Mason Graphite Closes $4.15 Million Additional Financing

June 13 2014 - 9:57PM

Marketwired Canada

NOT FOR DISTRIBUTION TO THE UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION

IN THE UNITED STATES.

Mason Graphite Inc. ("Mason Graphite" or the "Company") (TSX

VENTURE:LLG)(OTCQX:MGPHF) is pleased to announce that it has closed the

additional financing previously announced on April 28, 2014.

The Company completed an additional private placement financing through

convertible debentures (the "Debentures") for aggregate gross proceeds of

$4,150,000 with three renowned Quebec-based institutions: Sodemex Developpement,

s.e.c. ($3,000,000), a subsidiary of the Caisse de depot et placement du Quebec,

the Fonds de solidarite FTQ ($950,000) and the Fonds regional de solidarite FTQ

Cote-Nord ($200,000). The Company can trigger the conversion of the Debentures

and anticipate the redemption under certain conditions.

In connection with the Debenture offering, the Company also issued, on a

proportionate basis, an aggregate of 2,075,000 common share purchase warrants

(the "Warrants"), each of which entitles the holder to purchase one common share

of the Company ("Common Shares") at a price of $0.91 for a period of 24 months

following the closing of the transaction.

The net proceeds of this financing will be used to fund the continued

development of the Lac Gueret project and for general corporate purposes.

The Debentures provide, among other things, that:

-- The Debentures are set to mature on June 11, 2019 and bear interest at a

fixed annual rate of 12%.

-- The Debenture holders are entitled to convert the principal amount of

the Debentures into Common Shares at a conversion price of $0.845 per

Common Share and all accrued and unpaid interest thereunder (subject to

the prior approval of the TSX Venture Exchange) at a conversion price to

be determined by the market price of the Common Shares at the time of

settlement.

-- In the event that the Company, before the repayment of principal amount

of the Debentures, proceeds with the issuance of Common Shares or other

convertible securities at a price that is less than $0.65 per security

(the "Subsequent Financing"), the conversion price of the Debentures

will be the price per security in the Subsequent Financing, plus a 30%

premium, provided that such conversion price shall in no case be lower

than $0.63.

-- If the Company completes a construction project financing for the Lac

Gueret project and if the Company issues Common Shares under such

financing at a price per Common Share that is greater than $1.00 (the

"Construction Financing Price"), the Company shall have the right to

force the full conversion of Debentures at the conversion price equal to

the Construction Financing Price less a 10% discount.

-- The Debentures, the Warrants and any Common Shares issued on exercise

thereof are subject to a four month and one day hold period.

In connection with the closing of the Debenture offering, the Company and Forbes

& Manhattan Inc. ("F&M") agreed that effective June 1, 2014 the amended and

restated independent contractor agreement between F&M and the Company dated

October 1, 2012 is terminated. In addition, the Company and F&M agreed to amend

certain terms of the amended and restated transfer of rights and obligations

agreement dated October 1, 2012 (the "Assignment Agreement") between F&M and the

Company. The amendments include removing the exclusivity of F&M's engagement

under the Assignment Agreement to source and identify potential off-take

partners and limiting the fees payable to F&M in connection with a successful

transaction.

This news release does not constitute an offer to sell or a solicitation of an

offer to buy any of the securities in the United States. The securities have not

been and will not be registered under the United States Securities Act of 1933,

as amended (the "1933 Act"), or any state securities laws and may not be offered

or sold within the United States or to, or for the account or benefit of U.S.

persons (as defined in Regulation S under the 1933 Act) absent such registration

or an applicable exemption from such registration requirements.

About Mason Graphite

Mason Graphite is a Canadian mining company focused on the exploration and

development of its 100% owned Lac Gueret graphite property, located in

northeastern Quebec. The property hosts a National Instrument 43-101 compliant

Mineral Resource featuring 50,024,000 tonnes grading 15.6% Cg, including

6,672,000 tonnes grading 32.4% Cg, in the Measured and Indicated categories and

11,861,000 tonnes grading 17.1% Cg, including 2,637,000 tonnes grading 30.5% Cg,

in the Inferred category (see press release dated December 5, 2013). Excellent

potential exists for further mineral growth. A Preliminary Economic Assessment

study was completed on a 7.6Mt mineral resource estimate from July 2012 which

features 22 years of production at 27.4% Cg and a pre-tax internal rate of

return of 33.7% (see technical report entitled "Technical Report on the Mineral

Resources Estimation Update 2013, Lac Gueret Graphite Project, Quebec, Canada"

issued on January 17, 2014). The Company's senior management team possesses

significant graphite expertise from their experience at Timcal/Imerys, including

Benoit Gascon, CPA, CA, who held executive positions for 20 years, including

over 6 years as President and CEO; Jean L'Heureux, Eng., Executive

Vice-President, Process Development, with over 20 years of experience; and Luc

Veilleux, CPA, CA, Chief Financial Officer and Executive Vice-President, with 8

years of experience. Timcal, now owned by Imerys, is one of the largest graphite

producers in the world.

