Halmont Properties Corporation First Quarter Results

May 28 2024 - 6:01PM

HALMONT PROPERTIES CORPORATION (TSX-V: HMT)

(“Halmont” or the “Company”) announced today that net income to

shareholders for the three months ended March 31, 2024, was

$4,114,000 as compared to net income of $2,333,000 for the three

months ended March 31, 2023.

|

(thousands, except per share amount) |

Three months ended |

|

|

March 31, 2024 |

|

March 31, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

8,770 |

|

|

|

$ |

3,807 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income - total |

|

4,114 |

|

|

|

|

2,333 |

|

|

|

|

- for common shareholders |

|

3,788 |

|

|

|

|

2,043 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share for common shareholders |

|

2.75 |

|

¢ |

|

|

1.57 |

|

¢ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In response to the deterioration in lease rates

for heritage office buildings, proactive measures were taken in

recent years to adapt to the evolving market realities. On February

21, 2024, we completed the sale of our remaining heritage office

building. The proceeds from this sale, together with the funds

previously received from the earlier sale of three other buildings,

are expected to be reinvested in institutionally occupied buildings

and forest properties.

In April 2024, we completed the purchase of a

50% equity interest in 25 Dockside Drive, Toronto, ON in

partnership with George Brown College. Situated adjacent to the

College’s two other premier waterfront buildings, this acquisition

effectively doubled the size of its waterfront campus.

The fully diluted book value of Halmont’s common

shares, assuming the conversion of its capital notes and

convertible preferred shares, increased to 82¢ per common share

compared to 72¢ in March 2023.

Halmont Properties Corporation invests directly

in real assets including commercial, forest, and residential

properties.

This news release includes certain

forward-looking statements including management’s assessment of the

Company’s future plans and operations based on current views and

expectations. All statements other than statements of historic

facts are forward-looking statements. These statements contain

substantial known and unknown risks and uncertainties, some of

which are beyond the Company’s control. The Company’s actual

results, performance or achievement could differ materially from

those expressed in, or implied by, these forward-looking

statements. Readers should not place undue reliance on these

forward-looking statements which represent estimates and

assumptions only as of the date on which such statements are made.

The Company undertakes no obligation to publicly revise or update

any forward-looking statements, whether as a result of new

information, future events or otherwise.

For additional information:Heather M.

FitzpatrickPresidentT: 647-448-7147

Halmont Properties (TSXV:HMT)

Historical Stock Chart

From Feb 2025 to Mar 2025

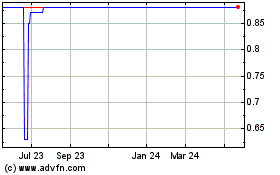

Halmont Properties (TSXV:HMT)

Historical Stock Chart

From Mar 2024 to Mar 2025