Allegiant Gold Ltd. (“Allegiant” or the “Company”) (AUAU:

TSX-V) (AUXXF: OTCQX) is pleased to announce that it has

filed a preliminary short form prospectus in connection with its

bought deal offering of 12,500,000 Units at $0.40 per Unit, and has

concurrently filed an updated technical report on its Eastside

project entitled “Updated Resource Estimate and NI 43-101 Technical

Report, Eastside and Castle Gold-Silver Project Technical Report,

Esmeralda County, Nevada” prepared by Mine Development Associates

and dated July 30, 2021 (the “MDA Technical Report”).

The MDA Technical Report incorporates

information from drilling and exploration work conducted by the

Company at Eastside, including approximately 9,000 metres of RC

drilling, since the date of the last technical report on the

property in January of 2020. The work has resulted in a significant

increase in Inferred resources at its district-scale flagship,

Eastside and Castle property near Tonopah, Nevada. The updated

resource now incorporates a resource at the Castle Area and 9

additional holes at the Eastside Original Pit Zone. Highlights

include:

- Includes

1.09 million gold ounces at 0.55 grams per tonne

(“g/t”) at Eastside Original Pit Zone and an inferred resource of

314,000 gold ounces at 0.49 g/t at the Castle

Area, both within pit-constrained models at a cut-off grade of 0.15

g/t gold, US$1,750/ounce gold price and a US$21.88 silver

price;

- The updated

Eastside Resource estimate represents a 41%

increase in gold ounces over the previous Eastside

resource report, an increase of 408,000 gold

ounces

- The Eastside

resource is open to the south and west and at depth; the Castle

resources are open in all directions. The planned work program for

2021-2022 will focus on the recent high-grade discovery in the

Eastside Original Pit Zone as well as expansion and exploration

drilling to the south, west and east.

Eastside Resource Estimate

The updated resource estimate (“Updated Resource

Estimate and NI 43-101 Technical Report, Eastside and Castle

Gold-Silver Project Technical Report, Esmeralda County, Nevada”)

was conducted by Mine Development Associates

(“MDA”), a division of RESPEC of Reno, Nevada with

an effective date of July 30, 2021. Contained pit-constrained

Inferred Resources (cut-off grade of 0.15 g/t)

of 1,090,00 Au ounces in 61,730,000

tonnes at 0.55 g/t Au and

8,700,000 Ag ounces at 4.4 g/t Ag

at the Original Pit Zone and 314,000 Au ounces in

19,986,000 tonnes at 0.49 g/t Au

at the Castle Area. In accordance with NI 43-101, the MDA Technical

Report dated July 30, 2021, will be filed on SEDAR. This report

builds on and supersedes the NI 43-101 reports of Ristorcelli

(December 2016), Ristorcelli (July 2017), Ristorcelli (January

2020) and Ristorcelli (November 2020) titled “Amended Updated

Resource Estimate and NI 43-101 Technical Report, Eastside and

Castle Gold-Silver Project, Esmeralda County, Nevada” prepared for

Allegiant with an Effective Date of December 30, 2019.

Andy Wallace, ALLEGIANT Chief Geologist, oversaw

the incorporation of the additional 9 drill holes at the Original

Pit Zone and 49 drill holes at the Castle Area into the updated and

initial inferred resource estimate.

Table 1: Eastside Inferred Gold and

Silver Resources

https://www.globenewswire.com/NewsRoom/AttachmentNg/150404e9-c10a-4760-821f-5637bf41bb0bhttps://www.globenewswire.com/NewsRoom/AttachmentNg/762c7545-3fee-4412-a9d3-91c356832d34

The resources in the table below are the

estimate of Inferred gold and silver resources at

Eastside. The base case uses a cut-off grade of 0.15 g/t gold as

well as other cut-off grade levels which approximates anticipated

economic cutoffs based on preliminary metallurgical test work and

operations cost estimates. To determine the "reasonable prospects

for eventual economic extraction" MDA prepared the estimate based

on per tonne mining costs of US$1.65 and G&A costs of US$0.50

respectively. Heap-leach and milling costs used were US$4.60 and

US$10.00, respectively. The prices of gold and silver were US$1,750

and US$21.88 per ounce, respectively. MDA ran a series of optimized

pits using variable gold and silver prices, mining costs,

processing costs and processing scenarios.

Notes to table of

resources:

- Contained ounces may not add due to

rounding.

- These Mineral Resources occur in

such form, grade or quality and quantity that there are reasonable

prospects for eventual economic extraction.

- It is reasonably expected that the

majority of Inferred Mineral Resources could be upgraded to at

least Indicated Mineral Resources with continued

drilling.

- Inferred Mineral Resources are not

Mineral Reserves. Mineral resources which are not mineral reserves

do not have demonstrated economic viability.

