres. Mineralization

thickness averages about 3 metres and can range from 1 metre to,

very locally, greater than 10 metres.

The open pit portion of the 2024 MRE includes

mostly shallow tabular-style deposits, with the remainder being

shallow prismatic-style deposits. The underground portion of the

2024 MRE includes deeper prismatic-style mineralization and easily

accessible tabular-style mineralization found adjacent to the pit

wall boundaries of certain deposits.

Metallurgy

Metallurgical test work is in progress and will

provide data to support the flow-sheet design for the process

plant, including comminution tests, pre-concentration tests (Ore

Sorting and Dense Media Separation (DMS)), flotation tests and

dewatering tests. The Company is also investigating concentrations

of the critical metals Indium (In), Germanium (Ge), and Gallium

(Ga) in the Zinc concentrate produced from flotation tests and in

sphalerite mineralization within the various Zones.

2024 Drill Program

A brownfield exploration campaign is underway.

The program is focused on discovering high-grade prismatic-style

deposits. One drill was active in March and tested three

high-potential target areas. Results are pending. Additional

targets are ready for drilling, and new targets are continually

being developed. The plan is to diligently test these exploration

targets this summer.

Induced polarization and magnetic surveys are

best suited for geophysical targeting of these types of deposits.

Surveys over in situ prismatic-style deposits were used for

calibration purposes for these geophysical methods. Targets are

generated by using a combination of airborne gravity gradiometry

data, LiDAR, AeroTEM survey, structural lineament interpretation,

and trend analysis. The search has been expanded to adjacent

carbonate formations that the Company believes are fertile for

discovery.

Notes Regarding This Mineral Resource

Estimate

Mineral Resource Estimate

- The

independent qualified person for the 2024 MRE, as defined by

National Instrument (“NI”) 43-101 guidelines, is Pierre-Luc

Richard, P.Geo., of PLR Resources Inc and subcontracted by BBA Inc.

The effective date of the 2024 MRE is May 31, 2024. Mr. Richard has

also approved the technical contents of this press release.

- These

mineral resources are not mineral reserves as they have not

demonstrated economic viability. The quantity and grade of reported

Inferred Resources in this MRE are uncertain in nature, and there

has been insufficient exploration to define these Inferred

Resources as Indicated or Measured. However, it is reasonably

expected that the majority of Inferred Mineral Resources could be

upgraded to Indicated Mineral Resources with continued

exploration.

-

Resources are presented as undiluted and in situ for an open-pit

and underground scenario and are considered to have reasonable

prospects for economic extraction.

- The 2024

MRE was prepared using Leapfrog Edge v.2023.2.1 and is based on

20,682 surface drill holes and 181,313 samples, of which 17,428

drill holes and a total of 92,652 assays were included in the

modelled mineralization. The drill hole database includes recent

drilling of 148,026 metres in 2,258 drill holes since 2017 and also

incorporates Cominco Ltd.’s historical drill holes, the use of

which was partially validated by a drill hole collar survey,

twinning programs and a partial core resampling program. The

cut-off date for the drill hole database was April 30, 2024.

- The 2024

MRE encompasses 103 zinc-lead-bearing zones, each defined by a

series of individual wireframes with a minimum true thickness of

2.5 metres.

-

High-grade capping was done on the composited assay data and

established on a per-zone basis for zinc and lead. Capping grades

vary from 15% to 45% Zn and 5% to 40% Pb.

- Density

values were calculated based on the formula established and used by

Cominco Ltd. during their operational period between 1964 and 1987.

Density values were calculated from the density of dolomite,

adjusted by the amount of sphalerite, galena, and marcasite/pyrite

as determined by metal assays. A porosity of 5% was assumed. Waste

material was assigned the density of porous dolomite.

- Grade

model resource estimation was calculated from drill hole data using

an Ordinary Kriging interpolation method in a sub-blocked block

model using blocks measuring 5 m x 5 m x 2.5 m in size and

sub-blocks down to 1.25 metres x 1.25 metres x 0.625 metres.

- Zinc

equivalency percentages are calculated using long-term metal prices

indicated below in (10), forecasted metal recoveries, concentrate

grades, transport costs, smelter payable metals and charges.

