DAMARA GOLD CORP. (TSX-V:DMR)

(“

Damara” or the “

Company”) and

Colorado Resources Ltd (“Colorado”) (TSX-V:CXO)

are pleased to announce that they have entered into a letter

agreement (the “

Agreement”) whereby Damara can

acquire a 100% interest (subject to its Back-in Right (as defined

below)) (the “

Transaction”) in Colorado’s

Kinaskan-Castle project (the “

K-C Property”)

located in the Liard Mining Division within the “Golden Triangle

Area” of northwestern British Columbia. Completion of the

Transaction is subject to the receipt of all required approvals,

including the approval of Damara’s shareholders and the approval of

the Exchange (as defined below).

The PropertyThe K-C Property is

comprised of 49 mineral claims (17,839ha) and is located

approximately 195 km north of the town of Stewart and 75 km south

of Dease Lake. The Golden Triangle area is a district which hosts

several significant gold-copper mines1 including Imperial Metals

Red Chris1 and mine development and mineral occurrences including

GJ1, Quash1, Hank1, GT Gold1 and Spectrum1.

Historical2 ExplorationPrevious work at the K-C

Property focused on the western side of the property and included

the completion of 21 diamond drillholes (4,805m) between 1988 and

2013. The mineralization at the K-C Property is associated with an

east-west striking structural and intrusive corridor that is

spatially related to a 150m x 1500m long copper and gold soil

anomaly, a coincident magnetic anomaly and IP chargeability

high.

Gold – copper mineralization noted to date

includes both broad porphyry style and higher grade vein styles as

illustrated by two intercepts in historic2 holes:

- DDH CA 13-01 with 274 m of 0.102% Cu and 0.283 g/t Au

- DDH CA 13-03 with 4 m of 2.14% Cu, 4.88 g/t Au, and 73.2 g/t Ag

contained within a 174 m interval of 0.106% Cu and 0.466 g/t

Au3

The historic data2 suggest that the gold-copper

mineralization on the K-C Property is open to the east and it

occurs in an alteration zone that has been traced over a distance

of 4.4 km to the eastern property boundary. This area has seen the

lowest density of historical drill testing.

Recent ExplorationColorado recently initiated a

preliminary exploration program which included the collection of

859 soil and 201 rock samples, 10 km2 of geological mapping, an

11-line km I.P. survey and a 150-line km airborne magnetic survey.

Damara, as part of the consideration, will bear the cost of this

initial program.

Transaction and Concurrent Financing

Rationale

- The Transaction and will provide Damara the opportunity to

become an active explorer in the Golden Triangle;

- The Concurrent Financing will broaden Damara’s shareholder

investor base and fund the exploration programs and provide working

capital for the next 12 months;

- The Transaction will allow for the combined exploration

expertise of Colorado’s and Damara’s board and management to

advance the K-C Property;

- Increased market capitalization along with the improved capital

markets are expected to boost Damara’s trading activity and

liquidity.

William Yeomans, Director of Damara, stated:

“The collaboration of Damara and Colorado is a unique opportunity

for Damara shareholders as it positions the Company favorably to

advance the K-C Property and become an explorer in the prolific

Golden Triangle Area.”

Lawrence Nagy, Chairman of Colorado, stated:

“The Transaction will give Colorado, which currently holds a 15.7%

interest in Damara, the opportunity to focus its attention on its

core assets - KSP and North ROK - while providing an opportunity to

share in any future success at the K-C Property.”

Transaction

OverviewConsideration for the Transaction includes an

aggregate $250,000 in cash payments and the issuance of 10,250,000

common shares in the capital of Damara (the “Consideration

Shares”) to Colorado, and $8,000,000 in exploration

expenditures (which includes $300,000 reimbursement of the initial

program within 5 business days of receipt of the approval of the

TSX Venture Exchange (the “Exchange”) for the

Transaction) over a three year period. Colorado will have the

exclusive right, within 45 days from the option exercise date, to

elect to exercise its back-in right (the “Back-in

Right”) wherein Colorado can acquire a 51% interest upon

incurring $8,000,000 in exploration expenditures over a two year

period with a minimum $2,000,000 in year one. In the event the

Back-in Right is exercised and the terms thereof fulfilled, the

parties have agreed to form a joint venture in which Damara will

hold a 49% interest and Colorado will hold a 51% interest. In the

event the Back-in Right is not exercised Colorado will be granted a

1% net smelter return royalty.

The Transaction is a non-arm’s length

transaction pursuant to Multilateral Instrument 61-101 – Protection

of Minority Security Holders in Special Transactions (“MI

61-101”).

In accordance with Exchange policies, the

Company will seek minority shareholder approval of the Transaction,

including the issuance of the Consideration Shares. Further

information regarding the Transaction will be contained in a

management information circular that Damara will prepare and file

in due course in connection with an annual general and special

meeting of Damara shareholders, which is expected to be held on

December 29, 2017. Closing of the Transaction is expected to occur

shortly thereafter.