Qualified Person

Jean L'Heureux, Eng., Mason Graphite's Executive Vice-President of Process

Development and a Qualified Person as defined by National Instrument 43-101, has

reviewed and approved the scientific and technical content of this press

release.

Stay Connected: Twitter: @MasonGraphite Facebook: /MasonGraphite

For more information about Mason Graphite, visit www.masongraphite.com.

Cautionary Statements

This press release contains "forward-looking information" within the meaning of

Canadian securities legislation. All information contained herein that is not

clearly historical in nature may constitute forward-looking information.

Generally, such forward-looking information can be identified by the use of

forward-looking terminology such as "plans", "expects" or "does not expect", "is

expected", "budget", "scheduled", "estimates", "forecasts", "intends",

"anticipates" or "does not anticipate", or "believes", or variations of such

words and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward-looking information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of activity,

performance or achievements of the Company to be materially different from those

expressed or implied by such forward-looking information, including but not

limited to: (i) volatile stock price; (ii) the general global markets and

economic conditions; (iii) the possibility of write-downs and impairments; (iv)

the risk associated with exploration, development and operations of mineral

deposits; (v) the risk associated with establishing title to mineral properties

and assets; (vi) the risks associated with entering into joint ventures; (vii)

fluctuations in commodity prices; (viii) the risks associated with uninsurable

risks arising during the course of exploration, development and production; (ix)

competition faced by the resulting issuer in securing experienced personnel and

financing; (x) access to adequate infrastructure to support mining, processing,

development and exploration activities; (xi) the risks associated with changes

in the mining regulatory regime governing the resulting issuer; (xii) the risks

associated with the various environmental regulations the resulting issuer is

subject to; (xiii) risks related to regulatory and permitting delays; (xiv)

risks related to potential conflicts of interest; (xv) the reliance on key

personnel; (xvi) liquidity risks; (xvii) the risk of potential dilution through

the issue of common shares; (xviii) the Company does not anticipate declaring

dividends in the near term; (xix) the risk of litigation; and (xx) risk

management.

Forward-looking information is based on assumptions management believes to be

reasonable at the time such statements are made, including but not limited to,

continued exploration activities, no material adverse change in metal prices,

exploration and development plans proceeding in accordance with plans and such

plans achieving their stated expected outcomes, receipt of required regulatory

approvals, and such other assumptions and factors as set out herein. Although

the Company has attempted to identify important factors that could cause actual

results to differ materially from those contained in the forward-looking

information, there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that such

forward-looking information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in such

forward-looking information. Such forward-looking information has been provided

for the purpose of assisting investors in understanding the Company's business,

operations and exploration plans and may not be appropriate for other purposes.

Accordingly, readers should not place undue reliance on forward-looking

information. Forward-looking information is made as of the date of this press

release, and the Company does not undertake to update such forward-looking

information except in accordance with applicable securities laws.

Mineral resources that are not mineral reserves do not have demonstrated

economic viability. The estimate of mineral resources may be materially affected

by environmental, permitting, legal, title, taxation, sociopolitical, marketing,

or other relevant issues.

The quantity and grade of reported inferred mineral resources in this news

release are uncertain in nature and there has been insufficient exploration to

define these inferred mineral resources as indicated or measured mineral

resources and it is uncertain if further exploration will result in upgrading

them to indicated or measured mineral resources.

The PEA is preliminary in nature and includes Inferred Mineral Resources, which

are considered too geologically speculative to have mining and economic

considerations applied to them that would enable them to be categorized as

mineral reserves. Mineral resources that are not mineral reserves do not have

demonstrated economic viability. There is no certainty that the reserves

development, production, and economic forecasts on which the PEA is based will

be realized.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Investor Relations

info@masongraphite.com

Simon Marcotte

Vice-President Corporate Development

+1 (416) 861-5822

Benoit Gascon, President & CEO

Head Office (Greater Montreal)

3030 Le Carrefour blvd. Suite 600

Laval QC H7T 2P5

Toronto Office

65 Queen Street West, Suite 800

Toronto, ON M5H 2M5

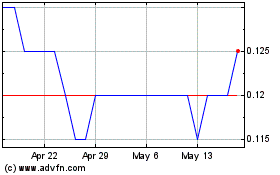

Mason Resources (TSXV:LLG)

Historical Stock Chart

From Jun 2024 to Jul 2024

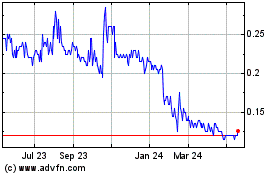

Mason Resources (TSXV:LLG)

Historical Stock Chart

From Jul 2023 to Jul 2024