Firm Capital Apartment REIT Provides Strategic Review Update, Improved Q3/2024 Results and Senior Management Change

November 06 2024 - 5:01PM

Firm Capital Apartment Real Estate Investment Trust (“the

“

Trust”), (TSXV: FCA.U), (TSXV: FCA.UN) is pleased

to report its financial results for the three and nine months ended

September 30, 2024, provide a Strategic Review update and senior

management change:

STRATEGIC REVIEW

UPDATE Given the progress the Trust has made on

dispositions and debt repayment to date, the Trust is in a positive

cash flow position and is expected to continue to be so based on

senior management’s forecasts. Since the commencement of the

Strategic Review, the Trust has: (i) disposed of $71.6 million of

wholly owned real estate; (ii) $60.7 million of debt repayment;

(iii) completed the sale of one of its joint venture properties for

$15.9 million (100% of the property); and (iv) redeemed $1.7

million of the preferred investment in Hartford, Connecticut with a

first mortgage refinancing. As a result, the leverage profile has

declined to its current level of 36.2% from 59.3% at December 31,

2023.

Furthermore, the board continues to work to

dispose of its remaining Wholly Owned Assets and evaluate uses for

the Trust. Senior management has had multiple discussions with a

number of third parties as to the best path forward for the entity.

Senior management and the board will report back to unitholders in

due course.

The Board will continue to assess matters on a

quarterly basis and determine if the Trust should: (i) distribute

excess income; (ii) distribute net proceeds from asset sales, after

debt repayment; (iii) reinvest net proceeds into other investments;

(iv) distribute proceeds as a return of capital or special

distribution; and/or (v) use excess proceeds to repurchase Trust

units in the marketplace. It is the Trust’s current intention not

to disclose developments with respect to the Strategic Review

unless and until it is determined that disclosure is necessary or

appropriate, or as required under applicable securities laws

NET ASSET VALUE (“NAV”) INCREASED BY

$0.11 TO $6.59 PER TRUST UNIT (CAD $8.90): Including

disposition costs of assets held for sale, the Trust reported an

improved NAV of $6.59 per Trust Unit (CAD $8.90), up from the $6.48

per Trust Unit (CAD$8.87) reported on June 30, 2024.

EARNINGS

- For the three months ended

September 30, 2024, net income was approximately $0.8 million, in

comparison to the $2.8 million net loss reported for the three

months ended June 30, 2024, and the $1.5 million net loss reported

for the three months ended September 30, 2023;

- Excluding non-cash fair value

adjustments, net income was $0.1 million for the three months ended

September 30, 2024, in comparison to the $0.4 million net loss

reported for the three months ended June 30, 2024, and the $0.4

million net loss reported for the three months ended September 30,

2023;

- For the three months ended

September 30, 2024, AFFO was $0.2 million, in comparison to the

negative $0.4 million reported for the three months ended June 30,

2024, and the negative $0.3 million reported for the three months

ended September 30, 2023; and

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

Sep 30, 2024 |

Jun 30, 2024 |

Sep 30, 2023 |

|

Sep 30, 2024 |

Sep 30, 2023 |

|

Net Income (Loss) |

$ |

807,897 |

$ |

(2,809,976) |

$ |

(1,483,852) |

|

$ |

(3,300,929) |

$ |

(8,240,393) |

|

Net Income (Loss) Before Fair Value

Adjustments |

$ |

142,916 |

$ |

(373,700) |

$ |

(418,741) |

|

$ |

(288,720) |

$ |

(479,587) |

|

FFO |

$ |

252,335 |

$ |

(702,340) |

$ |

(662,938) |

|

$ |

(1,263,636) |

$ |

(1,312,319) |

|

AFFO |

$ |

158,924 |

$ |

(354,384) |

$ |

(348,782) |

|

$ |

(237,628) |

$ |

(361,013) |

| |

|

|

|

|

|

|

STRATEGIC REVIEW PROGRESS

- $71.6 MILLION OF WHOLLY

OWNED ASSET DISPOSITIONS AND $60.7 MILLION OF DEBT

REPAYMENT: The Trust has sold four of six wholly owned

assets for gross proceeds of approximately $71.6 million. Net of

associated mortgage debt and closing costs, the net sale proceeds

of approximately $28 million were used to redeem additional debt

including, but not limited to the: (i) $13.8 million (CAD $18.8

million), 6.25% convertible unsecured subordinated debentures due

June 30, 2026 (the “Convertible Debentures”); (ii)

$5.1 million (CAD$6.9 million) Bridge Loan; (iii) $1.0 million

Credit Facility with a Canadian Chartered Bank; and (iv) $3.0

million partial repayment of one of the mortgages secured by a

property located in Houston, Texas, resulting in the interest rate

on this mortgage being reduced to 8.25% per annum from 9% per annum

and the term extended to February 4, 2026. In addition, as part of

the transaction to sell the Trust’s only property located in

Florida property, the Trust agreed to provide seller financing of

$4.0 million that generates a minimum 9% return for unitholders.