Damara’s independent directors have determined

that the proposed Transaction is fair and in the best interests of

the Company and will recommend that disinterested shareholders vote

in favour of resolutions supporting the Transaction. The Board will

seek to engage a financial adviser to provide the required

valuation of MI 61-101, subject to limitations and assumptions

contained therein, and confirm that the aggregate consideration as

described in the Agreement to be paid by Damara in connection with

the Transaction is fair, from a financial point of view, to

Damara’s shareholders.

For Colorado, the Transaction would qualify as

an Exempt Transaction pursuant to the policies of the Exchange

except for the fact that the Transaction involves Non-Arm’s Length

Parties and therefor is subject to Exchange approval. Colorado is

exempt from the valuation and minority shareholder approval

requirements of MI 61-101 as the Transaction.

Concurrent FinancingThe Company

also announces it is arranging a concurrent financing (the

“Concurrent Financing”) wherein it intends to issue units (each a

“Unit”) at a price of $0.15 per Unit and

flow-through common shares (“FTS”) at a price of

$0.20 per FTS. Each Unit will consist of one common share (issued

on a non-flow-though basis) and one-half of one share purchase

warrant (each whole warrant a “Warrant”). Each

Warrant will entitle the holder to purchase an additional common

share at $0.30 per share for a period of 24 months. Completion of

the minimum Concurrent Financing is a condition of the

Transaction.

Qualified PersonWilliam

Yeomans, P. Geo., a director of the Company is the Qualified Person

as defined by National Instrument 43-101 - Standards of Disclosure

for Mineral Projects (“NI 43-101”) who reviewed the preparation of

the technical data in this news release for each of Damara and

Colorado.

About DamaraDamara Gold Corp.

is a TSX Venture listed Canadian public company with a Board of

Directors seasoned in the mineral exploration industry and with a

record of mineral deposit discovery worldwide.

| |

|

|

| ON BEHALF OF

THE BOARD OF DIRECTORS OF DAMARA“William

Yeomans”William Yeomans, Director |

|

ON BEHALF OF

THE BOARD OF DIRECTORSOF

COLORADO“Lawrence Nagy”Lawrence Nagy, Chairman of the

Board |

| |

|

|

| For additional

information visit Damara’s website at www.damaragoldcorp.com

or contact: |

|

For additional

information visit Colorado Resources' websiteat

www.coloradoresources.com or contact: |

| |

|

|

| Damara Gold

Corp.William YeomansPh: (250-768-1168) |

|

Colorado Resources Ltd.Lawrence

Nagy(250)-768-1511 |

NR: 17-07

Cautionary Notes1 This news

release contains information about adjacent properties on which

neither Damara nor Colorado has a right to explore or mine. Readers

are cautioned that mineral deposits on adjacent properties are not

indicative of mineral deposits on the Company’s or Colorado’s

properties.2 Historical information contained in this news

release, maps or figures regarding the Company’s or Colorado’s

projects or adjacent properties are reported for historical

reference only and cannot be relied upon as neither the Company’s

QP or Colorado’s QP, as defined under NI-43-101 has not prepared

nor verified the historical information.3 All drill intercepts

are drill indicated lengths. Insufficient technical information

exists to demonstrate the true widths of these intersections.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Statements Regarding Forward-Looking

InformationCertain statements contained in this news

release may contain forward-looking information within the meaning

of Canadian securities laws. Such forward-looking information is

identified by words such as “estimates”, “intends”, “expects”,

“believes”, “may”, “will” and include, without limitation,

statements regarding the Colorado’s or the Company’s plans or

business operations (including plans for completing the Transaction

and the Concurrent Financing, as applicable and otherwise for

progressing assets), estimates regarding mineral resources,

projections regarding mineralization and projected expenditures.

There can be no assurance that such statements will prove to be

accurate; actual results and future events could differ materially

from such statements. Factors that could cause actual results to

differ materially include, among others, metal prices, risks

inherent in the mining industry, financing risks, labour risks,

uncertainty of mineral resource estimates, equipment and supply

risks, title disputes, regulatory risks and environmental concerns.

In addition, the completion of the Transaction and the Concurrent

Financing is subject to the receipt of all required approvals,

including the approval of the Company’s shareholders and the

Exchange. Most of these factors are outside the control of Colorado

and the Company. Investors are cautioned not to put undue reliance

on forward-looking information. Except as otherwise required by

applicable securities statutes or regulation, the Company and

Colorado expressly disclaim any intent or obligation to update

publicly forward-looking information, whether as a result of new

information, future events or otherwise.

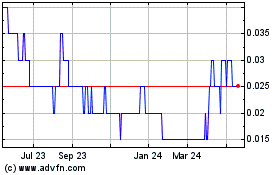

Damara Gold (TSXV:DMR)

Historical Stock Chart

From Nov 2024 to Dec 2024

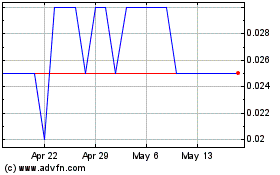

Damara Gold (TSXV:DMR)

Historical Stock Chart

From Dec 2023 to Dec 2024