- The

estimate is reported using a ZnEq cut-off varying from 1.41% to

1.51% for open-pit resources and 4.10% to 4.40% for underground

resources. Variations consider trucking distances from the

pit-constrained mineralization to the mill and metallurgical

parameters for each area. The cut-off grade was calculated using

the following parameters (amongst others): zinc price = USD1.30/lb;

lead price = USD1.00/lb; CAD:USD exchange rate = 1.30. The cut-off

grade will be re-evaluated considering future prevailing market

conditions and costs.

- The

Inferred Mineral Resource category is constrained to areas where

drill spacing is less than 100 metres, and where reasonable

geological and grade continuity is shown. The Indicated Mineral

Resource category is constrained to areas where modern drilling has

been completed, where drill spacing is less than 30 metres, and

where reasonable geological and grade continuity is shown. When

needed, a series of clipping boundaries were created manually in

plan views to either upgrade or downgrade classification. The

maximum drill spacing judged acceptable when creating these

clipping boundaries was 50m for the indicated category.

- The pit

optimization used to develop the Mineral Resource-constraining pit

shells was done using Geovia Whittle 2022. The constraining pit

shells were developed using overall pit slopes per area and by

individual pits based on a preliminary geotechnical report. The

rock slopes range from 38° to 52° with an average of 49°, and the

overburden slopes range from 33° to 45° with an average of

38°.

-

Calculations used metric units (metre, tonne). Metal contents are

presented in percentages or pounds. Metric tonnages were rounded,

and any discrepancies in total amounts are due to rounding

errors.

- CIM

definitions and guidelines for Mineral Resource Estimates have been

followed.

- The QP

is unaware of any known environmental, permitting, legal,

title-related, taxation, socio-political or marketing issues or any

other relevant issues that could materially affect this MRE.

Other Inputs to the 2024

MRE

- The

independent qualified person providing the pit shells, and cut-off

grades for the 2024 MRE is Alexandre Dorval, ing., of G Mining

Services. Mr. Dorval has approved the technical contents of this

press release.

- The

independent qualified person providing the underground mining

shapes and cut-off grades for the 2024 MRE is Carl Michaud, ing.,

of G Mining Services. Mr. Michaud has approved the technical

contents of this press release.

- The

independent qualified person providing the metallurgical components

relating to the 2024 MRE is Colin Hardie, P. Eng., of BBA Inc. Mr.

Hardie has approved the technical contents of this press

release.

About Osisko Metals

Osisko Metals Incorporated is a Canadian

exploration and development company creating value in the critical

metals space, more specifically copper and zinc. The Company is in

a joint venture with Appian Capital Advisory LLP for the

advancement of one of Canada's premier past-producing zinc mining

camps, the Pine Point Project, located in the Northwest

Territories, for which current mineral resources have been

calculated for the 2024 MRE (as defined herein). The Project is

held under the joint venture company Pine Point Mining Limited. The

current mineral resource estimate consists of 49.5Mt

grading 5.52% ZnEq of Indicated Mineral Resources and 8.3Mt grading

5.64% ZnEq of Inferred Mineral Resources (in accordance

with National Instrument 43-101 – Standards of Disclosure for

Mineral Projects). A technical report will follow

this press release within 45 days. The Pine Point Project is

located on the south shore of Great Slave Lake in the Northwest

Territories, near infrastructure, with paved highway access, an

electrical substation, and 100 kilometres of viable haulage

roads.

In addition, and outside of the Pine Point JV,

the Company acquired in July 2023, from Glencore Canada

Corporation, a 100% interest in the past-producing Gaspé Copper

Mine, located near Murdochville in the Gaspé peninsula of Québec.

The Company is currently focused on resource evaluation of the

Copper Mountain Expansion Project that hosts a current mineral

resource consisting of an Indicated Mineral Resource

of 495Mt grading 0.37% CuEq and

an Inferred Mineral Resource of 6.3Mt grading 0.37% CuEq

(in accordance with National Instrument 43-101 – Standards of

Disclosure for Mineral Projects); see May 6, 2024 news release of

Osisko Metals entitled “Osisko Metals announces updated mineral

resource estimate at Gaspé Copper – indicated resource of 495 mt

grading 0.37% copper equivalent". Gaspé Copper hosts the largest

undeveloped copper resource in Eastern North America, strategically

located near existing infrastructure in the mining-friendly

province of Québec.