The Trust has two remaining wholly owned assets located in Houston,

Texas comprised of 485 apartment units that are actively being

marketed.

- JOINT VENTURE ASSET

DISPOSITIONS AND INVESTMENT UPDATES: On January 31, 2024,

the Trust completed the sale of one of its joint venture properties

located in Maryland for $15.9 million (100% of the property). Net

of associated mortgage debt and closing costs, the net sale

proceeds were approximately $4.1 million, of which the Trust

received approximately $1.1 million given its 25% ownership in the

property.On October 1, 2024, one of the Trust’s joint venture

investments located in Hartford, Connecticut refinanced its

existing first mortgage in excess of the original principal

balance, resulting in net proceeds of $2.2 million available to the

joint venture. From the net proceeds, the joint venture repaid the

preferred investment owing to the Trust of $1.7 million and made a

partial return of common equity of approximately $0.1 million to

the Trust.The Trust continues to work with the remaining various

Joint Venture sponsors in either various sale processes or to hold

for longer periods of time until unitholder value is realized.

- PREFERRED CAPITAL

INVESTMENTS: As at September 30, 2024, the Trust had three

Preferred Capital Investments located in Texas, South Dakota and

Florida that aggregate approximately $9.1 million, gross principal

balance. The Trust continues to hold these investments and earns

income of 10% on the Texas portfolio, 12% on the South Dakota

portfolio, and 9% on the Florida portfolio. All preferred capital

investments are current in terms of their interest payments.

SENIOR MANAGEMENT CHANGE

Effective November 15, 2024, Claudia Alvarenga is resigning as

Chief Financial Officer of the Trust to pursue other opportunities

outside of real estate and the public markets. The Trust appointed

Mordechai Roth as interim Chief Financial Officer.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS:

Certain information in this news release

constitutes forward-looking statements under applicable securities

law. Any statements that are contained in this news release that

are not statements of historical fact may be deemed to be

forward-looking statements. Forward-looking statements are often

identified by terms such as "may", "should", "anticipate",

"expect", "intend" and similar expressions.

Forward-looking statements necessarily involve

known and unknown risks, including, without limitation, risks

associated with general economic conditions; adverse factors

affecting the U.S. real estate market generally or those specific

markets in which the Trust holds properties; volatility of real

estate prices; inability to access sufficient capital from internal

and external sources, the completion of the Strategic Review;

and/or inability to access sufficient capital on favourable terms;

industry and government regulation; changes in legislation, income

tax and regulatory matters; the ability of the Trust to implement

its business strategies; competition; currency and interest rate

fluctuations and other risks. Additional risk factors that may

impact the Trust or cause actual results and performance to differ

from the forward looking statements contained herein are set forth

in the Trust's Annual Information form under the heading Risk

Factors (a copy of which can be obtained under the Trust's profile

on www.sedar.com).

Readers are cautioned that the foregoing list is

not exhaustive. Readers are further cautioned not to place undue

reliance on forward-looking statements as there can be no assurance

that the plans, intentions or expectations upon which they are

placed will occur. Such information, although considered reasonable

by management at the time of preparation, may prove to be incorrect

and actual results may differ materially from those anticipated.

Forward-looking statements contained in this news release are

expressly qualified by this cautionary statement. Except as

required by applicable law, the Trust undertakes no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events or otherwise.

Certain financial information presented in this

press release reflect certain non-International Financial Reporting

Standards (“IFRS”) financial measures, which

include, but not limited to NOI, FFO and AFFO. These measures are

commonly used by real estate investment companies as useful metrics

for measuring performance, however, they do not have standardized

meaning prescribed by IFRS and are not necessarily comparable to

similar measures presented by other real estate investment

companies. These terms are defined in the Trust’s Management

Discussion and Analysis for the three and nine months ended

September 30, 2024, filed on www.sedar.com.

Neither the Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

|

For further information, please contact:Sandy PoklarPresident &

Chief Executive Officer(416) 635-0221 |

Claudia AlvarengaChief Financial Officer(416) 635-0221 |

|

|

|

|

For Investor Relations information, please contact:Victoria

MoayediDirector, Investor Relations(416) 635-0221 |

|

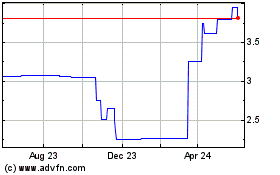

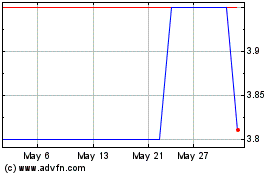

Firm Capital Apartment R... (TSXV:FCA.U)

Historical Stock Chart

From Jan 2025 to Feb 2025

Firm Capital Apartment R... (TSXV:FCA.U)

Historical Stock Chart

From Feb 2024 to Feb 2025