- The Qualified Person for the above

resource estimate is Steven Ristorcelli, C.P.G., an associate of

MDA

The Original Pit Zone drilling database contains

36,923 gold assays and 14,163 silver assays used for the estimation

of the resources reported herein. The assigned densities range from

2.15g/cm3 for volcaniclastic sedimentary rocks and steam-heated

altered rhyolite, to 2.6g/cm3 for undifferentiated basement

Paleozoic rocks. The principal rhyolite host rock was assigned a

density value of 2.35g/cm3.

The Castle Area drilling database on which the

deposit is modeled has 455 historical drill holes and 49 RC drill

holes completed by the Company. The drilling database from which

the estimate was made has 11,402 gold assays. Silver was not

modeled. The assigned densities range from 2.4g/cm3 to 2.6g/cm3 and

the overlying gravels were assigned 1.8g/cm3

At Eastside, preliminary metallurgical studies

conducted by Kappes, Cassiday and Associates, in Reno, Nevada,

indicate the mineralization is amenable to recovery by cyanidation.

Heap-leach extractions are expected to be around 70% and 20% for

gold and silver, respectively, but likely would require crushing.

Milling with a fine grind is expected to result in extractions over

90% for gold and approximately 50% silver.

QUALIFIED PERSON

Andy Wallace is a Certified Professional

Geologist (CPG) with the American Institute of Professional

Geologists and is the Qualified Person under NI

43-101, Standards of Disclosure for Mineral Projects, who has

reviewed and approved the scientific and technical content of this

press release.

The NI 43-101 updated resource estimate for the

Eastside and Castle gold-silver property was prepared under the

direction of Steven Ristorcelli, C.P.G., and associate of MDA, a

Qualified Person under NI 43-101, who has reviewed and consented to

the information in this news release that relates to the reported

resources.

ABOUT ALLEGIANT

Allegiant owns 100% of 10 highly prospective

gold projects in the United States, 7 of which are located in the

mining-friendly jurisdiction of Nevada. Three of Allegiant’s

projects are farmed-out, providing for cost reductions and

cash-flow. Allegiant’s flagship, district-scale Eastside project

hosts a large and expanding gold resource and is located in an area

of excellent infrastructure. Preliminary metallurgical testing

indicates that both oxide and sulphide gold mineralization at

Eastside is amenable to heap leaching.

ON BEHALF OF THE BOARD

Peter Gianulis CEO

For more information contact:

Investor Relations (604) 634-0970 or

1-888-818-1364 ir@allegiantgold.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Certain statements and information contained in

this press release constitute "forward-looking statements" within

the meaning of applicable U.S. securities laws and “forward-looking

information” within the meaning of applicable Canadian securities

laws, which are referred to collectively as "forward-looking

statements". The United States Private Securities Litigation Reform

Act of 1995 provides a “safe harbor” for certain forward-looking

statements. Allegiant Gold Ltd.’s (“Allegiant”) exploration plans

for its gold exploration properties, the drill program at

Allegiant’s Eastside project, the preparation and publication of an

updated resource estimate in respect of the Original Zone and the

Castle Area at the Eastside project, Allegiant’s future exploration

and development plans, including anticipated costs and timing

thereof; Allegiant’s plans for growth through exploration

activities, acquisitions or otherwise; and expectations regarding

future maintenance and capital expenditures, and working capital

requirements. Forward-looking statements are statements and

information regarding possible events, conditions or results of

operations that are based upon assumptions about future economic

conditions and courses of action. All statements and information

other than statements of historical fact may be forward-looking

statements. In some cases, forward-looking statements can be

identified by the use of words such as “seek”, “expect”,

“anticipate”, “budget”, “plan”, “estimate”, “continue”, “forecast”,

“intend”, “believe”, “predict”, “potential”, “target”, “may”,

“could”, “would”, “might”, “will” and similar words or phrases

(including negative variations) suggesting future outcomes or

statements regarding an outlook. Such forward-looking statements

are based on a number of material factors and assumptions and

involve known and unknown risks, uncertainties and other factors

which may cause actual results, performance or achievements, or

industry results, to differ materially from those anticipated in

such forward-looking information. You are cautioned not to place

undue reliance on forward-looking statements contained in this

press release. Some of the known risks and other factors which

could cause actual results to differ materially from those

expressed in the forward-looking statements are described in the

sections entitled “Risk Factors” in Allegiant’s Listing

Application, dated January 24, 2018, as filed with the TSX Venture

Exchange and available on SEDAR under Allegiant’s profile at

www.sedar.com. Actual results and future events could differ

materially from those anticipated in such statements. Allegiant

undertakes no obligation to update or revise any forward-looking

statements included in this press release if these beliefs,

estimates and opinions or other circumstances should change, except

as otherwise required by applicable law.

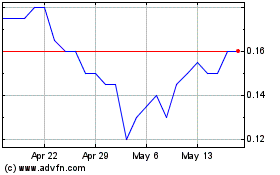

Allegiant Gold (TSXV:AUAU)

Historical Stock Chart

From Nov 2024 to Dec 2024

Allegiant Gold (TSXV:AUAU)

Historical Stock Chart

From Dec 2023 to Dec 2024