About Appian Capital Advisory

Appian Capital Advisory LLP is a

London-headquartered investment advisor to long-term value-focused

private capital funds that invest solely in mining and

mining-related companies.

Appian is a leading investment advisor in the

metals and mining industry, with global experience across South

America, North America, Europe, Australia and Africa and a

successful track record of supporting companies to achieve their

development targets, with a global operating portfolio overseeing

nearly 6,300 employees. Appian has a global team of 65 experienced

professionals with presences in London, Toronto, Vancouver,

Montreal, New York, Lima, Belo Horizonte, Perth, Mexico City and

Dubai. The Appian team, through its private capital funds, has a

long history of successfully bringing mines through development and

into production, having completed 9 mine builds in the last 6

years.

For more information, please visit

www.appiancapitaladvisory.com.

For further information on this news release,

visit

www.osiskometals.com or

contact:

Robert Wares, Chairman & CEO of Osisko

Metals IncorporatedEmail: IR@osiskometals.com Phone:

514-861-4441

Cautionary Note Regarding

Forward-Looking Information

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation based on expectations, estimates and projections as at

the date of this news release. Any statement that involves

predictions, expectations, interpretations, beliefs, plans,

projections, objectives, assumptions, future events or performance

are not statements of historical fact and constitute

forward-looking information. This news release may contain

forward-looking information pertaining to the Pine Point and Gaspé

Copper Projects, including, among other things, the results of the

2022 PEA on Pine Point and the IRR, NPV and estimated costs,

production, production rate and mine life; the ability to identify

additional resources and reserves (if any) and exploit such

resources and reserves on an economic basis; the expected high

quality of the metal concentrates; the potential economic impact of

the projects on local communities, including but not limited to the

potential generation of tax revenues and contribution of jobs; the

timing and ability for Projects to reach construction decision (if

at all); the estimated costs to take the Projects to construction

decision (if at all) and the impact to the Company of the

disposition of ownership interest and control in the Pine Point

Project, which is a material property of the Company; Gaspé Copper

hosting the largest undeveloped copper resource in Eastern North

America and Glencore becoming a Control Person of the Company.

Forward-looking information is not a guarantee

of future performance and is based upon a number of estimates and

assumptions of management, in light of management’s experience and

perception of trends, current conditions and expected developments,

as well as other factors that management believes to be relevant

and reasonable in the circumstances, including, without limitation,

assumptions about: favourable equity and debt capital markets; the

ability and timing for the Pine Point joint-venture parties to fund

cash calls to advance the development of the Pine Point Project and

pursue planned exploration and development; future spot prices of

copper, zinc, lead and molybdenum; the timing and results of

exploration and drilling programs; the accuracy of mineral resource

estimates; production costs; political and regulatory stability;

the receipt of governmental and third party approvals; licenses and

permits being received on favourable terms; sustained labour

stability; stability in financial and capital markets; availability

of mining equipment and positive relations with local communities

and groups. Forward-looking information involves risks,

uncertainties and other factors that could cause actual events,

results, performance, prospects and opportunities to differ

materially from those expressed or implied by such forward-looking

information. Factors that could cause actual results to differ

materially from such forward-looking information are set out in the

Company’s public disclosure record on SEDAR (www.sedar.com) under

Osisko Metals’ issuer profile. Although the Company believes that

the assumptions and factors used in preparing the forward-looking

information in this news release are reasonable, undue reliance

should not be placed on such information, which only applies as of

the date of this news release, and no assurance can be given that

such events will occur in the disclosed time frames or at all. The

Company disclaims any intention or obligation to update or revise

any forward- looking information, whether as a result of new

information, future events or otherwise, other than as required by

law.

Neither the Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

Exchange) accepts responsibility for the adequacy or accuracy of

this news release. No stock exchange, securities commission or

other regulatory authority has approved or disapproved the

information contained herein.

Map 1: Pine Point Project

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/5baec6c5-cf0b-4929-ae56-d25c5b53c0cd

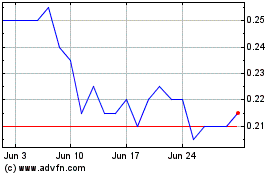

Osisko Metals (TSXV:OM)

Historical Stock Chart

From Feb 2025 to Mar 2025

Osisko Metals (TSXV:OM)

Historical Stock Chart

From Mar 2024 to Mar 2025